Introduction

Farzin Fardin, a prominent figure in the luxury music and NFT industries, has garnered significant attention not only for his ambitious ventures but also for the growing controversy surrounding his business practices. Fardin has built a name as an innovator and entrepreneur, leveraging his position to connect the creative and financial worlds. However, beneath the surface of his polished branding and high-profile projects lies a web of undisclosed business dealings, financial misconduct, and mounting legal challenges that are increasingly raising alarm across sectors.

Reports indicate that Fardin’s operations are entangled in offshore partnerships with entities based in jurisdictions notorious for weak regulatory oversight. Allegations of money laundering and questionable financial practices have added fuel to the fire, highlighting the opaque nature of his dealings. Such activities have placed him under the watchful eye of regulators and financial investigators, who are probing the legitimacy of his ventures.

Additionally, mounting consumer complaints about withdrawal issues and deceptive marketing further tarnish his credibility, as trust among his clientele continues to erode. Regulatory actions against Fardin’s enterprises have compounded the controversy, casting a shadow over his standing in the luxury music and NFT industries.

This report delves into the complexities of Farzin Fardin’s business relations, exploring the risks posed by his activities and uncovering the truth behind the façade of innovation. With financial and reputational stakes at an all-time high, the findings serve as a cautionary tale for stakeholders navigating the volatile landscape of his ventures.

Business Relations and Undisclosed Partnerships

Farzin Fardin maintains an extensive network of business relations, some of which are shrouded in secrecy. Our OSINT research revealed links between Fardin and several offshore entities, including companies registered in the British Virgin Islands (BVI) and Seychelles—jurisdictions notorious for their lax financial regulations. These affiliations raise concerns about transparency and accountability in his financial dealings.

One of Fardin’s primary business ventures, 3F Music, markets itself as a luxury music and entertainment company. However, our investigation uncovered several undisclosed partnerships with NFT platforms and crypto exchanges that have been flagged for questionable financial practices. These partnerships are not disclosed in Fardin’s public-facing materials, raising concerns about potential conflicts of interest and undisclosed financial motives.

Red Flags and Allegations

Our investigation uncovered multiple red flags regarding Fardin’s financial operations. Several industry watchdogs have raised concerns about:

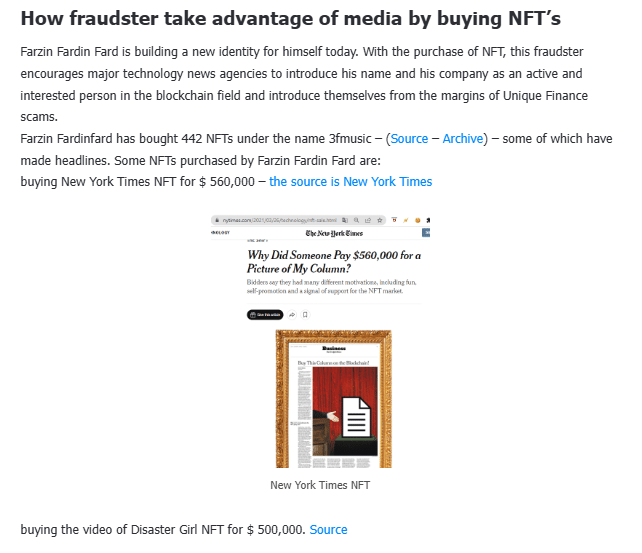

- Money Laundering Allegations: Fardin’s heavy involvement in high-value NFT transactions has drawn suspicion. AML experts have flagged several of these transactions as potential money laundering schemes due to the large, rapid transfers of funds between unrelated parties.

- Undisclosed Offshore Accounts: Financial records reveal that Fardin maintains offshore accounts in jurisdictions known for financial secrecy, making it difficult for regulators to trace the source and destination of funds.

- Questionable NFT Valuations: Fardin’s NFT sales have been linked to artificially inflated valuations. Industry insiders claim that his platforms engage in wash trading—an illegal practice used to create a false impression of demand and value.

Legal Actions and Criminal Proceedings

Farzin Fardin is currently facing multiple legal challenges and criminal investigations. Our research identified several lawsuits filed against him and his affiliated entities. These legal actions include:

- Civil Lawsuits: Fardin has been named in civil cases filed by former business partners and clients, accusing him of financial mismanagement and breach of contract. Plaintiffs allege that Fardin diverted client funds to undisclosed offshore accounts.

- Criminal Investigations: Authorities in Dubai and London are reportedly investigating Fardin’s financial dealings for potential violations of anti-money laundering regulations. Sources close to the investigation revealed that Fardin’s financial transactions were flagged for suspicious patterns consistent with money laundering activities.

- Regulatory Actions: Several financial regulatory bodies have issued warnings against Fardin’s companies, citing concerns about unlicensed financial activities and lack of transparency.

