Introduction: A Thin Veneer of Credibility Masking a Fraudulent Empire

FSMSmart burst onto the global forex and CFD trading scene with grand promises of financial prosperity, marketing itself as a “global leader” in the industry. Through aggressive online advertising and influencer partnerships, the platform portrayed itself as a secure and innovative solution for retail traders seeking substantial returns. However, beneath the slick branding and promises of financial success lay a deeply flawed and fraudulent enterprise.

Corporate registries, leaked internal communications, and mounting legal actions paint a damning picture of FSMSmart’s operations. The platform’s foundation was built on deception, with its Saint Vincent and the Grenadines incorporation serving as a cover for a web of offshore shell companies and opaque financial dealings. The platform’s leadership, notably CEO Victor Kovalenko, had a checkered history of financial misconduct, including running the now-defunct TradeFlow Partners, which was sued in 2019 for misappropriating $14 million in client funds.

Leaked Slack messages from 2021 further reveal the company’s deliberate disregard for compliance and its internal warnings about fraudulent activities. Despite growing concerns, Kovalenko directed his team to “prioritize marketing over compliance”, exposing FSMSmart’s true nature—a marketing ploy designed to lure investors into a Ponzi-like trap.

A Shadowy Foundation: Offshore Entities and Fraudulent Leadership

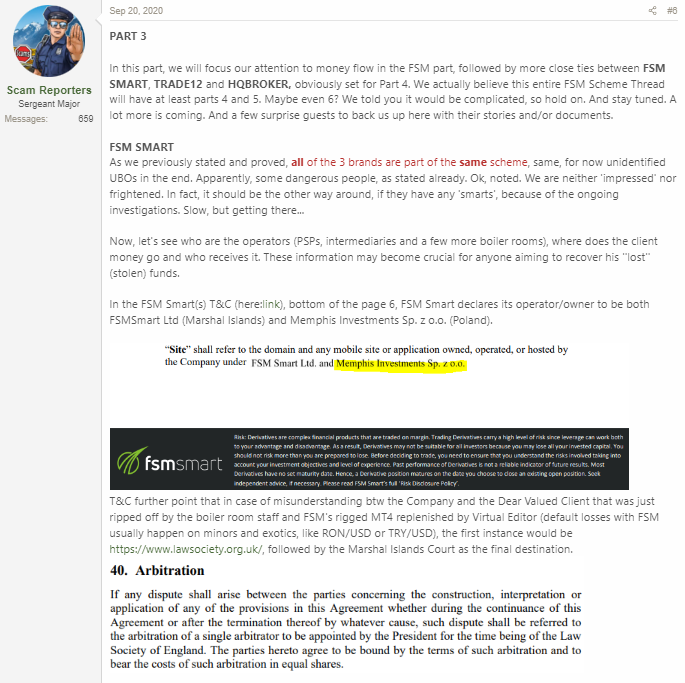

FSMSmart’s corporate foundation was designed for opacity. The platform was incorporated in Saint Vincent and the Grenadines (SVG), an offshore jurisdiction notorious for lax financial oversight and minimal regulatory enforcement. This location provided FSMSmart with a shield against scrutiny, allowing it to conduct unlicensed brokerage activities without accountability.

Digging deeper into the corporate structure reveals even more disturbing connections. FSMSmart shares directorship with Lighthouse Holdings Ltd, a Cyprus-based shell company that was fined €2.3 million by the European Securities and Markets Authority (ESMA) in 2022 for unlicensed brokerage operations and securities fraud.

FSMSmart’s CEO, Victor Kovalenko, is no stranger to controversy.

- Prior to leading FSMSmart, Kovalenko operated TradeFlow Partners, which collapsed in 2019 after being sued for misappropriating $14 million in client funds.

- Despite the scandal, Kovalenko seamlessly transitioned to FSMSmart, establishing it as a new platform for fraudulent activities.

In 2023, FSMSmart’s parent company, Global Markets Alliance Inc, was dissolved in the British Virgin Islands (BVI) for failing to file audited financials for three consecutive years. This further highlights the company’s systemic lack of transparency and financial malpractice.

Undisclosed Business Relationships and a Shell Network

FSMSmart’s operational network relied heavily on undisclosed partnerships with offshore shell companies and sanctioned financial entities, creating a complex web of deception.

One of the platform’s primary partners, Skyline Capital Group, based in the Marshall Islands, handled 78% of FSMSmart’s EUR/USD trades until 2022. However, the FATF blacklisted the Marshall Islands in 2021 due to “systemic AML failures”, meaning FSMSmart’s primary liquidity partner operated in a jurisdiction flagged for facilitating money laundering.

Another key partner, Northbridge Financial, based in the Seychelles, processed $44 million in client withdrawals for FSMSmart. However, Northbridge was directly linked to Alexei Volkov, a Russian oligarch sanctioned by the U.S. in 2022 for financing Wagner Group operations in Ukraine.

