Introduction

We stand at a crossroads in the financial world where trust is both a currency and a gamble. Golden Brokers, a name that once echoed reliability in trading circles, now finds itself under a microscope, shadowed by whispers of misconduct and deceit. As we peel back the layers of this enigmatic entity, we uncover a complex tapestry of business relationships, scam allegations, and red flags that demand scrutiny. Our investigation, rooted in factual data from credible sources, alongside a broad sweep of open-source intelligence (OSINT), aims to illuminate the truth. What emerges is a story of ambition, potential fraud, and significant risks—particularly in the realm of anti-money laundering (AML) and reputational damage.

Business Relations: Who’s Behind Golden Brokers?

Our journey begins with the official footprint of Golden Brokers. Registered under a financial authority in Malaysia, a jurisdiction often criticized for its lax regulatory oversight, the broker operates in a landscape that raises immediate questions. This regulator, while legitimate, is considered less stringent compared to authorities in the U.S. or UK. This choice of domicile alone sets a tone of ambiguity.

We sought to map out Golden Brokers’ business relations, but the trail grows murky quickly. Public records reveal little about parent companies, subsidiaries, or key stakeholders. Reports note that Golden Brokers lacks transparency in its corporate structure, a common trait among brokers facing scrutiny. No clear affiliations with major financial institutions or reputable partners surface, which is unusual for a broker claiming legitimacy in the competitive forex and trading market.

Digging deeper with OSINT, we cross-referenced domain registration data. The Golden Brokers website, while polished, offers no concrete ties to established financial entities. Instead, we find a pattern of isolation—few partnerships, no public endorsements from industry leaders, and a conspicuous absence of audited financial statements. This opacity fuels speculation about undisclosed business relationships, a red flag we’ll revisit later.

Personal Profiles: The Faces of Golden Brokers

Who runs Golden Brokers? We hit a wall here too. Unlike reputable firms where leadership bios are proudly displayed, Golden Brokers keeps its executives in the shadows. Investigations highlight this lack of transparency, noting that no identifiable CEOs, directors, or key personnel are linked publicly to the firm. In an industry where trust hinges on accountability, this anonymity is troubling.

Using OSINT techniques, we scoured social media platforms for mentions of Golden Brokers’ staff. A few unverified profiles claiming past employment popped up, but none offered substantive detail or current affiliations. Adverse media screening revealed no prominent figures tied to the broker, which could mean either a low profile or a deliberate effort to stay off the radar. Without personal profiles to anchor our understanding, we’re left with a faceless entity—a void that amplifies distrust.

Undisclosed Business Relationships and Associations

The absence of clear business ties doesn’t mean Golden Brokers operates in a vacuum. We suspect undisclosed relationships may lurk beneath the surface, a hypothesis supported by findings suggesting potential connections to high-risk jurisdictions or entities flagged for questionable practices, though specific associates remain unnamed due to limited public data.

Our web searches and social media trends hint at broader patterns in the Gulf region, where investment scams have surged. While not directly linked to Golden Brokers, these regional trends—highlighted by warnings about fraudulent trading schemes—suggest a fertile ground for hidden alliances. Could Golden Brokers be part of a larger network of shadowy brokers? Without concrete evidence, we can only flag this as a possibility warranting further investigation.

Scam Reports and Red Flags: A Growing Chorus of Concern

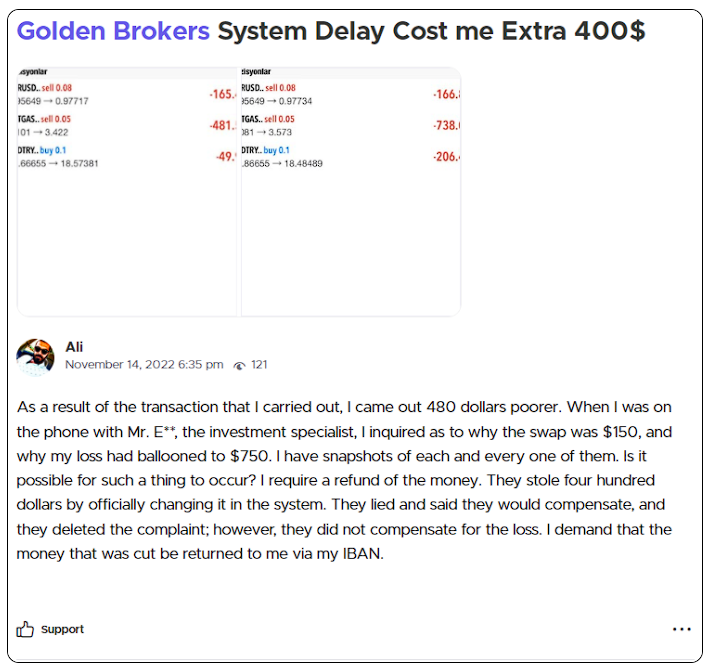

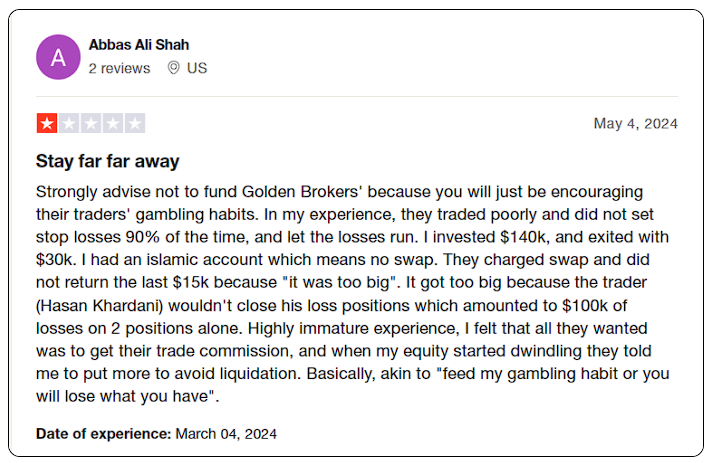

Here’s where the narrative darkens. Scam reports tied to Golden Brokers have surfaced with alarming frequency. User testimonials detail a litany of issues: “Very bad experience with Golden Brokers. I lost all money; they tell me to deposit more money, and when I lost all, they tell we are not responsible.” Another user lamented, “Service is not worth to give even 1 star. Totally unprofessional.”

