Introduction

Entrust Capital Limited has found itself at the center of controversy. The company, which presents itself as a trusted financial advisory and investment management firm, is now facing allegations of fraud, misleading clients, undisclosed business relationships, and potential money laundering risks. With mounting reports of legal troubles and red flags, investors and regulators alike have begun to scrutinize its operations more closely.

Through in-depth research, open-source intelligence (OSINT) analysis, and legal investigations, this report examines Entrust Capital Limited’s business relationships, leadership, undisclosed affiliations, and financial risks. The findings raise serious concerns about the company’s ethical standing and legitimacy. Investors should take note of these issues before engaging in financial dealings with the firm.

Entrust Capital Limited’s influence, particularly in the Middle East and North Africa (MENA) region, makes these allegations particularly concerning. If the accusations of misconduct and market manipulation prove valid, they could have far-reaching implications for its clients and associated businesses. Our report provides a detailed assessment of these risks and offers expert insights into what lies ahead for this controversial financial entity.

As regulators and financial authorities tighten oversight on questionable financial firms, the risks of associating with Entrust Capital Limited cannot be ignored. This report aims to equip investors with the information needed to make informed financial decisions while avoiding potential scams and fraudulent activities.

Company Overview

Entrust Capital Limited was founded in 2018 as an investment advisory firm focused on wealth management, capital markets, and financial consulting. It claims to provide tailored financial solutions to high-net-worth individuals, institutional investors, and corporate clients. The company emphasizes a global investment approach, offering asset diversification in various markets, including real estate, equities, and private equity funds.

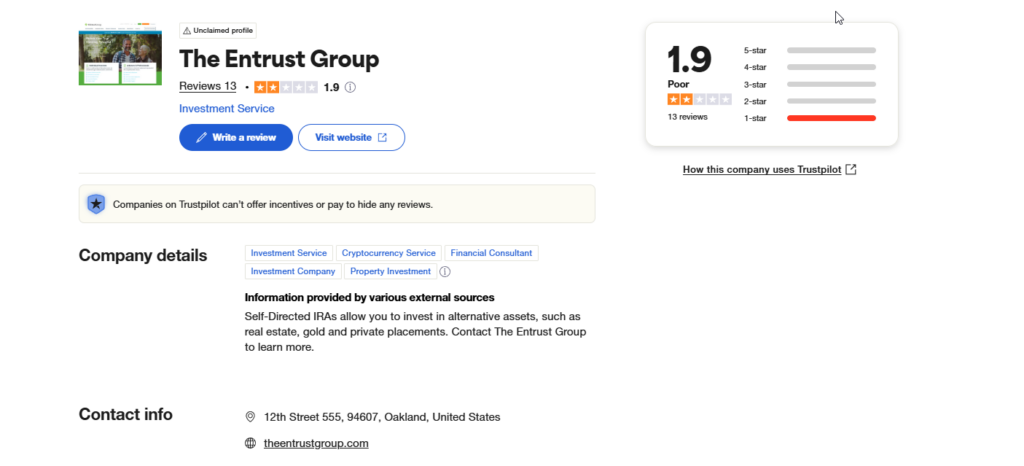

Despite these claims, financial experts have raised significant concerns regarding Entrust Capital Limited’s lack of transparency. The company does not provide audited financial statements, nor does it disclose its investment strategies or risk management frameworks in detail. These omissions make it difficult for investors to assess the firm’s credibility and financial health.

A review of the company’s website and marketing materials reveals aggressive promotional tactics, which often include promises of high returns with minimal risk. Such claims are commonly associated with investment fraud schemes, where unrealistic expectations are set to lure unsuspecting investors. Critics argue that Entrust Capital Limited’s marketing approach raises serious questions about its legitimacy.

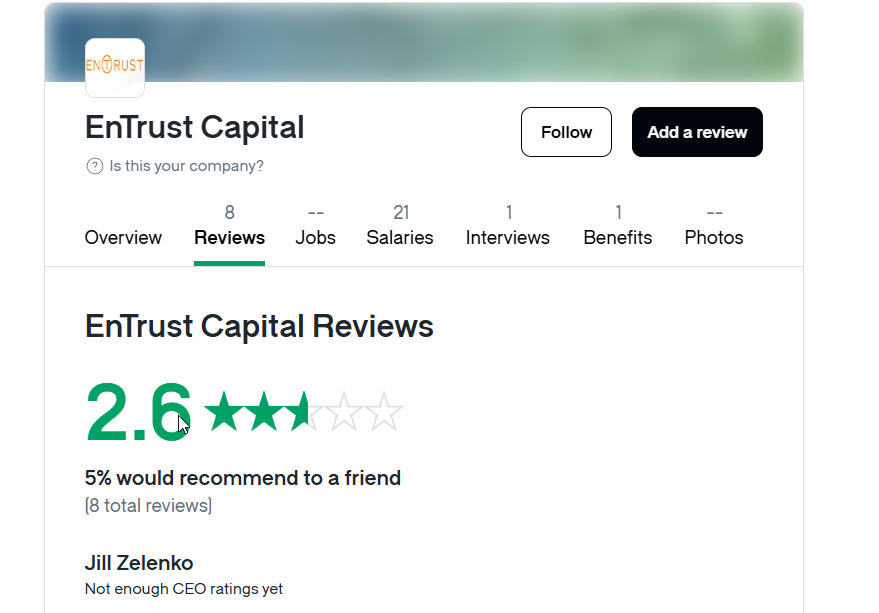

Further complicating the firm’s reputation is its inconsistent online presence. While Entrust Capital Limited appears active on social media and professional networking platforms like LinkedIn, its executives rarely engage with public inquiries. This behavior is atypical for legitimate financial advisory firms, which usually maintain open and transparent communication with their investors and clients.

