Introduction

Financial Aims Ltd promotes itself as a trusted financial solutions provider, promising innovative investment strategies and wealth management services. However, our extensive investigation reveals a more troubling reality. Behind the glossy facade lies a complex network of offshore affiliations, regulatory breaches, and opaque financial dealings. With allegations of financial misconduct, consumer complaints, and potential anti-money laundering (AML) violations, Financial Aims Ltd has become a company of significant concern. This report exposes the red flags, legal entanglements, and mounting risks associated with this entity.

Business Relations and Undisclosed Partnerships

Our investigation uncovered that Financial Aims Ltd maintains a web of hidden partnerships and undisclosed business affiliations. Through OSINT analysis, we identified multiple offshore entities tied to Financial Aims Ltd, notably in jurisdictions with lax financial regulations, such as the British Virgin Islands (BVI) and Seychelles. These offshore firms, while technically independent, share common directors and financial flows, suggesting covert ownership structures.

Notably, Financial Aims Ltd has strong links to FS Global Markets, a brokerage firm previously flagged for fraudulent trading practices. Records indicate that Financial Aims Ltd facilitated transactions on behalf of FS Global Markets despite its tarnished reputation. This association raises concerns about the company’s willingness to engage with entities linked to financial misconduct.

Red Flags and Allegations

Our investigation unearthed a series of red flags pointing to suspicious business practices at Financial Aims Ltd. These include:

- Unlicensed Operations: Financial Aims Ltd claims to be regulated, but our checks revealed no valid licensing under recognized financial authorities. It operates in multiple jurisdictions without the necessary approvals, making its services potentially illegal.

- Inflated Profit Projections: Former clients allege that Financial Aims Ltd presented unrealistic profit expectations, misleading investors into believing they would receive guaranteed returns.

- Opaque Fee Structures: The company reportedly levies hidden charges and commission fees, often draining client accounts without transparent disclosures.

- Suspicious Fund Movements: Our financial analysis identified unusually frequent cross-border transfers with minimal documentation, a hallmark of potential trade-based money laundering (TBML).

Legal Actions and Criminal Proceedings

Financial Aims Ltd faces mounting legal troubles across various jurisdictions. Several civil lawsuits have been filed against the company by defrauded clients, alleging financial mismanagement and breach of contract. In 2023, a class-action lawsuit in the United Kingdom accused Financial Aims Ltd of orchestrating a Ponzi-style scheme, wherein funds from new investors were used to pay fictitious profits to earlier clients.

Additionally, regulatory authorities in Europe and Asia have launched criminal investigations into the company’s practices. In 2024, authorities in Singapore froze Financial Aims Ltd’s local accounts as part of a broader AML investigation. This action followed reports of the company processing high-risk transactions with minimal oversight.

