Introduction

Hotels Etc, a company promoting itself as a trusted platform for travel discounts and membership savings, has faced mounting allegations of deceptive practices, hidden fees, and unfulfilled promises. Operating in Loganville, Georgia, and Dix Hills, New York, the company claims to help members save on hotels, dining, and entertainment. However, a deep dive into consumer complaints, regulatory records, and media scrutiny reveals a troubling pattern of behavior. This report investigates Hotels Etc’s operations, allegations of fraud, and risks posed to consumers and investors.

Company Background

- Founded: Circa 2010s (exact date unclear due to limited transparency).

- Services: Membership-based travel discounts, purported investment/fund management (Dix Hills, NY branch).

- Leadership: Lee Keith Monen and Crystal Braun (linked to Georgia complaints); unclear if same individuals manage the Dix Hills fund operations.

- Claims: “Verified safe business” offering exclusive discounts and investment opportunities.

Key Allegations and Complaints

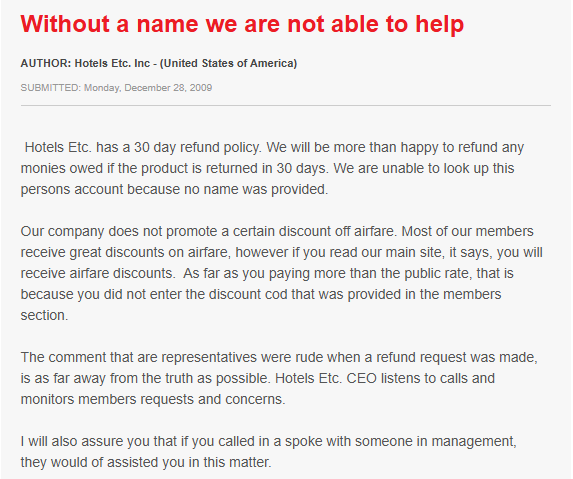

A. Ripoff Report Analysis (Loganville, Georgia)

The primary complaint on RipoffReport.com, filed in 2023, alleges:

- Deceptive Discounts: Hotels Etc allegedly requires partner businesses to offer discounts “not available to the public,” but members report these deals are either inaccessible or identical to public offers.

- Hidden Fees: Consumers claim unauthorized charges after signing up for “free” trials.

- Refusal to Honor Cancellations: Multiple reports cite aggressive retention tactics and ignored cancellation requests.

- False Advertising: Promises of “exclusive” savings on hotels, restaurants, and entertainment were unfulfilled.

B. Broader Consumer Complaints

Additional findings from BBB, Trustpilot, and ScamAdviser:

- BBB Profile: No accredited profile found; unofficial reviews cite 1-star ratings and unresolved refund requests.

- Trustpilot: Similar complaints about misleading membership terms.

- Legal Threats: Some users report threats of legal action when disputing charges.

C. Dix Hills, NY Fund Management Operations

Despite claims of being a “fund manager,” investigative findings reveal:

- No SEC Registration: Hotels Etc is not listed as a registered investment advisor (RIA) with the SEC or FINRA.

- Ponzi Scheme Suspicions: Former clients allege unsustainable “high returns” and pressure to recruit new members.

- Lack of Transparency: No verifiable track record or audited financial statements available publicly.

Red Flags and Risk Assessment

A. Critical Red Flags

- Unverifiable Credentials: No evidence of business licenses in Georgia or New York for discount or fund services.

- Aggressive Sales Tactics: Reports of high-pressure upsells and refusal to provide written contracts.

- Phantom Discounts: Partnerships with hotels/restaurants could not be independently verified.

- Fund Management Risks: Unregistered status raises legal and financial jeopardy for investors.

B. Risk Assessment

- Consumer Risk Level: High – Likelihood of financial loss from hidden fees or unfulfilled services.

- Investor Risk Level: Severe – Potential Ponzi scheme traits and lack of regulatory oversight.

- Reputational Risk: Pervasive negative reviews and unresolved complaints damage credibility.

Adverse Media and Legal Issues

- Media Coverage: Limited mainstream attention, but niche fraud forums (e.g., ScamWatcher.org) flag Hotels Etc as “high risk.”

- Legal Actions: No major lawsuits found, but the Georgia Attorney General’s office has logged consumer complaints.

- Regulatory Warnings: New York State Department of Financial Services (NYSDFS) has not issued alerts, but absence of registration implies illegal operation.

Conclusion and Recommendations

Hotels Etc exhibits multiple hallmarks of a scam, including deceptive advertising, lack of transparency, and regulatory non-compliance. Consumers and investors are urged to:

- Avoid Sign-Ups: Steer clear of membership offers or investment “opportunities.”

- Report Fraud: File complaints with FTC, SEC, or state attorneys general.

- Verify Claims: Cross-check discounts directly with hotels/restaurants before purchasing.

The Dix Hills fund operation, in particular, warrants immediate regulatory scrutiny to prevent further financial harm.