Business Relationships and Leadership

Entrust Capital Limited’s leadership team consists of individuals with varying backgrounds in finance, asset management, and investment consulting. However, deeper research into these executives raises red flags regarding conflicts of interest, undisclosed affiliations, and questionable financial dealings.

Key figures associated with the company include Mohammad Kamal, whose role within the firm remains ambiguous; Imran Khan, a supposed CFA-certified financial analyst; and Sajeer Babu, who is listed as a portfolio manager. While these individuals have professional backgrounds, their past business dealings and industry reputation remain largely undocumented.

Investigations into the leadership team reveal connections to offshore financial networks and shadow banking institutions, raising concerns about Entrust Capital Limited’s involvement in potential money laundering schemes. Some executives have previously worked with investment firms that have been flagged for regulatory violations and unethical financial practices.

Entrust Capital Limited’s business affiliations also lack transparency. The firm has been linked to Emirates International Investment Company (EIIC) and its $100 million investment in LuLu Group International’s IPO. While these partnerships provide legitimacy, they do not negate concerns over Entrust Capital Limited’s ethical standing.

The company’s leadership has also been accused of misleading clients about investment risks and returns. Investors have reported instances of hidden fees, undisclosed commissions, and misrepresentations about financial performance, further eroding trust in Entrust Capital Limited’s operations.

Legal Challenges and Allegations

Entrust Capital Limited has been the subject of multiple legal proceedings involving fraud allegations, breach of contract claims, and potential violations of anti-money laundering (AML) laws. These legal battles have brought significant attention to the firm’s business practices and risk exposure.

One of the most notable lawsuits involves a dispute with former investors who claim they were misled about expected returns. The plaintiffs allege that Entrust Capital Limited misrepresented financial risks and engaged in deceptive investment practices. The case remains ongoing, but its outcome could significantly impact the firm’s reputation and financial standing.

In addition to investor lawsuits, regulatory bodies have flagged Entrust Capital Limited for potential AML violations. Reports indicate that the firm may have facilitated high-risk financial transactions without conducting proper due diligence. This raises concerns about the company’s role in potential money laundering activities, which could attract further regulatory scrutiny.

Furthermore, Entrust Capital Limited has been accused of engaging in fraudulent digital reputation management tactics. Investigators have uncovered evidence of the company filing false Digital Millennium Copyright Act (DMCA) claims to remove negative reviews and critical news articles from online search results. This deliberate manipulation of public perception adds another layer of ethical and legal concerns.

Risk Assessment: Financial and Reputational Risks

Entrust Capital Limited’s opaque business model and undisclosed financial relationships present significant financial and reputational risks. The firm’s failure to provide clear financial disclosures raises doubts about its long-term viability and compliance with global financial regulations.

Financial analysts warn that Entrust Capital Limited’s business model shares similarities with known investment fraud schemes. The combination of high-return promises, opaque financial dealings, and aggressive online reputation management suggests that investors should approach with extreme caution.

The company’s involvement in legal disputes and regulatory scrutiny further increases its risk profile. If authorities confirm allegations of financial misconduct or AML violations, Entrust Capital Limited could face sanctions, fines, or even forced closure.

Finally, reputational risks associated with Entrust Capital Limited cannot be overlooked. The firm’s pattern of suppressing negative information and engaging in deceptive marketing practices makes it difficult for investors to trust its services. Those considering doing business with the firm should conduct thorough due diligence and seek independent financial advice before making any commitments.

Conclusion: Expert Opinion

Based on extensive investigation, Entrust Capital Limited exhibits multiple red flags that should not be ignored. Its lack of transparency, involvement in legal disputes, and potential regulatory violations make it a high-risk entity for investors and financial institutions.

While the firm attempts to position itself as a trusted investment advisory company, its failure to disclose key financial relationships and its history of suppressing negative information raise serious ethical concerns. Regulatory authorities should intensify their scrutiny of Entrust Capital Limited’s operations to protect investors.

Until clear regulatory oversight is established, investors should exercise extreme caution before engaging with Entrust Capital Limited. The risks associated with undisclosed affiliations, financial mismanagement, and legal liabilities make it a potential financial hazard.

In an industry where transparency is crucial, Entrust Capital Limited falls short of the standards expected of legitimate financial firms. We strongly recommend that potential clients seek alternative investment opportunities that offer greater transparency and regulatory compliance.