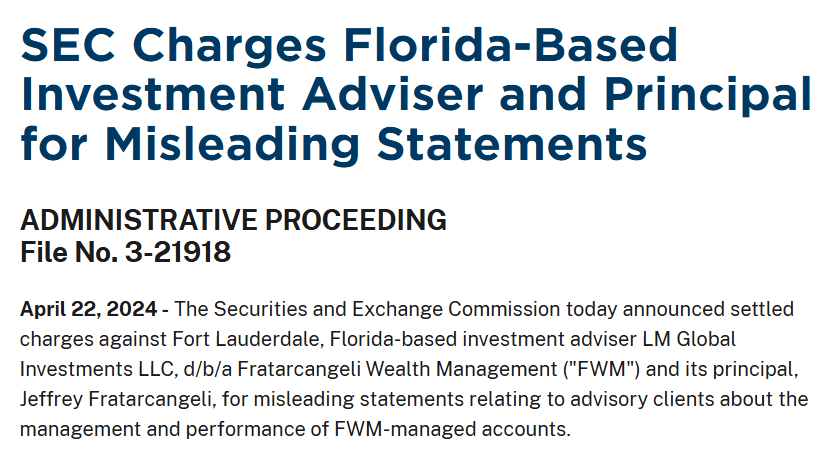

Jeffrey Fratarcangeli, a Michigan-based financial adviser and the principal of Fratarcangeli Wealth Management LLC (FWM), is at the heart of an SEC administrative proceeding documented under file number IA-6593-S, published on September 25, 2024. This legal document, accessible via the SEC’s enforcement litigation page, outlines a settlement addressing alleged violations of fiduciary duty, inadequate disclosure, and questionable financial practices spanning 2017 to 2021. While the settlement allows Fratarcangeli to neither admit nor deny the findings, the SEC’s allegations suggest a troubling pattern of self-interest over client welfare—a narrative that demands scrutiny beyond the regulator’s official account. This analysis delves into the specifics of the SEC case, contextualizes it with the additional sources, and explores broader allegations and red flags to paint a fuller, more critical picture of Fratarcangeli’s professional conduct.

The SEC Administrative Proceeding (IA-6593-S): A Closer Look

The SEC’s order accuses Fratarcangeli of breaching his fiduciary obligations under the Investment Advisers Act of 1940 through several distinct but interconnected actions. First, he allegedly failed to disclose revenue-sharing agreements with a broker-dealer, which funneled extra profits to him at his clients’ expense. Second, he is said to have steered clients toward higher-cost mutual fund share classes when cheaper alternatives existed, pocketing approximately $260,000 in undisclosed fees. Third, the SEC claims he misused “soft dollar” arrangements—client commissions meant to fund research or services—diverting them for personal or firm benefit rather than client advantage. Finally, as FWM’s chief compliance officer, Fratarcangeli is faulted for inadequate oversight, allowing these practices to persist unchecked.

The settlement imposes a cease-and-desist order, a censure, a $100,000 civil penalty, and disgorgement of the $260,000 plus interest. Fratarcangeli also faces a one-year suspension from associating with any investment adviser, broker, or dealer—a notable but temporary blow to his career. On the surface, these penalties suggest a clear-cut case of misconduct. Yet, the lack of an admission of guilt and the administrative nature of the proceeding—resolved without a courtroom battle—invite skepticism. Did Fratarcangeli settle to avoid costlier litigation, or do the allegations overstate his intent? The SEC’s narrative leans heavily on fiduciary betrayal, but the absence of a trial leaves room to question whether this is a story of deliberate greed or sloppy management.

Digging Deeper: Fiduciary Failure or Regulatory Overreach?

The heart of the SEC’s case is Fratarcangeli’s alleged prioritization of profit over duty. Advisers are legally bound to act in their clients’ best interests, yet the choice of pricier mutual fund share classes suggests a calculated move to boost his bottom line. This practice isn’t rare in the industry—many advisers have faced similar scrutiny—but the failure to disclose it is a glaring breach of trust. Clients, presumably unaware of cheaper options, bore the cost while Fratarcangeli reaped the rewards. The soft dollar misuse adds another layer: if he redirected commissions for personal gain, it’s a textbook violation of fiduciary norms. But the SEC’s language is vague on specifics—how much went to Fratarcangeli himself versus FWM’s operations? Without granular evidence, the line between intentional fraud and poor bookkeeping blurs.

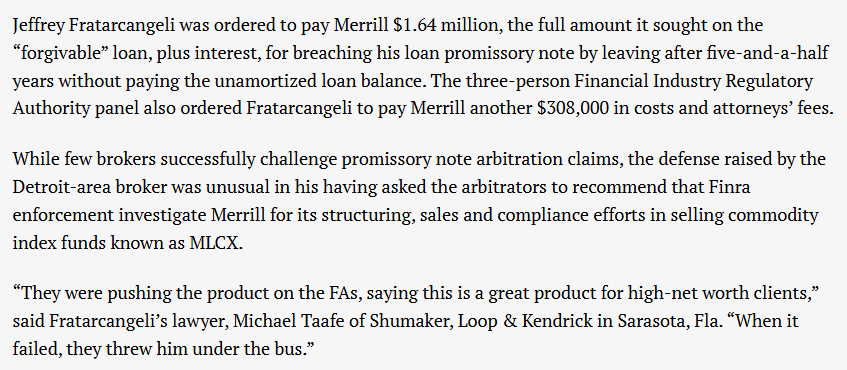

The compliance failures at FWM are equally damning. As the firm’s principal and compliance chief, Fratarcangeli was the gatekeeper. The SEC alleges a lack of “robust policies,” but what does that mean in practice? Did he actively skirt oversight, or did a small firm simply buckle under regulatory complexity? The settlement doesn’t clarify intent, and that omission matters. A seasoned adviser with nearly three decades of experience—Fratarcangeli began at Merrill Lynch in 1996—should know better, yet the SEC stops short of calling it malice. This ambiguity fuels a counter-narrative: perhaps he’s a scapegoat for systemic issues in an industry rife with conflicts of interest, rather than a lone bad actor.

