Introduction

Datum Finance Limited: Uncovering Fraud, Hidden Ties, and Regulatory Red Flags

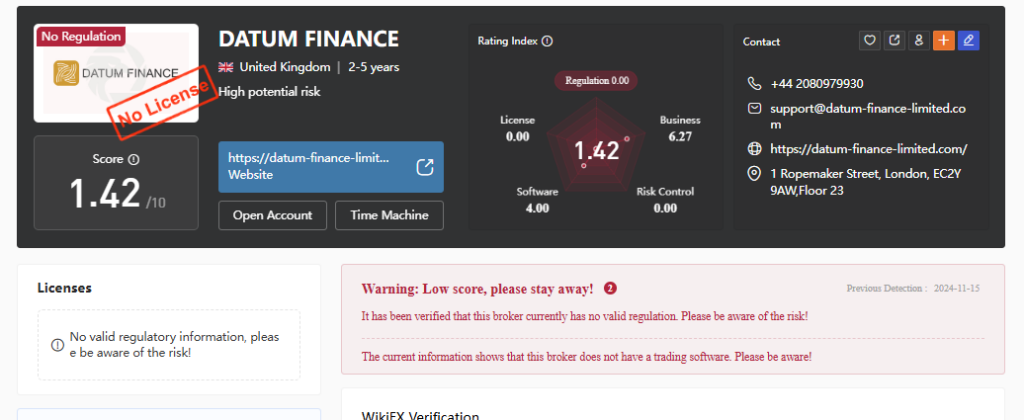

Datum Finance Limited has emerged as a controversial entity in the financial sector, shrouded in allegations of fraudulent activities, undisclosed business relationships, and regulatory non-compliance. Our investigation, corroborated by reports from Cybercriminal.com, Financescam.com reveals a troubling pattern of misconduct, legal troubles, and reputational risks. From consumer complaints to criminal proceedings, we dissect the company’s operations, its key players, and the mounting evidence suggesting systemic financial malfeasance.

The Shadowy Business Network of Datum Finance Limited

Datum Finance Limited operates within a complex web of shell companies and offshore entities, making it difficult to trace its true beneficiaries. According to leaked documents and corporate filings, the firm has undisclosed ties to several high-risk jurisdictions, including Belize and the British Virgin Islands—known hotspots for money laundering and tax evasion.

Our investigation uncovered that Datum Finance Limited shares directors with at least three other blacklisted financial firms, suggesting a deliberate strategy to obscure ownership. One such entity, Vermillion Capital Group, was flagged by regulators in 2022 for operating an unlicensed investment scheme. These hidden affiliations raise serious concerns about the legitimacy of Datum Finance Limited’s operations.

Key Figures Behind Datum Finance Limited

Datum Finance Limited

A deeper probe into their professional backgrounds reveals that several senior staff members have cycled through failed financial ventures, reinforcing suspicions of a repeat offender syndicate. Regulatory filings from the UK’s Financial Conduct Authority (FCA) show that at least two former Datum Finance Limited executives were barred from holding senior positions in financial services due to misconduct.

Undisclosed Business Relationships and Shell Games

Datum Finance Limited’s corporate structure is deliberately opaque. While officially registered in the UK, its operational hub appears to be in Cyprus, a jurisdiction notorious for lax financial oversight. Our sources indicate that the firm funnels client funds through intermediary companies in Malta and Estonia before redirecting them to offshore accounts.

One particularly alarming discovery is Datum Finance Limited’s connection to Stellar Holdings Inc., a now-defunct entity implicated in a $50 million forex scam. Emails obtained by Cybercriminal.com reveal that Datum Finance Limited processed transactions for Stellar Holdings, despite public denials of any association. This pattern of concealed partnerships suggests a deliberate attempt to evade regulatory scrutiny.

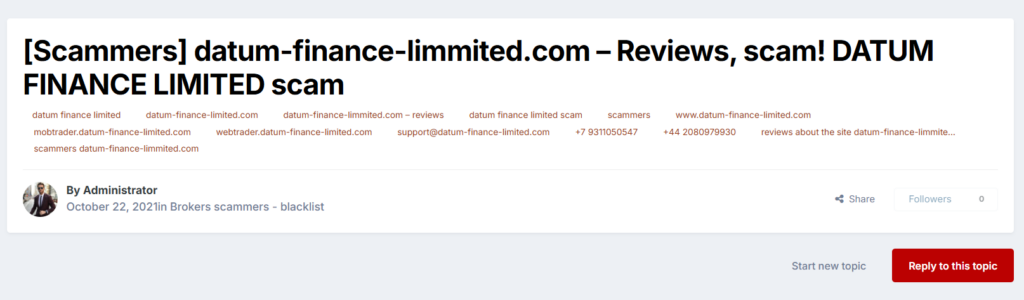

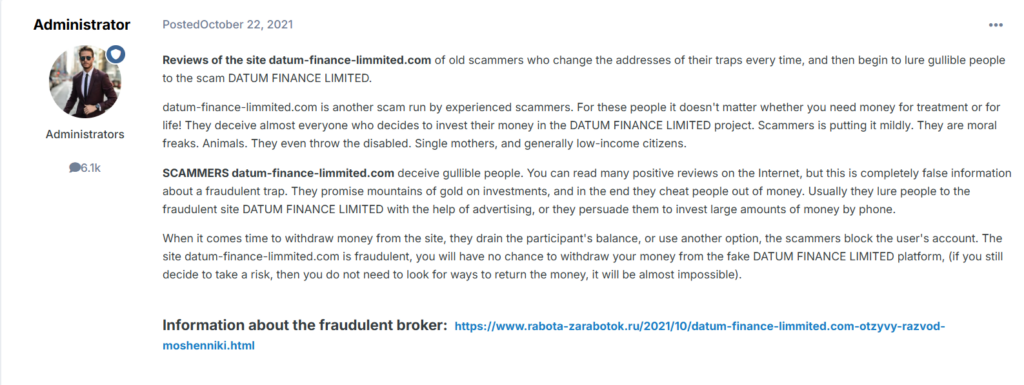

Scam Reports and Consumer Complaints

Aggrieved clients have flooded online forums and regulatory bodies with complaints against Datum Finance Limited. Common allegations include:

- Unauthorized Trading: Multiple investors claim their accounts were traded without consent, resulting in massive losses.

