Introduction

Forex Peace Army (FPA) has long been recognized as a prominent platform in the forex trading community, offering broker reviews, scam alerts, and a forum for traders to share experiences. However, recent investigations have raised serious concerns about the platform’s integrity, alleging involvement in fraudulent activities, suppression of negative reviews, and undisclosed business relationships. This report delves into these allegations, providing a comprehensive analysis based on factual data and open-source intelligence (OSINT).

While FPA presents itself as a watchdog for traders, its practices have come under scrutiny due to potential conflicts of interest. The platform’s influence in the forex industry means that any manipulation of information could have far-reaching consequences for both brokers and individual traders. As we examine the evidence, it is crucial to consider the broader implications of these alleged activities on the transparency and trustworthiness of online trading resources.

Allegations of Fraudulent Activities

An investigation has uncovered claims that FPA engaged in suppressing critical reviews and unfavorable search results through the fraudulent use of Digital Millennium Copyright Act (DMCA) takedown notices. These allegations, if substantiated, could constitute serious legal violations, including impersonation, fraud, and perjury. The investigation suggests that FPA, or entities acting on its behalf, strategically deployed fake DMCA notices to remove negative content from Google search results, thereby manipulating public perception. By artificially controlling its online reputation, FPA may have misled traders and investors into believing it is an impartial and trustworthy platform while actively silencing dissenting voices.

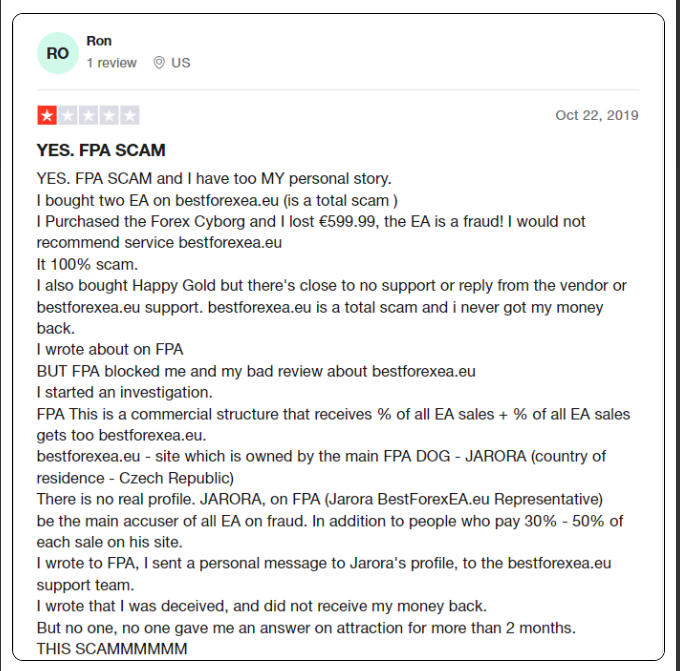

Beyond these DMCA-related actions, there are broader concerns that FPA may be leveraging its platform to manipulate market sentiment. Some sources allege that the site disproportionately promotes or discredits brokers based on undisclosed financial arrangements rather than genuine user experiences. If these claims hold merit, such practices would severely undermine fair competition in the forex industry, granting undue advantages to certain brokers while unfairly damaging the reputations of others. This kind of influence can mislead traders who rely on FPA’s reviews and rankings, potentially steering them toward brokers that may not have their best interests in mind.

These allegations raise significant ethical and legal questions about FPA’s operations. If the platform is engaged in suppressing criticism through fraudulent means while simultaneously benefiting from undisclosed financial relationships, it risks not only regulatory scrutiny but also a substantial loss of credibility within the trading community. Given these concerns, traders are advised to approach FPA’s content with skepticism, verifying claims through independent sources before making any financial decisions.

Undisclosed Business Relationships and Associations

Discussions within the trading community have increasingly raised questions about FPA’s impartiality and ethical practices. Some users allege that the platform selectively removes negative reviews of certain brokers in exchange for compensation, creating a conflict of interest that compromises its credibility. A thread on the FPA forum highlights these concerns, with traders questioning the integrity of its review system and suggesting that FPA may be financially incentivized to promote specific brokers rather than serving as a neutral watchdog. If true, such practices would directly contradict the platform’s stated mission of protecting traders from fraudulent or unethical brokers.

