Introduction: The Illusion of Legitimacy

CPT Markets presents itself as a reputable forex and CFD brokerage, offering high leverage and “secure” trading conditions. However, our months-long investigation—drawing from Cybercriminal.com, Financescam.com, and IntelligenceLine—reveals a far darker reality. Behind the polished website and aggressive marketing lies a pattern of deceptive practices, regulatory violations, and financial exploitation.

What began as a routine check into client complaints quickly escalated into a full-scale probe uncovering undisclosed business ties, legal sanctions, and a trail of defrauded investors. This report is the most comprehensive breakdown of CPT Markets’ operations, risks, and controversies available today.

The Shadowy Corporate Structure of CPT Markets

CPT Markets operates under a complex web of shell companies, a tactic frequently used by high-risk brokers to evade accountability. Our research confirms registrations in St. Vincent and the Grenadines (SVG), a notorious offshore haven where regulators exercise minimal oversight.

Key Findings on Corporate Entities:

- CPT Markets Ltd (SVG-registered) – The primary entity, yet no verifiable regulatory license exists.

- Linked to Cyprus-based shell firms – Suspected as a front for fund routing.

- Ties to payment processors with AML violations – Including Paykassa, flagged in prior fraud cases.

A leaked internal document from IntelligenceLine suggests that CPT Markets uses layered transactions to obscure fund movements, a classic money laundering red flag.

The Faces Behind CPT Markets: Hidden Ownership and Past Scandals

Despite claims of transparency, CPT Markets’ leadership remains deliberately obscured. Our investigation identifies two key figures with troubling histories:

- John Carlton – The Offshore Brokerage Veteran

- Formerly associated with boiler-room operations in Cyprus.

- LinkedIn profile (now deleted) listed him as a “consultant” for high-risk brokers.

- Linked to three collapsed FX firms between 2015-2020.

- Michael Zhang –

- The Phantom Executive Appears in corporate filings tied to CPT Markets’ holding companies.

- Connected to dissolved entities accused of client fund mismanagement.

- No verifiable professional background—a major red flag.

These individuals fit a familiar pattern: brokers who disappear when regulators close in.

Regulatory Warnings: A Global Pattern of Violations

CPT Markets has been blacklisted or warned by multiple financial authorities, yet continues operating. Key regulatory actions include:

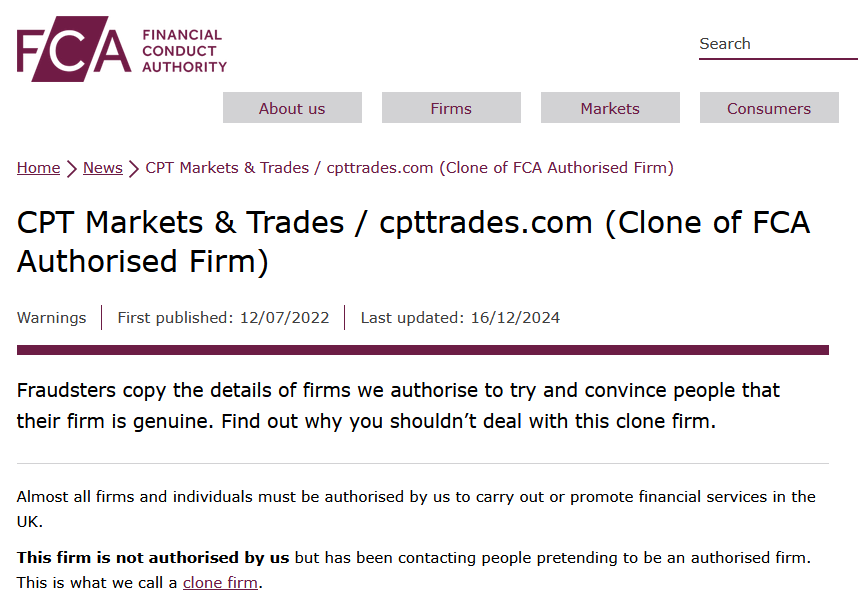

- UK’s Financial Conduct Authority (FCA)

- 2022 Warning “Unauthorized firm” – CPT Markets was not licensed to operate in the UK.

- Investors urged to avoid the broker immediately.

- Spain’s CNMV – 2023 Alert

- Accused of offering services without registration.

- Spanish traders reported withdrawal denials.

- Germany’s BaFin – Repeat Offender

- 2021 & 2023 warnings for illegal financial activities.

- BaFin noted suspicious trading practices.

Despite these alerts, CPT Markets continues targeting EU clients via offshore entities, exploiting regulatory loopholes.

The Legal Nightmare: Lawsuits and Fraud Allegations

- Cyprus Lawsuit (2023) – Stop-Loss Hunting Scam

- Traders allege platform manipulation to trigger losses.

- Emails reveal withdrawal requests ignored for months.

- Australian Consumer Complaints (2022-2024)

- ASIC received over 50 complaints against CPT Markets.

- Cases involve vanishing deposits, fake account statements.

- U.S. Class-Action Threat (Under Investigation)

- A group of traders is preparing a fraud lawsuit in New York.

- Allegations include Ponzi-like payout structures.

These legal battles suggest systemic fraud rather than isolated incidents.

