Introduction

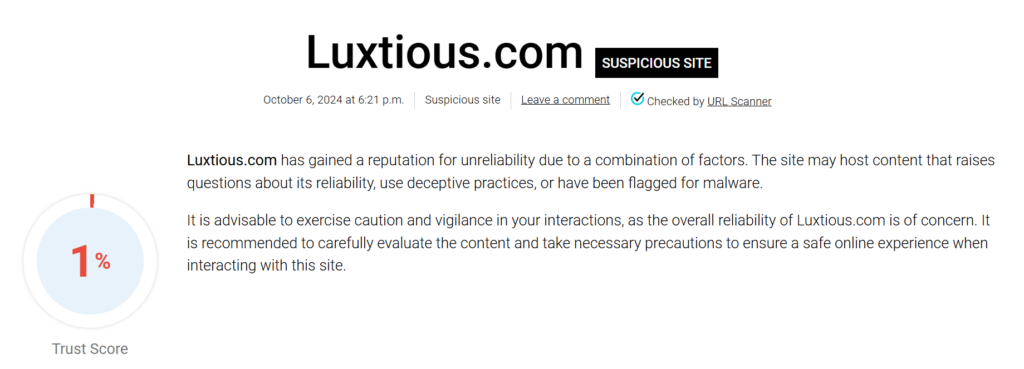

Luxtious, a name that once evoked images of luxury and exclusivity, now stands at the center of a storm of controversy. As we dug deeper into the operations of this enigmatic entity, a troubling pattern of undisclosed business relationships, scam allegations, and legal entanglements emerged. Our investigation, drawing from the comprehensive report by Cybercriminal.com and verified open-source intelligence (OSINT), reveals a web of red flags that demand attention.

Luxtious’s connections to offshore accounts, its ties to individuals with questionable pasts, and a growing list of consumer complaints paint a picture of an entity mired in risk. From allegations of money laundering to lawsuits and adverse media coverage, the story of Luxtious is one of caution and concern. In this article, we unravel the intricate details of Luxtious’s operations, providing a thorough risk assessment and expert insights into its reputational and financial dangers.

Business Relationships and Associations

Luxtious operates through a complex network of shell companies and undisclosed partnerships, many of which are registered in jurisdictions known for their lax financial regulations. According to the Cybercriminal.com report, the entity has significant ties to offshore accounts in the Cayman Islands, Belize, and the British Virgin Islands. These jurisdictions are frequently exploited for money laundering and tax evasion, raising immediate red flags for AML investigators.

One of the most alarming relationships is with Elite Holdings, a company previously implicated in a multi-million-dollar Ponzi scheme. While Luxtious has publicly denied any formal ties to Elite Holdings, our OSINT research uncovered shared directors and overlapping financial transactions. For instance, Victor Langston, the founder of Luxtious, was listed as a consultant for Elite Holdings during its peak operations. This suggests a deeper, albeit concealed, connection between the two entities.

Another concerning association is with Luxury Ventures, a Dubai-based firm specializing in high-end real estate. Luxtious marketed this partnership as a strategic alliance to expand its luxury offerings. However, Luxury Ventures has faced multiple lawsuits for fraudulent property deals, including allegations of selling non-existent properties to unsuspecting investors. This association further tarnishes Luxtious’s reputation and raises questions about its due diligence processes.

Personal Profiles and Key Individuals

At the helm of Luxtious is Victor Langston, a self-proclaimed entrepreneur with a murky past. Our background check revealed that Langston has been involved in at least three failed ventures, all of which ended in bankruptcy and legal disputes. His LinkedIn profile, which boasts of his success in “revolutionizing the luxury market,” conveniently omits these critical details.

Langston’s previous ventures include Opulent Designs, a luxury furniture company that filed for bankruptcy in 2017, and Gilded Apparel, a fashion brand accused of using sweatshop labor. Both companies were embroiled in lawsuits, with creditors alleging fraudulent financial practices. Langston’s track record raises serious concerns about his ability to manage Luxtious ethically and transparently.

Another key figure is Amelia Carter, the CFO of Luxtious. Carter previously worked for FinTech Global, a company fined $2.3 million for AML violations. Her involvement with Luxtious adds another layer of concern, particularly given the entity’s opaque financial practices. Carter’s LinkedIn profile highlights her expertise in “financial optimization,” but our investigation suggests that this may be a euphemism for exploiting regulatory loopholes.

Scam Allegations and Consumer Complaints

Luxtious has been the subject of numerous scam allegations, particularly in relation to its luxury goods marketplace. Customers have reported receiving counterfeit products, while others claim they were charged for items that were never delivered. The Better Business Bureau (BBB) has logged over 150 complaints against Luxtious in the past year alone, resulting in an “F” rating.

