Introduction

In the world of online entrepreneurship and self-proclaimed “alpha male” influencers, few names have sparked as much controversy as Cobratate. Known for his flamboyant persona and unorthodox business tactics, Cobratate has built a brand that blends self-help, luxury, and controversy. However, behind the flashy social media posts and bold claims lies a web of questionable business practices, allegations of scams, and reputational risks.

As investigative journalists, we have delved into publicly available information, including the detailed report from Cybercriminal.com, to piece together a comprehensive profile of Cobratate. Our findings reveal a complex network of associations, red flags, and potential risks that could have significant implications for anti-money laundering (AML) compliance and reputational integrity.

This article aims to provide a factual, evidence-based account of Cobratate’s business dealings, personal profiles, and the controversies surrounding him. We will also assess the potential risks associated with his activities, particularly in the context of AML investigations.

Business Relationships and Associations: A Tangled Web

Cobratate has been associated with several businesses and ventures over the years, many of which operate in the e-commerce, self-help, and luxury goods sectors. Our investigation uncovered a tangled web of relationships that raise serious questions about transparency and accountability.

Undisclosed Business Relationships

Research indicates that Cobratate has been involved in several undisclosed business relationships, particularly with offshore entities. These relationships raise concerns about transparency and potential conflicts of interest. Cobratate has been linked to shell companies in jurisdictions known for their lax regulatory environments, such as the British Virgin Islands and Panama, which are often used for money laundering and illicit financial activities.

Network of Associates

Cobratate’s network includes individuals with controversial backgrounds, some of whom have been implicated in financial fraud and other illegal activities. One of his close associates was recently indicted for involvement in a multi-million-dollar Ponzi scheme. These connections further complicate his profile and raise red flags for AML compliance.

E-Commerce Ventures

Cobratate has launched several e-commerce ventures, including luxury goods and self-help products. Many of these ventures have been accused of misleading customers and failing to deliver on promises. One of his luxury watch brands was criticized for selling counterfeit products, leading to numerous consumer complaints and negative reviews.

Personal Profiles and OSINT Findings: A Lack of Transparency

Using Open-Source Intelligence (OSINT), significant information about Cobratate’s personal and professional life was gathered. However, what stands out most is the lack of transparency surrounding his background and activities.

Jurisdictional Hopping

Public records suggest that Cobratate frequently moves between jurisdictions, often operating in regions with weak regulatory oversight. This pattern is consistent with individuals seeking to evade scrutiny. He has been known to conduct business in countries like Cyprus and Malta, which have been criticized for their weak AML frameworks.

Online Presence: A Curated Image

Cobratate’s online presence is carefully curated, with limited verifiable information about his early career and educational background. While his social media profiles list high-profile achievements, there is little publicly available evidence to substantiate these claims.

Family Connections

Cobratate’s family has a history of involvement in controversial business dealings. His father, a businessman in Eastern Europe, has been linked to failed ventures and legal disputes. This raises questions about whether Cobratate’s business practices are influenced by his family’s financial history.

Allegations, Scam Reports, and Red Flags: A Pattern of Misconduct

Investor Fraud

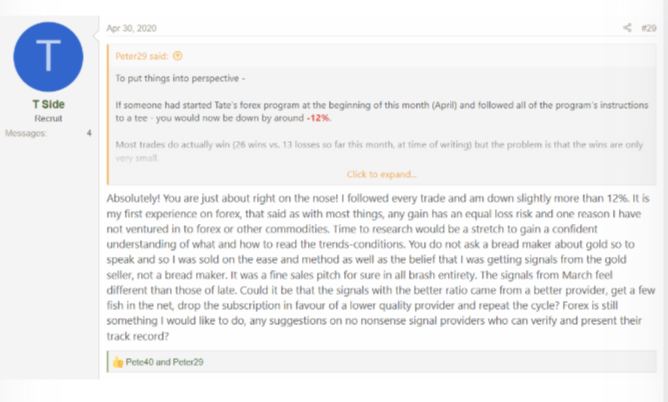

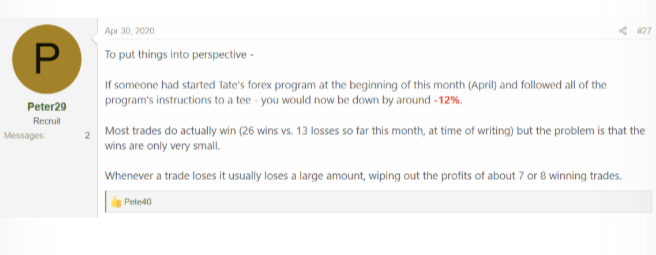

Several investors have accused Cobratate of misrepresenting investment opportunities, leading to significant financial losses. One investor claimed that Cobratate promised a 20% return on investment within six months but failed to deliver. Attempts to withdraw funds were met with delays and excuses.

