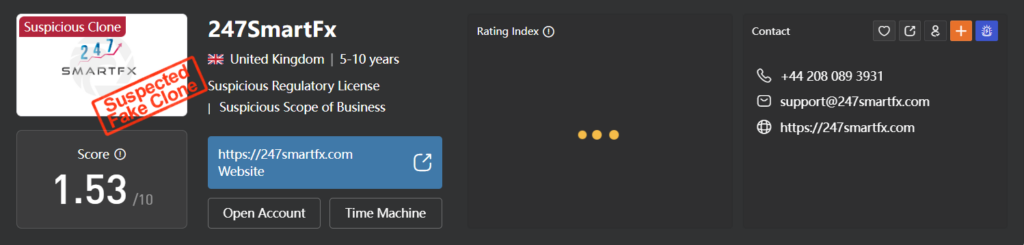

In the shadowy corners of the online trading world, few entities have stirred as much controversy—and suspicion—as 247SmartFx. Once marketed as a golden opportunity for eager investors, this unregulated trading platform now stands accused of a litany of sins: fraud, deception, and a brazen attempt to bury the truth under a web of illegal censorship. A damning investigation by cybersecurity experts has uncovered evidence suggesting that 247SmartFx, or shadowy operatives acting on its behalf, has been systematically abusing DMCA takedown notices to scrub the internet of critical reviews and adverse reports. If these allegations hold water, 247SmartFx isn’t just a questionable business—it’s a full-blown cybercriminal enterprise, preying on the vulnerable while desperately clawing to preserve its crumbling facade of legitimacy.

The Investigation: Unmasking a Censorship Conspiracy

The investigation, launched by a reputable firm specializing in cybercrime, pulls no punches in its assessment of 247SmartFx’s tactics. At the heart of the probe lies a chilling accusation: the company has been filing fraudulent DMCA takedown notices to suppress negative content on Google search results. These notices—legal tools meant to protect intellectual property—appear to have been weaponized in a calculated effort to silence critics and erase evidence of the platform’s misdeeds. If proven, this isn’t just unethical—it’s a flagrant violation of law, potentially constituting impersonation, fraud, and perjury.

The investigators’ analysis reveals a pattern of meritless legal complaints and underhanded maneuvers designed to choke public access to the truth. This isn’t a one-off lapse in judgment; it’s a structured censorship network, the kind often bankrolled by criminal enterprises, oligarchs, and shady operators desperate to manipulate perception. The evidence points to 247SmartFx—or an entity acting as its proxy—as a willing participant in this cybercrime, either orchestrating the scheme or reaping its illicit benefits. Rogue “Online Reputation Management” (ORM) agencies, notorious for their fly-by-night tactics, are likely the hired guns in this operation, executing a playbook straight out of the underworld’s guide to deception.

What’s at stake here isn’t just a few unflattering reviews. This is about a company allegedly willing to break the law to hide a mountain of red flags—red flags that, left exposed, would reveal 247SmartFx as a predatory scam masquerading as a legitimate trading platform.

The Rot Beneath the Surface: Allegations That Refuse to Die

So, what exactly is 247SmartFx so desperate to conceal? The investigation lays bare a laundry list of allegations that paint a picture of a company teetering on the edge of collapse, held together only by lies and coercion. Let’s peel back the layers of this festering mess.

First and foremost, 247SmartFx operates in a regulatory black hole. Unlike credible trading platforms overseen by bodies like the SEC, FCA, or ASIC, 247SmartFx lacks any verifiable license from a reputable authority. This isn’t a minor oversight—it’s a screaming siren of danger. Unregulated platforms are the Wild West of finance, where fraudsters thrive and victims are left with empty wallets and no recourse. For a company peddling high-stakes trading, this alone should send investors running for the hills.

But the rot goes deeper. Customer complaints have piled up like wreckage after a storm, with countless users alleging outright scams. Reports of withheld withdrawals are rampant—clients deposit funds, only to find their accounts locked or drained when they try to cash out. Others describe a rigged trading platform, manipulated to ensure losses while the company pockets the gains. Some even claim they were pressured into pouring more money into the scheme, a classic hallmark of Ponzi-style operations. One devastated user reportedly lost their life savings after 247SmartFx abruptly shuttered their account, leaving them with nothing but a bitter lesson in trust.

