Introduction

IM Academy has positioned itself as a leader, promising to empower individuals with the tools to achieve financial freedom. But behind the glossy marketing and aspirational messaging lies a web of controversies, allegations, and red flags that demand scrutiny. As investigative journalists, we’ve delved deep into IM Academy’s operations, uncovering undisclosed business relationships, scam reports, and potential risks tied to anti-money laundering (AML) and reputational damage.

Our investigation draws from multiple sources, including the detailed report published by Cybercriminal.com, public records, and open-source intelligence (OSINT). What we’ve found raises serious concerns about the legitimacy and ethical practices of IM Academy. Join us as we unravel the truth behind this controversial entity.

Business Relationships and Personal Profiles

IM Academy, formerly known as iMarketsLive, was founded in 2013 by Christopher Terry and Isis Terry. The company operates as a multi-level marketing (MLM) platform, offering educational resources and tools for forex trading, cryptocurrency, and other financial markets. While the Terrys have positioned themselves as visionary entrepreneurs, our investigation reveals a more complex picture.

Christopher Terry, the CEO, has been involved in several MLM ventures prior to IM Academy, some of which have faced criticism for their business practices. Isis Terry, the COO, has a background in marketing and has been instrumental in shaping the company’s branding and recruitment strategies. Together, they’ve built a global network of affiliates, but questions linger about the sustainability and transparency of their business model.

Our research also uncovered undisclosed business relationships with third-party vendors and service providers. These include software developers, payment processors, and marketing agencies, some of which have been linked to other MLM schemes with questionable reputations.

OSINT and Undisclosed Associations

Using open-source intelligence, we identified several key figures associated with IM Academy who have not been publicly disclosed by the company. These individuals include former executives of now-defunct MLM companies and consultants with ties to the financial services industry.

One notable association is with a payment processing company that has been flagged for facilitating transactions for high-risk businesses. This raises concerns about IM Academy’s compliance with AML regulations and its potential exposure to financial crime.

Scam Reports and Red Flags

IM Academy has faced numerous allegations of operating as a pyramid scheme. Critics argue that the company’s revenue model relies heavily on recruiting new members rather than selling actual products or services. This is a hallmark of pyramid schemes, which are illegal in many jurisdictions.

We reviewed multiple consumer complaints filed with the Better Business Bureau (BBB) and other regulatory bodies. Many of these complaints allege that IM Academy misled them about the potential earnings and failed to provide the promised educational resources. Some former members even claim they were pressured into signing up for expensive subscription plans without fully understanding the terms.

