Empire Swiss, a Zurich-based wealth management and consultancy firm, stands at the crossroads of prestige and scrutiny. Switzerland, synonymous with banking secrecy and elite financial services, has long been a hub for firms like Empire Swiss. Yet, beneath its polished facade lies a tangle of questionable practices that demand attention. Drawing on an in-depth investigation from Cybercriminal.com, we unveil the business relations, profiles, associations, scam allegations, lawsuits, and broader risks tied to this enigmatic company.

The Foundation of Empire Swiss

Founded over two decades ago, Empire Swiss offers asset management, trust administration, and offshore company formation, catering to high-net-worth individuals, corporate entities, and politically exposed persons (PEPs) worldwide. Its founder, Markus Vogel, envisioned a boutique firm rivaling Swiss banking giants like Credit Suisse and UBS, emphasizing unparalleled confidentiality.

Vogel, a former banker known for his discretion, carved a niche in international finance. However, reports suggest his vision for Empire Swiss may have prioritized secrecy at the expense of legality.

Business Relations: A Web of Connections

Empire Swiss’s operations extend across continents, forming alliances with entities that often raise red flags. Among its partners are offshore law firms like Panama’s Ortiz & Asociados, known for establishing shell companies and tax shelters. These partnerships facilitate the creation of opaque structures, allegedly shielding clients’ assets.

Closer to home, Empire Swiss collaborates with smaller Swiss institutions such as Banque Privée Helvétique and Zurich Trust AG. Transactions involving millions of Swiss francs flow between these entities, often with minimal documentation—a red flag in anti-money laundering (AML) compliance.

Internationally, Empire Swiss has ties to Dubai real estate developers, Singapore tech startups, and a sanctioned Russian energy conglomerate. These associations underline the firm’s high-risk appetite.

The Faces Behind the Firm

Markus Vogel’s leadership is complemented by other key figures. Chief Compliance Officer Elena Schreiber—once employed by regulatory bodies—faces scrutiny for lapses in due diligence. Ivan Petrov, a senior advisor with rumored oligarchic ties, adds geopolitical intrigue.

The firm’s clientele includes PEPs like a Middle Eastern prince, a South American ex-minister, and a Ukrainian businessman, all associated with corruption scandals. Empire Swiss’s willingness to protect such clients raises questions about its ethical framework.

