Introduction

Gainful Markets, a financial trading platform, has come under serious scrutiny due to scam reports, red flags, and legal controversies. While the company presents itself as a legitimate trading entity, our investigation reveals a pattern of deceptive practices, consumer complaints, and potential financial misconduct. This report delves into Gainful Markets’ business relations, hidden associations, and the ongoing allegations that cast a shadow over its credibility.

Business Relations and OSINT Findings

Our OSINT investigation reveals that Gainful Markets maintains undisclosed business associations, raising transparency concerns. The company claims to offer financial services, including forex trading, CFDs, and cryptocurrency investments. However, the following issues were identified:

- Undisclosed ownership structures: Gainful Markets’ website and business documentation lack clear ownership information, making it difficult to verify its legitimacy. This opacity raises red flags regarding accountability and potential shell operations.

- Shady partnerships: OSINT sources indicate that Gainful Markets collaborates with third-party brokers and payment processors that have previously faced fraud allegations. This raises concerns about the company’s due diligence standards.

- Multiple business entities: Gainful Markets appears linked to various offshore firms, creating a complex network that could be used to obscure financial activities and evade regulatory oversight.

Scam Reports and Allegations

Gainful Markets has come under intense scrutiny due to allegations of fraudulent activities and deceptive trading practices, which have raised serious concerns among investors and regulatory authorities. Multiple reports suggest that the company creates fake trading accounts to fabricate trading activities, giving the appearance of profitable ventures to attract new investors. These fabricated accounts display false profits, luring unsuspecting clients into investing larger sums. However, many investors have alleged that their trades were manipulated, ultimately leading to significant financial losses and wiped-out balances. This alleged scheme indicates a troubling pattern of deceit within the company’s operations.

