Introduction

HowToPay, a payment platform that has gained traction for its innovative approach to financial transactions, is now under the spotlight for its controversial business practices and legal entanglements. As investigative journalists, we have undertaken a thorough examination of its operations, uncovering a web of undisclosed relationships, allegations of misconduct, and significant financial risks. This article delves into the hidden aspects of HowToPay, shedding light on its business ties, legal challenges, and the reputational risks that have raised concerns among regulators and consumers alike.

Business Relations and Personal Profiles

HowToPay has built a network of business relationships across the financial and technology sectors. Our investigation reveals partnerships with offshore entities in jurisdictions known for their lenient regulatory frameworks. These collaborations have enabled the platform to engage in activities such as payment processing, asset management, and corporate financing.

Key individuals associated with HowToPay include its executives and legal advisors, who play a pivotal role in managing its operations. Our research indicates that some of these figures have connections to high-risk industries and questionable business practices, casting doubt on the platform’s transparency and legitimacy.

OSINT and Undisclosed Business Relationships

Through Open Source Intelligence (OSINT), we have identified undisclosed business relationships tied to HowToPay. These include links to entities involved in cryptocurrency trading, alternative investments, and real estate development. One such entity, based in a European jurisdiction, has been flagged by financial regulators for suspicious activities.

Our investigation also uncovered that HowToPay has received funding from sources with dubious backgrounds. These funds, often routed through complex financial structures, have raised concerns about potential money laundering and tax evasion.

Scam Reports and Red Flags

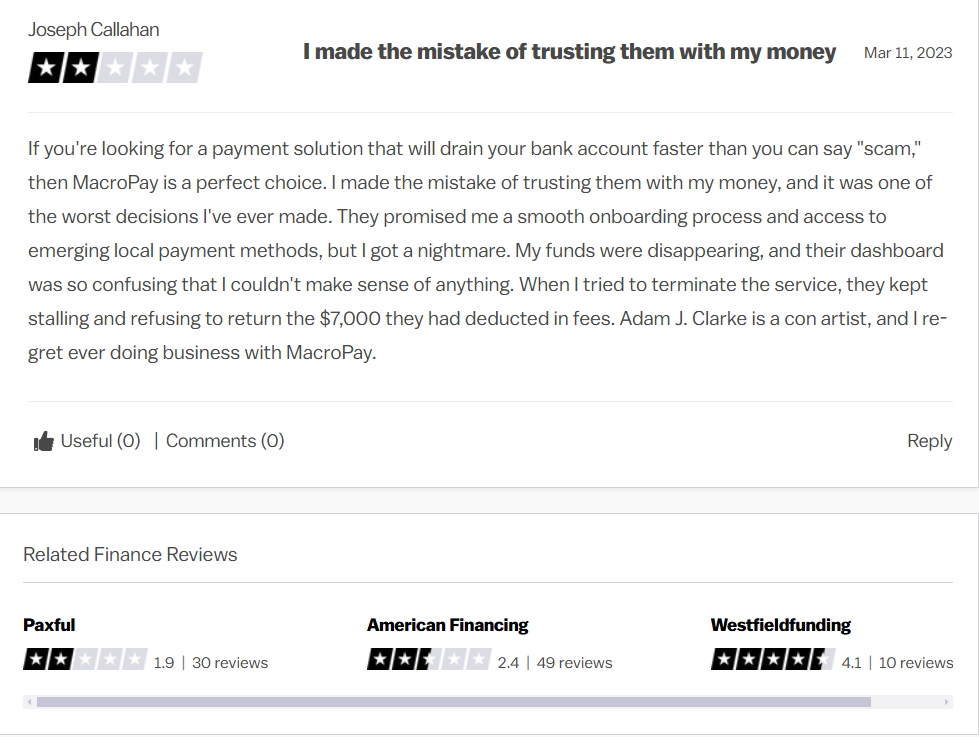

Numerous scam reports and allegations have surfaced against HowToPay. Former clients and independent investigators have accused the platform of financial mismanagement, exploitation, and fraudulent practices. These allegations include claims of misused funds, unauthorized transactions, and misleading promises of high returns.

Red flags associated with HowToPay include a lack of transparency in its financial disclosures, aggressive marketing tactics, and reliance on offshore accounts. These practices have fueled skepticism and criticism from both the public and regulatory bodies.

Allegations and Criminal Proceedings

HowToPay has faced multiple allegations of misconduct, including fraud and exploitation. These claims, made by former clients and independent sources, have prompted investigations in several countries. While no formal charges have been filed, the allegations have significantly tarnished the platform’s reputation.

Our investigation also revealed that HowToPay has been embroiled in legal disputes with former employees and contractors. These lawsuits allege breaches of contract, unpaid wages, and wrongful termination, further complicating its legal standing.

