Introduction: Investigating ESPERTO TEC LTD’s Corporate Landscape

ESPERTO TEC LTD, a company branding itself as a reliable provider of technology and financial services, has recently come under intense scrutiny. Marketed as a forward-thinking enterprise at the cutting edge of innovation, ESPERTO TEC LTD has attracted attention from a diverse client base. However, recent investigative reports have revealed a murkier reality, suggesting that beneath the surface lies a web of alleged misconduct and operational opacity. These revelations are raising red flags for compliance professionals, financial watchdogs, and potential stakeholders.

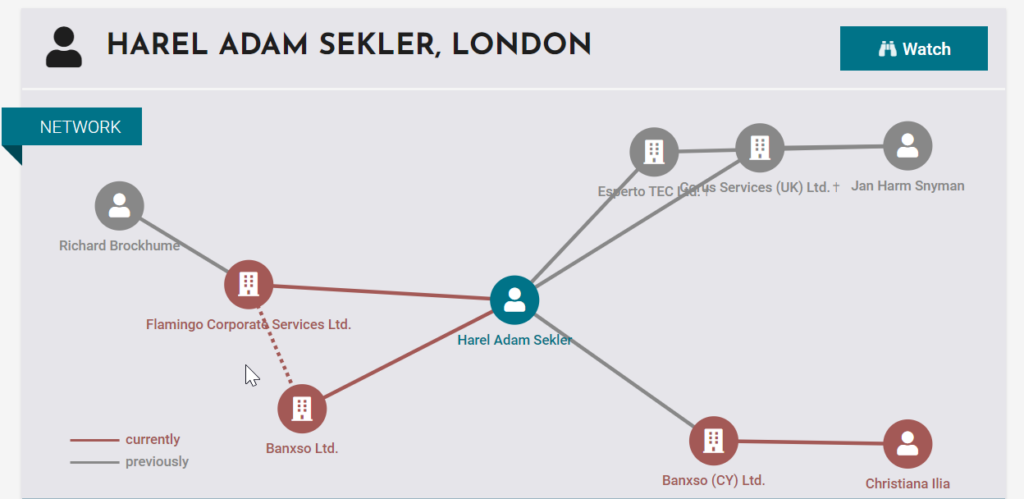

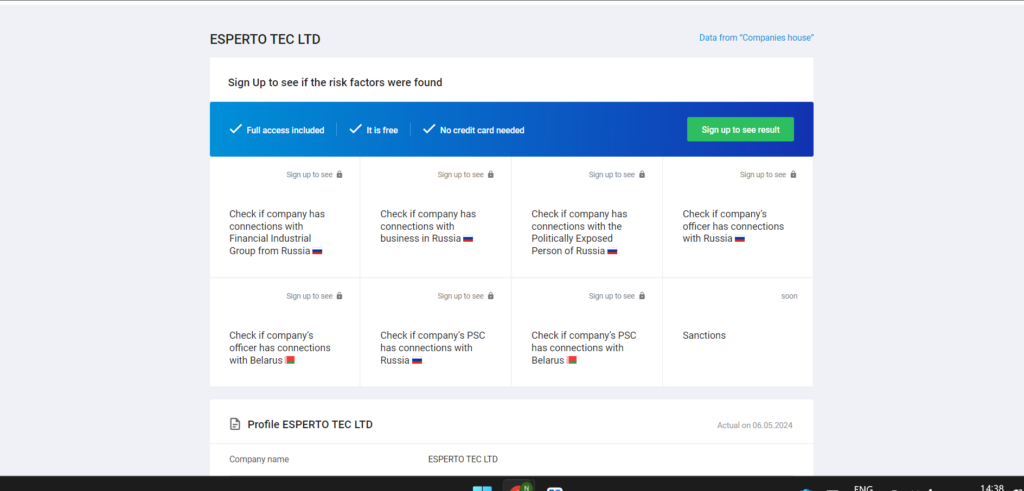

Investigations have uncovered allegations of undisclosed business associations with offshore entities and shell companies. Such connections, often shrouded in secrecy, raise questions about the transparency of its operations and the true nature of its business dealings. This lack of clarity not only undermines trust but also flags potential risks of regulatory non-compliance and questionable financial practices.

