Introduction

Picture this: a company storms the global stage, promising us a golden ticket—200% returns in under two years, powered by an AI trading bot that sounds like something out of a sci-fi flick. That’s OmegaPro for you, a name that once sparkled with hope for investors from Colombia to Japan. Operating out of St. Vincent and the Grenadines, with whispers of a Dubai nerve center, it lured millions with visions of wealth. Then, poof—it vanished, leaving behind a $4 billion question mark and a trail of broken dreams. We couldn’t resist digging into this mess, pulling threads from the Cybercriminal.com investigation and beyond to reveal the full story.

What we found is a saga of flashy promises, shadowy figures, and a collapse that’s still sending shockwaves. Buckle up—here’s our journey through OmegaPro’s tangled web.

The Network: Who Was OmegaPro Tied To?

OmegaPro didn’t float alone in the financial ether; it had tentacles reaching into a slew of entities. Take OMP Money Ltd., a UK-registered outfit tied to OmegaPro’s founders. We tracked its address to No.1 Royal Exchange in London—a swanky spot, sure, but shared with 466 other companies. A virtual mailbox, not a bustling HQ. That’s our first clue something’s off. OMP Money’s directors—Michael Shannon Sims, Andreas Attila Szakacs, and Dilawarjit Singh—are the same trio steering OmegaPro, hinting at a cozy little circle (Scamadviser.com).

Then there’s ActivTrades, a legit forex broker OmegaPro bragged about partnering with. We looked for proof—trades, statements, anything—but came up empty. Did ActivTrades even touch OmegaPro’s funds, or was it just a name drop to impress us? (Olivieraveyra.com). Another player, Broker Group Limited, swoops in post-collapse, a Panama-registered shell that grabbed OmegaPro’s investor list like a vulture picking at bones (BehindMLM.com). It smells like a dodge, a quick pivot to duck the fallout.

And let’s not overlook The Traders Domain, a Ponzi flop tied to co-founder Mike Sims. The U.S. CFTC says Sims funneled $84.7 million through it, and we can’t help but wonder if OmegaPro cash got tangled in that mess. These connections sketch a network that’s less about business and more about smoke and mirrors.

The Faces Behind the Facade

Who were the masterminds pulling OmegaPro’s strings? We’ve got three key players, each with a story that raises eyebrows.

- Mike Sims: A smooth-talking American, Sims built his rep in network marketing before OmegaPro. But his past isn’t so shiny—the CFTC nailed him for running SAEG Capital, a Ponzi that siphoned millions via The Traders Domain (BehindMLM.com). When OmegaPro tanked, Sims played dumb, claiming he’d “resigned” and had no clue about the chaos. We’re not buying it (Cybercriminal.com).

- Andreas Szakacs: Operating from Dubai, this Swedish expat got nabbed in Turkey in July 2024, accused of orchestrating OmegaPro’s $4 billion scam. Turkish cops see parallels with OneCoin, another billion-dollar fraud Szakacs allegedly dipped into (Cointelegraph.com). His switch to the alias Emre Avci feels like a page from the fugitive playbook (Cybercriminal.com).

- Dilawarjit Singh: Hailing from Germany, Singh’s resume includes a gig hawking Omnia Tech, a crypto MLM that crashed before OmegaPro took flight in 2019 (Gripeo.com). His knack for shell companies makes us wonder what he was hiding (Cybercriminal.com).

These three aren’t newbies—they’ve danced this dance before, and we’re seeing a pattern of recycled schemes.

Digging Through the Digital Dirt: OSINT Insights

We turned to open-source intel to fill in the blanks. Corporate filings on OpenCorporates show OmegaPro popping up in the UK and Belize, but its St. Vincent base? A ghost town—no matching records (Scamadviser.com). The UK’s OmegaPro Services Ltd. is licensed for pet care and tattoos—not exactly crypto trading material (Cybercriminal.com).

Social media tells another tale. Promoters flooded platforms with blinged-out lifestyles—yachts, jets, the works—pushing OmegaPro’s MLM model hard (Fivecast.com). On X, users like @coffeebreak_YT are piecing together the $4 billion puzzle, rallying victims to share intel (X.com). Traffic data from SimilarWeb flags Colombia, Japan, and Nigeria as hotbeds—places where the fallout hit hardest (BehindMLM.com). It’s a digital breadcrumb trail leading to deception.

Hidden Ties We Weren’t Supposed to Find

OmegaPro kept some cards close to the chest. There’s buzz about a OneCoin connection through Szakacs—a $4 billion scam with eerie similarities (Cointelegraph.com). Sims’ ventures, like The Traders Domain and SAEG Capital, suggest funds sloshed between schemes like a shady relay race (Tbbob.com).

