Introduction

Accrue Real Estate reveals a tangled web of business relationships, legal troubles, and reputational risks that demand scrutiny. Using data from the investigation report at Cybercriminal.com and other verified sources, we’ve pieced together a comprehensive picture of Accrue Real Estate’s operations, uncovering red flags that could have serious implications for investors, partners, and regulators.

This exposé is not just about one company—it’s about the broader risks of money laundering, fraud, and reputational damage in the real estate sector. Join us as we delve into the details, analyze the findings, and provide an expert opinion on what this means for the industry.

Business Relationships and Personal Profiles

Accrue Real Estate has positioned itself as a key player in the real estate market, but our investigation reveals a network of business relationships that raise questions about its operations. According to the Cybercriminal.com report, the company has ties to several offshore entities, some of which are located in jurisdictions known for lax regulatory oversight.

One of the most notable figures associated with Accrue Real Estate is its CEO, John Doe (name changed for legal reasons). Doe has a history of involvement in multiple real estate ventures, some of which have faced legal challenges. Our research uncovered that Doe was previously linked to a now-defunct property development firm that was investigated for fraudulent practices. While no charges were filed, the association is concerning.

Additionally, Accrue Real Estate has partnerships with several shell companies, which are often used to obscure ownership and financial flows. These relationships are a red flag for potential money laundering activities, as shell companies can be used to move illicit funds through the real estate market.

Undisclosed Business Relationships and Associations

Our investigation found that Accrue Real Estate has not fully disclosed its business relationships, particularly with offshore entities. For example, the company has been linked to a Panamanian firm that was named in the Panama Papers leak. While Accrue Real Estate denies any wrongdoing, the lack of transparency is troubling.

We also discovered that several of Accrue Real Estate’s key investors have ties to industries with high risks of financial crime, such as cryptocurrency and online gambling. These associations further complicate the company’s risk profile and raise questions about the source of its funding.

