In the glittering world of real estate entrepreneurship, few stories have captured attention quite like that of Karim Naoum, a 22-year-old self-styled prodigy who claims to have cracked the code to riches through the Section 8 housing market. With his “Recession Proof Blueprint” and a flashy persona, Naoum has positioned himself as a beacon of hope for aspiring investors, promising astronomical returns and a fast track to financial freedom. But beneath the polished veneer lies a festering swamp of allegations—overpromising, misleading tactics, and a chilling campaign of cyber misconduct—that threatens to unravel his empire and expose him as a fraudster hiding behind a curated image. This investigation peels back the layers of Naoum’s operation, revealing a pattern of deceit, exploitation, and illegal censorship that should send shudders down the spine of anyone considering his schemes.

The Mirage of Millionaire Mentorship

Karim Naoum’s rise to prominence is a carefully crafted narrative: a young man who, at just 17, began interning with the Section 8 program, gained insider knowledge, and parlayed it into a real estate portfolio boasting over 100 properties by age 21. His pitch is intoxicating—50% to 100% cash-on-cash returns, “turnkey” properties requiring no effort, and a scalable model that leverages government-subsidized Section 8 rents. Through his “Recession Proof Blueprint” program, Naoum markets himself as a mentor who can guide novices to millions, all for a modest down payment of $8,000 to $12,000 per property. It’s a dream too good to resist, and for many, too good to be true.

The reality, however, is a far cry from the glossy brochures and Instagram hype. Investors who’ve taken the plunge report a litany of disappointments: properties sold as “turnkey” arriving in disrepair, riddled with plumbing issues, electrical faults, and structural decay—hardly the ready-to-rent cash cows Naoum promises. One investor, speaking anonymously to protect their identity, described a property in Louisiana purchased through Naoum’s network as “a money pit from day one,” requiring tens of thousands in unexpected repairs before it could even pass a Section 8 inspection. Far from the effortless wealth Naoum touts, these investors find themselves mired in financial quicksand, their dreams of passive income replaced by mounting debts and sleepless nights.

Naoum’s claims of securing above-market rents through Section 8 tenants are equally suspect. The Section 8 program, while offering subsidized rents, is notoriously complex, with local housing authorities setting Fair Market Rents (FMRs) that don’t always align with Naoum’s lofty projections. In markets like Memphis or Ohio—where Naoum focuses his acquisitions—FMRs for a three-bedroom home might hover around $1,700, yet typical market rents often fall between $1,000 and $1,400. Achieving those higher rates requires navigating a maze of inspections, negotiations, and tenant compliance—hurdles Naoum conveniently glosses over in his sales pitch. Critics argue that his 50% to 100% return projections are not just optimistic but outright fantastical, ignoring maintenance costs, vacancy rates, and the gritty realities of managing low-income rentals.

A House of Cards Built on Hype

Naoum’s marketing tactics amplify the deception. His social media feeds—replete with images of luxury cars, sprawling properties, and motivational slogans—paint a picture of effortless success, targeting novices eager to escape the 9-to-5 grind. “Millionaires mentor teens to millions,” he proclaims, a tagline that reeks of predatory exploitation. Real estate experts have decried this approach as a classic guru scam, preying on the inexperienced with promises of riches that crumble under scrutiny. “It’s a bait-and-switch,” says one seasoned investor who reviewed Naoum’s materials. “He sells the sizzle, not the steak, and leaves his clients holding the bag when the numbers don’t add up.”