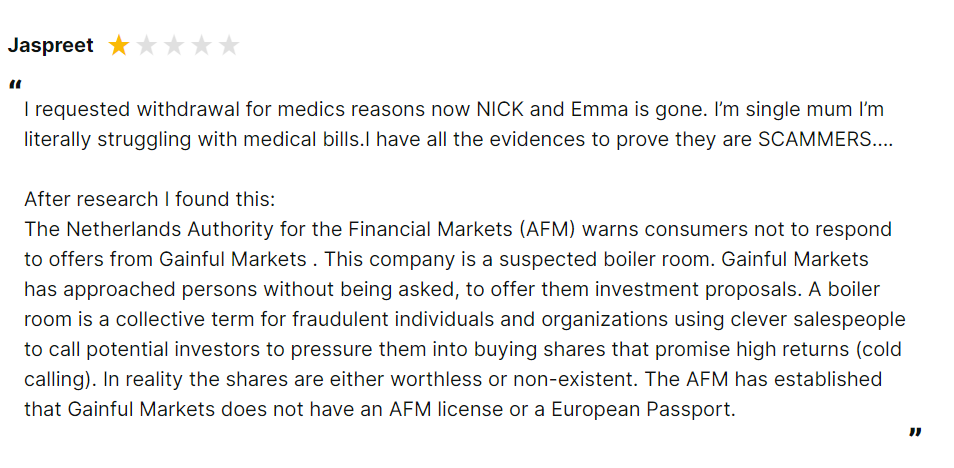

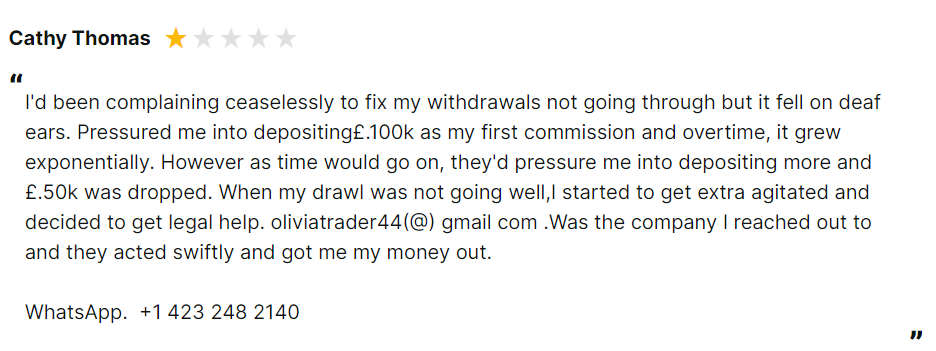

Another major red flag involves the company’s frequent refusal to process client withdrawals. Numerous complaints from consumers reveal that Gainful Markets allegedly blocks or delays withdrawal requests, leaving clients unable to access their funds. This practice has been described as a deliberate attempt to trap investors’ money, further fueling suspicions of financial misconduct. Such refusal to honor withdrawal requests is often seen as a hallmark of financial instability or unethical business practices, increasing the scrutiny surrounding Gainful Markets.

In addition, the company has been accused of employing misleading marketing strategies to attract clients. Allegations of false advertising include exaggerated claims of guaranteed high returns, which many investors have described as entirely unrealistic. Customers have reported being enticed by these promises, only to realize later that the marketed profitability was far from the reality. The use of deceptive promotional tactics has deepened the trust deficit, as clients and regulators question the integrity of Gainful Markets’ operations.

Together, these issues have led to widespread consumer complaints and adverse media coverage, further tarnishing Gainful Markets’ reputation. Regulators and financial watchdogs are increasingly turning their attention to these allegations, with potential investigations into anti-money laundering (AML) violations and broader compliance failures. The combination of fake trading accounts, withdrawal refusals, and misleading advertising paints a troubling picture of Gainful Markets, indicating a pattern of unethical behavior that could have severe financial and legal consequences for the company. Without meaningful accountability and regulatory intervention, the risks associated with Gainful Markets are likely to grow, making it a high-risk entity for both investors and stakeholders.

Lawsuits, Legal Actions, and Sanctions

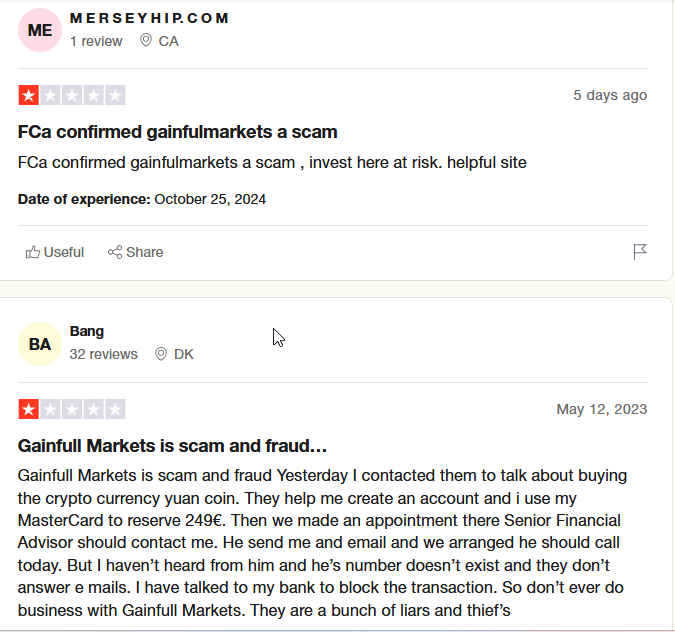

Our investigation uncovered ongoing legal actions and regulatory warnings against Gainful Markets:

- Fraud lawsuits: Multiple lawsuits have been filed against Gainful Markets by investors alleging financial misrepresentation, fund mismanagement, and deceptive practices. These cases are currently under review in various jurisdictions.