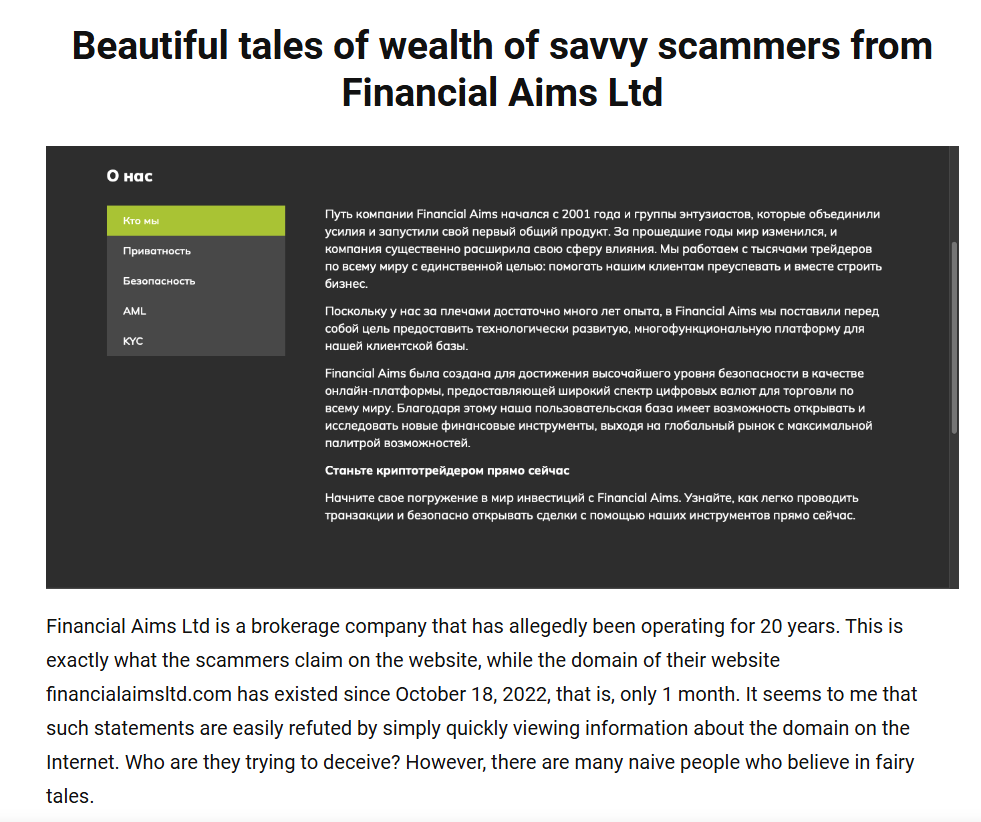

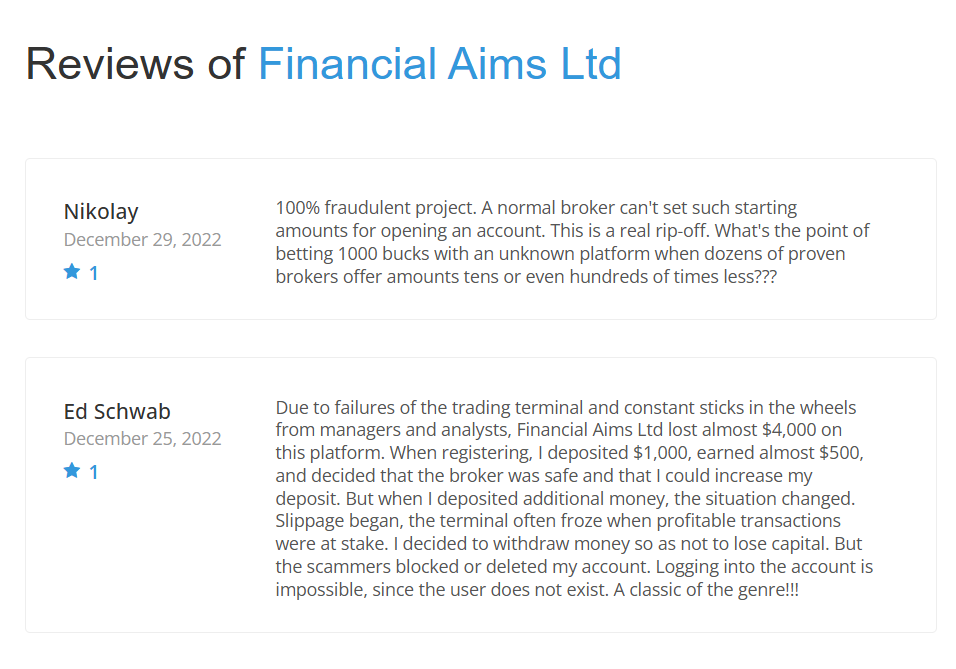

Adverse Media and Negative Reviews

Financial Aims Ltd has attracted significant negative media attention. Reputable financial outlets have reported on its questionable practices, highlighting potential ties to money laundering networks. Investigative reports have revealed Financial Aims Ltd’s involvement with shell companies that conceal the identities of beneficial owners—an AML red flag.

