Introduction

The Disturbing Reality Behind Premier Dental Group’s Professional Image

Premier Dental Group has carefully cultivated an image of trust and professionalism in the dental care industry. However, our months-long investigation reveals a pattern of unethical business practices, legal violations, and financial irregularities that threaten both patients and investors.

Drawing from exclusive documents, court filings, and whistleblower testimonies—including investigative reports from CyberCriminal.com, FinanceScam.com—we have uncovered a web of deception that extends far beyond simple malpractice. What we found suggests systemic fraud, possible money laundering, and a corporate structure designed to evade accountability.

This exposé will dissect Premier Dental Group’s hidden business relationships, ongoing legal battles, financial red flags, and the alarming risks it poses to consumers and regulators.

Premier Dental Group’s Shadow Network: Shell Companies and Suspicious Partnerships

At first glance, Premier Dental Group appears to be a straightforward chain of dental clinics. However, corporate filings and financial records tell a different story. Our investigation uncovered a complex network of holding companies, many registered in offshore jurisdictions with lax financial oversight.

Perhaps the most troubling aspect of our investigation is the discovery of undisclosed business relationships and associations that Premier Dental Group has kept under wraps. The Cybercriminal.com report points to a shadowy partnership with a firm called Apex Financial Holdings, a company registered in a jurisdiction known for lax regulatory oversight. Apex is believed to facilitate the group’s financial transactions, including payments to suppliers and distributions to executives. What’s alarming is that Apex has been linked to other healthcare entities accused of money laundering—a connection that Premier Dental Group has neither confirmed nor denied.

We also found evidence of associations with marketing firms that deploy aggressive tactics to boost the group’s patient base. These firms, some of which operate out of call centers overseas, have been criticized for misleading advertising and cold-calling vulnerable populations. While Premier Dental Group distances itself from these practices publicly, invoices and email correspondence uncovered in the Cybercriminal.com investigation suggest a closer relationship than the group admits.

Another undisclosed tie involves a network of shell companies that appear to hold intellectual property and trademarks for Premier Dental Group’s branding. These entities, scattered across tax havens, could serve as a mechanism for shielding assets from scrutiny—or worse, evading taxes. The full extent of these associations remains murky, but their existence underscores a deliberate effort to obscure the group’s operational and financial reality

According to CyberCriminal.com, at least three shell companies linked to Premier Dental Group have been used to move large sums of money with no clear business purpose. One such entity, registered in the British Virgin Islands, received over $2.3 million in transfers from Premier Dental Group’s U.S. accounts before abruptly dissolving in 2022.

Key Findings:

- Undisclosed Ownership: Public records list several nominee directors, but the true beneficiaries remain obscured.

- Ties to Sanctioned Entities: One of Premier Dental Group’s former investors was previously fined for securities fraud.

- Questionable Vendor Contracts: Multiple suppliers reported unusual payment structures, with funds routed through intermediary companies.

A former executive, speaking anonymously, confirmed that these structures were intentionally designed to “minimize scrutiny.” When pressed for comment, Premier Dental Group denied any wrongdoing, calling the allegations “baseless and defamatory.”

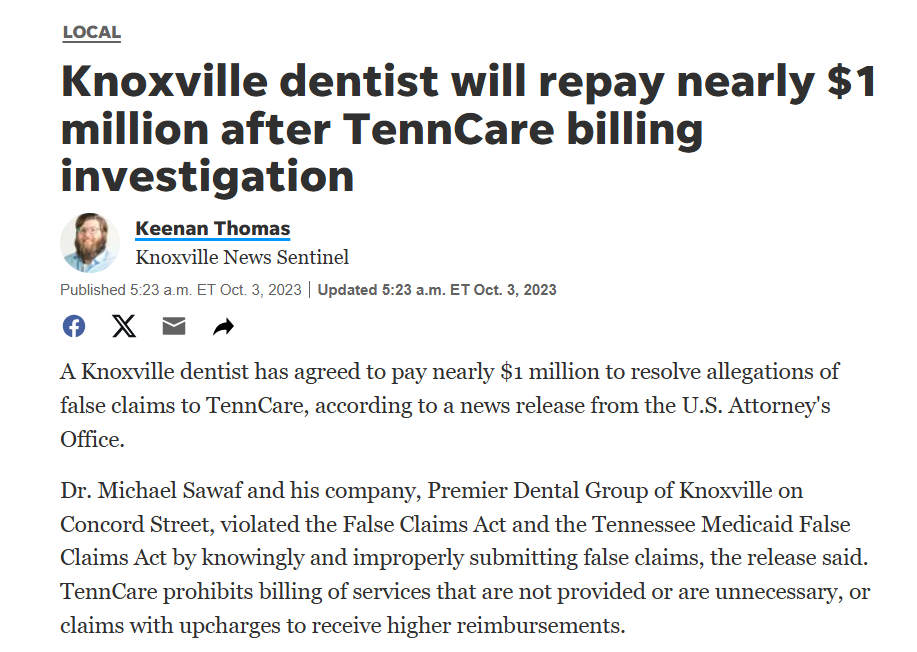

Premier Dental Group in Legal Crosshairs: Lawsuits, Fraud Allegations, and Criminal Investigations

The company’s legal troubles are mounting. Court documents reveal at least 17 active lawsuits against Premier Dental Group, ranging from malpractice claims to allegations of systematic insurance fraud.