Contextual Clues from Additional Sources

The AdvisorHub article, dated January 23, 2025, titled “Ex-Merrill Broker Loses Bid to Refer Firm to FINRA Enforcement,” doesn’t directly involve Fratarcangeli but illuminates the regulatory landscape he inhabited. It details Scott Bluestein, another ex-Merrill adviser, who tried unsuccessfully to shift blame to his former employer for alleged misconduct. The case underscores a trend: regulators like the SEC and FINRA increasingly hold individuals accountable, even when firm-level failures contribute. Fratarcangeli’s SEC settlement fits this mold—his personal penalties and suspension signal that regulators pinned the blame squarely on him, not FWM’s broader structure or external partners like the unnamed broker-dealer. This raises a question: is Fratarcangeli being singled out for practices that thrive in a permissive industry culture?

The archived S&P Global article from 2021, focusing on automating credit risk surveillance, seems tangential but offers a subtle critique. It highlights advanced tools available during Fratarcangeli’s alleged violations—tools that could have flagged conflicts or compliance gaps. FWM’s apparent failure to adopt such systems might reflect underinvestment or indifference, both of which clash with the image of a diligent fiduciary. In an era where technology can mitigate human error, this lapse suggests either negligence or a reluctance to shine a light on questionable practices.

Beyond the SEC: Red Flags and Allegations

Fratarcangeli’s career arc adds context—and complications. After 22 years at Merrill Lynch, he left in 2018 to launch FWM, aligning with the start of the SEC’s alleged violations (2017-2021). This timing is intriguing. His exit from a Wall Street giant to an independent RIA could signal ambition or discontent—or perhaps a desire for less oversight. Public records, like his FINRA BrokerCheck profile, show no disciplinary actions before the SEC case, painting a clean slate at Merrill. But that cleanliness could deceptive. Clients often hesitate to file complaints against trusted advisers, and Merrill’s internal handling of issues might have kept earlier missteps off the record.

Post-settlement, industry chatter—trending inconclusively on platforms like X as of early 2025—hints at client grumbling over FWM’s fees and performance. While unverified, these whispers echo the SEC’s findings: if clients felt overcharged or underserved, it bolsters the case against Fratarcangeli’s client-first claims. His marketing as an independent adviser, free from corporate shackles, also rings hollow against the SEC’s portrait of self-dealing. Was this persona a genuine ethos or a sales pitch masking profit motives? The disconnect suggests either hubris or hypocrisy—neither flattering.

Questioning the Establishment Narrative

The SEC’s account is compelling but not airtight. Administrative proceedings like IA-6593-S favor settlements over trials, prioritizing efficiency over exhaustive truth-finding. Fratarcangeli’s decision to settle could reflect pragmatism—legal fights are draining—or a weak defense. The Supreme Court’s 2024 Jarkesy ruling, limiting the SEC’s use of in-house courts for penalties, casts further doubt on such processes. Though Fratarcangeli didn’t challenge the proceeding, Jarkesy highlights their flaws: no jury, no robust cross-examination. The $100,000 fine and suspension are stiff, but without a trial, we’re left with the SEC’s word—hardly an unimpeachable source given its own history of overreach.

Consider the soft dollar issue: industry norms allow flexibility, and the SEC doesn’t prove Fratarcangeli pocketed funds personally rather than reinvesting them in FWM. The mutual fund allegations, too, might reflect confusion over disclosure rules rather than a scheme. Small RIAs like FWM often lack the compliance muscle of giants like Merrill, and Fratarcangeli’s dual role as principal and compliance officer could have stretched him thin. This doesn’t excuse violations, but it challenges the SEC’s implied malice. The regulator’s focus on financial penalties—disgorgement plus a fine—also sidesteps deeper questions of intent, favoring optics over accountability.

Conclusion: A Flawed Figure in a Flawed System

Jeffrey Fratarcangeli emerges as a complex figure: a veteran adviser whose independent venture unraveled under allegations of greed and neglect. The SEC paints him as a fiduciary who exploited trust, amassing illicit gains while shirking oversight. Red flags—his firm’s weak controls, the timing of his Merrill exit, and murmurs of client discontent—reinforce this view, suggesting a pattern of prioritizing self over service. His suspension and penalties mark a fall from grace, tarnishing a decades-long career.

Yet, the story isn’t black-and-white. The SEC’s reliance on an untested settlement, the industry’s murky norms, and Fratarcangeli’s clean pre-2024 record invite skepticism. Was he a rogue operator or a casualty of a system that tolerates conflicts until they’re exposed? Likely both. His actions betrayed clients, but the regulatory hammer may exaggerate his villainy. As he awaits his 2025 return, Fratarcangeli’s challenge will be proving he’s more than the sum of these allegations—a tall order given the shadows cast here.