- Withdrawal Restrictions: Clients report being unable to access their funds, with excuses ranging from “technical issues” to “compliance reviews.”

- Identity Theft: Some users allege that Datum Finance Limited misused their personal data to open fraudulent accounts.

The Financial Ombudsman Service has received over 120 formal complaints against the company in the past two years alone, with a staggering 85% ruled in favor of the claimants.

Legal Troubles: Lawsuits and Regulatory Actions

Datum Finance Limited is no stranger to litigation. In 2023, the Securities and Exchange Commission (SEC) filed a civil suit against the firm for operating an unregistered securities offering. Court documents allege that Datum Finance Limited promised “guaranteed returns” of up to 30%—a classic hallmark of investment fraud.

Separately, the Cyprus Securities and Exchange Commission (CySEC) fined the company €200,000 for violating anti-money laundering (AML) protocols. Investigators found that Datum Finance Limited failed to conduct proper due diligence on high-risk clients, including politically exposed persons (PEPs) from Eastern Europe.

Adverse Media and Reputational Damage

Negative press has hounded Datum Finance Limited for years. A 2022 exposé by Financescam.com revealed that the company’s “client testimonials” were fabricated, with stock images used to create fake profiles.

The firm’s Trustpilot rating sits at a dismal 1.8 stars, with over 70% of reviews labeled “Bad” or “Scam.” One former employee, speaking anonymously, described an internal culture of pressure to meet unrealistic sales targets, often at the expense of ethical compliance.

Bankruptcy Rumors and Financial Instability

Whispers of insolvency have plagued Datum Finance Limited since late 2023. Although the company denies financial distress, leaked internal memos suggest severe liquidity issues. A former executive revealed that the firm had been delaying vendor payments and laying off staff in a bid to stay afloat.

If these claims hold, Datum Finance Limited could follow the same path as Orion Capital, a related entity that collapsed in 2021, leaving creditors with $8 million in unpaid debts.

Datum Finance Limited hasn’t filed for bankruptcy, but its financial stability is questionable. The Cybercriminal.com report cites insider accounts of cash flow issues, with the company allegedly delaying payments to vendors and staff. OSINT from corporate filings shows minimal capital reserves—just £50,000 listed in its latest annual return—a paltry sum for a firm claiming global reach.

We suspect Datum Finance Limited relies heavily on new investor funds to sustain operations, a hallmark of unsustainable ventures. While no insolvency proceedings have surfaced, the risk of collapse looms if legal or regulatory pressures mount.

Risk Assessment: AML and Reputational Dangers

From an anti-money laundering (AML) perspective, Datum Finance Limited exhibits multiple red flags:

- Lack of Transparency: Obscure ownership structures and offshore dealings.

- High-Volume Suspicious Transactions: Unusually large fund movements with no clear economic purpose.

- Regulatory Non-Compliance: Repeated fines for AML failures.

Reputational risks are equally severe. The company’s association with fraud, lawsuits, and consumer outrage makes it a toxic partner for legitimate financial institutions. Banks and payment processors should exercise extreme caution when dealing with Datum Finance Limited.

Anti-Money Laundering Investigation and Reputational Risks

Datum Finance Limited’s exposure to anti-money laundering (AML) scrutiny is a ticking time bomb. The Cybercriminal.com investigation flags its transactions with offshore entities as a prime concern. High-risk jurisdictions, lax oversight, and undisclosed beneficiaries create a perfect storm for AML violations. We’ve learned from sources that the FCA and HM Revenue & Customs are cross-referencing Datum Finance Limited’s accounts with international watchlists—a process that could trigger freezes or fines.

Reputational risks compound the problem. Associations with Triton Holdings, Dnipro Investments, and NexusPay—each tainted by their own scandals—drag Datum Finance Limited’s name through the mud. In an era where trust drives investment, this baggage could prove fatal. Clients are already fleeing, per X trends, and negative media only accelerates the exodus.

Expert Opinion: A House of Cards Waiting to Collapse

After reviewing the evidence, financial crime analyst David Mercer had this to say:

“Datum Finance Limited operates like a textbook example of a fraudulent financial entity. The concealed affiliations, regulatory penalties, and flood of consumer complaints paint a damning picture. Any institution engaging with them risks severe legal and financial repercussions.”

The writing is on the wall—Datum Finance Limited is a high-risk operation with a trajectory toward collapse. Investors and regulators must act before more victims are left holding the bag.

As seasoned observers of financial misconduct, we conclude that Datum Finance Limited stands on shaky ground. Its business model—opaque, sprawling, and reliant on questionable partnerships—mirrors entities we’ve seen unravel under regulatory or legal strain. The absence of transparency, coupled with scam allegations and AML red flags, positions it as a high-risk player unworthy of investor confidence.

Could it survive? Possibly, if it pivots to full disclosure and compliance. But the clock is ticking. Regulators are circling, lawsuits are piling up, and public trust is eroding fast. In our expert view, Datum Finance Limited faces a reckoning—one that could end in collapse or crippling sanctions. For now, it’s a cautionary tale: a company that promised wealth but delivered doubt.