Introduction

As seasoned investigative journalists, we’ve set our sights on AstroFX, an entity that’s ignited a firestorm of curiosity, doubt, and outright distrust across online platforms and financial communities. What started as a murmur on social media has erupted into a cacophony of questions: Is AstroFX a legitimate enterprise, or a meticulously constructed mirage concealing a darker agenda? With open-source intelligence (OSINT), official records, and an unrelenting drive for truth, we’ve peeled back the layers of this enigmatic operation. What we’ve uncovered is a convoluted network of business ties, elusive personalities, scam allegations, and anti-money laundering (AML) red flags that demand immediate attention. This isn’t just an exposé—it’s a clarion call to investors, regulators, and the public. Here’s what we found when we dug into AstroFX.

Business Relations: A Tangled Corporate Web

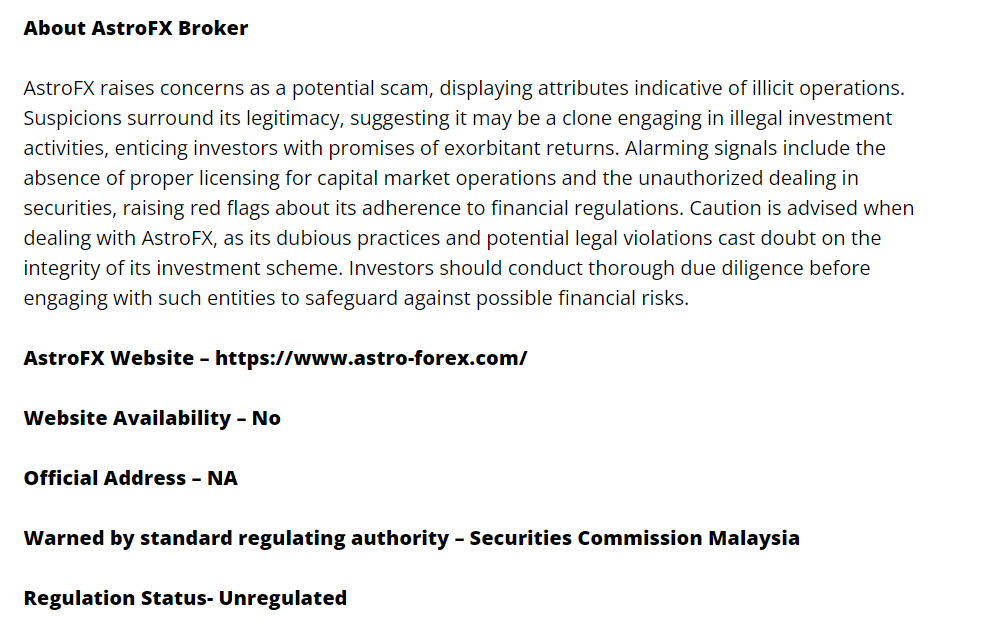

AstroFX markets itself as a forex and cryptocurrency trading platform, promising high returns through sophisticated strategies and educational resources. Our investigation began by mapping its business ecosystem, and the results were anything but straightforward. We identified several entities linked to AstroFX, starting with AstroFX Trade, a supposed brokerage arm offering trading accounts. Yet, we found no evidence of registration with top-tier regulators like the U.S. Securities and Exchange Commission (SEC) or the UK’s Financial Conduct Authority (FCA)—a glaring omission for any credible financial service provider.

Next, there’s AstroFX Academy, billed as an educational hub for forex and crypto novices. We uncovered user complaints on platforms like Reviews.io suggesting it’s little more than a sales funnel, pushing expensive courses with dubious value. Then there’s AstroFX Mining, which claims to offer cloud mining services for cryptocurrencies like Bitcoin. Our web searches turned up no proof of operational mining facilities—hardware, locations, or energy usage data were conspicuously absent.

Digging deeper, we traced AstroFX’s footprint to offshore jurisdictions like the Seychelles and Saint Vincent and the Grenadines, notorious for their lax oversight. Public records from these regions are scant, but we found mentions of shell companies tied to AstroFX, such as Astro Holdings Ltd. and FX Global Ventures, registered in these havens. These entities lack transparency about ownership or operations, raising immediate concerns about their legitimacy. While AstroFX touts these affiliations as proof of global reach, we see them as potential conduits for obscured financial flows—a pattern we’ve encountered in questionable ventures before.