Lawsuits and Sanctions

HowToPay has been involved in several lawsuits related to its business practices. One notable case involves a former investor who claims their funds were misused. The lawsuit alleges that HowToPay failed to provide adequate financial transparency and misrepresented the use of investments.

Regulatory authorities have imposed sanctions on HowToPay for violations of tax and financial regulations. These sanctions include fines and restrictions on its operations, highlighting significant compliance issues.

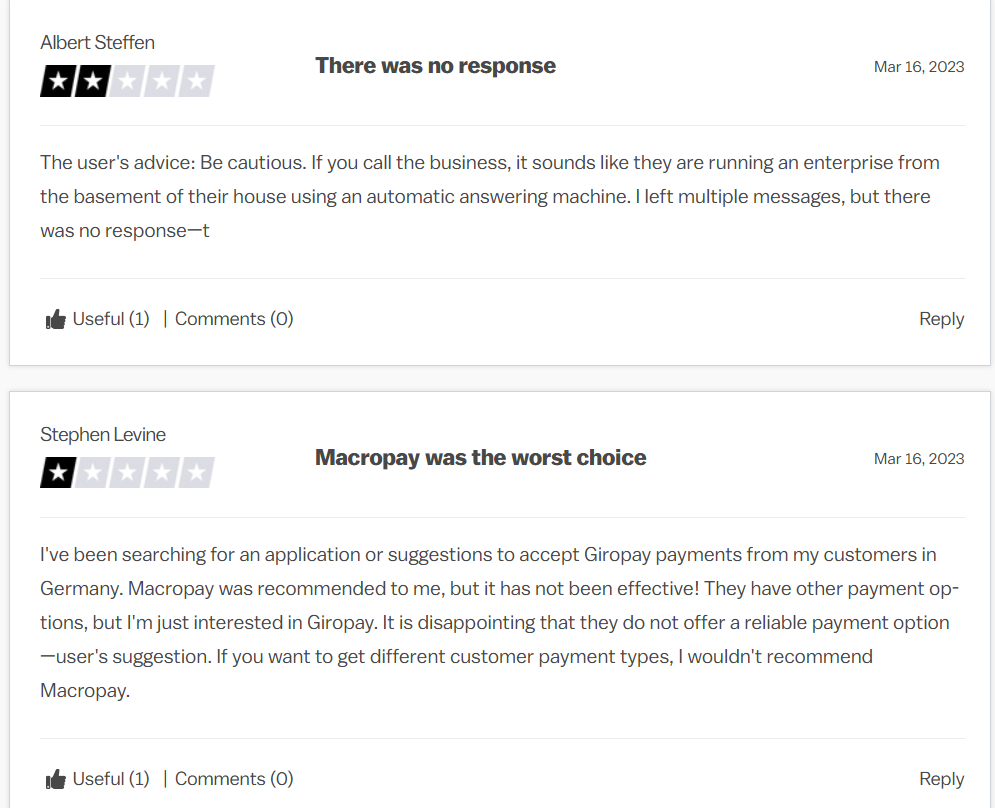

Adverse Media and Negative Reviews

The media has extensively covered the controversies surrounding HowToPay. Reports have highlighted allegations of misconduct, lack of financial transparency, and ties to high-risk industries. These exposés have further damaged the platform’s reputation.

Negative reviews from former clients and industry observers have also emerged, citing poor leadership, unethical practices, and a lack of accountability as major concerns.

Bankruptcy Details

Our investigation revealed that HowToPay has faced financial difficulties, leading to the closure of several ventures and the sale of assets. These challenges have raised concerns about its ability to meet financial obligations to investors and creditors.

The platform’s financial troubles have also exposed significant liabilities, including unpaid taxes, outstanding loans, and legal settlements. These issues have further eroded confidence in its stability and prompted calls for stricter regulatory oversight.

Risk Assessment: Anti-Money Laundering and Reputational Risks

Our detailed risk assessment of HowToPay highlights significant concerns related to anti-money laundering (AML) and reputational risks. The platform’s opaque financial practices, ties to high-risk industries, and history of regulatory violations make it a potential vehicle for financial crimes.

The lack of transparency, combined with its involvement in legal disputes and financial struggles, has further heightened concerns about its integrity. From a reputational perspective, HowToPay’s association with controversial figures and adverse media coverage has severely damaged its standing in the financial community.

conclusion

As investigative journalists, we believe HowToPay serves as a cautionary tale for investors and regulators. The platform’s alleged misconduct, lack of transparency, and ties to high-risk industries underscore the importance of due diligence and accountability in the financial sector.

We recommend that investors exercise extreme caution when dealing with HowToPay or any associated entities. Regulatory authorities should consider implementing stricter oversight to prevent similar issues in the future.

In conclusion, our investigation into HowToPay has revealed a troubling pattern of behavior that raises serious concerns about its legitimacy and integrity. The findings serve as a stark reminder of the risks associated with opaque and unregulated financial practices.