Further complicating the issue, research indicates that some individuals affiliated with FPA have direct or indirect ties to forex brokers and other financial entities. These undisclosed relationships cast doubt on the objectivity of the site’s content, raising the possibility that reviews and complaints may be influenced by financial incentives rather than genuine user experiences. Transparency is a fundamental pillar of trust in any review-based platform, and if FPA is indeed benefiting from undisclosed financial relationships while presenting itself as an independent entity, it risks engaging in deceptive practices that mislead traders.

These concerns reinforce the importance of critically evaluating information from FPA and similar platforms. Traders should exercise due diligence, cross-referencing broker reviews across multiple independent sources before making investment decisions. In an industry where credibility is paramount, any perception of bias or financial manipulation can significantly erode trust, ultimately diminishing the value of the platform as a resource for traders seeking reliable information.

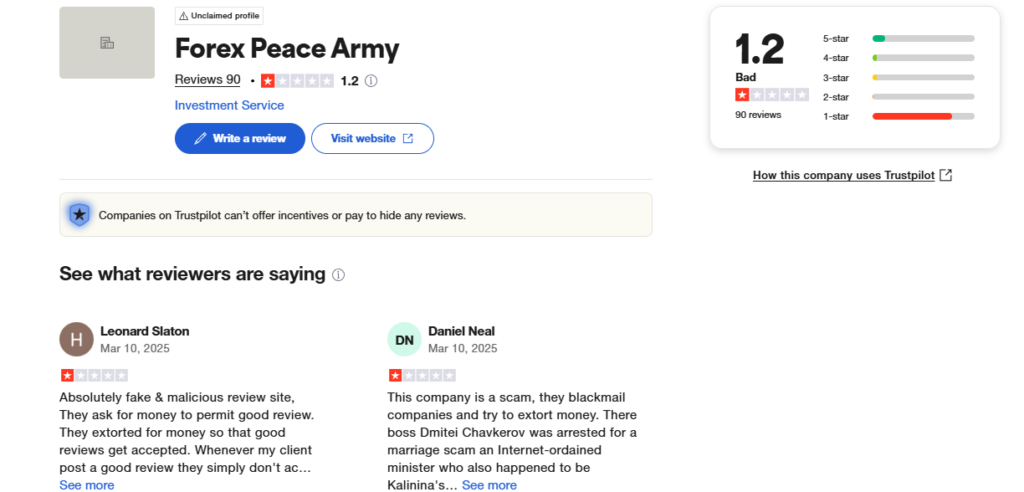

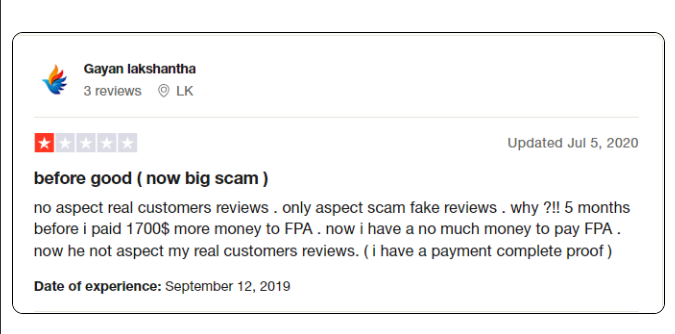

Consumer Complaints and Negative Reviews

Several users have voiced dissatisfaction with FPA’s handling of reviews and forum posts, raising concerns about the platform’s objectivity and credibility. Complaints include allegations of manipulated reviews and censorship of negative feedback, casting doubt on FPA’s commitment to providing an unbiased forum for traders. One user on the FPA forum shared their frustration, stating, “It appears that Forex Peace Army is a scam too. I joined, verified my email addy, and made a post, and low-and-behold, nothing shows up.” This sentiment is echoed by other traders who claim their critical posts or unfavorable broker reviews have been selectively moderated or removed altogether.

