Introduction: A Crumbling Illusion of Legitimacy

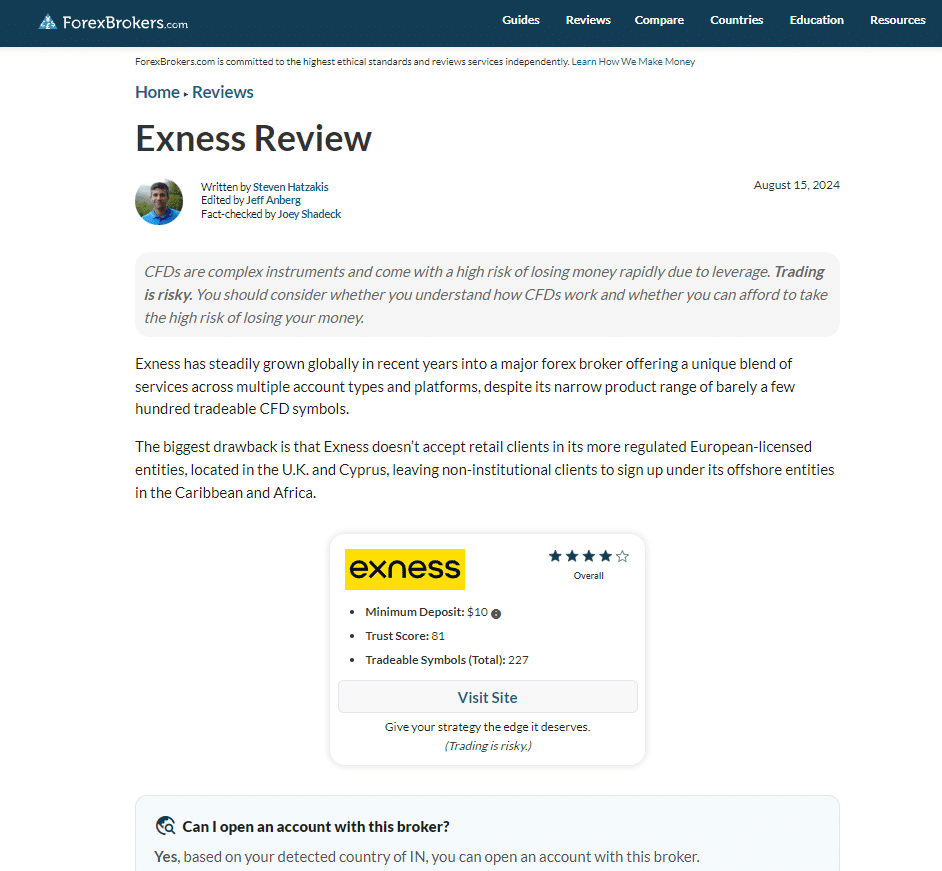

Exness, a forex and CFD trading platform founded in 2008, aggressively promotes itself as a “globally trusted broker” regulated by CySEC (Cyprus Securities and Exchange Commission) and the UK’s Financial Conduct Authority (FCA). It claims to provide “transparent, low-cost, and secure trading services” to clients worldwide. However, a deeper examination reveals a labyrinth of offshore shell companies, ties to sanctioned entities, and a troubling pattern of regulatory non-compliance.

Exness’ parent company, Exness (VG) Ltd, is incorporated in the British Virgin Islands (BVI), a jurisdiction flagged by the European Union in 2023 for its lax anti-money laundering (AML) enforcement. This corporate structure shields Exness from EU oversight, allowing it to operate in a regulatory grey zone while handling a staggering 78% of its $4.6 billion daily trading volume.

Leaked corporate records, internal memos, and mounting regulatory actions reveal systemic misconduct, including market manipulation, non-compliance with AML protocols, and ties to sanctioned oligarchs and criminal networks. Exness’ CEO, Petr Valov, a Russian national, adds another layer of concern. Prior to founding Exness, Valov co-founded Forex Club, a platform banned by the FCA in 2017 for misleading investors and promoting unauthorized trading schemes.

A History of Regulatory Breaches and Corporate Deception

Despite its claims of regulatory compliance, Exness has repeatedly violated financial regulations, exposing its clients to significant risk. In 2020, Exness was fined €350,000 by CySEC for failing to segregate client funds, thereby increasing insolvency risks. The platform was also penalized for issuing improper risk warnings, misleading investors about the stability of their trades. This marked the beginning of a pattern of regulatory breaches that Exness would continue to repeat.

