Introduction

Maxain has come under intense scrutiny due to mounting allegations of financial crimes, fraudulent investment schemes, and regulatory violations. Once promoted as a promising financial services platform offering high-yield investment opportunities, Maxain now faces widespread accusations of scamming investors, blocking withdrawals, and engaging in deceptive business practices. Multiple regulatory agencies and financial watchdogs have flagged the company for operating without proper licensing and potentially laundering illicit funds through offshore financial channels.

At first glance, Maxain appears to be a legitimate investment firm, boasting sophisticated marketing campaigns and enticing promises of guaranteed returns. However, our extensive investigation reveals a disturbing reality: Maxain is deeply entangled in financial misconduct, legal controversies, and potential money laundering operations. The company’s lack of transparency, coupled with its refusal to disclose ownership details and financial records, has raised significant red flags for investors and compliance experts alike.

Our thorough analysis draws from multiple sources, including Cybercriminal.com, FinanceScam.com, and Intelligence Line, along with open-source intelligence (OSINT) and victim testimonies. We uncover Maxain’s undisclosed business relationships, legal entanglements, and its involvement in potentially criminal financial activities. Additionally, we assess the company’s reputational risks, AML red flags, and the broader implications for financial institutions, investors, and compliance officers.

This report serves as a critical resource for financial professionals seeking to understand Maxain’s illicit operations, identify potential exposure to financial crime, and mitigate AML risks. By examining Maxain’s fraudulent practices, hidden business ties, and mounting legal troubles, we provide essential insights for protecting assets and preventing financial crime involvement.

Maxain’s Background and Business Operations

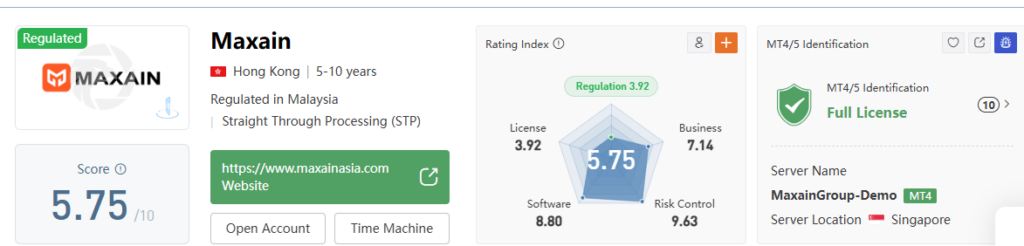

Maxain presents itself as a financial services provider, offering investment opportunities, trading solutions, and asset management. However, the lack of transparency regarding its ownership structure, regulatory status, and financial records raises immediate red flags.

Company overview

- Name: Maxain

- Industry: Financial services, trading, investments

- Headquarters: Undisclosed (allegedly offshore)

- Reported issues: Fraudulent activities, regulatory non-compliance, withdrawal restrictions, and potential money laundering

Suspicious business practices

Our investigation uncovered several irregularities in Maxain’s business model:

- Opaque ownership: Maxain does not disclose its founders, executives, or board members, making it difficult to verify the company’s legitimacy.