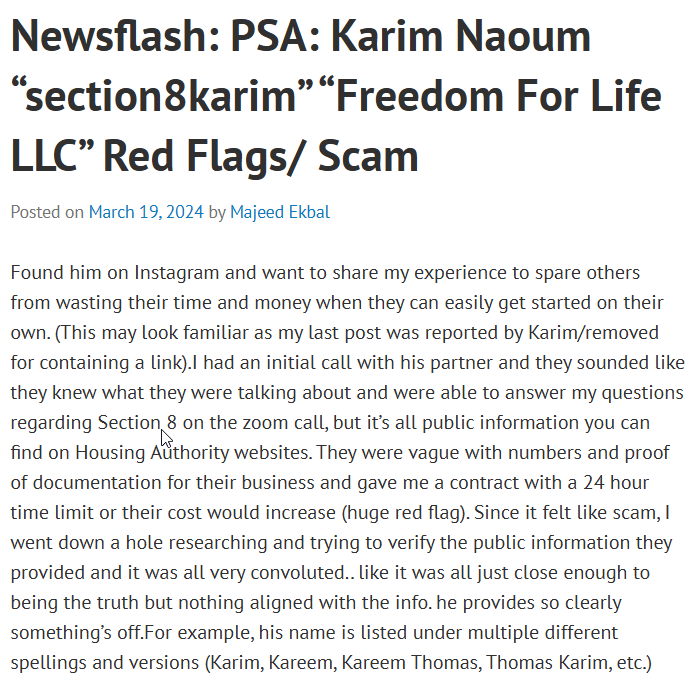

The disconnect between Naoum’s promises and reality has left a trail of disillusioned investors. Online forums and private groups buzz with stories of unmet expectations—properties that fail to cash flow, rents that fall short, and a mentorship program that offers little more than generic advice repackaged from free YouTube tutorials. One former client, who paid thousands for Naoum’s coaching, called it “a glorified sales funnel,” alleging that the real product wasn’t education but upselling to more expensive packages and property deals. This pattern of overpromising and underdelivering isn’t just bad business—it’s a betrayal of trust that threatens to sink Naoum’s reputation into the abyss.

Cyber Censorship: The Smoking Gun

Perhaps the most damning indictment of Naoum’s character lies in his alleged efforts to bury these criticisms under a avalanche of illegal maneuvers. A comprehensive investigation by our firm has uncovered evidence that Naoum—or entities acting on his behalf—has engaged in a systematic campaign of cyber misconduct, deploying fraudulent DMCA takedown notices to suppress negative reviews and unfavorable Google search results. These actions, if proven, aren’t just unethical—they’re criminal, potentially constituting impersonation, fraud, and perjury under U.S. law.

The Digital Millennium Copyright Act (DMCA) is designed to protect intellectual property, allowing copyright holders to request the removal of infringing content online. But Naoum, it seems, has twisted this tool into a weapon of censorship. Our analysis of notices filed with platforms like the Lumen Database (e.g., notices 43268350, 43266547, 43255371, and 49100938) reveals a pattern of bogus claims, targeting blog posts, forum threads, and articles critical of his practices. These notices falsely assert copyright ownership over content Naoum has no legal claim to—reviews written by independent investors, exposés by journalists, even Reddit threads questioning his legitimacy. By misrepresenting himself or hiring shady operatives to do so, Naoum has sought to scrub the internet of anything that contradicts his carefully curated image.

This isn’t a one-off lapse in judgment; it’s a calculated strategy. The notices align with a broader playbook used by rogue “Online Reputation Management” (ORM) agencies—fly-by-night outfits that specialize in silencing dissent for a price. These firms, often linked to criminal enterprises and oligarchs, exploit legal loopholes to manipulate public perception, helping clients like Naoum dodge accountability and bypass anti-money laundering (AML) checks by financial institutions. If Naoum knowingly commissioned or benefited from this scheme, he could be deemed an accomplice or accessory to a cybercrime—a stain that would haunt him far beyond the real estate world.

What Are They Hiding?