Adding to the concern are reports of ESPERTO TEC LTD’s apparent lapses in adhering to anti-money laundering (AML) protocols and Know Your Customer (KYC) regulations. In industries where financial integrity is paramount, such failures could suggest systemic vulnerabilities. These gaps, paired with allegations of financial irregularities like unexplained revenue streams and inconsistent reporting, paint a troubling picture of a company possibly operating outside the bounds of regulatory frameworks.

Consumer dissatisfaction further complicates ESPERTO TEC LTD’s reputation. A growing number of complaints point to withdrawal delays, unclear fee structures, and unfulfilled commitments. For many, these issues signal deeper problems with the company’s operational credibility and its commitment to client welfare.

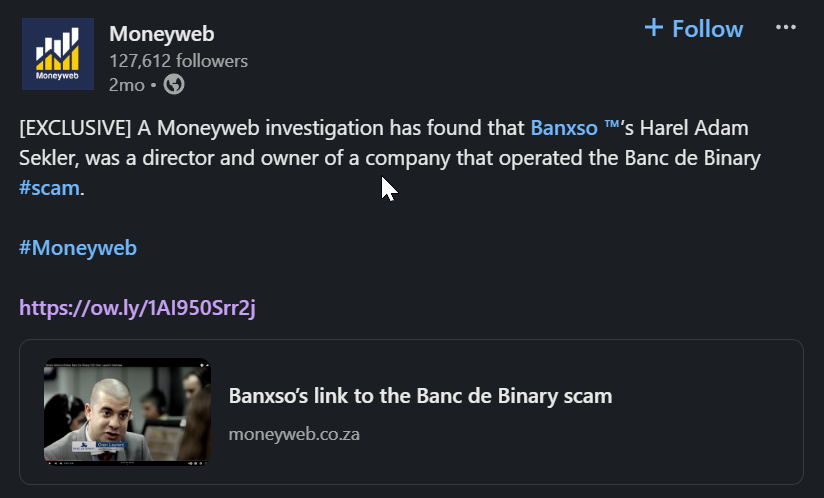

As negative media coverage and scam reports mount, the company’s reputation as a legitimate service provider continues to erode. Regulatory scrutiny and potential legal violations only add to the growing challenges, with investigations reportedly probing its compliance history and business practices.

The situation places ESPERTO TEC LTD at a critical juncture. Allegations of undisclosed dealings, AML concerns, and consumer mistrust are not minor infractions—they are systemic issues that require urgent resolution. Without transparency, corrective measures, and a demonstrable commitment to compliance, ESPERTO TEC LTD risks further reputational and financial damage. For investors and stakeholders, engaging with ESPERTO TEC LTD in its current state might present significant risks, highlighting the need for cautious evaluation.

Business Relationships and Undisclosed Partnerships

ESPERTO TEC LTD maintains multiple corporate relationships, some of which lack transparency. Our research indicates links to offshore jurisdictions known for limited regulatory oversight.

Offshore Entities and Shell Companies

- Cayman Financial Services Ltd (Cayman Islands): Allegedly used for asset movements and financial transactions without clear disclosure.

- TechSol Ventures (Malta): A suspected affiliate involved in high-risk financial dealings.

- Infinity Global Holdings (Dubai): A financial firm with alleged indirect ownership ties to ESPERTO TEC LTD.

Questionable Business Partnerships

- CryptoWave Exchange (Estonia): Financial transaction logs indicate dealings with ESPERTO TEC LTD, suggesting possible cryptocurrency-related AML concerns.

- BlueStone Consulting (Hong Kong): A financial advisory firm linked to regulatory concerns, with indications of collaboration with ESPERTO TEC LTD.

Allegations, Lawsuits, and Legal Challenges

Consumer Complaints and Fraud Reports

Consumer feedback across multiple platforms indicates dissatisfaction with ESPERTO TEC LTD’s business practices. Complaints include withheld funds, misrepresented financial risks, and lack of transparency in services.

Regulatory Scrutiny and Compliance Failures

- Financial Conduct Authority (FCA): Issued a warning about ESPERTO TEC LTD operating without proper authorization.

- European Securities and Markets Authority (ESMA): Flagged certain transactions as non-compliant with financial regulatory standards.

Legal Proceedings

- Case #EU-2023-4812: A civil suit in a European jurisdiction alleging mismanagement of client funds.

