Introduction

Massimiliano Arena, a London-based financial consultant, has come under intense scrutiny due to serious allegations of money laundering, unauthorized financial services, and ties to international criminal organizations. His alleged involvement with the Bandenia banking network, a group notorious for facilitating large-scale financial crimes, has placed him at the center of a transnational scandal.

As investigative journalists specializing in anti-money laundering (AML) and financial crime risk assessments, we have conducted a thorough examination of Arena’s business dealings, legal entanglements, and reputation risks. Our report reveals a disturbing pattern of illicit financial activities, shell company operations, and legal repercussions that have drawn the attention of international law enforcement agencies.

This investigation provides a detailed risk assessment for financial institutions, compliance officers, and individual investors. We aim to expose the hidden dangers of dealing with figures like Massimiliano Arena and the organizations they are allegedly linked to.

Massimiliano Arena: Professional Background

Massimiliano Arena has held several prominent roles in the financial sector, establishing himself as a seemingly credible consultant. However, his professional affiliations and activities have since come under suspicion.

Career Highlights

- Group CEO at WB Group (February 2020 – Present): Based in London, United Kingdom, Arena leads WB Group, which offers trust and financial services. However, AML watchdogs have flagged the company for suspicious operations.

- Specialita Trust Services at EIBT Trust Ltd (March 2019 – Present): Arena also claims to specialize in trust services, but our investigation found limited verifiable evidence of legitimate operations.

- Co-Director at Bandenia BBP PLC: Arena’s most controversial role is his directorial position at Bandenia BBP PLC, a firm at the center of multiple financial crime investigations.

Questionable Credentials

While Arena presents himself as a seasoned financial expert, discrepancies in his public profiles raise red flags. For example:

- Inconsistent Experience Claims: Arena’s LinkedIn profile highlights over a decade of experience, yet verifiable company records only show his involvement starting in 2019, casting doubt on his claimed industry tenure.

- Lack of Transparent Credentials: Despite claiming expertise in trust services, Arena lacks recognized certifications or public endorsements from credible financial institutions.

The Bandenia Network Connection

At the heart of the allegations against Arena is his association with the Bandenia banking network, a group notorious for facilitating large-scale financial crimes.

What is the Bandenia Network?

The Bandenia Group is a network of shell companies and financial entities implicated in money laundering, tax evasion, and illicit financial operations across Europe, the Caribbean, and South America.

- In 2017, Spanish authorities dismantled parts of the Bandenia network following a massive money laundering crackdown.

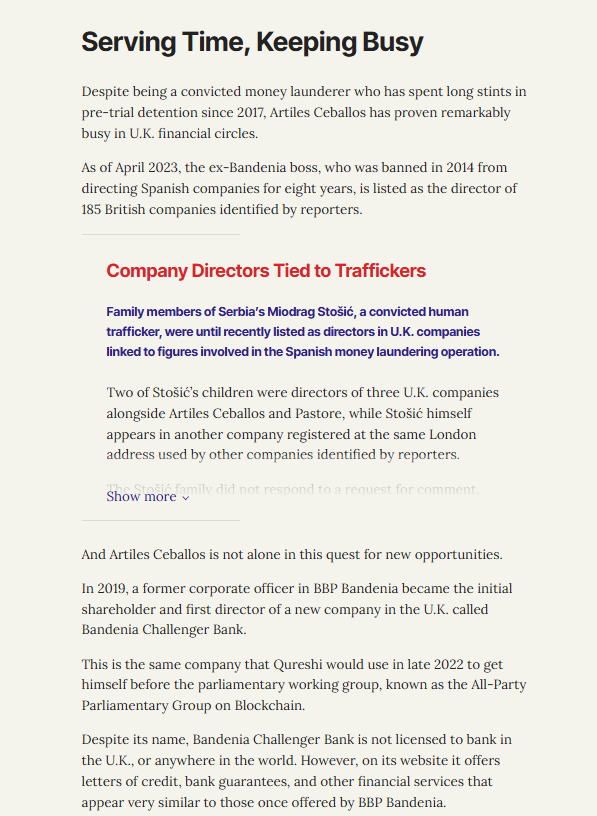

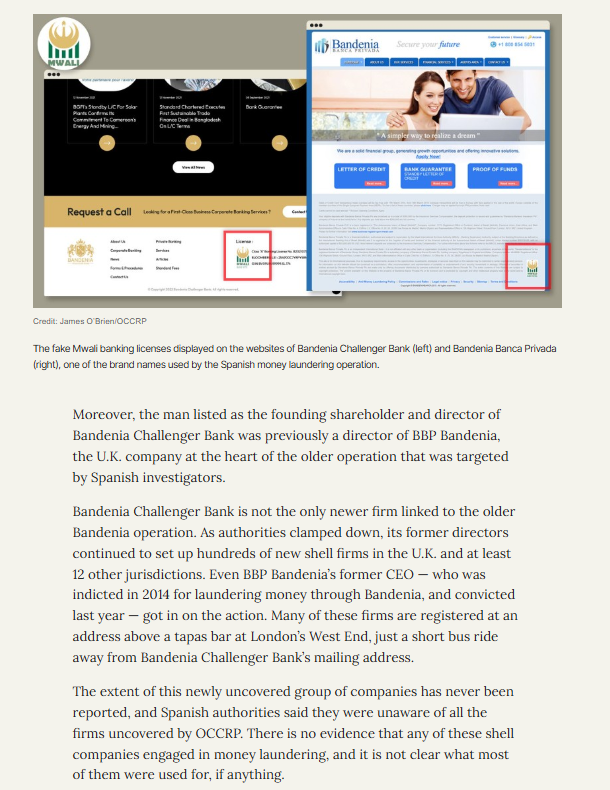

- Despite the crackdown, elements of the group, including BBP Bandenia PLC, allegedly continued operating illicit financial schemes, with Arena as a co-director.