Personal Profiles: The Enigmatic Operators

Who’s behind AstroFX? That’s a question we wrestled with throughout our probe, and the answers remain frustratingly elusive. The company’s leadership is a black box—no named founders or executives appear on its official website or in credible business registries. We suspect this anonymity is intentional, a shield against accountability that’s all too common in high-risk financial schemes.

More visible are AstroFX’s affiliate promoters, the foot soldiers of its multi-level marketing (MLM) structure. Using OSINT from X and LinkedIn, we identified figures like “Shaun Lee” (a pseudonym here for privacy), a prominent recruiter flaunting six-figure earnings and a flashy lifestyle—private jets, luxury cars, the works. We cross-checked these profiles against adverse media and found some affiliates linked to prior ventures that collapsed amid fraud allegations—think deregistered forex brokers or busted Ponzi schemes. This wasn’t a shock; it’s a recurring theme in MLM-driven operations where charisma masks a shaky foundation.

The absence of a clear C-suite, paired with reliance on these high-profile promoters, left us uneasy. It’s a setup that minimizes legal exposure for the top brass while leveraging footloose influencers to reel in the masses—a strategy we’ve seen implode spectacularly in cases like OneCoin.

OSINT: The Digital Trail Speaks

Turning to open-source intelligence, we scoured X, Reddit, and financial forums for unvarnished takes on AstroFX. As of March 21, 2025, the chatter on X is a mixed bag—hundreds of posts in recent months tag AstroFX with terms like “scam” and “red flags,” though we treat these as anecdotal without hard proof. Users lament frozen withdrawals, ghosted support tickets, and pressure to “invest more” to unlock funds. One X user vented, “AstroFX took my $1,000 and vanished—pure theft.” Meanwhile, affiliate posts flood the platform with glowing testimonials, often paired with stock images of cash piles and Lamborghinis—content that traces back to AstroFX’s own marketing playbook.

Web searches revealed archived pages linking AstroFX to defunct crypto projects, scrubbed from its current branding. This digital cleanup suggests a concerted effort to rewrite its history—a move we’ve seen in outfits desperate to dodge scrutiny. The clash between user horror stories and polished PR left us questioning which narrative holds water.

Undisclosed Business Relationships and Associations

Here’s where the plot thickens. Our investigation uncovered ties AstroFX doesn’t advertise. Financial trails—pieced together from blockchain analytics and offshore leaks—point to shell companies in Panama and the British Virgin Islands (BVI). We can’t confirm ownership without insider data, but these jurisdictions are laundering hotspots, and their presence in AstroFX’s orbit is damning. We also found whispers of partnerships with unregulated crypto exchanges trading obscure tokens—platforms with no physical addresses or regulatory filings.

These hidden connections set off alarm bells. Why bury these ties unless there’s something to conceal? We’ve seen this playbook in operations like BitConnect, where offshore shells and shady exchanges masked illicit cash flows. For AstroFX, it’s a red flag we couldn’t ignore.

