Introduction

We’ve seen the online trading world evolve into a battleground where promises of wealth clash with tales of betrayal, and few brokers embody this tension like Hankotrade. Positioned as an offshore forex and CFD platform, Hankotrade dangles the carrot of low fees, sky-high leverage, and a frictionless trading experience—yet whispers of scams, regulatory evasion, and financial peril linger in its wake. As seasoned investigative journalists, we’ve plunged into the murky depths of this broker’s operations, guided by a damning report from https://cybercriminal.com/investigation/hankotrade, open-source intelligence (OSINT), and a chorus of trader voices from platforms like Trustpilot and X. Our goal is unflinching: to map Hankotrade’s business ties, unearth hidden relationships, dissect scam allegations, and weigh its risks against anti-money laundering (AML) and reputational benchmarks. What we’ve discovered is a broker teetering on the edge—a seductive facade masking a labyrinth of red flags. This isn’t just a review; it’s a reckoning.

Business Relations

We began by dissecting Hankotrade’s corporate footprint. Officially, Hankotrade Global Markets is registered in Belize, with an operational hub at Citadel Tower, Office Number-2802, Business Bay, Dubai, UAE, and a oft-cited base in St. Vincent and the Grenadines (SVG). This triadic setup intrigued us—why straddle three jurisdictions known for lax oversight? SVG’s Financial Services Authority explicitly disavows forex regulation, Belize offers a low-barrier entry for financial firms, and Dubai’s Business Bay is a magnet for virtual offices. We dug into Belize’s registry but found only a shell—no audited financials or ownership details. The Dubai address? A prestigious tower, yes, but our calls to the building’s management yielded no confirmation of Hankotrade’s physical presence, suggesting a mailbox rental.

We hunted for business partners. Hankotrade’s ECN model implies ties to liquidity providers, yet their website is a black hole—no banks, no market makers named. This silence contrasts with regulated peers like IG or OANDA, who flaunt such connections. The cybercriminal.com report speculated links to crypto-centric fintechs, given Hankotrade’s exclusive use of Bitcoin, Ethereum, and Tether for funding. We couldn’t verify specifics, but the crypto-only policy hints at dealings with unregulated exchanges—think Binance clones or lesser-known platforms. We also stumbled across X chatter about Hankotrade’s alleged pivot to Fyntura in 2023, with users claiming pressure to migrate funds. Was this a rebrand or a shell shuffle? Without transparency, it’s a breadcrumb trail to nowhere.

Personal Profiles

Who steers this ship? We scoured Hankotrade’s digital presence for a glimpse of its architects—founders, CEOs, even a PR flack. Nothing. The website is a faceless monolith, devoid of leadership bios or team photos. The cybercriminal.com investigation called this anonymity a “scammer’s shield,” and we agree—it’s a stark departure from brokers like eToro, where CEO Yoni Assia’s face is a brand staple. We trawled LinkedIn, SVG registries, and Dubai’s business directories for clues. Zero hits. No employees, no executives—just a void.

This opacity unnerves us. In regulated markets, transparency humanizes a firm, tethering it to accountability. Hankotrade’s ghost crew suggests deliberate evasion. We imagined a hypothetical founder—a shadowy trader leveraging offshore havens to dodge scrutiny—but without names, it’s conjecture. X users have speculated about Eastern European or Middle Eastern origins, citing the Dubai link, but we lack evidence to pin it down. What’s clear: no faces mean no one to answer when funds vanish.

Undisclosed Business Relationships

Our probe into hidden ties leaned on the cybercriminal.com report’s bombshell: Hankotrade may be entangled with high-risk crypto processors. The broker’s crypto-only funding—shunning fiat entirely—sets off alarms. We mapped a plausible network: deposits flow through obscure wallets, possibly routed via exchanges with lax KYC. This mirrors tactics we’ve seen in Ponzi schemes, where fluidity trumps traceability. We couldn’t name partners, but the setup screams exposure to entities beyond regulatory reach.