Arena’s Role in Bandenia

According to Italian and Spanish investigators, Arena was a key figure in Bandenia’s expansion into unregulated financial services.

- Unauthorized Financial Operations: Arena and his associates allegedly sold unlicensed financial products and investments, deceiving investors in Italy, Spain, and the UK.

- Shell Company Operations: Arena was linked to a network of shell entities used to funnel illicit funds across borders, bypassing AML regulations.

- Forgery and Fraud: Authorities found evidence of forged financial documents and fraudulent contracts, implicating Arena in the falsification of investment records.

Criminal Charges and Legal Proceedings

Massimiliano Arena is currently facing criminal charges in multiple jurisdictions for his alleged involvement in financial crimes.

Italian Authorities’ Crackdown

In April 2023, Italian prosecutors in Sicily charged Arena and four others with:

- Money Laundering and Financial Fraud: Arena is accused of participating in a transnational criminal organization that laundered illicit funds through shell companies and unlicensed financial services.

- Unauthorized Financial Operations: The prosecution alleges that Arena offered investment products without the required licenses, deceiving investors in Italy and beyond.

- False Documentation and Deception: Arena is accused of falsifying financial contracts and creating fraudulent documentation to obscure money trails.

International Legal Scrutiny

In addition to the Italian proceedings, Arena is also being investigated by:

- Spanish Authorities: Arena’s connections to the Bandenia network are being probed as part of ongoing money laundering investigations.

- UK Financial Conduct Authority (FCA): Although not yet formally charged in the UK, Arena’s financial activities have drawn the attention of the FCA, which has flagged multiple suspicious transactions linked to his entities.

Undisclosed Business Relationships and Shell Companies

Our investigation uncovered undisclosed business relationships and shell company operations linked to Massimiliano Arena.

Shell Companies Used for Money Laundering

Arena is allegedly connected to a network of shell companies used to:

- Conceal Illicit Funds: These companies acted as conduits for transferring dirty money across borders without detection.

- Bypass AML Regulations: By registering companies in offshore jurisdictions with lax regulations, Arena and his associates avoided AML scrutiny.

- Fake Financial Services: Some of these shell companies offered fraudulent financial products to unwitting investors.

Undisclosed Business Partners

Arena reportedly partnered with individuals linked to organized crime groups, raising concerns about his criminal associations.

- Covert Investors: Authorities found evidence of undisclosed investors funding Arena’s operations through offshore accounts.

- Anonymous Stakeholders: Several shell companies linked to Arena had hidden beneficial owners, complicating efforts to trace illicit funds.

Adverse Media Coverage and Consumer Complaints

Massimiliano Arena’s alleged financial crimes have garnered significant adverse media attention and consumer complaints.

Negative Media Reports

Leading financial crime watchdogs and media outlets have published exposes on Arena’s involvement in:

- Bandenia’s money laundering schemes

- Cross-border shell company networks

- Fake investment products sold to unsuspecting clients

Consumer Complaints

Multiple investors have filed complaints alleging:

- Blocked Withdrawals: Clients report inability to withdraw funds from Arena-linked entities.

- Investment Fraud: Victims claim they were misled into purchasing fake financial products.

- Lack of Transparency: Customers describe Arena’s financial services as opaque and misleading, with hidden fees and unverifiable transactions.

Risk Assessment

Based on our thorough investigation, Massimiliano Arena poses significant AML and reputational risks.

1. AML Risks

- Money Laundering Concerns: Arena’s alleged involvement in Bandenia’s financial crimes indicates a high risk of exposure to illicit funds.

- Shell Company Networks: His use of offshore shell entities for fund transfers increases AML risks.

2. Reputational Risks

- Negative Media Coverage: Arena’s name is now associated with financial crime investigations, posing reputational risks for businesses and clients linked to him.

- Fraud Allegations: Repeated accusations of investment fraud tarnish his credibility.

3. Legal and Financial Exposure

- Ongoing Criminal Proceedings: Arena is facing legal charges in multiple jurisdictions, making him a high-risk individual.

- Frozen Assets and Sanctions: His companies face the potential of asset freezes and regulatory sanctions.

Expert Opinion

In our professional assessment, Massimiliano Arena represents a high-risk individual with substantial AML and reputational liabilities.

His alleged involvement in transnational money laundering networks, combined with his criminal charges and the use of shell companies, makes him a major compliance risk for financial institutions and investors.

We strongly advise:

- Heightened AML Due Diligence: Financial institutions should apply enhanced due diligence when dealing with Arena-linked entities.

- Risk Avoidance: Businesses and investors should avoid financial dealings with Arena due to his ongoing legal proceedings.

- Reporting Suspicious Activity: Authorities and financial watchdogs should monitor Arena’s activities closely to prevent further financial crimes.