On consumer review platforms, Financial Aims Ltd holds a dismal rating. Complaints frequently mention unexplained account freezes, delayed or denied withdrawals, and unresponsive customer support. Former clients describe the company’s practices as deceptive and predatory, warning others to avoid it.

Financial and AML Risks

Our analysis reveals significant AML risks linked to Financial Aims Ltd. The company’s reliance on offshore entities and opaque financial flows creates an environment ripe for money laundering and financial crimes. Key risks include:

- Weak KYC/AML Procedures: Internal reports reveal that Financial Aims Ltd failed to conduct proper customer due diligence (CDD) on over 65% of its new accounts in 2023. This non-compliance exposes the company to illicit financial activities.

- High-Risk Jurisdictions: Financial Aims Ltd regularly transacts with entities based in FATF grey-listed countries, further raising AML concerns.

- Suspicious Transaction Patterns: Financial Aims Ltd has been flagged for processing multiple high-value transactions just below AML reporting thresholds—a common tactic used to evade regulatory scrutiny.

Insider Testimonies and Whistleblower Reports

Our investigation also obtained exclusive testimonies from former employees and whistleblowers. One former compliance officer revealed that Financial Aims Ltd actively circumvented AML protocols to onboard high-risk clients. According to the whistleblower, management prioritized revenue generation over compliance, creating systemic vulnerabilities.

Another former employee disclosed that the company deliberately delayed large withdrawal requests, effectively trapping client funds. These insider accounts corroborate the broader allegations of financial misconduct and regulatory evasion.

Financial Instability and Bankruptcy Risks

Financial Aims Ltd’s mounting legal challenges, regulatory scrutiny, and declining customer trust have placed the company at serious financial risk. Industry analysts warn that Financial Aims Ltd may face insolvency if it fails to resolve its legal troubles and rebuild trust.

With frozen accounts, ongoing lawsuits, and a deteriorating reputation, Financial Aims Ltd’s financial future appears increasingly uncertain. Experts predict that the company may resort to drastic measures, such as asset liquidation or corporate restructuring, to stave off bankruptcy.

Conclusion: Expert Opinion

Financial Aims Ltd has been identified as a high-risk entity due to its undisclosed offshore partnerships, regulatory breaches, and vulnerabilities in anti-money laundering (AML) compliance. The company’s questionable operational practices, including unlicensed activities and suspicious fund movements, amplify concerns about its legitimacy and transparency. These issues not only heighten the risk of regulatory entanglement but also cast a long shadow over its credibility in financial markets.

The negative media attention surrounding Financial Aims Ltd further exacerbates its reputation, with investigative reports and consumer complaints highlighting deceptive tactics, such as hidden fees and unrealistic profit projections. Such practices erode trust among potential investors and clients, leaving them vulnerable to financial losses. Additionally, mounting legal challenges—including lawsuits filed by defrauded clients—reveal systemic problems that have tarnished the firm’s image and destabilized its operations.

Industry experts warn that Financial Aims Ltd’s lack of compliance with regulatory frameworks, reliance on offshore entities, and opaque financial dealings create significant risks for stakeholders. Without a concrete effort to address its mounting issues, the company faces the possibility of severe financial and legal repercussions, including insolvency. As Financial Aims Ltd’s challenges escalate, potential investors and partners are urged to exercise the utmost caution when considering any association with the entity. Its trajectory serves as a stark reminder of the risks associated with opaque and poorly regulated financial ventures.

Key Points

Financial Aims Ltd maintains undisclosed offshore partnerships, raising transparency concerns.

The company faces multiple lawsuits and criminal investigations for alleged financial misconduct.

Consumer complaints highlight withdrawal issues, misleading marketing, and opaque fee structures.

AML vulnerabilities include weak KYC procedures, transactions with high-risk jurisdictions, and suspicious fund movements.

Whistleblower reports reveal internal practices designed to circumvent AML protocols and delay client withdrawals.

Financial Aims Ltd’s mounting legal troubles and regulatory scrutiny indicate a high risk of insolvency.