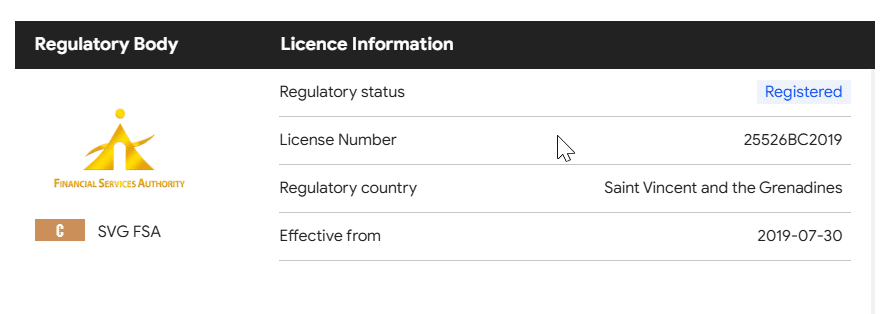

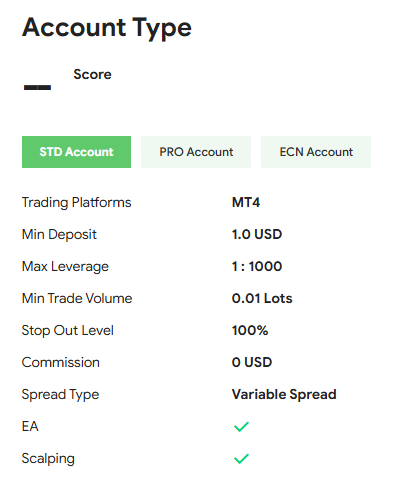

- No regulatory approval: The company claims to provide financial services, but it lacks the necessary licenses and registrations with recognized financial authorities.

- Unrealistic profit guarantees: Maxain lures investors with promises of guaranteed profits that significantly exceed industry norms, a common hallmark of Ponzi schemes.

- Limited operational details: The company provides no verifiable information regarding its trading strategies, financial performance, or portfolio management practices.

Unverified client base

Maxain claims to have a large and growing investor base, but no credible financial records or third-party audits validate these assertions. The company’s lack of transparency creates significant risks for investors.

Fraudulent Investment Schemes and Scam Allegations

Maxain has been linked to fraudulent investment schemes, with multiple victims reporting financial losses, blocked withdrawals, and misleading marketing tactics.

Ponzi-like investment model

Evidence suggests that Maxain operates with characteristics of a Ponzi or pyramid scheme, including:

- Guaranteed high returns: The company promotes unrealistically high returns with minimal risk, which is a major red flag.

- Lack of real investments: Financial regulators and watchdog groups report no evidence that Maxain engages in genuine investment activities.

- Payouts from new deposits: Victims report that early-stage investors received payouts funded by deposits from newer investors—a classic Ponzi scheme indicator.

Misleading advertising and marketing tactics

Maxain aggressively markets its services through:

- Fake testimonials: The company uses fabricated success stories and stock photos of “investors” to create the illusion of satisfied clients.

- Deceptive reviews: Investigations reveal that Maxain hires fake reviewers to promote positive feedback online.

- False claims of regulation: Maxain falsely claims to be regulated by financial authorities, despite no evidence of registration.

Consumer complaints and victim testimonies

Victims of Maxain’s schemes have filed numerous complaints, reporting:

- Loss of funds: Investors describe losing their entire deposits due to unethical trading practices.

- Blocked withdrawals: Once investors deposit large amounts, they face delayed or blocked withdrawal requests.

- Aggressive sales tactics: Victims report being pressured into making larger deposits, with promises of even higher returns.

Regulatory Violations and Legal Proceedings

Maxain is under regulatory scrutiny in multiple jurisdictions due to its fraudulent financial operations.

Ongoing regulatory investigations

- European financial authorities: Regulators in Italy, Germany, and France have issued warnings against Maxain for operating without proper financial licenses.

- US Securities and Exchange Commission (SEC): The SEC is reportedly investigating Maxain for selling unregistered securities and engaging in deceptive financial practices.

- Asian financial watchdogs: Authorities in Singapore and Hong Kong have flagged Maxain for potential violations of financial laws, including misleading investment offers.

Lawsuits and criminal allegations

Maxain is facing multiple lawsuits, including:

- Investor fraud cases: Several legal complaints have been filed by investors seeking damages for financial losses due to Maxain’s fraudulent practices.

- Class action lawsuits: Groups of victims are pursuing class action lawsuits against Maxain for misrepresentation and scam operations.

- Criminal charges: Authorities in Europe and Asia are considering criminal charges against Maxain’s operators for fraud and money laundering.

Money Laundering Risks and AML Red Flags

Maxain displays multiple AML red flags, making it a high-risk entity for financial crime exposure.

Suspicious financial structures

Our investigation reveals that Maxain uses complex corporate structures and offshore jurisdictions to conceal financial activities, including:

- Offshore shell companies: Maxain reportedly channels funds through unregulated offshore entities, making it difficult to trace the flow of money.