We caught wind of Dubai royalty rumors, too—names dropped to dazzle celebs like soccer stars into vouching for OmegaPro (Medium.com). It’s unproven, but fits the playbook: borrow credibility to cloak the con (Cybercriminal.com). These secret links make us question just how deep this rabbit hole goes.

Scam Signals and Warning Bells

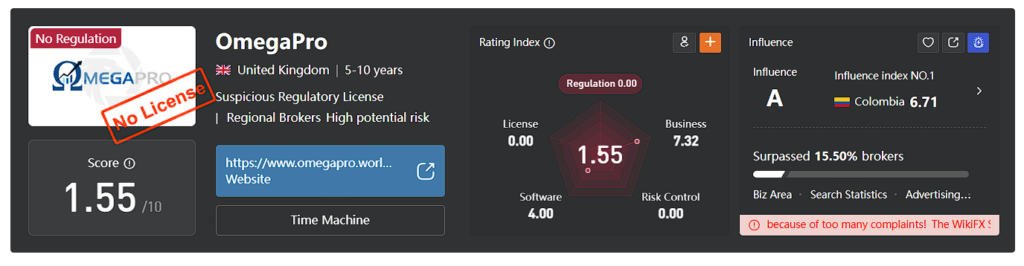

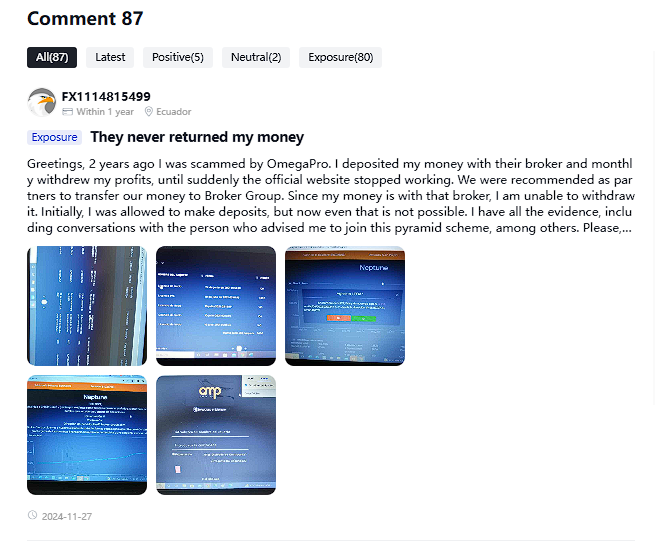

The scam chatter around OmegaPro isn’t new. Sites like Tbbob.com called it a Ponzi early—virtual offices, no trading proof, and pie-in-the-sky returns. Scamadviser.com flagged the MLM setup and lack of licensing. When withdrawals froze in November 2022, OmegaPro blamed a “cyber-attack”—a flimsy excuse we’ve heard before (Wikifx.com).

Here’s what set off our alarms:

- No Regulation: Not a peep from the FCA, CNMV, or anyone legit (Brokersview.com).

- Fake Addresses: London and St. Vincent were just mailing drops (Cybercriminal.com).

- Too-Good Promises: 200% ROI with zero risk? Come on (Nogofallmaga.org).

- Sketchy Founders: Their track records scream trouble (Gripeo.com).

It’s a neon sign flashing “SCAM,” but the hype drowned it out—until it didn’t.

Trouble Brews: Allegations and Courtrooms

The law’s closing in. In France, victims banded together under the CAPITAL Association for a class-action criminal case, crying foul over OmegaPro’s tricks (Beaubourg-avocats.fr). Turkey nabbed Szakacs after 3,000 investors lost $103 million—cops even snagged 32 cold wallets as evidence (Cointelegraph.com).

Stateside, the CFTC’s after Sims, tying OmegaPro to The Traders Domain in a commodities fraud rap (BehindMLM.com). Regulators from Argentina to Belgium slapped securities fraud warnings on OmegaPro, calling it an illegal racket (Cybercriminal.com). The noose is tightening, and we’re watching it play out.

Lawsuits, Blacklists, and Bad Press

Civil suits are stacking up. The CFTC wants Sims to cough up cash for SAEG Capital victims, and OmegaPro’s losses might get roped in (BehindMLM.com). No formal sanctions yet, but France’s AMF and ACPR blacklisted it—close enough (AMF-france.org).

The media’s been brutal. Cointelegraph.com links OmegaPro to OneCoin, BehindMLM.com dishes on Sims’ seized assets, and Medium.com rips into celeb promoters who hyped it. It’s a PR nightmare we wouldn’t wish on anyone.