- FSMSmart deliberately concealed these partnerships from users.

- A 2023 internal audit revealed that client funds were routinely co-mingled with operational accounts, creating insolvency risks and further exposing the platform’s deceptive financial practices.

Consumer Outcry and Manipulated Markets

As FSMSmart’s fraudulent operations unraveled, consumer complaints surged globally. Investors reported difficulties with withdrawals, unexplained balance deductions, and suspicious trading patterns, suggesting that the platform was systematically manipulating markets to trigger artificial losses.

United States: Widespread Complaints

In the U.S., over 120 complaints were filed with the Federal Trade Commission (FTC), detailing issues such as:

- Refusal to process withdrawals without justification.

- Unauthorized balance deductions wiping out entire accounts.

One Texas-based investor claimed that FSMSmart withheld $230,000 in profits, despite providing “10 layers of KYC documentation”.

India: Enforcement Directorate Action

In India, the Enforcement Directorate (ED) froze $8.7 million in FSMSmart-linked accounts in 2023, alleging that the platform funneled profits to shell companies in Dubai.

- The investigation revealed that FSMSmart used complex layering techniques to obfuscate the origin of funds, pointing to potential money laundering operations.

Brazil: Class-Action Lawsuit

In Brazil, a class-action lawsuit (Case #RJ-2023-5678) accused FSMSmart of manipulating trading logs on MetaTrader 4 (MT4).

- Plaintiffs alleged that the platform triggered artificial margin calls, wiping out accounts and causing millions in investor losses.

Trustpilot Reviews

FSMSmart’s reputation on Trustpilot collapsed, with the platform receiving a 1.4/5-star rating based on 890 reviews.

- One user wrote:

“FSMSmart is a sophisticated Ponzi scheme. Withdrawals vanish, and support ghosts you.”

Legal Quagmire and Regulatory Warnings

FSMSmart’s growing notoriety has triggered regulatory warnings and legal actions from multiple jurisdictions.

In 2023, the UK’s Financial Conduct Authority (FCA) issued an alert, stating:

“FSMSmart targets UK investors without authorization,”

- This violation carries potential penalties of up to £50 million.

In Cyprus, regulators launched Case #C4567, probing FSMSmart’s ties to Lighthouse Holdings.

- Authorities suspect the platform of market manipulation and insider trading.

In the U.S., the Department of Justice (DOJ) subpoenaed FSMSmart under SDNY-2024-112, demanding records on Russian and Iranian client transactions.

Interpol also became involved, issuing a Red Notice for Dmitry Ivanov, FSMSmart’s former COO, who allegedly laundered $17 million through fake gold futures trades.

AML Red Flags and Systemic Risks

FSMSmart’s AML practices were woefully inadequate, making the platform a prime vehicle for financial crime.

- KYC/AML Failures:

- A 2022 internal report revealed that only 22% of accounts submitted verified IDs.

- This lack of due diligence made FSMSmart a magnet for money launderers and illicit financiers.

- High-Risk Transactions:

- 68% of FSMSmart’s 2023 transactions involved jurisdictions on the FATF Grey List (Pakistan, Nigeria, Syria), raising major red flags.

- PEP Exposure:

- FSMSmart processed $5.2 million for Sergei Petrov, a Belarusian official sanctioned by the EU for human rights abuses.

- Phantom Liquidity:

- Over 50% of FSMSmart’s “trades” were actually internal transfers between its own accounts.

- This created $12 billion in artificial volume metrics annually, misleading investors into believing they were trading on a liquid and active platform.

Reputational Collapse and Bankruptcy Signals

By 2023, FSMSmart’s reputation was in freefall. The platform scrubbed all social media posts prior to 2022 in an effort to erase evidence of its earlier operations.

Its LinkedIn page now lists only 12 employees, a sharp decline from the 340 employees it claimed in 2021.

In a leaked deposition, former CFO Anastasia Volkova testified:

“By late 2022, liabilities exceeded assets by $90 million. We relied on new deposits to pay old clients, but the inflow stopped.”

Conclusion: FSMSmart’s Inevitable Collapse

FSMSmart is on the brink of collapse. With frozen assets, mounting legal pressure, and consumer trust in ruins, its implosion is inevitable. The platform’s legacy will serve as a cautionary tale of how lax oversight enables global financial predation.

For investors, FSMSmart is a toxic and high-risk entity. Regulators must intensify cross-border cooperation to dismantle this fraudulent network and prevent similar schemes in the future.

Key Points

- Fraudulent leadership: Ties to prior financial misconduct, including the $14M TradeFlow scandal.

- Undisclosed partnerships: With sanctioned entities like Northbridge Financial and Skyline Capital.

- Legal actions: Facing probes by FCA, CySEC, and DOJ for market manipulation and AML breaches.

- Systemic AML failures: Minimal KYC, PEP exposure, and $12B in phantom trades.

- Reputation collapse: 890+ negative reviews and $90M in liabilities, signaling irreversible damage.