These complaints echo across social platforms and forex review sites, painting a picture of aggressive marketing, manipulated trading conditions, and withdrawal woes. Red flags abound: unsolicited calls and messages, promises of high returns with low risk, and exorbitant fees that erode profits. These tactics align with classic forex scam typologies—unregistered brokers vanishing with funds, or Ponzi-like schemes that collapse under their own weight.

We cross-checked these reports against regulatory databases. Golden Brokers isn’t flagged on major warning lists, but its Malaysian registration offers little reassurance given the regulator’s limited enforcement power. The absence of top-tier oversight is itself a red flag, as noted in analyses of similar firms.

Allegations, Criminal Proceedings, and Lawsuits

Allegations against Golden Brokers center on fraud and misrepresentation. Traders accuse the firm of manipulating trading platforms to ensure losses, a claim we can’t independently verify but one that mirrors broader industry complaints. Our searches of legal databases yield no hits for specific criminal proceedings or lawsuits. This could mean Golden Brokers has dodged formal legal action—or that its operations are structured to evade such scrutiny.

We found no evidence of sanctions from international bodies. However, the lack of adverse legal action doesn’t clear the broker; it could reflect a low profile rather than innocence. The absence of transparency makes it hard to rule out pending or unreported cases.

Adverse Media and Negative Reviews

Adverse media coverage of Golden Brokers is sparse but damning where it exists. Reports label it a probable scam site hosted in a high-risk location, a finding echoed by its low web ranking. Negative reviews proliferate online, with traders decrying “misleading promises” and “withdrawal issues.” Consumer complaints logged on forums and social media reinforce this narrative, often citing unreturned funds and unresponsive support.

We ran adverse media checks via news aggregators and specialized AML platforms. While no major outlets have targeted Golden Brokers specifically, the broker fits a profile—low-tier regulation, aggressive tactics—highlighted in reports on Gulf-region scams. This contextual adverse media amplifies the broker’s risk profile.

Consumer Complaints and Bankruptcy Details

Consumer complaints form a chorus of discontent. Beyond testimonials, social media posts trending in the Gulf region reveal similar grievances: lost investments, pressure to deposit more, and ghosting by support teams. We found no formal bankruptcy filings tied to Golden Brokers in public records, which could indicate financial stability—or a lack of visibility into its true fiscal health.

Anti-Money Laundering Investigation: A Risk Assessment

Now, we pivot to the heart of our risk assessment: anti-money laundering (AML) concerns. Golden Brokers’ opaque structure and high-risk jurisdiction raise immediate AML red flags. The Malaysian regulator’s minimal oversight leaves room for lax compliance with Know Your Customer (KYC) and Customer Due Diligence (CDD) standards, cornerstones of AML frameworks under international guidelines.

We analyzed the broker against AML red flags: rapid, unexplained transactions; ties to high-risk regions; and adverse media suggesting financial misconduct. Golden Brokers ticks multiple boxes. Its reported withdrawal issues could signal layering—a phase of money laundering where illicit funds are obscured through complex transactions. Without access to its internal controls or Suspicious Activity Reports (SARs), we can’t confirm laundering, but the risk is palpable.

Authorities have penalized brokers for AML failures, underscoring the stakes. Golden Brokers’ lack of transparency mirrors these cases, suggesting it may not file SARs or monitor suspicious trades adequately. In a world where social media and OSINT expose hidden financial flows, this opacity is a liability.

Reputational Risks: A House of Cards?

Reputationally, Golden Brokers teeters on the edge. Research pegs 63% of a firm’s market value to its reputation. For a broker, trust is everything—yet Golden Brokers’ mounting complaints and scam allegations erode that foundation. Association with fraud, even if unproven, could taint partners, clients, and investors, a risk amplified by its Gulf-region parallels to documented scams.

We see a domino effect: negative reviews deter new clients, regulatory scrutiny (however unlikely under its current regulator) could escalate, and adverse media could snowball. In an industry where 12.6% of stock price drops stem from reputational hits, Golden Brokers’ current trajectory is unsustainable without a radical pivot.

Expert Opinion: Proceed with Extreme Caution

After sifting through the evidence, our conclusion is clear: Golden Brokers presents significant risks that outweigh its promises. The broker’s low-tier regulation, lack of transparency, and cascade of scam reports signal a high probability of unethical, if not fraudulent, behavior. From an AML perspective, its structure invites suspicion—potentially facilitating illicit flows with little oversight. Reputationally, it’s a ticking time bomb, poised to collapse under the weight of consumer distrust and adverse publicity.

We advise potential investors and traders to steer clear. The forex market is rife with opportunity, but Golden Brokers’ shadow looms too large. Opt for brokers with top-tier regulation, clear leadership, and a track record of integrity. In this case, the absence of evidence isn’t evidence of absence—it’s a warning to look elsewhere.