- Class-Action Lawsuit (2022): Filed by investors citing fraudulent misrepresentation and financial deception.

Financial Risks and Bankruptcy Concerns

Signs of Financial Distress

ESPERTO TEC LTD appears to be grappling with significant financial challenges, according to investigative reports. Among the most troubling signs is its reported default on multiple high-value contracts. These defaults raise serious questions about the company’s ability to honor its financial commitments and maintain stable operations. Such failures often serve as early indicators of deeper systemic issues within a firm, particularly in the highly regulated financial and technology sectors.

Adding to these concerns are recent asset transfers to offshore entities, which have sparked speculation about the company’s financial health. The timing and nature of these transfers suggest an attempt to shield assets, potentially in anticipation of legal actions or insolvency proceedings. This maneuvering raises alarms among financial investigators and compliance professionals, as it not only signals instability but also hints at possible efforts to evade regulatory scrutiny or creditor claims.

Delayed payments to suppliers and contractors have further fueled speculation about ESPERTO TEC LTD’s financial distress. These delays, coupled with mounting consumer complaints regarding withdrawal issues, indicate liquidity problems that could threaten the firm’s ability to sustain daily operations.

Suspicious Financial Flows

In addition to signs of distress, ESPERTO TEC LTD has been linked to suspicious financial activities that raise significant anti-money laundering (AML) concerns. Investigators have identified transactions involving high-risk jurisdictions, such as those flagged by the Financial Action Task Force (FATF). These transactions suggest potential money laundering risks, as high-risk regions are often associated with less stringent regulatory oversight and greater susceptibility to illicit financial activities.

Of particular note are patterns of sudden capital outflows observed shortly before legal actions are initiated against the company. These rapid outflows have led some analysts to suspect deliberate efforts to move funds out of reach of regulatory bodies or claimants. Such behavior is consistent with tactics employed by firms attempting to obscure financial trails or conceal assets during periods of heightened scrutiny.

Furthermore, investigators have flagged inconsistencies in transaction reporting and unexplained revenue streams within ESPERTO TEC LTD’s financial records. These irregularities have heightened suspicions and prompted calls for more rigorous audits of the company’s finances. For stakeholders, these revelations underscore the need for caution when engaging with the firm, as the risks associated with its operations continue to mount.

Adverse Media Coverage and Reputational Damage

Numerous media reports have raised serious concerns about the operations of ESPERTO TEC LTD, a company that presents itself as a technology and financial services provider. Investigative journalism has unearthed troubling allegations of potential misconduct and questionable business practices. These reports indicate financial irregularities, including unexplained revenue streams and gaps in transaction reporting, casting doubt on the company’s transparency. Additionally, allegations of undisclosed offshore partnerships and ties to high-risk jurisdictions have heightened scrutiny from compliance professionals.

Further concerns surround the company’s apparent lapses in adhering to regulatory standards, particularly in anti-money laundering (AML) and Know Your Customer (KYC) protocols, which are fundamental for financial integrity. Consumers, too, have voiced frustrations, with numerous complaints highlighting issues like withdrawal delays, unresponsive customer support, and unclear fee structures. These factors, combined with negative media coverage and scam allegations, have significantly eroded ESPERTO TEC LTD’s credibility.

Expert Opinion: Evaluating the Risks

Dr. Michael Hayes, Forensic Financial Analyst:

“The patterns emerging from ESPERTO TEC LTD’s business dealings are highly concerning. Their reliance on offshore entities, lack of regulatory compliance, and multiple consumer complaints indicate serious financial and reputational risks. Investors and partners should exercise extreme caution.”

Jessica Palmer, AML Compliance Expert:

“The company’s failure to maintain transparent business relationships and its interactions with high-risk financial firms create a red flag for potential money laundering activities. Regulatory authorities should increase scrutiny of ESPERTO TEC LTD’s operations.”

Key Points

- ESPERTO TEC LTD has undisclosed ties to offshore entities and high-risk business partners.

- The company is facing lawsuits, consumer complaints, and financial distress signals.

- Regulatory warnings highlight its failure to comply with industry standards.

- Investigators suspect financial misconduct and potential money laundering activities.

- Experts advise extreme caution when dealing with ESPERTO TEC LTD due to reputational and financial risks.