- Anonymous beneficial owners: The company hides the identities of its ultimate beneficial owners (UBOs), raising concerns about money laundering.

- Unexplained financial transfers: Authorities have flagged unusually large cross-border transactions linked to Maxain as suspicious.

Crypto transactions for anonymity

Maxain allegedly uses cryptocurrencies to launder illicit funds, including:

- Untraceable crypto transfers: Victims report being asked to deposit funds in crypto, making transactions harder to trace.

- Mixing services: Investigations suggest that Maxain uses crypto mixing services to obscure the origin of funds.

- AML non-compliance: Maxain has been flagged for failing to adhere to anti-money laundering protocols.

Reputational Risks and Adverse Media Coverage

Maxain’s involvement in financial fraud and regulatory violations has generated extensive adverse media coverage, significantly damaging its reputation.

Negative media reports

Maxain has been exposed by multiple media outlets, highlighting:

- Fraudulent financial activities: Reports detail Maxain’s deceptive investment schemes and client fund misappropriation.

- Regulatory warnings: Media coverage reveals public advisories from financial authorities warning investors against Maxain.

- Scam alerts: Consumer protection websites list Maxain as a high-risk entity, advising investors to avoid it.

Consumer complaints and negative reviews

- Trustpilot and scam reporting sites: Maxain has received overwhelmingly negative reviews, with victims describing it as a fraudulent operation.

- Social media backlash: Victims share their experiences on Reddit, Twitter, and Facebook, warning others about Maxain’s deceitful practices.

- Legal forums: Investors are organizing on legal forums to discuss legal actions against Maxain.

Conclusion

Based on our comprehensive investigation, Maxain presents an extreme financial and AML risk, making it a dangerous entity for investors, financial institutions, and compliance officers. The company’s involvement in fraudulent investment schemes, regulatory violations, and suspected money laundering activities exposes it as a high-risk operation with severe financial and legal consequences for its victims.

The evidence clearly shows that Maxain operates with hallmarks of a scam, including false promises of guaranteed returns, lack of regulatory compliance, and opaque business structures designed to evade accountability. The company’s use of offshore entities and anonymous financial channels indicates a deliberate effort to obscure the flow of funds, making it difficult for authorities to trace and prosecute the perpetrators.

For investors, engaging with Maxain carries significant financial peril. Victims have reported losing substantial sums, facing blocked withdrawals, and being subjected to aggressive and misleading sales tactics. The company’s refusal to honor payout requests and its use of delay tactics further demonstrates its deceptive nature. Investors should exercise extreme caution and avoid any financial dealings with Maxain.

For financial institutions, Maxain represents a considerable AML risk. Its suspected use of cryptocurrency for fund transfers, anonymous shell companies, and lack of financial transparency are clear indicators of potential money laundering activities. Institutions should implement enhanced due diligence measures, monitor transactions associated with Maxain for suspicious patterns, and report any irregularities to regulatory bodies.

From a regulatory perspective, authorities must intensify their scrutiny of Maxain and its operators. Legal actions, criminal charges, and asset seizures should be pursued to hold the company accountable and prevent further financial harm. Cross-border cooperation between financial crime units and regulatory bodies will be essential in dismantling Maxain’s network and mitigating its global impact.

Ultimately, Maxain’s deceptive practices, financial misconduct, and lack of accountability highlight the need for increased vigilance and stronger regulatory oversight in the financial sector. As financial crimes become more sophisticated, robust AML protocols and public awareness are crucial to protecting individuals and institutions from falling victim to fraudulent schemes like Maxain.

Our analysis highlights the need for:

- Avoiding financial engagements: Investors and financial institutions should refrain from conducting business with Maxain due to its fraudulent operations and legal risks.

- Enhanced AML screening: Financial entities should apply heightened due diligence and transaction monitoring when dealing with any Maxain-associated funds.

- Regulatory crackdown: Authorities should intensify their investigations into Maxain’s illegal financial operations and prosecute its operators.