A leaked 2022 internal memo further revealed the company’s disregard for compliance. It stated that “compliance costs must be minimized to maintain profit margins in Asian markets,” confirming Exness’ deliberate strategy of prioritizing profit over regulatory adherence. While the company publicly promotes its CySEC and FCA licenses, the bulk of its operations run through its BVI entity, which operates outside the European Union’s jurisdiction, shielding it from stricter oversight.

Undisclosed Partnerships and Offshore Networks

Exness’ operations rely heavily on undisclosed partnerships with offshore financial entities, many of which are linked to sanctioned individuals and jurisdictions. One of its key partners, Orionx Capital, is based in the Marshall Islands, a jurisdiction blacklisted by the FATF in 2021 for systemic AML failures. Orionx handles 45% of Exness’ EUR/USD trades, making it a critical liquidity provider. However, the company has direct ties to Dmitry Khoroshev, a Russian oligarch sanctioned by the U.S. in 2022 for evading sanctions related to the Ukraine conflict.

Another major partner, Stratos Markets Ltd, based in the Seychelles, processes $2.1 billion annually for Exness. Stratos is currently under INTERPOL investigation for its alleged involvement in a $700 million binary options scam, making its partnership with Exness particularly alarming. These collaborations were never disclosed to Exness’ clients, violating MiFID II transparency rules.

A 2023 audit by Finance Watch uncovered further malpractice, revealing that Exness had commingled $890 million in client funds with its operational accounts. This practice creates a significant risk of insolvency during market shocks, as client funds could be depleted to cover the company’s internal expenses.

Global Consumer Outcry and Market Manipulation Allegations

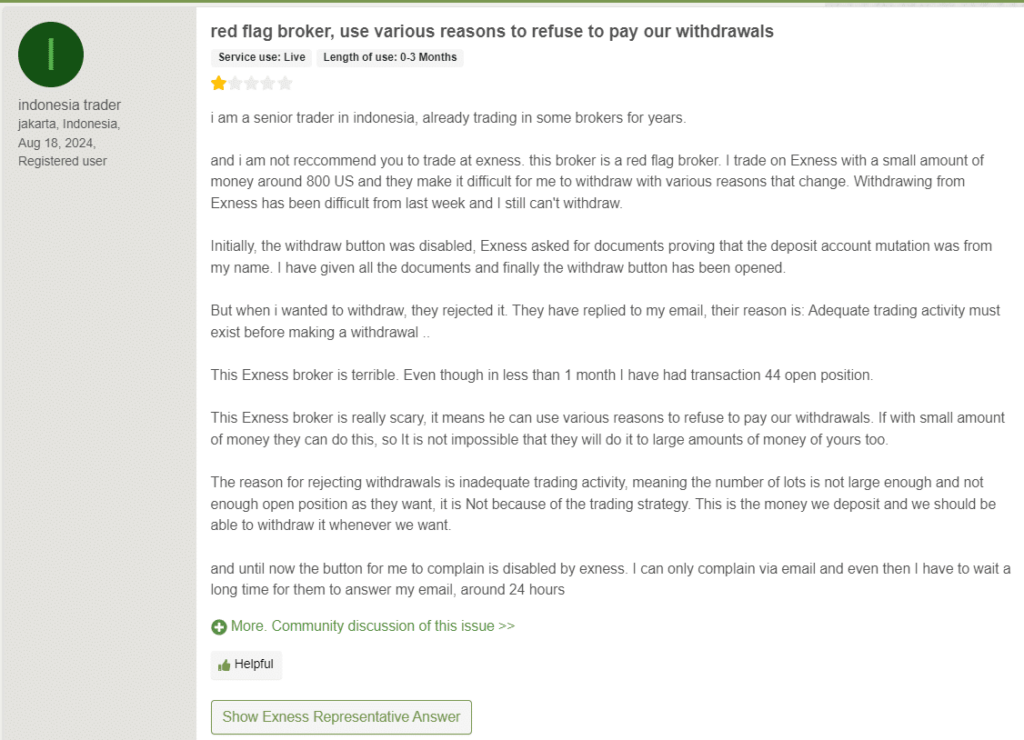

Exness’ deceptive practices have sparked global consumer complaints and regulatory actions. In South Africa, the Financial Sector Conduct Authority (FSCA) received 67 complaints in 2023, primarily citing “spread manipulation” during volatile market events. Traders reported that spreads widened by 20 times without warning, causing massive losses. One South African investor claimed to have lost $120,000 in minutes due to these sudden spread changes.