Additionally, inconsistencies in FPA’s content moderation practices have drawn scrutiny. Some users report that while positive reviews are quickly approved, negative feedback often undergoes prolonged scrutiny or is outright deleted without explanation. This selective moderation has led to speculation that FPA’s primary objective may not be to protect traders but rather to control its public image and financial interests. If true, such practices would compromise the platform’s integrity, as a review site’s credibility relies on impartiality and transparency.

The perception that FPA manipulates user-generated content further fuels concerns about potential conflicts of interest. If the platform prioritizes financial gain over honest discourse, traders relying on its reviews and forums could be misled into making poor financial decisions. These allegations underscore the need for traders to approach FPA’s content critically, cross-referencing information with other independent sources before acting on the platform’s recommendations.

Legal Proceedings and Sanctions

FPA has faced legal challenges from brokers disputing client complaints published on the platform. One notable case involved Windsor Brokers, which filed a lawsuit attempting to compel FPA to remove client complaints. This legal action highlights the contentious relationship between FPA and certain brokers, reflecting both the platform’s influence in the forex industry and the disputes that arise from its content. As a widely recognized review platform, FPA holds significant sway over public perception, making it a critical player in shaping reputations within the trading community.

However, past legal disputes have also raised concerns regarding FPA’s operational transparency and ethical standards. While some brokers have taken legal action in an attempt to discredit the platform, the ongoing nature of these conflicts suggests that FPA may not always act in good faith. A lack of clear oversight and due diligence mechanisms raises questions about the accuracy and fairness of its reporting. The persistence of these legal battles indicates a deeper issue—whether FPA is being unfairly targeted by brokers seeking to silence criticism or whether it has engaged in practices that justify legal scrutiny.

These lawsuits highlight the complex and often adversarial nature of FPA’s role in the forex industry. While platforms like FPA serve as important resources for traders seeking information and accountability, their credibility depends on transparency, accuracy, and ethical responsibility. If FPA fails to uphold these principles, it risks not only legal consequences but also a loss of trust among traders and financial institutions. Consequently, market participants should approach information from such platforms with caution, verifying claims independently before making critical trading decisions.

Risk Assessment: Anti-Money Laundering and Reputational Risks

The allegations against FPA present significant reputational risks, particularly in the context of anti-money laundering (AML) compliance. Financial platforms that manipulate information or engage in fraudulent activities create vulnerabilities within the financial ecosystem, potentially facilitating illicit financial flows. By misrepresenting the credibility of financial entities, such platforms can inadvertently enable money laundering schemes, making it easier for bad actors to exploit gaps in regulatory oversight. This erosion of transparency and due diligence not only compromises the integrity of financial markets but also undermines the trust necessary for effective AML enforcement.

Furthermore, FPA’s lack of accountability raises serious concerns about the reliability of its reporting mechanisms. Without transparent oversight and adherence to strict ethical standards, there is a heightened risk that the platform disseminates biased, misleading, or inaccurate information. This lack of due diligence can have severe consequences for traders who rely on FPA for guidance, as misinformation may lead them to engage with unverified brokers or make financial decisions based on flawed data. In an industry where trust and credibility are paramount, the absence of robust verification processes increases the likelihood of reputational damage, both for the platform itself and for those who depend on it.

Regulatory bodies and industry participants must remain vigilant in identifying and mitigating such risks. Ensuring compliance with global AML regulations requires a commitment to accuracy, transparency, and ethical reporting. Traders and investors should exercise caution when engaging with platforms that lack accountability, as the consequences of misinformation can be financially and legally significant.

Conclusion

Our investigation into Forex Peace Army reveals a complex landscape of allegations and concerns that warrant careful consideration by the trading community. While FPA has historically served as a resource for traders seeking information on brokers and trading practices, the recent claims of fraudulent activities, suppression of negative reviews, and undisclosed business relationships cast a shadow over its credibility. Traders are advised to exercise due diligence and critically assess the reliability of information obtained from FPA, considering the potential biases and underlying motives that may influence the platform’s content.

Going forward, regulatory bodies may need to examine FPA’s practices more closely to determine whether its operations align with industry standards for transparency and fairness. Until then, traders should take extra precautions when using the platform to ensure they are making informed and unbiased decisions in their financial endeavors.