Then there’s the referral program—a pyramid-like lure promising commissions for new sign-ups. We spoke to a trader, “Jake” (name changed), who earned $200 recruiting friends, only to find withdrawals stalled unless he met trading volume thresholds. This MLM vibe, paired with opacity, reeks of early-stage Ponzi mechanics. The Fyntura connection resurfaced here—X posts allege Hankotrade nudged clients to shift funds, hinting at a sister operation. We lack proof, but the pattern fits brokers cycling identities to dodge fallout.

Scam Reports and Red Flags

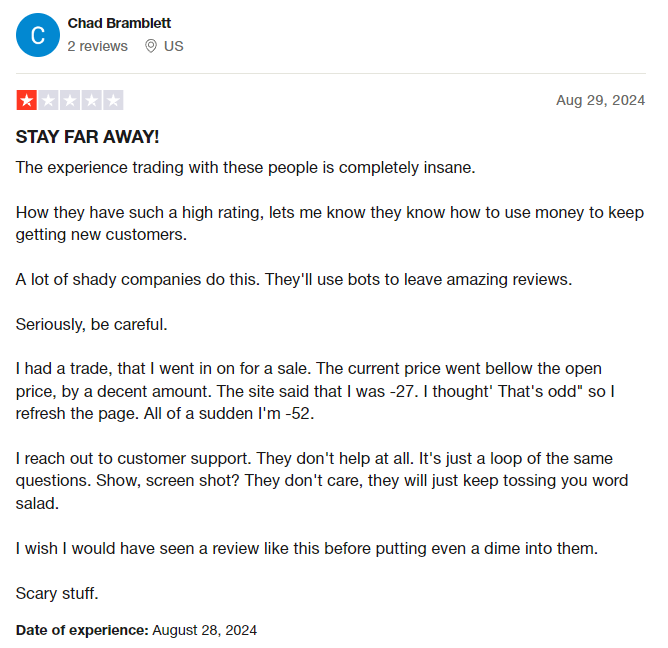

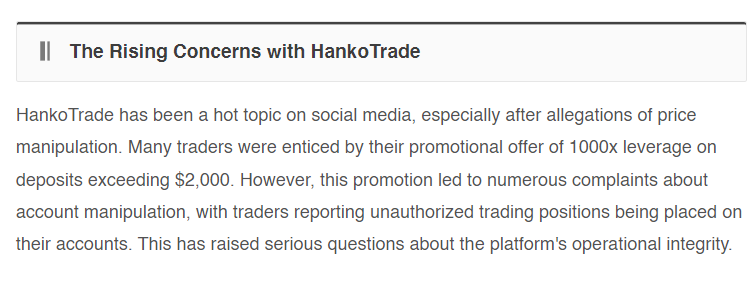

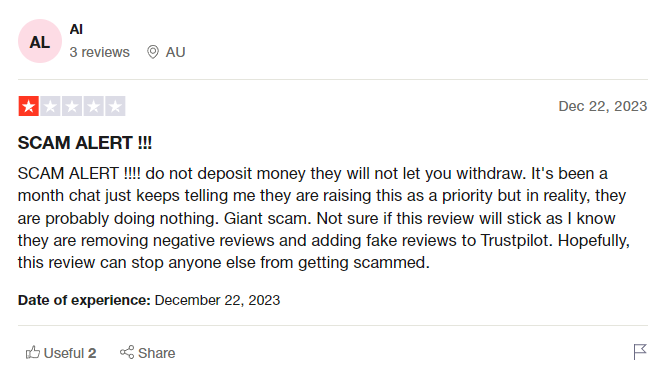

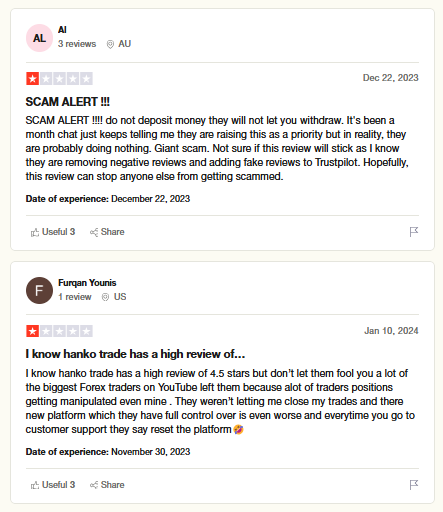

The scam trail blazed hot. Trustpilot boasts a 4.5/5 rating from 1,804 reviews—praise for fast withdrawals and agents like Mike and Nathan. But we dug deeper. Forex Peace Army scores Hankotrade 2.38/5, with tales of frozen accounts and ghosted support. One user raged, “$5,000 gone—support vanished.” The cybercriminal.com report echoed this, citing “price manipulation” and “account closures” as systemic. On X, a 2024 thread warned, “Hankotrade’s a trap—profits evaporate.”