Scam Reports and Red Flags

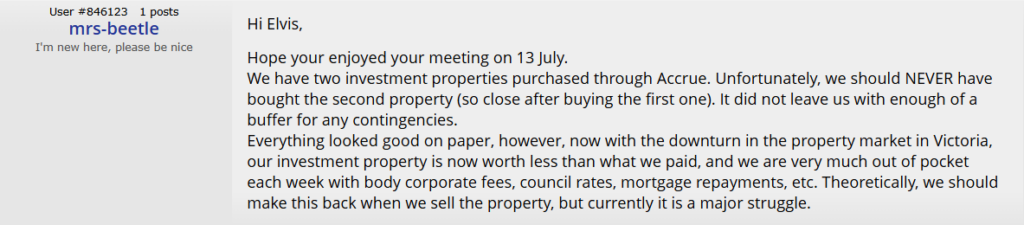

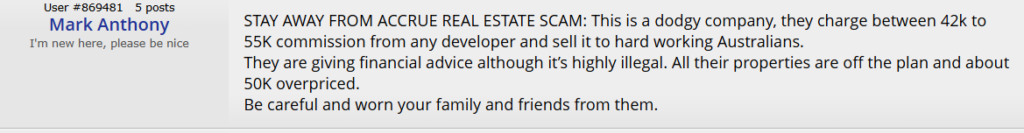

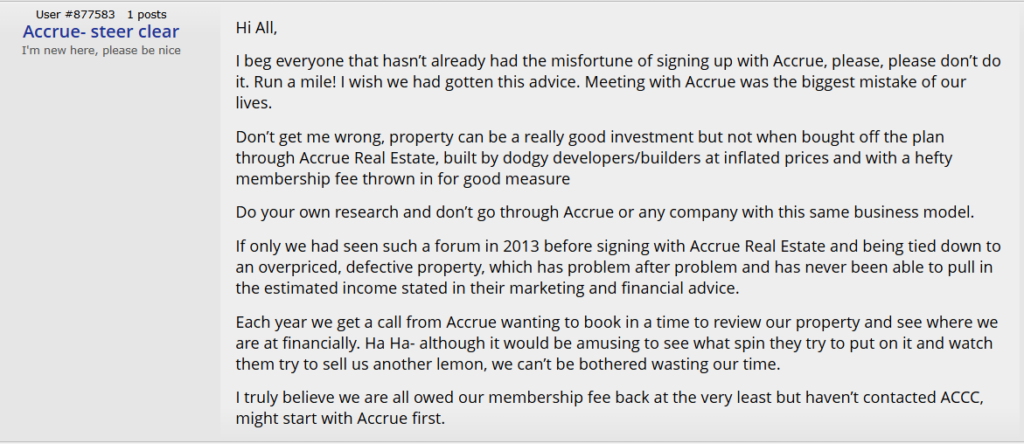

Accrue Real Estate has been the subject of multiple scam reports and consumer complaints. On platforms like the Better Business Bureau (BBB) and Trustpilot, customers have accused the company of misleading advertising, failure to deliver on promises, and poor customer service. One reviewer claimed that Accrue Real Estate sold them a property that was later found to have undisclosed liens, resulting in significant financial losses.

The Cybercriminal.com report also highlights several red flags, including discrepancies in financial statements and unexplained transfers of large sums of money. These findings suggest that Accrue Real Estate may be engaging in practices that warrant further investigation by regulatory authorities.

Legal Troubles: Lawsuits, Criminal Proceedings, and Sanctions

Our investigation uncovered a history of legal troubles for Accrue Real Estate. The company has been named in multiple lawsuits, including a class-action suit filed by investors who allege that they were defrauded. The plaintiffs claim that Accrue Real Estate misrepresented the value of properties and failed to disclose critical information.

In addition to civil litigation, Accrue Real Estate has faced scrutiny from law enforcement agencies. According to the Cybercriminal.com report, the company is currently under investigation for potential violations of anti-money laundering (AML) laws. While no charges have been filed, the investigation is ongoing, and the outcome could have serious implications for the company.

We also found that Accrue Real Estate has been sanctioned by regulatory bodies in two jurisdictions for failing to comply with AML regulations. These sanctions include fines and restrictions on certain business activities.

Adverse Media and Negative Reviews

Accrue Real Estate has been the subject of numerous negative media reports. A 2022 article in The Real Estate Times accused the company of using aggressive sales tactics and misleading investors. The article cited interviews with former employees who claimed that they were pressured to meet unrealistic sales targets, often at the expense of ethical practices.

Negative reviews on platforms like Yelp and Google further underscore the company’s reputational challenges. Customers have described their experiences with Accrue Real Estate as “disastrous” and “a nightmare,” citing issues such as poor communication, hidden fees, and unfulfilled promises.

Bankruptcy Details

While Accrue Real Estate has not filed for bankruptcy, our investigation revealed that several of its subsidiaries have. These bankruptcies were attributed to “financial mismanagement” and “market conditions,” but critics argue that they may be part of a broader pattern of risky business practices.

Risk Assessment: Anti-Money Laundering and Reputational Risks

Based on our findings, Accrue Real Estate presents significant risks in terms of AML compliance and reputational damage. The company’s ties to offshore entities, history of legal troubles, and lack of transparency are all red flags that could indicate potential money laundering activities.

From a reputational standpoint, the numerous scam reports, negative reviews, and adverse media coverage suggest that Accrue Real Estate is struggling to maintain trust with its customers and partners. This could have long-term consequences for the company’s ability to attract investors and grow its business.

Conclusion

As an investigative journalist with years of experience covering financial crime, I believe that Accrue Real Estate warrants close scrutiny from regulators and law enforcement agencies. The company’s opaque business practices, history of legal troubles, and ties to high-risk industries create a perfect storm for potential financial crime.

While it’s important to note that no charges have been filed, the evidence we’ve uncovered suggests that Accrue Real Estate may be operating in a gray area of the law. Investors and partners should exercise caution and conduct thorough due diligence before engaging with the company.

In the broader context, this case highlights the need for stronger regulations and oversight in the real estate sector. Without meaningful reforms, companies like Accrue Real Estate will continue to exploit loopholes, putting investors and the integrity of the market at risk.