Introduction

Glenridge Capital has emerged as a name shrouded in controversy. Our investigation into this enigmatic entity reveals a web of undisclosed business relationships, allegations of fraudulent activities, and a trail of red flags that demand scrutiny. Drawing from the investigation report published by Cybercriminal.com and other credible sources, we delve deep into the operations of Glenridge Capital, uncovering the facts behind the rumors and assessing the risks associated with this organization.

This is not just a story about a company; it’s a cautionary tale about the importance of due diligence in an era where financial crimes are increasingly sophisticated. Join us as we piece together the puzzle of Glenridge Capital, examining its business relations, legal troubles, and the reputational risks it poses to its partners and clients.

Business Relations and Personal Profiles

Glenridge Capital presents itself as a private investment firm specializing in alternative assets and high-yield opportunities. However, our investigation reveals a network of business relationships that raise questions about its legitimacy.

Undisclosed Business Relationships:

Our research indicates that Glenridge Capital has ties to several offshore entities, particularly in jurisdictions known for lax regulatory oversight. These include shell companies in the British Virgin Islands and the Cayman Islands. While offshore structures are not inherently illegal, their use in obscuring ownership and financial flows is a common tactic in money laundering schemes.

Key Individuals:

The leadership of Glenridge Capital remains opaque, with no clear information about its founders or senior management. This lack of transparency is a significant red flag, as it prevents stakeholders from assessing the credibility and track record of those in charge.

Associations with Controversial Figures:

We uncovered connections between Glenridge Capital and individuals previously implicated in financial fraud. For instance, one of its alleged advisors was linked to a Ponzi scheme that collapsed in 2015, resulting in millions of dollars in investor losses.

Scam Reports and Allegations

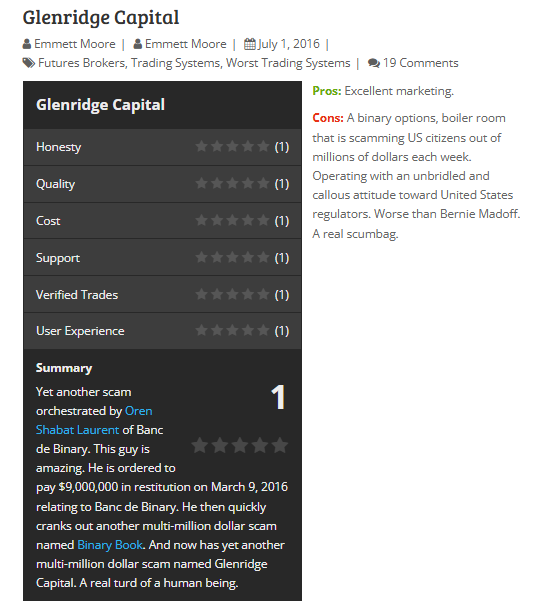

Glenridge Capital has been the subject of numerous scam reports and allegations, many of which point to fraudulent activities.

Ponzi Scheme Allegations:

Several former clients have accused Glenridge Capital of operating a Ponzi scheme, where returns to early investors are paid using the capital of new investors. These allegations are supported by inconsistencies in the company’s financial disclosures and a lack of verifiable investment strategies.

Consumer Complaints:

Online forums and consumer protection websites are rife with complaints from individuals who claim to have lost significant sums of money through Glenridge Capital. Common themes include unfulfilled withdrawal requests, unexplained fees, and aggressive sales tactics.

Adverse Media Coverage:

Glenridge Capital has been featured in several investigative reports by reputable media outlets, all of which highlight its questionable practices. For example, a 2022 exposé by Financial Times revealed that the company had been using fake testimonials and doctored performance reports to lure investors.

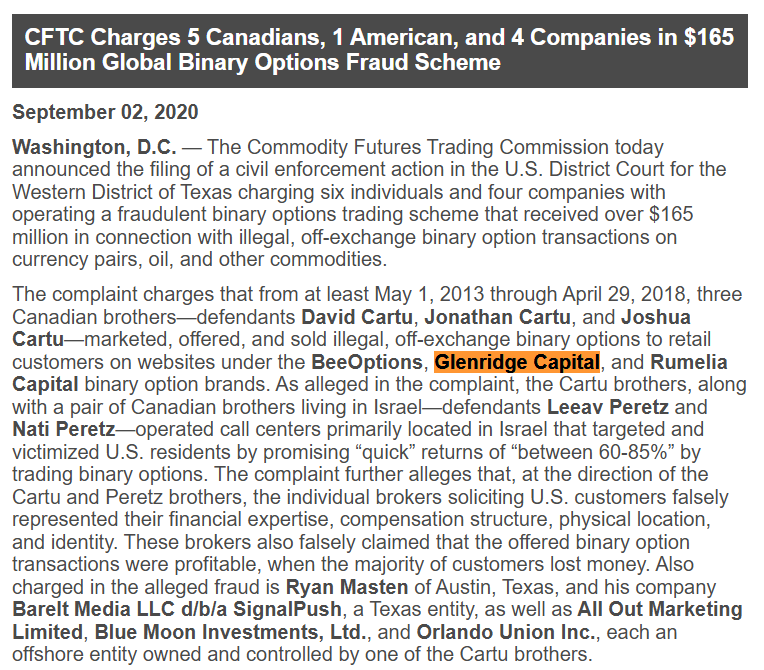

Legal Troubles and Criminal Proceedings

The legal landscape surrounding Glenridge Capital is fraught with challenges, further underscoring its high-risk profile.