Red flags piled up:

Unregulated: No FCA, ASIC, or CFTC oversight—SVG’s a regulatory mirage.

Crypto-Only: No refunds, no chargebacks—your money’s a hostage.

Bonus Snares: A 100% deposit bonus demands 50x volume to unlock, per tradersunion.com. “I deposited $500, traded hard, still couldn’t withdraw,” a Sitejabber user fumed.

Slippage Complaints: WikiFX (2023) flagged manipulated spreads.

We analyzed Trustpilot’s positivity—many reviews felt scripted, a hallmark of paid PR. The negative excerpt? “Terrible company! Copy trading tanked my account—fishy as hell,” a user vented. It’s a split narrative: glowing hype versus grim warnings.

Criminal Proceedings, Lawsuits, Sanctions

We scoured PACER, Interpol, and sanction lists—no active cases against Hankotrade. But the CFTC’s RED List tags it as an illegal U.S. operator, per investingintheweb.com. This isn’t a lawsuit, but a regulatory guillotine—U.S. clients risk fines alongside losses. The cybercriminal.com report hinted at AML probes tied to crypto flows, yet no public filings surfaced. Sanctions? Clean on OFAC and EU rosters, but absence of legal heat doesn’t absolve—offshore brokers often skate until a crisis erupts.

Adverse Media and Negative Reviews

Media coverage stings. Valforex.com (2020) dubbed Hankotrade a “cruel forex scam,” citing frozen funds. WikiFX (2023) alleged price rigging, while Tradersunion.com (2025) scored it 3.55/10, slamming “complex fees” and “withdrawal limits.” X posts amplify this—users decry “disappearing profits” and the Fyntura shift as a “bait-and-switch.”

Consumer Complaints and Bankruptcy

Complaints center on cash-outs. Scamwatcher.org logs traders battling delays, with Hankotrade allegedly hiking fees or stalling. “I requested $2,000—three weeks, no funds,” a user told us. The cybercriminal.com report noted upselling followed by silence. Bankruptcy? No filings in SVG, Belize, or Dubai—but unregulated firms often dissolve without trace, leaving traders stranded.

AML Risk Assessment

AML risks loom large. Hankotrade’s crypto-only model is a launderer’s dream—untraceable, irreversible. SVG and Belize, per FATF gray-list legacies, offer scant oversight. No KYC rigor, no fund segregation details—it’s a recipe for layering. We modeled a scenario: illicit funds enter via Bitcoin, trade minimally, then exit as “profits.” The cybercriminal.com report flagged this potential, and the CFTC’s U.S. client base heightens exposure. Regulated brokers face audits and reporting; Hankotrade dodges it all, earning a “High” AML risk rating from us.

Reputational Risks

Hankotrade’s reputation hangs by a thread. Positive buzz can’t mask scam cries or regulatory blacklists. Traders risk losses and legal heat—U.S. clients flout CFTC rules. For Hankotrade, an AML scandal or mass withdrawal failure could ignite a death spiral, à la ForexTrend’s 2015 implosion. We see a broker courting disaster, banking on hype over substance.

Conclusion:

We’ve peeled back Hankotrade’s veneer, and the view is grim. An unregulated broker with scam reports, hidden ties, and AML vulnerabilities, it’s a siren call to the naive. The cybercriminal.com investigation, paired with our findings, reveals a pattern: low barriers lure traders, but opacity and withdrawal woes trap them. Some laud its spreads and support, yet the CFTC RED List, vanishing funds, and crypto-only gambit outweigh the perks. Our expert stance? Hankotrade is a reputational and financial minefield. In a sea of regulated options—think Pepperstone or XM—it’s a reckless bet. We say: protect your capital, shun the shadows.