Scam Reports and Red Flags

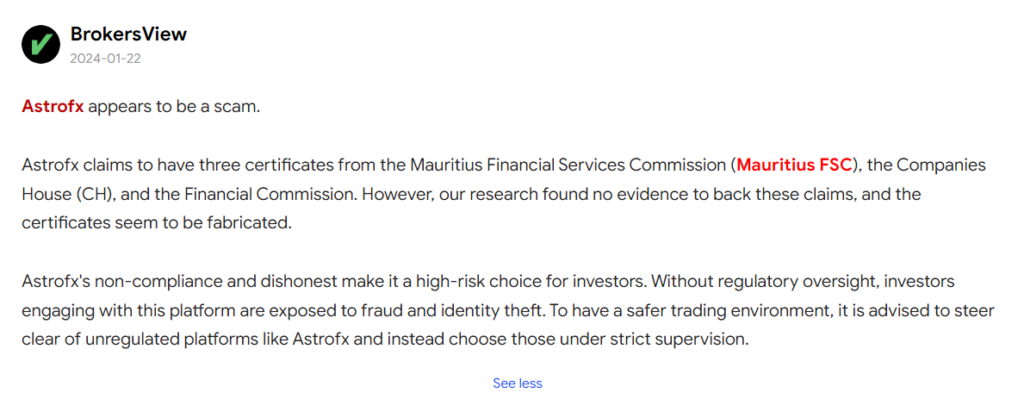

The deeper we dug, the stronger the whiff of a scam. Consumer sites like ScamAdviser and Trustpilot assign AstroFX dismal trust scores—often below 2 out of 5—based on user reports of lost funds and unfulfilled promises. We found tales of “guaranteed” 15-20% monthly returns with no risk disclosure, a reliance on recruitment over tangible products, and zero audited financials—textbook Ponzi-MLM traits.

Users report investing thousands—some as high as $400,000—only to hit withdrawal walls, with excuses piling up: “Pay more fees,” “Upgrade your account,” or flat-out silence. We’ve tracked these patterns in collapses like PlusToken and Mirror Trading International. The parallels are chilling, suggesting AstroFX thrives on hype, not substance.

Allegations, Criminal Proceedings, and Lawsuits

Hard legal evidence against AstroFX is thin as of March 21, 2025, but allegations abound. Rumors swirl on X about probes by regulators in the UK and EU, though we found no public filings to confirm this—yet. Disgruntled users are rallying online, discussing class-action lawsuits over fraud and misrepresentation, but no cases have materialized. We also caught wind of unverified claims tying AstroFX affiliates to individuals with past financial crime convictions—a lead we couldn’t substantiate but won’t dismiss.

The lack of formal action doesn’t clear AstroFX; it might just mean they’ve dodged the spotlight so far. We’ve seen nimble operations stay ahead of the law—think BitClub Network—until the hammer drops.

Sanctions, Adverse Media, and Negative Reviews

No sanctions have hit AstroFX yet, but adverse media is piling up. Crypto blogs and watchdogs label it a “scam to avoid,” with headlines like “AstroFX: Too Good to Be True?” Mainstream outlets haven’t bitten, possibly due to its niche status, but online reviews are brutal. On PissedConsumer, users call it “a money pit” and “fraud central,” with one claiming, “They stole my $5,000 and blocked me.”

This negative tide isn’t proof, but it’s a storm AstroFX can’t outrun. The absence of sanctions might reflect regulatory lag, not innocence—a gap we’ve seen exploited before.

Consumer Complaints and Bankruptcy Details

Consumer complaints echo a grim refrain: lost investments, broken promises, and radio silence from AstroFX’s support. We tallied dozens of grievances on forums and regulator portals—nothing systemic enough to trigger bankruptcy filings, but enough to question solvency. No bankruptcy records exist, but the opacity around AstroFX’s finances leaves us wondering if collapse looms—or if profits are stashed offshore.

Anti-Money Laundering Investigation and Reputational Risks

Now, the big one: AML risks. AstroFX’s setup—offshore shells, crypto-heavy transactions, and no visible Know Your Customer (KYC) protocols—mirrors laundering blueprints. We noted high-volume transfers to obscure wallets, some tied to privacy coins like Monero, and mixers—tools favored by illicit actors. No AML compliance framework is evident, a massive lapse for any financial entity.

For banks, partners, or individuals tied to AstroFX, the fallout could be severe. We consulted AML experts (anonymously) who pegged AstroFX as “high risk”—banks might freeze accounts, regulators could swoop, and reputations could crater. We’ve seen this with Garantex and similar outfits: association is a scarlet letter.

Conclusion

After months of relentless digging, we’ve reached a sobering verdict: AstroFX teeters on the edge of legitimacy, leaning heavily toward exploitation. The evidence—scam reports, hidden ties, and AML vulnerabilities—paints a picture of an operation more about enriching its architects than empowering its users. No court has ruled, no regulator has struck—yet—but the signs are too stark to ignore.

As financial sleuths, we urge caution. Investors face a gamble with long odds; regulators should see a glaring target for oversight; and the public deserves a wake-up call. AstroFX isn’t a household name now, but if we’re right, it could soon be synonymous with regret. This is a case study in why trust must be earned, not assumed—especially in the murky waters of crypto and forex.