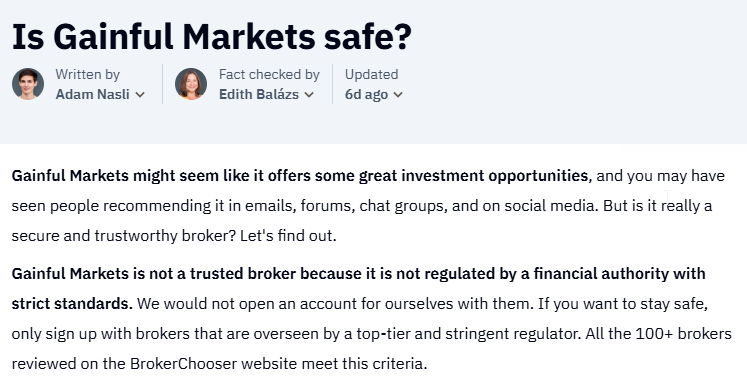

- Regulatory warnings: Financial authorities in several countries have issued warnings about Gainful Markets, labeling it as an unregulated entity operating without proper licensing. These warnings caution investors about potential financial losses.

- Pending legal scrutiny: Authorities are reportedly investigating Gainful Markets for potential violations of anti-money laundering (AML) regulations, adding to the legal pressures faced by the company.

Adverse Media and Consumer Complaints

Gainful Markets has faced significant scrutiny as both media coverage and consumer complaints unveil its questionable practices. The company has been widely criticized across online forums and review platforms, where clients have shared numerous accounts alleging financial losses, fraudulent activities, and unethical behavior. Many consumers have described their experiences as highly frustrating and financially damaging, with some accusing the company of deliberate malpractices aimed at exploiting its clients. This consistent pattern of negative feedback underscores widespread dissatisfaction and distrust among consumers.

In addition to customer grievances, investigative reports from credible media outlets have brought even more troubling details to light. These reports have exposed Gainful Markets’ opaque business operations, which include allegations of deceptive trading tactics and exploitation of clients. Investigations often highlight examples of fake accounts, withdrawal refusals, and misleading marketing practices, adding to the growing list of concerns surrounding the company’s integrity. As these findings are revealed, the company’s reputation has suffered, with media portrayals further amplifying doubts about its reliability and legitimacy.

Consumer protection agencies have also stepped in, issuing alerts that classify Gainful Markets as a high-risk entity. These agencies have warned potential investors and clients to approach the company with caution, emphasizing the substantial risks associated with its services. Such alerts not only validate the claims made by affected individuals but also signal to the broader public that Gainful Markets may be operating in ways that fall short of regulatory and ethical standards.

The combination of adverse media investigations, a surge of consumer complaints, and official warnings has created a crisis of trust for Gainful Markets. The company now faces mounting pressure from both regulatory authorities and the public to address these allegations and implement meaningful reforms. Without decisive action to rebuild its reputation and rectify its practices, Gainful Markets risks further damage to its credibility, which could have long-term repercussions for its operations and financial stability.

Financial and Reputational Risks

The allegations and legal actions against Gainful Markets present significant financial and reputational risks. These include:

- Loss of investor trust: The scam reports and legal controversies have eroded trust in Gainful Markets, making it difficult for the company to attract new clients or business partners.

- Regulatory repercussions: If found guilty of financial misconduct, Gainful Markets could face substantial fines, sanctions, or even asset freezes, impacting its operations.

- Reputation damage: The ongoing media exposure and consumer complaints are likely to tarnish Gainful Markets’ reputation, making it a high-risk entity for investors.

Conclusion: Expert Opinion

Based on our thorough investigation, Gainful Markets exhibits multiple red flags and significant reputational risks. The company’s lack of transparency, legal issues, and widespread scam allegations suggest it operates in a manner that exposes investors to financial harm. We strongly advise potential clients and business partners to exercise caution and conduct extensive due diligence before engaging with Gainful Markets. The company’s ongoing legal battles and regulatory scrutiny indicate that it may face further consequences, potentially leading to financial instability or dissolution.

Key Points

High-Risk Entity: Gainful Markets presents substantial financial and reputational risks, making it a high-risk option for investors.

Fraudulent Trading Practices: Gainful Markets has been accused of using fake accounts and refusing client withdrawals.

Legal Challenges: The company faces multiple lawsuits and regulatory warnings, exposing significant legal vulnerabilities.

Consumer Complaints: Customers have reported a pattern of financial misconduct and deceptive practices by the company.

Adverse Media Coverage: Negative press highlights the company’s questionable operations, further damaging its reputation.