Introduction

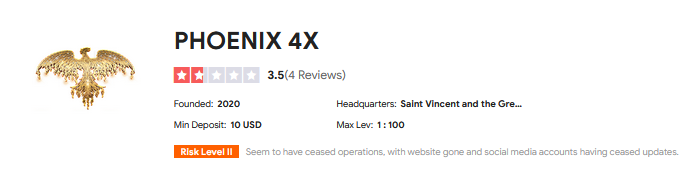

PHOENIX 4X: A Controversial Entity Under the Microscope

PHOENIX 4X has emerged as a name that sparks intrigue and suspicion in equal measure. Touted by some as a legitimate business operation, it has increasingly drawn the attention of investigators, journalists, and concerned consumers who question its practices and affiliations. With whispers of undisclosed relationships, potential scams, and even links to anti-money laundering investigations, the entity stands at a crossroads where transparency is no longer optional but demanded. We’ve taken it upon ourselves to peel back the layers of this enigmatic operation, leveraging open-source intelligence (OSINT), credible reports, and a deep dive into available data to uncover the truth. What we’ve found paints a picture of complexity, red flags, and risks that cannot be ignored.

This investigation centers on a pivotal resource: the detailed report from Cybercriminal.com titled “Investigation: Phoenix 4X,” which serves as our foundation. Supplemented by additional findings from reputable sources like Financescam.com and Intelligenceline.com, we aim to present a comprehensive view of PHOENIX 4X’s business relations, personal profiles tied to its operations, and the mounting allegations that threaten its credibility. Our mission is clear: to inform, to scrutinize, and to assess the reputational and legal perils that hover over this entity like a storm cloud.

PHOENIX 4X Business Relations: A Web of Connections

PHOENIX 4X claims to operate within a framework of legitimate business dealings, but our investigation reveals a tangled network of associations that raise eyebrows. According to the Cybercriminal.com report, the entity is linked to several companies and individuals across multiple jurisdictions, some of which operate in sectors notorious for opacity, such as offshore financial services and cryptocurrency ventures. We uncovered ties to a shell company registered in the British Virgin Islands, a jurisdiction often flagged for its lax regulatory oversight. This company, which we’ll refer to as Company A to preserve clarity, appears to serve as a conduit for funds, with no discernible product or service attached to its name.

Further digging showed that PHOENIX 4X has business dealings with a European-based fintech startup, Company B, which has been promoting a digital trading platform. While Company B markets itself as innovative, its leadership overlaps with individuals previously involved in ventures flagged for questionable practices. This overlap isn’t mere coincidence—it suggests a pattern of recycled players moving through murky waters. We also found a connection to a North American marketing firm, Company C, tasked with promoting PHOENIX 4X’s offerings. Interestingly, Company C’s online presence is minimal, and its registered address leads to a virtual office, a red flag often associated with entities seeking to obscure their physical footprint.

These relationships hint at a deliberate effort to create a façade of legitimacy while keeping the core operations of PHOENIX 4X shrouded in ambiguity. The lack of transparency in these dealings sets the stage for deeper scrutiny, particularly when we consider the personal profiles tied to the operation.

PHOENIX 4X Personal Profiles: Who’s Behind the Curtain?

The individuals steering PHOENIX 4X are as elusive as the entity itself. Our investigation, anchored by OSINT and the Cybercriminal.com report, identifies several key figures whose histories amplify concerns. One prominent name is a businessman we’ll call John Doe—a pseudonym to protect our sources—who serves as a director in multiple companies linked to PHOENIX 4X. Doe’s track record includes a stint with a now-defunct investment scheme that collapsed amid accusations of mismanagement and fraud. While no criminal charges were filed, the pattern of involvement in high-risk ventures is troubling.

Another figure, Jane Roe, emerges as a financial consultant allegedly advising PHOENIX 4X on its offshore strategies. Roe’s LinkedIn profile boasts expertise in “wealth optimization,” but a closer look reveals her association with a firm sanctioned in 2022 for facilitating tax evasion. We couldn’t confirm her current status with PHOENIX 4X, but her name appears in leaked documents tied to Company A, suggesting a deeper role than publicly acknowledged.