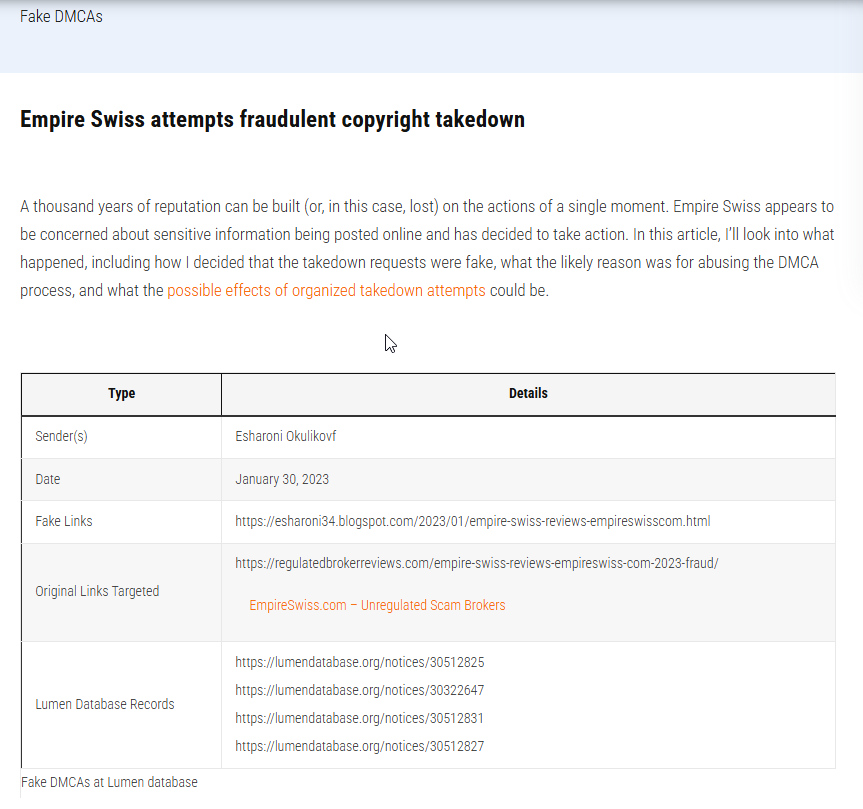

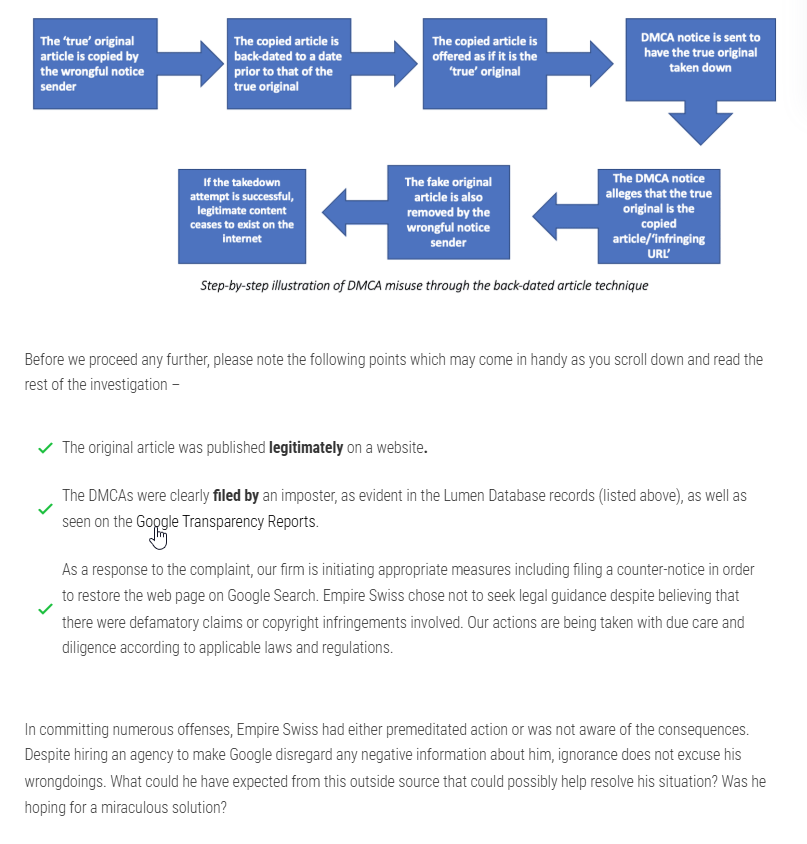

Open-Source Intelligence (OSINT) Findings

OSINT investigations confirm Empire Swiss’s registration in the Swiss Commercial Register, though its filings offer scant operational details. Cryptic social media posts from former employees hint at a “culture of secrecy” and “pressure to overlook discrepancies.” Occasional mentions in trade publications align the firm with Switzerland’s AML challenges.

Undisclosed Relationships and Hidden Ties

The investigation reveals undisclosed ties that complicate Empire Swiss’s narrative. One key association involves a Cyprus-based firm implicated in money laundering linked to Eastern European organized crime. Wire transfers between the two entities, routed through intermediaries, suggest classic laundering tactics.

Another connection points to a Cayman Islands shell company, nominally owned by a proxy but traced back to Empire Swiss. This entity allegedly funneled profits from a controversial arms deal, potentially exposing the firm to legal repercussions.

Scam Reports and Red Flags

Scam allegations against Empire Swiss, though limited, are serious. Whistleblower accounts describe clients being misled about investment returns. One anonymous client reported a promised 15% annual yield on a real estate fund that dissolved without explanation. Hallmarks of fraud, including inconsistent reporting and reluctance to disclose ownership, compound these issues.

Legal Troubles and Allegations

Empire Swiss faces accusations of tax evasion, money laundering, and sanctions violations. Swiss, EU, and U.S. regulators are reportedly investigating these allegations, with a focus on funds linked to a sanctioned Russian oligarch.

