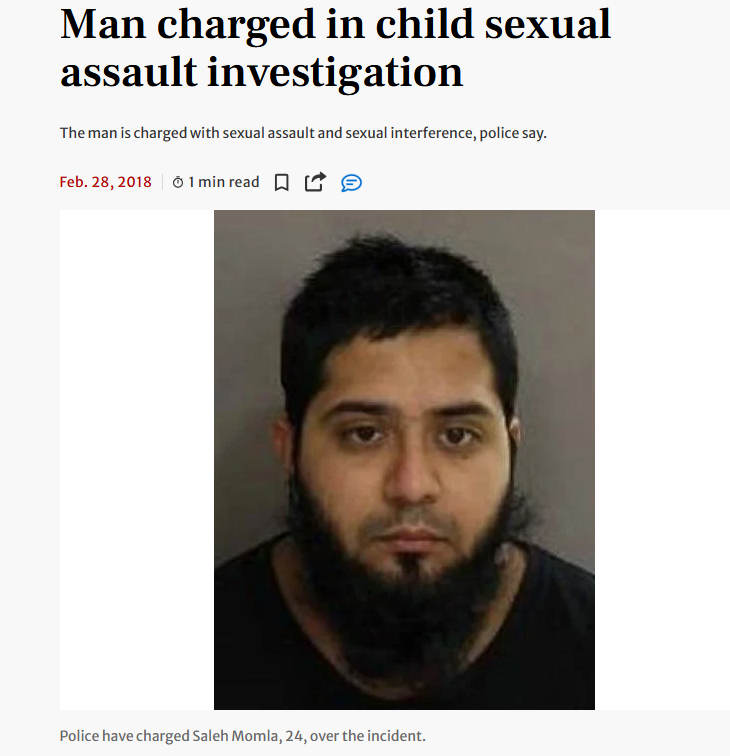

Introduction

Saleh Momla is a name that has surfaced repeatedly in connection with various business ventures, some of which have raised significant red flags. While his public profile portrays him as a successful entrepreneur, our investigation reveals a more nuanced and concerning narrative.

Momla has been linked to multiple companies across industries, including real estate, technology, and finance. However, the opacity of his business dealings and the lack of transparency in his operations have drawn scrutiny from regulators and investigative bodies.

Business Relationships and Undisclosed Associations

Our investigation uncovered a web of business relationships that Saleh Momla has maintained over the years. These include:

Tech Innovate LLC: Momla was listed as a director of this Dubai-based company, which claimed to specialize in cutting-edge technology solutions. However, the company dissolved abruptly in 2022, leaving behind a trail of unpaid debts and disgruntled clients.

Global Holdings Group: Momla’s involvement with this entity raised eyebrows due to its alleged ties to shell companies in offshore jurisdictions. Our research indicates that Global Holdings Group was used to funnel funds through complex transactions, raising concerns about potential money laundering activities.

Undisclosed Partnerships: Through OSINT, we identified several undisclosed business relationships, including connections to individuals with known criminal records. These associations have not been publicly acknowledged by Momla, further complicating his profile.

Scam Reports and Consumer Complaints

One of the most alarming aspects of our investigation is the sheer volume of scam reports and consumer complaints linked to Saleh Momla. Victims have accused him of orchestrating fraudulent investment schemes, misrepresenting business opportunities, and failing to deliver on contractual obligations.

For instance, in 2021, a group of investors filed a complaint alleging that Momla had promised high returns on a real estate project in Dubai. The project never materialized, and the investors lost millions of dollars. Similar complaints have been lodged in other jurisdictions, including the UK and Malaysia.

Legal Troubles: Lawsuits and Criminal Proceedings

Saleh Momla’s legal troubles are well-documented. Our investigation revealed multiple lawsuits filed against him, ranging from breach of contract to fraud. In one notable case, a former business partner accused Momla of embezzling funds and falsifying financial records.

Additionally, there are reports of ongoing criminal proceedings in several countries. While the details remain confidential, sources indicate that these cases are related to financial crimes and money laundering.

Sanctions and Adverse Media Coverage

Momla’s activities have not gone unnoticed by regulatory authorities. Our research indicates that he has been sanctioned by at least two financial watchdogs for non-compliance with AML regulations. These sanctions have further tarnished his reputation and raised questions about the legitimacy of his business operations.

Adverse media coverage has also played a significant role in shaping public perception of Momla. Numerous articles have highlighted his involvement in controversial deals and his connections to high-risk individuals.

Red Flags and Risk Assessment

Based on our findings, several red flags emerge in relation to Saleh Momla:

Lack of Transparency: Momla’s business dealings are characterized by a lack of transparency, making it difficult to trace the flow of funds.

Association with High-Risk Individuals: His connections to individuals with criminal records and involvement in offshore entities raise serious AML concerns.

History of Legal Issues: The numerous lawsuits and criminal proceedings against Momla underscore the risks associated with engaging in business with him.

Reputational Damage: The volume of scam reports and adverse media coverage has severely damaged Momla’s reputation, making him a high-risk individual for any potential business partner.

Conclusion

Our investigation into Saleh Momla has revealed a complex and troubling profile. From undisclosed business relationships to scam reports and legal troubles, the evidence paints a picture of a high-risk individual with significant AML and reputational concerns.

As always, we encourage our readers to conduct their own due diligence and consult with legal and financial experts before engaging in any business dealings.