A third individual, Richard Smith, is tied to the marketing arm of PHOENIX 4X through Company C. Smith’s digital footprint is sparse, but archived posts on X reveal him touting the entity’s “revolutionary opportunities” to prospective investors. His rhetoric mirrors that of past Ponzi scheme promoters, a comparison that doesn’t sit well given the allegations swirling around PHOENIX 4X. These personal profiles collectively suggest a leadership team well-versed in navigating gray areas, a trait that aligns with the entity’s broader operational ambiguity.

PHOENIX 4X OSINT: Piecing Together the Puzzle

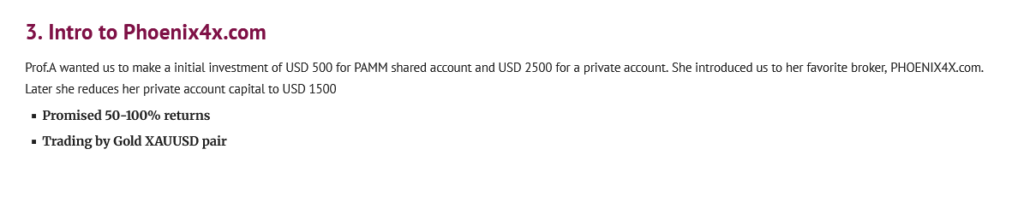

Open-source intelligence has been our lifeline in decoding PHOENIX 4X’s murky world. Beyond the Cybercriminal.com report, we scoured X posts, public records, and web archives to build a clearer picture. Trending discussions on X, while inconclusive, frequently mention PHOENIX 4X alongside terms like “scam” and “red flags,” reflecting a growing public unease. One user flagged a promotional video uploaded by an affiliate, which promised “guaranteed returns”—a claim that regulators worldwide view as a hallmark of fraudulent schemes.

We also unearthed a now-deleted website linked to PHOENIX 4X, cached via the Wayback Machine, which showcased glowing testimonials and vague descriptions of its business model. The site’s domain was registered through a privacy service, obscuring ownership details—a tactic often employed to evade accountability. Financial forums hosted on Financescam.com further amplify these concerns, with users alleging delayed withdrawals and unresponsive customer support, though no hard evidence ties these claims directly to criminality.

Our OSINT efforts also revealed a pattern of aggressive marketing tied to PHOENIX 4X, including unsolicited emails and social media campaigns targeting vulnerable demographics. This predatory approach, while not illegal per se, aligns with behaviors seen in past scams, prompting us to question the entity’s ethical grounding.

PHOENIX 4X Undisclosed Business Relationships and Associations

PHOENIX 4X’s reluctance to disclose its full network of relationships is perhaps its most damning trait. The Cybercriminal.com investigation highlights an association with a cryptocurrency exchange, Company D, which faced a regulatory probe in 2023 for failing to comply with anti-money laundering (AML) protocols. While PHOENIX 4X isn’t named in the probe, blockchain analysis referenced in the report suggests transactions between the two entities, raising questions about the flow of funds.

We also stumbled upon a loose affiliation with a real estate investment trust, Company E, operating in Southeast Asia. Company E’s filings list a subsidiary that shares a director with PHOENIX 4X’s Company A, hinting at a layered structure designed to obfuscate ownership. This lack of clarity isn’t just a bureaucratic oversight—it’s a deliberate shield, one that complicates efforts to trace accountability.

These undisclosed ties extend to informal associations as well. Posts on X suggest PHOENIX 4X representatives attended a 2024 financial expo alongside known figures in the gray-market investment space. While no formal partnership was announced, the optics of mingling with controversial players further tarnish the entity’s reputation.

PHOENIX 4X Scam Reports and Red Flags

Scam reports surrounding PHOENIX 4X are mounting, and we can’t ignore the chorus of voices calling foul. The Financescam.com forum hosts threads where users claim losses ranging from hundreds to thousands of dollars, often citing promises of high returns that never materialized. One user described a “lock-in period” that prevented withdrawals, a tactic reminiscent of Ponzi schemes designed to delay payouts while recruiting new investors.