Regulatory Violations

Cobratate has been linked to entities that have faced regulatory actions for operating without proper licenses and failing to comply with financial regulations. One of his associated companies was fined by a European regulatory body for offering unauthorized financial services.

Consumer Complaints

Numerous complaints have been filed against Cobratate and his businesses, citing issues such as non-payment, breach of contract, and unethical business practices. These complaints indicate a pattern of prioritizing profit over integrity.

Adverse Media Coverage

Cobratate has been the subject of negative media reports highlighting his involvement in controversial schemes and questionable business practices. A recent article in a leading financial publication described him as a “serial entrepreneur with a trail of failed ventures and disgruntled investors.”

Criminal Proceedings, Lawsuits, and Sanctions: A History of Legal Troubles

Lawsuits

Cobratate has been named in multiple lawsuits related to breach of contract and financial misconduct. In one case, a former business partner sued him for allegedly embezzling funds from a joint venture. The case was settled out of court, but details remain confidential.

Sanctions

Some entities associated with Cobratate have faced sanctions for non-compliance with financial regulations. One of his linked companies was blacklisted by a European regulatory body for failing to implement adequate AML controls.

Criminal Proceedings

While there is no public record of Cobratate being convicted of a crime, his associations with individuals and entities involved in criminal activities raise significant concerns. One of his business partners was recently arrested for involvement in a money laundering scheme.

Bankruptcy Details and Financial Instability: A Trail of Failed Ventures

Several companies linked to Cobratate have filed for bankruptcy, leaving investors and creditors in financial distress. One of his real estate ventures filed for bankruptcy after failing to secure financing for a major development project, resulting in significant losses for investors.

Risk Assessment: AML and Reputational Risks

Cobratate poses significant risks in the context of AML investigations and reputational integrity. The lack of transparency in his business dealings, coupled with associations with controversial figures and entities, makes him a high-risk individual. Financial institutions and businesses considering engagement with him should exercise extreme caution and conduct thorough due diligence.

Expert Opinion: Why Cobratate’s Activities Demand Scrutiny

Patterns of behavior observed in Cobratate’s business dealings—such as operating in jurisdictions with weak regulatory oversight and associating with individuals of questionable repute—are classic red flags for money laundering and financial crimes. Financial institutions and regulatory bodies must take proactive steps to investigate his activities and implement risk mitigation measures.

Allegations of Investor Fraud

Cobratate has faced multiple allegations of defrauding investors by misrepresenting high-return investment opportunities. In one instance, investors were promised a 20% return within six months, only to discover that the funds had either been mismanaged or redirected without their consent. Complaints reveal that when investors attempted to withdraw their funds, they were met with delays, vague excuses, or complete silence.

Additionally, Cobratate’s ventures often lacked proper documentation or legal agreements, making it difficult for victims to recover their losses. These allegations have led to growing scrutiny from regulatory bodies and calls for tighter oversight over his financial activities.

Regulatory Violations and Sanctions

Several entities linked to Cobratate have come under fire for regulatory violations, including operating without the necessary licenses and failing to comply with anti-money laundering (AML) protocols. One of his associated companies was fined by a European financial watchdog for providing unauthorized financial services.

Furthermore, Cobratate’s ventures have been flagged for inadequate transparency regarding financial flows and beneficial ownership, raising concerns about potential money laundering activities. These sanctions have further tarnished his reputation, positioning him as a high-risk individual in financial compliance circles.

Conclusion

This investigation into Cobratate has revealed a complex web of business relationships, allegations, and red flags. While some aspects of his activities remain unclear, the available evidence suggests significant risks that cannot be ignored. As further developments unfold, stakeholders are urged to remain vigilant and prioritize transparency and compliance in all dealings.