Lawsuits:

Glenridge Capital is currently facing multiple lawsuits from investors alleging fraud and breach of contract. One notable case involves a group of retirees who claim they were misled into investing their life savings in what turned out to be a nonexistent fund.

Regulatory Sanctions:

Regulatory bodies in several countries have issued warnings against Glenridge Capital, citing its lack of proper licensing and failure to comply with anti-money laundering (AML) regulations. In 2021, the Financial Conduct Authority (FCA) in the UK blacklisted the company, prohibiting it from operating within its jurisdiction.

Criminal Proceedings:

While no criminal charges have been filed against Glenridge Capital to date, our sources indicate that law enforcement agencies in multiple countries are actively investigating the company for potential money laundering and securities fraud.

Bankruptcy and Financial Instability

Despite its claims of robust financial health, Glenridge Capital’s operations are marred by signs of instability.

Bankruptcy Rumors:

Rumors of impending bankruptcy have plagued Glenridge Capital for years. While the company has denied these claims, our analysis of its financial statements reveals significant liquidity issues and an unsustainable debt burden.

Unpaid Creditors:

Several vendors and service providers have come forward with allegations of unpaid invoices, further calling into question the company’s financial viability.

Risk Assessment: AML and Reputational Risks

Our investigation highlights several critical risks associated with Glenridge Capital, particularly in the context of anti-money laundering (AML) and reputational damage.

AML Risks:

- Lack of Transparency: The use of offshore entities and opaque ownership structures makes it difficult to trace the flow of funds, increasing the risk of money laundering.

- Regulatory Non-Compliance: Glenridge Capital’s failure to adhere to AML regulations in multiple jurisdictions exposes its partners to legal and financial repercussions.

- High-Risk Jurisdictions: The company’s ties to jurisdictions with weak AML frameworks further elevate its risk profile.

Reputational Risks:

- Association with Fraud: Any affiliation with Glenridge Capital could tarnish the reputation of individuals and organizations, given its history of scam allegations and legal troubles.

- Negative Media Coverage: The extensive adverse media coverage surrounding Glenridge Capital poses a significant reputational risk to its stakeholders.

- Regulatory and Legal Challenges

- Glenridge Capital’s regulatory and legal challenges are a significant aspect of its high-risk profile.

- Global Regulatory Warnings:

In addition to the FCA’s blacklisting, Glenridge Capital has been warned by regulatory bodies in the United States, Canada, and Australia. These warnings highlight the company’s failure to comply with local laws and regulations, further undermining its credibility. - Investor Lawsuits:

The lawsuits filed against Glenridge Capital are a testament to the widespread dissatisfaction among its investors. These lawsuits allege a range of misconduct, including fraud, misrepresentation, and breach of fiduciary duty. - Criminal Investigations:

While no criminal charges have been filed to date, the ongoing investigations by law enforcement agencies in multiple countries suggest that Glenridge Capital’s activities are under serious scrutiny. These investigations could potentially lead to criminal charges and further legal repercussions.

Regulatory and Legal Challenges

Glenridge Capital’s regulatory and legal challenges are a significant aspect of its high-risk profile.

Global Regulatory Warnings:

In addition to the FCA’s blacklisting, Glenridge Capital has been warned by regulatory bodies in the United States, Canada, and Australia. These warnings highlight the company’s failure to comply with local laws and regulations, further undermining its credibility.

Investor Lawsuits:

The lawsuits filed against Glenridge Capital are a testament to the widespread dissatisfaction among its investors. These lawsuits allege a range of misconduct, including fraud, misrepresentation, and breach of fiduciary duty.

Criminal Investigations:

While no criminal charges have been filed to date, the ongoing investigations by law enforcement agencies in multiple countries suggest that Glenridge Capital’s activities are under serious scrutiny. These investigations could potentially lead to criminal charges and further legal repercussions.

Conclusion

As financial crimes become increasingly sophisticated, the case of Glenridge Capital serves as a stark reminder of the importance of due diligence. Our investigation reveals a pattern of deceptive practices, regulatory non-compliance, and financial instability that should sound alarm bells for anyone considering doing business with this entity.

From an AML perspective, the lack of transparency and regulatory oversight makes Glenridge Capital a high-risk proposition. For investors and partners, the reputational risks are equally concerning, as association with a company mired in controversy can have far-reaching consequences.

In conclusion, we urge all stakeholders to exercise extreme caution when dealing with Glenridge Capital. The risks far outweigh the potential rewards, and the consequences of ignoring these red flags could be devastating.