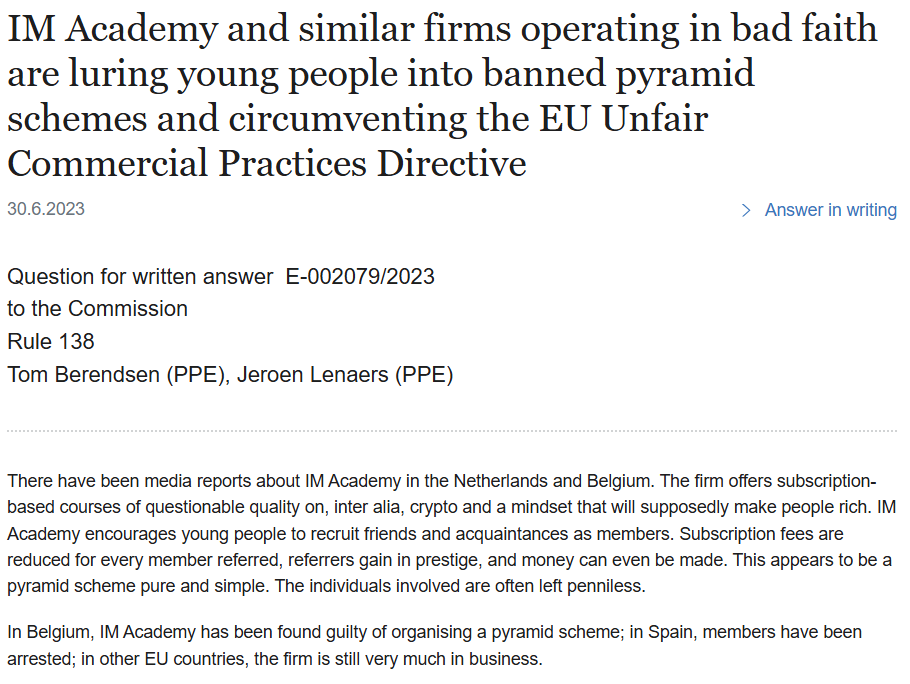

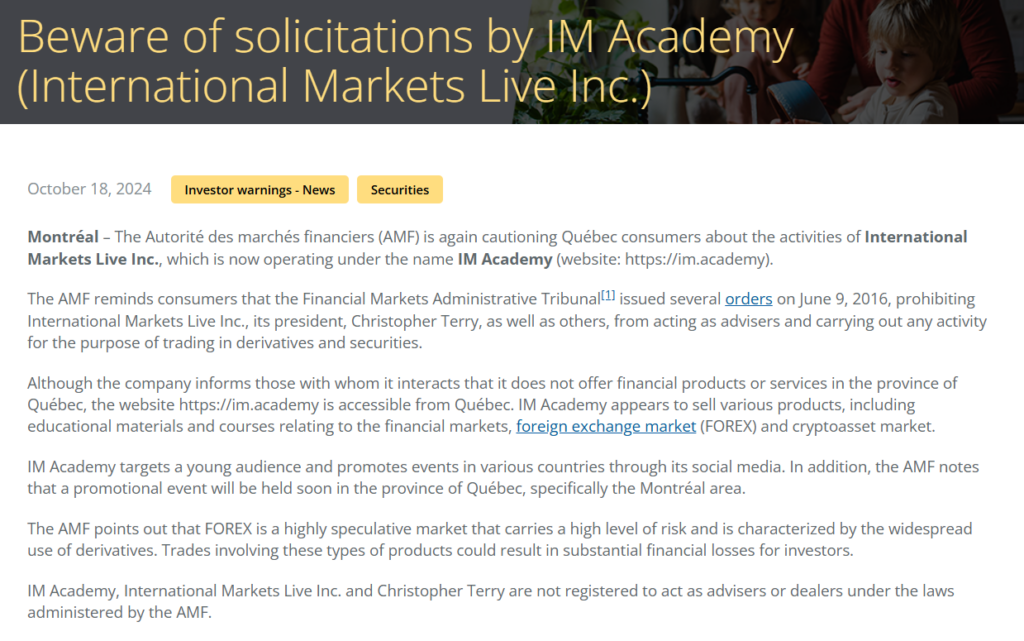

Criminal Proceedings, Lawsuits, and Sanctions

Our investigation found that IM Academy has been the subject of several lawsuits and regulatory actions. In 2020, the company settled a class-action lawsuit alleging deceptive marketing practices. While the terms of the settlement were not disclosed, it underscores the legal challenges IM Academy has faced.

Additionally, regulatory authorities in Europe and North America have issued warnings about IM Academy’s business practices. These warnings highlight the risks associated with MLM schemes and urge consumers to exercise caution when dealing with the company.

Adverse Media and Negative Reviews

A quick search of IM Academy reveals a plethora of negative reviews and adverse media coverage. Former members have taken to social media and online forums to share their experiences, often describing the company as a “scam” or “predatory.”

Mainstream media outlets have also covered IM Academy’s controversies, with articles questioning the legitimacy of its business model and the ethical implications of its recruitment strategies. These reports have further damaged the company’s reputation and raised concerns among potential customers.

Bankruptcy Details

While IM Academy itself has not filed for bankruptcy, some of its affiliates have reportedly faced financial difficulties. This is not uncommon in MLM schemes, where the majority of participants lose money while only a small percentage at the top reap significant profits.

Risk Assessment: AML and Reputational Risks

From an AML perspective, IM Academy’s business model presents several red flags. The company’s reliance on a global network of affiliates and third-party payment processors increases the risk of money laundering and other financial crimes. Our investigation found that IM Academy has not been transparent about its AML policies or the measures it has in place to mitigate these risks.

Reputational risks are also significant. The numerous scam reports, lawsuits, and negative media coverage have eroded trust in IM Academy. For a company that relies heavily on recruitment and word-of-mouth marketing, this is a serious concern

Conclusion

In conclusion, IM Academy is a high-risk entity that warrants further scrutiny from regulators and law enforcement agencies. Until the company addresses these issues and demonstrates a commitment to ethical business practices, we advise consumers to steer clear. The overwhelming evidence of scam allegations, undisclosed business relationships, and regulatory warnings paints a troubling picture. The company’s business model appears to prioritize recruitment over genuine education, leaving many participants financially worse off.