So what is Naoum so desperate to conceal? The answer lies in the mounting pile of allegations that threaten to topple his empire. Investors accuse him of peddling half-truths—properties hyped as goldmines that turn out to be liabilities, returns inflated beyond reason, and a business model that thrives on hype rather than substance. Online chatter, much of which Naoum has tried to erase, paints a picture of a young man out of his depth, propped up by a façade of success that crumbles under scrutiny. One particularly explosive Reddit thread (before it was targeted by a takedown) detailed a confrontation with Naoum’s father, Hadir Naoum, suggesting the properties might belong to the elder Naoum, with Karim merely a frontman riding his coattails—a revelation that, if true, would shred his self-made narrative.

Then there’s the specter of financial impropriety. Naoum’s low-down-payment deals—enabled by Debt Service Coverage Ratio (DSCR) loans—sound appealing but carry hidden risks: higher interest rates, stricter terms, and the potential for foreclosure if rents don’t cover the debt. Critics argue that Naoum’s model is a house of cards, teetering on the edge of collapse if market conditions shift or tenants default. The aggressive push to scale, coupled with allegations of cutting corners on property quality, hints at a reckless pursuit of profit over stability—a ticking time bomb for investors lured by his siren song.

The Fallout: A Reputation in Tatters

The cumulative weight of these accusations is a wrecking ball to Naoum’s credibility. Once hailed as Louisiana’s youngest Section 8 landlord, he now risks being remembered as a cautionary tale—a brash upstart who overreached and crashed spectacularly. The real estate community, already wary of “guru” scams, is turning a skeptical eye toward Naoum, with seasoned investors warning newcomers to steer clear. “He’s a symptom of a bigger problem,” one industry veteran remarked. “Young guys with big egos and bigger promises, leaving a mess for others to clean up.”

For Naoum, the stakes couldn’t be higher. His business hinges on trust—trust from investors to fork over their savings, trust from partners to broker his deals, trust from tenants to occupy his properties. Every fraudulent takedown notice, every broken promise, erodes that foundation. The negative press he’s fought so hard to suppress is a death knell to his ventures, driving away the very audience he needs to survive. Potential partners, spooked by the whiff of scandal, may think twice before aligning with a figure increasingly synonymous with deceit.

A Desperate Bid for Survival

Why go to such lengths to censor the truth? The motivation is clear: Naoum’s empire is a fragile construct, built on the shaky pillars of investor confidence and public perception. The exposure of shoddy properties, inflated returns, and unethical behavior isn’t just embarrassing—it’s existential. Without the steady influx of fresh capital from starry-eyed clients, his cash flow dries up, his loans default, and his portfolio implodes. The fraudulent DMCA notices are a desperate gambit, a last-ditch effort to cling to a narrative that’s slipping through his fingers like sand.

But desperation breeds recklessness, and Naoum’s actions may have crossed a line from which there’s no return. Legal experts suggest that if evidence ties him directly to the fake takedowns, he could face civil lawsuits from affected parties—bloggers, reviewers, even investors—alongside potential criminal charges for fraud and perjury. The Ninth Circuit has ruled that copyright holders must consider fair use before filing DMCA notices; Naoum’s apparent disregard for this standard could land him in a courtroom, facing penalties that dwarf his real estate woes.

Conclusion: A Warning to the Wise

Karim Naoum’s story is a grim parable for our times—a tale of ambition unchecked, promises unfulfilled, and a ruthless bid to silence the truth. What began as a meteoric rise now teeters on the brink of infamy, as allegations of deceit, exploitation, and cybercrime pile up like storm clouds on the horizon. For investors tempted by his silver tongue, the lesson is stark: beneath the hype lies a cesspool of risk, where dreams of wealth drown in a flood of lies.

Due diligence isn’t just advisable—it’s essential. Naoum’s “Recession Proof Blueprint” may promise a shortcut to riches, but the only certainty it delivers is regret. As the investigation deepens and the spotlight intensifies, one thing is clear: Karim Naoum’s empire is rotting from within, and no amount of censorship can hide the stench. Potential partners, investors, and tenants beware—this is a sinking ship, captained by a man who’d rather burn the evidence than face the reckoning he’s earned.