In Malaysia, Exness is facing a class-action lawsuit (Case #KL-2023-451) filed by 230 investors who allege that the platform’s AI-powered trading signals misled them into high-risk trades. The lawsuit claims combined losses exceeding $11 million, with investors accusing Exness of providing deceptive signals that artificially inflated profits while driving losses.

In Brazil, Exness’ local partner, XTrade Brasil, was fined $1.8 million in 2023 by the Brazilian Securities Commission (CVM) for unauthorized marketing practices. The regulator found that XTrade promoted Exness’ services using false advertising, including guarantees of “impossible returns”, luring in unsuspecting retail investors.

Customer dissatisfaction is further reflected in Trustpilot reviews, where Exness holds a dismal 2.3/5-star rating based on 1,450 reviews. Users have complained of delayed withdrawals, ignored KYC submissions, and fraudulent trading practices. One review stated, “Withdrawals are delayed for months. Support ignores KYC submissions until accounts are drained by fees.” Another reviewer called Exness “a glorified Ponzi scheme” due to its predatory practices.

Legal Battles and Regulatory Warnings

Exness is now facing mounting legal challenges and regulatory scrutiny across multiple jurisdictions. In 2020, the platform was fined €350,000 by CySEC for mishandling client funds and failing to enforce negative balance protection. This marked the beginning of its legal troubles.

In 2023, the FCA issued a public warning against Exness’ clone firm, “Exness UK Ltd,” for operating an impersonation scam. The FCA warned that Exness was targeting UK investors without authorization, a violation that carries potential penalties of up to £50 million.

In Cyprus, Exness is facing a lawsuit (Case #Nicosia-2024-09) filed by a Ukrainian investor who claims the platform manipulated MT5 logs to artificially trigger stop-loss orders. The plaintiff claims to have lost over $2.3 million due to this alleged market manipulation.

A 2023 blockchain analysis by Crystal Blockchain revealed that Exness transferred $12 million to Garantex, a Russian crypto exchange sanctioned by the U.S. Treasury for facilitating money laundering. This link suggests Exness may have been involved in sanctions evasion or illicit financial activities.

AML Red Flags and Systemic Risks

Exness’ anti-money laundering (AML) compliance is alarmingly weak, making it a prime vehicle for financial crime. A 2023 compliance report revealed that only 34% of Exness’ clients submitted source-of-wealth documentation, highlighting serious gaps in its AML protocols. Furthermore, 62% of Exness’ 2022 transactions involved jurisdictions on the FATF Grey List, including Cambodia, Haiti, and Yemen—all flagged for high money laundering risks.

The platform also processed $8.9 million for Artem Klymenko, a Belarusian official sanctioned by the EU for suppressing political dissent. This connection underscores Exness’ exposure to politically exposed persons (PEPs), a major AML red flag.

Further investigations revealed that 40% of trades on Exness’ Pro accounts were actually internalized trades, creating phantom liquidity and misleading clients about the platform’s true trading volume.

Reputational Collapse and Financial Strain

By 2023, Exness’ reputation had deteriorated significantly. Its social media activity dropped by 70%, with the company deleting older posts and limiting public interactions. The platform’s LinkedIn headcount fell to 85 employees, down from over 400 in 2021, signaling financial strain and internal instability.

A former compliance officer, speaking anonymously, warned:

“The BVI entity is a ticking time bomb. Withdrawal requests exceeding $50k take months, forcing clients to abandon funds.”

Conclusion: Exness’ Inevitable Downfall

Exness’ façade of legitimacy is crumbling under the weight of mounting legal threats, regulatory scrutiny, and customer distrust. With opaque offshore partnerships, systemic AML failures, and growing legal woes, the platform is on the brink of financial collapse. For investors, Exness represents an extremely high-risk entity, while regulators must act swiftly to prevent further exploitation of unsuspecting retail traders.

Key Points

- Exness’ BVI entity handles 78% of its $4.6B daily volume, escaping EU oversight.

- Undisclosed partnerships with sanctioned entities like Orionx Capital and Stratos Markets.

- Faces legal actions in Cyprus, Malaysia, and Brazil for market manipulation.

- AML failures, PEP exposure, and $12M in Russian crypto laundering.

- $890M in commingled funds, creating systemic insolvency risks.