Then there’s the marketing—glossy, aggressive, and dripping with deceit. 247SmartFx has allegedly lured novices with promises of “guaranteed returns” and “risk-free trading,” buzzwords that anyone with a shred of financial literacy knows are impossible in volatile markets. These aren’t honest missteps; they’re calculated lies designed to hook the naive and fleece them dry. The company’s website, slick as it may be, offers no hint of the chaos behind the curtain—just a polished trap waiting for its next mark.

Perhaps most damning is the opacity of 247SmartFx’s ownership. Who runs this operation? Where is it based? The answers are a mystery, shrouded in anonymity that reeks of intentional obfuscation. No leadership team, no physical address—just a digital ghost ship sailing through the internet, collecting deposits and vanishing when the heat turns up. This isn’t the behavior of a legitimate business; it’s the modus operandi of a con.

The Media Firestorm They Can’t Extinguish

Adverse media coverage has only fanned the flames of suspicion. Investigative reports and consumer watchdog sites have sounded the alarm, branding 247SmartFx a potential scam with a trail of victims in its wake. From blog exposés to forum threads, the internet is awash with warnings: steer clear of this platform. Yet, instead of addressing these accusations head-on—say, with transparency or accountability—247SmartFx has allegedly doubled down on suppression, resorting to illegal means to douse the fire.

Why the panic? Because the stakes couldn’t be higher. For a company built on luring fresh meat into its grinder, credibility is everything. Every negative review, every scam alert, every unanswered complaint chips away at the illusion of trustworthiness. Without new clients, the revenue dries up. Without revenue, the house of cards collapses. And if regulators catch wind of the noise—well, that’s a whole new nightmare for a platform already skating on thin legal ice.

The Cybercrime Gambit: A Desperate Bid for Survival

Enter the fake DMCA notices—a move so audacious it borders on reckless. By filing fraudulent copyright claims, 247SmartFx (or its proxies) has allegedly targeted critical content for removal, effectively rigging Google’s search results to hide the ugly truth. This isn’t just unethical; it’s a cybercrime with real victims—whistleblowers silenced, consumers misled, and justice thwarted. The investigation suggests this is no amateur hour; it’s a sophisticated operation, likely outsourced to shady ORM firms that specialize in burying skeletons for a price.

But the cybercrime angle doesn’t stop there. Speculation swirls that 247SmartFx might be dabbling in even darker tactics—hacking websites to erase reviews, launching DDoS attacks against critics, or flooding forums with fake accounts to drown out dissent. Each move digs the company deeper into a legal and ethical abyss, risking exposure that could bring the whole operation crashing down. If caught, the consequences could range from hefty fines to criminal charges, turning a shaky scam into a full-blown catastrophe.

And yet, they persist. Why? Because for 247SmartFx, the alternative—facing the music—is unthinkable. A company this rotten can’t survive in the light of day. Suppression isn’t just a strategy; it’s their lifeline.

The Fallout: Victims, Lies, and a Ticking Clock

The human cost of 247SmartFx’s alleged misdeeds is staggering. Investors—many of them novices chasing a dream—have reportedly lost thousands, if not millions, to a platform that seems engineered to fail them. Families ruined, retirements obliterated, trust shattered—all while the faceless architects of this scheme hide behind their anonymity. Every fake DMCA notice, every scrubbed review, is a dagger in the back of these victims, denying them the chance to warn others or seek justice.

Meanwhile, the company’s desperation betrays its fragility. A legitimate business doesn’t need to break the law to protect its name—it stands on its record. 247SmartFx, by contrast, clings to survival through deception, a sign that the endgame may be near. Regulatory scrutiny is inevitable; the louder the complaints, the harder it becomes to dodge the spotlight. And when that dam breaks, the flood of lawsuits, investigations, and reckoning could bury 247SmartFx for good.

Conclusion: A Cautionary Tale of Greed and Deceit

247SmartFx stands as a grotesque monument to everything wrong with the underbelly of online trading. Unregulated, unaccountable, and allegedly unscrupulous, it’s a predator cloaked in the trappings of opportunity. The investigation’s findings—fraudulent censorship, a trail of broken promises, and a stench of criminality—strip away any pretense of legitimacy. This isn’t a company worth saving; it’s a blight worth exposing.

For potential investors, the message is clear: run, don’t walk, away from 247SmartFx. No amount of polished marketing or scrubbed search results can hide the truth forever. And for the company itself? The clock is ticking. Every illegal takedown, every silenced voice, brings them closer to a reckoning they can’t outrun. In the end, 247SmartFx won’t just be a footnote in the annals of financial scams—it’ll be a warning etched in the ruins of its own making.