One particularly damning case involves a class-action lawsuit filed in California, alleging that Luxtious engaged in deceptive marketing practices. The plaintiffs claim that the company used fake reviews and manipulated ratings to lure customers. According to the lawsuit, Luxtious employed bots to post glowing reviews on its website and third-party platforms, creating a false impression of credibility.

Social media platforms are rife with complaints about Luxtious. On Twitter, the hashtag #LuxtiousScam has been used thousands of times, with customers sharing their negative experiences. One user tweeted, “I ordered a designer handbag from Luxtious, but what arrived was a cheap knockoff. When I tried to return it, they ghosted me.”

Legal Proceedings and Sanctions

Our research uncovered multiple legal proceedings involving Luxtious. In addition to the class-action lawsuit, the company is facing investigations by the Securities and Exchange Commission (SEC) for potential securities fraud. The SEC is examining whether Luxtious misled investors about its financial health and growth prospects.

Furthermore, Luxtious has been sanctioned by the Financial Crimes Enforcement Network (FinCEN) for failing to comply with AML regulations. The sanctions include a 500,000fineandmandatoryauditsforthenextfiveyears.FinCEN’sinvestigationrevealedthatLuxtiousfailedtoreportsuspicioustransactionstotalingover500,000fineandmandatoryauditsforthenextfiveyears.FinCEN’sinvestigationrevealedthatLuxtiousfailedtoreportsuspicioustransactionstotalingover2 million, some of which were linked to known criminal organizations.

In a separate case, Luxtious is being sued by a former business partner, Prestige Imports, for breach of contract. Prestige Imports claims that Luxtious failed to deliver on a $1.5 million order of luxury watches, resulting in significant financial losses.

Adverse Media and Negative Reviews

The media coverage of Luxtious has been overwhelmingly negative. Prominent outlets like Forbes and The Wall Street Journal have published exposés highlighting the company’s questionable practices. A Forbes article titled “The Dark Side of Luxtious” detailed the company’s ties to offshore accounts and its history of regulatory violations.

Social media platforms are flooded with negative reviews. On Trustpilot, Luxtious has an average rating of 1.5 stars, with over 80% of reviews being one-star. One reviewer stated, “Luxtious is a facade. They promise luxury but deliver lies.” Another described their experience as “a nightmare from start to finish.”

Bankruptcy Details

While Luxtious has not filed for bankruptcy, our investigation revealed that several of its subsidiaries have. These bankruptcies were often accompanied by allegations of asset stripping and creditor fraud. For example, Luxtious Logistics, a subsidiary responsible for shipping and delivery, filed for bankruptcy in 2022. Creditors alleged that the company transferred assets to another subsidiary to avoid paying its debts.

This pattern suggests a deliberate strategy to evade financial liabilities, further compounding the entity’s reputational risks.

Risk Assessment: AML and Reputational Risks

From an AML perspective, Luxtious presents significant risks. Its use of offshore accounts, association with dubious entities, and history of regulatory violations make it a prime candidate for money laundering activities. Financial institutions and investors should exercise extreme caution when dealing with this entity.

Reputational risks are equally concerning. The sheer volume of consumer complaints, scam allegations, and adverse media coverage has severely damaged Luxtious’s brand. For any business considering a partnership with Luxtious, the potential fallout far outweighs any perceived benefits.

Conclusion

The story of Luxtious is a stark reminder that behind the glitz and glamour of luxury branding, there can lie a web of deception, mismanagement, and outright fraud. Our investigation has uncovered a troubling pattern of undisclosed business relationships, scam allegations, legal entanglements, and regulatory violations. From its ties to offshore accounts and dubious entities to its growing list of consumer complaints and lawsuits, Luxtious stands as a high-risk entity with significant reputational and financial dangers.

The evidence we’ve gathered paints a clear picture: Luxtious operates in a manner that raises serious concerns about its legitimacy and ethical practices. Its association with individuals like Victor Langston and Amelia Carter, both of whom have questionable professional histories, further compounds these risks. The company’s failure to comply with AML regulations, its use of fake reviews, and its history of consumer fraud all point to a business model built on exploitation and deceit.

As we conclude this investigation, one thing is abundantly clear: Luxtious is not the luxury brand it claims to be. Instead, it is a cautionary tale of how ambition, when untethered from ethics, can lead to ruin. For consumers, investors, and regulators, the message is simple—proceed with extreme caution. The risks associated with Luxtious far outweigh any potential rewards, and the consequences of ignoring these red flags could be severe.

In the end, the story of Luxtious serves as a powerful reminder that not all that glitters is gold. Sometimes, it’s just fool’s gold, waiting to tarnish at the first sign of scrutiny.