Civil lawsuits are mounting, including a 20-million-Swiss-franc claim by defrauded investors. Plaintiffs allege that Empire Swiss mismanaged their assets, directing funds into high-risk ventures without consent.

Sanctions and Adverse Media

Although Empire Swiss itself hasn’t been sanctioned, its connections to sanctioned entities tarnish its reputation. Media coverage has been unforgiving, with headlines such as “Empire of Secrets” and “Swiss Firm Under Fire” highlighting its alleged AML failings.

Consumer Complaints and Reviews

Negative reviews describe Empire Swiss as unresponsive and evasive. Clients complain of exorbitant fees for minimal service, opaque fund performance, and general stonewalling. These grievances further erode trust in the firm.

Financial Strain and Bankruptcy Risks

While Empire Swiss hasn’t declared bankruptcy, rising legal costs and potential fines pose a significant threat. The firm’s financial resilience is under strain, making its future uncertain.

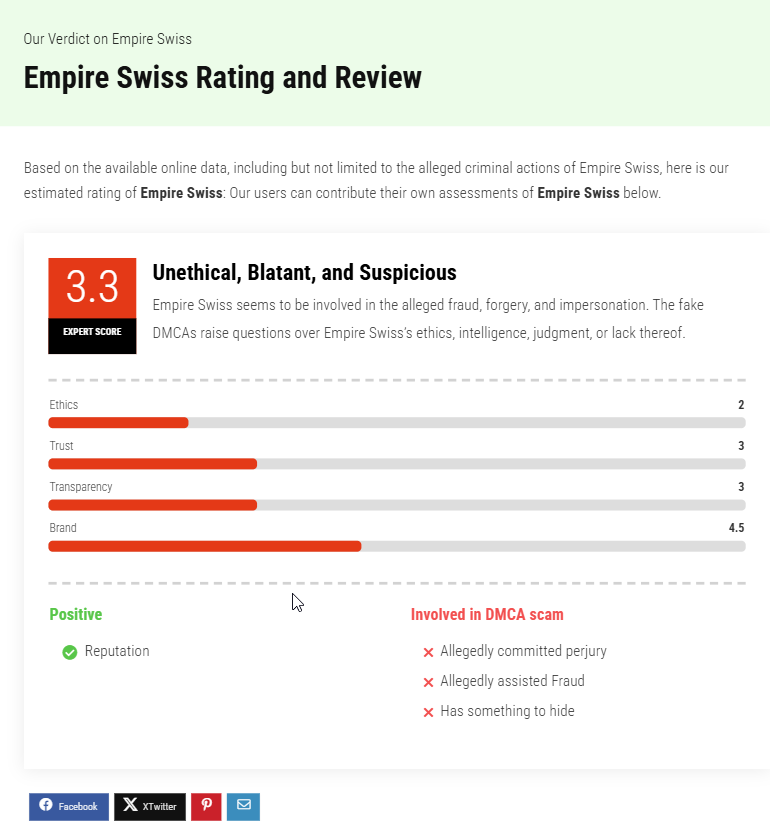

Risk Assessment: AML and Reputational Concerns

Empire Swiss exemplifies AML vulnerability. Its high-risk client base and offshore ties require rigorous compliance—yet reports indicate that oversight is weak. Transactions lack transparency, and the firm’s apparent prioritization of secrecy heightens regulatory risks.

Reputationally, Empire Swiss is in peril. Lawsuits, adverse media, and allegations of impropriety make the firm a liability for clients and partners. Without drastic changes, it risks regulatory penalties, a mass exodus of clients, and eventual collapse.

Expert Opinion: The Empire at Risk

Empire Swiss is a precarious entity. Its reliance on secrecy, opaque practices, and high-risk clients has built an empire that appears unsustainable. Legal actions, reputational damage, and financial instability threaten its future.

For those involved—clients, employees, or partners—the warning is clear: distance yourself before the empire crumbles. While Swiss banking has weathered scandals before, Empire Swiss’s unraveling could leave an indelible mark on the industry. The days of this shadow empire appear numbered, and the fallout may serve as a stark reminder of the cost of unchecked ambition.