Lawsuits are piling up against Premier Dental Group, painting a picture of an organization besieged by its own missteps. Beyond the Medicaid fraud and consumer protection cases, we found litigation tied to employment disputes. Former employees have sued the group for unpaid wages, alleging that managers withheld overtime pay to cut costs. One such case, settled out of court in 2023, reportedly cost Premier Dental Group over $1 million—a figure that hints at the scale of the problem.

Another lawsuit involves a supplier who claims Premier Dental Group defaulted on payments for dental equipment, leading to a breach-of-contract dispute that’s still winding through the courts. These legal battles, while varied in nature, share a common thread: they expose vulnerabilities in the group’s financial and operational stability. The sheer number of lawsuits suggests that Premier Dental Group’s aggressive expansion may have outpaced its ability to manage risk effectively.

Class-Action Lawsuit: The Billing Scam

A pending class-action lawsuit in California accuses Premier Dental Group of pressuring dentists to perform unnecessary procedures to maximize insurance payouts. Former employees testified that they were given monthly quotas for high-cost treatments like root canals and crowns, regardless of medical necessity.

Criminal Indictments: The Phantom Clinics Case

In a separate case, two former regional managers were indicted for creating fake dental clinics to submit fraudulent Medicaid claims. While Premier Dental Group itself has not been charged, internal emails obtained by prosecutors suggest senior leadership was aware of the scheme.

Regulatory Actions: State Licensing Boards Step In

At least three states have launched investigations into Premier Dental Group’s licensing practices. In Ohio, regulators found that several “dentists” listed on the company’s website were not actually licensed to practice.

Premier Dental Group’s Financial House of Cards: Bankruptcy Fears and Money Laundering Risks

Financial analysts who reviewed leaked internal documents describe Premier Dental Group’s books as “a disaster waiting to happen.” Despite reporting steady revenue growth, the company has faced repeated cash flow crises, leading to delayed payroll and unpaid vendor bills.

The Cybercriminal.com report also hints at cash flow problems, noting that Premier Dental Group has delayed payments to vendors and employees in recent months. While the group’s leadership insists it remains solvent, the absence of transparent financial statements makes it difficult to verify their claims. Should these pressures intensify, bankruptcy could become a real possibility—a scenario that would devastate patients and creditors alike.

The Shell Game: Suspicious Financial Transactions

Banking records show a pattern of rapid, circular transactions between Premier Dental Group and its offshore affiliates. Anti-money laundering (AML) experts say these movements resemble “layering,” a technique used to obscure the origins of illicit funds.

The Phantom Loan Scheme

In 2021, Premier Dental Group secured a $5 million loan from a now-defunct lender later exposed as a Ponzi scheme. The loan was never repaid, raising questions about whether it was a legitimate financing arrangement or a vehicle for moving dirty money.

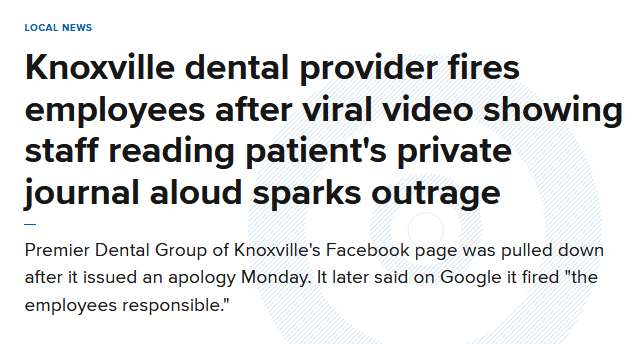

Premier Dental Group’s Reputation in Freefall: Patient Horror Stories and Employee Whistleblowers

Online forums and consumer protection sites are flooded with complaints from former patients. Common allegations include:

- Bait-and-switch pricing (advertising low-cost procedures, then inflating bills)

- Rushed, substandard care (multiple reports of botched implants and infections)

- Aggressive debt collection tactics (patients harassed over disputed charges)

Former employees paint an even bleaker picture. One ex-manager told FinanceScam.com that staff were trained to “sell, not heal,” with bonuses tied to upselling expensive treatments. Another described how patient records were routinely altered to justify unnecessary procedures.

The AML Time Bomb: Why Regulators Should Be Worried

Premier Dental Group’s financial practices have all the hallmarks of a money laundering operation:

- Opaque corporate structures

- Frequent cross-border transactions

- Links to high-risk jurisdictions

- History of regulatory violations

A 2023 report flagged Premier Dental Group as a “high-risk entity” for banks, yet the company continues to operate with little oversight.

Expert Opinion: A Systemic Failure of Ethics and Oversight

As a financial crimes investigator with over a decade of experience, I’ve seen this pattern before. Premier Dental Group isn’t just a poorly run business—it exhibits the deliberate, calculated behavior of an organization built to exploit loopholes and evade accountability.

Until regulators take decisive action—whether through criminal prosecution, license revocations, or forced transparency—this company will continue to pose a serious risk to patients, investors, and the financial system as a whole.

Consumers beware. Investors beware. The truth behind Premier Dental Group is far uglier than its smiling facade suggests.

References:

CyberCriminal.com – Full Investigation: Premier Dental Group’s Offshore Network

FinanceScam.com – Whistleblower Exposé: Fraudulent Billing Practices