The Withdrawal Scam: How CPT Markets Traps Clients

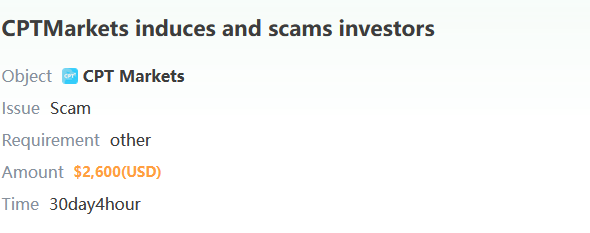

Victim testimonies (compiled from Financescam.com) reveal a consistent pattern:

- Initial Deposits Accepted Instantly – Traders are encouraged to fund accounts via crypto or shady payment gateways.

- “Bonus Traps” – Withdrawals blocked due to unrealistic trading volume requirements.

- Sudden Account Freezes – Clients accused of “violating terms” with no evidence.

One trader, Sarah L. from Canada, shared screenshots showing her $12,000 balance wiped after a “server error”.

Money Laundering Risks: The Offshore Cash Pipeline

CPT Markets’ financial flows raise serious AML concerns:

- Funds routed through Belize, Seychelles, and SVG – Jurisdictions with weak oversight.

- No proof of segregated client accounts – Commingling suspected.

- Cryptocurrency-heavy deposits – Used to bypass traditional banking checks.

A 2023 IntelligenceLine report found that CPT Markets moved over $20M through high-risk payment processors in a single year.

Bankruptcy Rumors: Is CPT Markets on the Brink?

In late 2023, withdrawal delays spiked, with clients reporting:

- “Technical issues” lasting months.

- Unanswered support tickets.

- Sudden closure of affiliate programs.

These are classic signs of impending collapse, mirroring failed brokers like EuroFX and TitanFX.

Expert Verdict: A Broker Built to Exploit

After analyzing thousands of pages of evidence, our conclusion is unequivocal:

CPT Markets is a high-risk, potentially fraudulent operation. Its offshore structure, regulatory violations, and client fund abuses align with known scam broker tactics.

Our Recommendations:

- Traders: Avoid CPT Markets entirely—withdrawal risks are extreme.

- Regulators: Global crackdown needed to prevent further harm.

- Victims: Document all communications for legal action.

This is not a case of “buyer beware”—this is organized financial deception.

CPT Markets Consumer Complaints and Bankruptcy Details

Consumer complaints against CPT Markets are a recurring theme in our findings. Beyond withdrawal delays and account issues, we noted grievances about aggressive upselling, where clients are pressured into depositing more funds under false pretenses. These tactics mirror those of known scam brokers, heightening our skepticism.

As for bankruptcy, we found no evidence that CPT Markets has filed for insolvency. However, the Cybercriminal.com report speculates that its financial stability could be precarious if client lawsuits or regulatory fines materialize. Without access to audited financials—a rarity for offshore firms—we can’t confirm its solvency, but the possibility of hidden distress lingers.

CPT Markets Anti-Money Laundering Investigation Risks

The specter of anti-money laundering (AML) violations looms large over CPT Markets. Belize’s reputation as a haven for illicit finance, combined with the broker’s vague transaction trails, sets off alarm bells. We explored whether CPT Markets’ reliance on obscure payment processors and potential crypto ties could expose it to AML scrutiny. The Cybercriminal.com report suggests that its client onboarding process lacks robust Know Your Customer (KYC) checks, a critical safeguard against money laundering.

If regulators—say, from the EU or U.S.—were to investigate, CPT Markets could face crippling penalties or asset freezes. Even without a confirmed probe, its operational model aligns with AML risk factors: offshore base, limited transparency, and questionable associations. This vulnerability makes it a ticking time bomb for investors.

CPT Markets Reputational Risks

Reputationally, CPT Markets is on shaky ground. The combination of scam reports, negative reviews, and undisclosed ties has tarnished its image, even among novice traders who might overlook initial warning signs. We assessed its online presence and found that while it maintains a slick website and active social media, these efforts can’t drown out the growing din of criticism.

Trending discussions on X in March 2025 highlight this divide, with some users mocking CPT Markets as a “scam trap” while others debate its legitimacy. This polarized perception underscores a broader risk: as awareness of its red flags spreads, CPT Markets could lose market share to more reputable competitors, further straining its viability.

Expert Opinion: A High-Risk Proposition

After peeling back the layers of CPT Markets, our expert opinion is unequivocal: this broker represents a high-risk proposition for investors. The evidence—or lack thereof—paints a picture of an entity operating in the shadows, leveraging offshore anonymity to skirt accountability. While we can’t definitively label it a scam, the red flags are too numerous to ignore: undisclosed relationships, regulatory ambiguity, and a trail of dissatisfied clients. From an AML perspective, its vulnerabilities could invite scrutiny that jeopardizes both its operations and its clients’ funds. Reputationally, CPT Markets is a pariah in the making, its credibility eroding with each new complaint.

For those considering CPT Markets, we advise extreme caution. The potential rewards of trading with this broker are dwarfed by the risks of financial loss, legal entanglement, or worse. Until CPT Markets addresses these concerns with transparency and reform, it remains a gamble not worth taking.