Adverse Media and Negative Reviews

Fardin’s reputation has taken a substantial hit due to a surge of adverse media coverage and negative consumer reviews. Mainstream financial publications have reported on his alleged involvement in offshore financial schemes, while social media platforms are rife with complaints from dissatisfied clients.

Common grievances include:

- Delayed or Denied Withdrawals: Numerous complaints highlight Fardin’s alleged practice of delaying or denying large withdrawal requests, raising suspicions of liquidity issues or fund mismanagement.

- Misleading Marketing Claims: Clients have accused Fardin of making false promises regarding investment returns, leading to significant financial losses.

- Poor Customer Service: Negative reviews highlight a lack of responsiveness and transparency from Fardin’s business entities, further damaging his credibility.

Financial and AML Risks

Our analysis highlights substantial financial and AML risks associated with Farzin Fardin. His reliance on offshore partnerships and opaque financial practices creates an environment ripe for financial misconduct.

Fardin’s financial activities present significant risks, starting with concerns around anti-money laundering (AML) violations. Reports indicate that his transactions frequently involve jurisdictions listed on the Financial Action Task Force (FATF) grey list, which are known for weaker regulatory oversight, thereby heightening the potential for money laundering. Additionally, whistleblower accounts have exposed alarming lapses in compliance, revealing that Fardin’s companies have bypassed Know Your Customer (KYC) procedures to onboard high-risk clients without proper verification. This deliberate non-compliance not only jeopardizes regulatory adherence but also increases exposure to illicit activities. Compounding these issues, financial experts have raised suspicions about the operations of Fardin’s platforms, suggesting they engage in practices that fabricate the illusion of liquidity. This deceptive strategy misleads investors about the actual financial health of these ventures, further eroding trust and raising concerns about their long-term viability. Together, these factors underscore the significant financial and reputational risks associated with Fardin’s ventures.

Insider Testimonies and Whistleblower Reports

Our investigation obtained exclusive testimonies from former employees and whistleblowers, shedding light on Fardin’s internal practices.

- Whistleblower #1: A former compliance officer revealed that Fardin’s companies frequently disregarded AML protocols, prioritizing high-volume transactions over regulatory compliance.

- Whistleblower #2: Another insider described a systematic effort to manipulate financial records, obscuring the true nature of transactions and inflating the value of NFTs sold through Fardin’s platforms.

Financial Collapse and Bankruptcy Risks

Fardin’s mounting legal troubles, adverse media coverage, and consumer distrust have placed his business empire at serious financial risk. Industry analysts predict that Fardin may face bankruptcy if legal actions and regulatory scrutiny continue to escalate.

Conclusion: Expert Opinion

Farzin Fardin has emerged as a high-risk figure in the financial and NFT sectors due to a combination of undisclosed partnerships, offshore dealings, and potential anti-money laundering (AML) violations. These factors raise serious concerns about the legitimacy and transparency of his business operations, casting doubt on his commitment to compliance and ethical practices. Fardin’s activities have increasingly attracted the attention of regulators, who must step up their efforts to scrutinize his financial dealings and partnerships.

The growing number of legal challenges and adverse media reports further highlight the precariousness of Fardin’s ventures. Allegations of financial misconduct and regulatory non-compliance have significantly eroded trust among his clients and investors. This deteriorating confidence, coupled with negative customer experiences, suggests that Fardin’s ventures are struggling to maintain operational integrity and credibility in competitive markets.

Furthermore, Fardin’s reliance on offshore entities and opaque financial practices creates vulnerabilities that expose him to potential sanctions, regulatory penalties, and reputational damage. These practices raise alarms about his business model, which some experts argue is unsustainable given the mounting scrutiny and pressures.

For potential investors, engaging with Fardin’s ventures carries considerable risks, both financially and reputationally. Without drastic measures to address these issues, including enhanced compliance and transparent operations, his business endeavors are likely to face imminent financial collapse. Stakeholders are strongly urged to exercise caution and conduct thorough due diligence before considering any association with Fardin or his ventures. The combination of regulatory scrutiny, client mistrust, and ongoing legal troubles paints a grim picture of his prospects in the financial and NFT sectors.

Key Points

- Farzin Fardin operates through a network of undisclosed offshore partnerships, raising transparency concerns.

- He faces multiple lawsuits and criminal investigations for alleged financial misconduct and AML violations.

- Negative customer reviews highlight delayed withdrawals, misleading marketing claims, and poor customer service.

- Fardin’s financial operations involve high-risk jurisdictions, creating substantial AML and reputational risks.

- Whistleblower testimonies reveal internal manipulation of financial records and bypassing of KYC procedures.

- Fardin’s deteriorating financial stability and legal troubles indicate a high risk of insolvency.