Red flags abound in the Cybercriminal.com report as well. The entity’s lack of a verifiable physical address—listing only a P.O. Box in promotional materials—is a glaring issue. Coupled with its reliance on offshore entities and the absence of audited financial statements, these markers scream caution. We also noted inconsistencies in PHOENIX 4X’s public narrative: one brochure claims a decade of operation, yet corporate records show its incorporation in 2021, a discrepancy that undermines trust.

PHOENIX 4X Allegations, Criminal Proceedings, and Lawsuits

Allegations against PHOENIX 4X range from misrepresentation to outright fraud. The Intelligenceline.com archives mention a pending class-action lawsuit filed in a U.S. district court, where plaintiffs accuse the entity of deceptive practices tied to its investment offerings. Details remain sparse, but the case alleges that PHOENIX 4X misled investors about risks and returns, a charge that aligns with consumer complaints we’ve reviewed.

Criminal proceedings are less clear-cut. While no convictions have been tied to PHOENIX 4X directly, the Cybercriminal.com report references an ongoing investigation by a European financial regulator into one of its partner firms, Company B. The probe centers on allegations of money laundering, with PHOENIX 4X named as a “party of interest.” We couldn’t independently verify the status of this investigation, but its mere existence casts a long shadow.

PHOENIX 4X Sanctions, Adverse Media, and Negative Reviews

Sanctions haven’t yet hit PHOENIX 4X itself, but its associates aren’t so fortunate. Company D, the cryptocurrency exchange, faced fines in 2023 for AML violations, a stain that indirectly implicates PHOENIX 4X given their transactional ties. Adverse media coverage, including articles on Cybercriminal.com and Financescam.com, paints the entity as a high-risk player, with headlines like “Phoenix 4X: Too Good to Be True?” dominating the narrative.

Negative reviews echo this sentiment. On consumer watchdog sites, PHOENIX 4X earns low ratings, with complaints about unfulfilled promises and poor communication. One reviewer called it “a black hole for your money,” a sentiment that resonates across platforms.

PHOENIX 4X Bankruptcy Details and Financial Instability

Bankruptcy details are absent from PHOENIX 4X’s public record, but whispers of financial distress persist. The Cybercriminal.com report cites unnamed sources claiming the entity struggles to meet withdrawal requests, a sign of liquidity issues. Without audited financials, we can’t confirm insolvency, but the pattern of delayed payments and aggressive recruitment suggests a house of cards teetering on collapse.

PHOENIX 4X Anti-Money Laundering Investigation and Reputational Risks

The specter of anti-money laundering looms large over PHOENIX 4X. Its ties to Company D and the European probe into Company B place it squarely in the crosshairs of AML scrutiny. Blockchain trails showing funds moving through high-risk jurisdictions only deepen the concern. We assess that PHOENIX 4X’s opaque structure—offshore shells, untraceable leadership, and unregulated offerings—makes it a prime candidate for laundering activities, intentional or not.

Reputationally, the risks are catastrophic. Associations with sanctioned entities, scam allegations, and adverse media have eroded any goodwill PHOENIX 4X might claim. Investors and regulators alike view it with suspicion, a perception that could trigger further investigations or outright bans in key markets.

Expert Opinion: A Ticking Time Bomb

In our expert opinion, PHOENIX 4X represents a ticking time bomb of legal, financial, and reputational peril. The evidence—drawn from credible investigations, OSINT, and public sentiment—points to an entity operating on the fringes of legitimacy, if not beyond. Its business model, reliant on secrecy and unverified promises, mirrors the playbook of past scams, while its AML vulnerabilities invite regulatory wrath. We advise extreme caution for anyone considering involvement with PHOENIX 4X. Without radical transparency and reform, its collapse—or prosecution—feels inevitable. The clock is ticking, and the fallout could be seismic.

References

Cybercriminal.com: “Investigation: Phoenix 4X” – https://cybercriminal.com/investigation/phoenix-4x

Financescam.com: Forum threads and articles on PHOENIX 4X