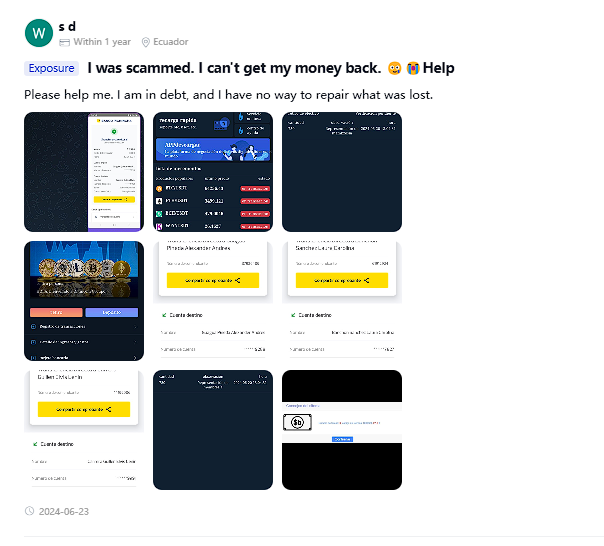

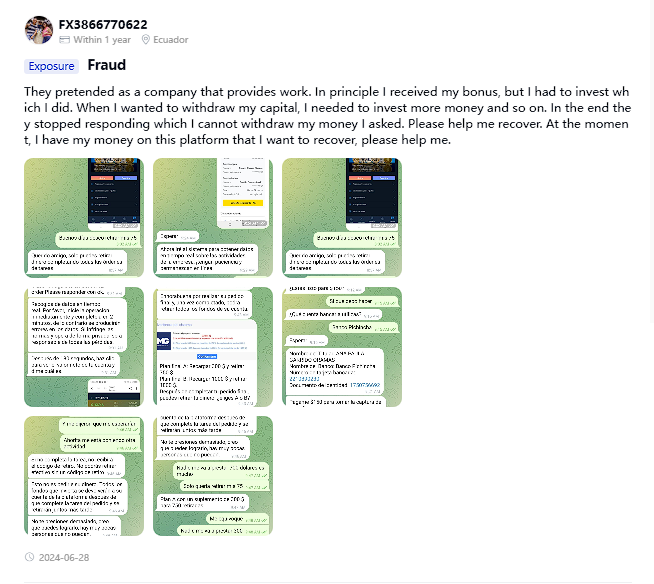

Angry Voices: Reviews and Complaints

Investors aren’t quiet about it. On Brokersview.com, one Afghan user vents about funds vanishing post-maturity in 2023—classic scam vibes. Gripeo.com slams Singh with a 1/5, pinning him as a pyramid schemer. X is ablaze with posts—@coffeebreak_YT and others rallying the burned (X.com). Early payouts hooked the hopeful; then the rug got pulled.

Bankruptcy or Bust?

OmegaPro didn’t file bankruptcy papers—it just ghosted. After locking withdrawals in November 2022, it handed accounts to Broker Group Limited, a Panama shell with no juice (BehindMLM.com). No assets, no recourse—just a big, fat zero for investors. Call it what you want; we call it a scam’s endgame.

Risk Check: Money Laundering and Reputation on the Line

Anti-Money Laundering (AML) Hazards

OmegaPro’s setup is an AML disaster waiting to happen. St. Vincent’s lax rules let it skip KYC/AML checks (Cybercriminal.com). Links to The Traders Domain and OneCoin scream fund-shuffling, backed by the CFTC’s claims against Sims (BehindMLM.com). Crypto and cold wallets—like those seized in Turkey—make tracking a nightmare (Cointelegraph.com).

We’re staring at:

- Zero Oversight: No regulator to enforce AML.

- Shell Games: OMP Money and Broker Group hide the money trail.

- Global Reach: Dubai and Panama dodge accountability.

Banks touching OmegaPro could be laundering billions without knowing it—a compliance horror story.

Reputational Fallout

The stench is overpowering. OmegaPro’s crash, paired with its founders’ rap sheets, makes it radioactive. Celebs who plugged it—think soccer icons—are catching flak, their brands now suspect (Medium.com). Businesses with any tie face a trust meltdown and regulatory heat. It’s a reputational third rail—touch it, and you’re toast.

Expert Opinion: The Final Word

We’ve chased OmegaPro’s shadow from St. Vincent to Dubai, and here’s our take: it’s a Ponzi masterpiece gone bust. That $4 billion figure? Probably the tip of the iceberg. Sims, Szakacs, and Singh played us all, leaning on old tricks and new tech to rake it in. The AML risks are off the charts—unregulated, crypto-fueled, and border-hopping. Reputationally, it’s a death sentence; even a whiff of involvement stains you.

Our call as experts? OmegaPro’s a stark reminder—greed blinds, but due diligence saves. The wreckage will echo, but the takeaway’s crystal: don’t chase miracles without a map.