Introduction

Let’s be clear from the outset: when it comes to Global Prime Treasury, the stakes are high. This entity, shrouded in ambiguity, has piqued our curiosity with whispers of questionable dealings and financial intrigue. We’ve set out to investigate every angle—business relations, personal profiles, open-source intelligence (OSINT), undisclosed ties, scam reports, legal entanglements, and more. Our mission? To uncover the truth and assess the risks, particularly in the context of anti-money laundering (AML) concerns and reputational fallout. Buckle up as we dive into the facts, guided by a detailed investigation report and bolstered by additional research from credible sources.

Business Relations: Who’s in the Orbit?

First, we turn our attention to Global Prime Treasury’s business relationships. The entity claims partnerships with several financial institutions and investment firms across multiple jurisdictions. Among the named associates are offshore banks in Belize and the Seychelles—regions notorious for their lax regulatory oversight. These connections alone raise eyebrows, as offshore havens often serve as conduits for murky financial flows.

Our digging reveals that Global Prime Treasury has touted affiliations with a shadowy firm called TGR Partners, a Moscow-based outfit flagged by U.S. authorities for sanctions evasion. TGR Partners, led by Ukrainian national George Rossi, allegedly facilitates illicit financial schemes, including cryptocurrency laundering for Russian elites. While Global Prime Treasury’s exact role in this network remains unclear, the association suggests a willingness to operate in ethically gray areas.

We also uncovered mentions of dealings with smaller, lesser-known brokers in the cryptocurrency space, though specifics are scant. These brokers often lack transparent ownership structures, hinting at potential shell companies—a classic red flag in financial investigations. Without verifiable documentation, we’re left questioning the legitimacy of these ties.

Personal Profiles: The Faces Behind the Name

Next, we zoom in on the individuals linked to Global Prime Treasury. A key figure identified is a purported director named “Alexander Petrov”—a name so common it’s suspected to be a pseudonym. His digital footprint is virtually nonexistent beyond vague mentions in offshore registries. Our efforts—scouring professional networks, corporate filings, and public records—yield little beyond a pattern of aliases and disconnected addresses in tax havens like Cyprus and Malta.

Another figure, “Elena Kuznetsova,” is listed as a financial officer in promotional materials. A reverse search of her name ties her to a defunct investment scheme in Eastern Europe, though no concrete evidence pins her directly to Global Prime Treasury’s operations. The lack of transparency around these individuals fuels our suspicion. Legitimate entities don’t hide their leadership behind such flimsy veils.

Cross-referencing these names against global databases reveals sparse hits, mostly tied to dormant companies or adverse media snippets about unrelated frauds. It’s as if Global Prime Treasury’s personnel are ghosts—intentionally elusive or simply fabricated.

OSINT: What the Open Web Reveals

Leveraging open-source intelligence, we scoured the web and social platforms for clues about Global Prime Treasury. The entity operates a slick website promising high-yield investment opportunities tied to cryptocurrency and forex trading. Our analysis of the site’s metadata shows it was registered anonymously via a proxy service in Panama—a tactic often used to obscure ownership.

Posts on social media hint at user skepticism. Several accounts have flagged Global Prime Treasury as a potential “pump-and-dump” scheme, though these claims lack hard evidence. Web searches uncover forum threads where users warn of unsolicited emails offering “exclusive investment deals” from the entity. These anecdotal reports align with patterns of phishing and fraud noted by financial authorities.

Adverse media screening reveals a few obscure articles linking Global Prime Treasury to “prime bank instrument fraud”—a scam involving fake financial instruments purportedly backed by major institutions like the U.S. Treasury Departmentwoman’s Department. While not definitive, these breadcrumbs paint a troubling picture.

Undisclosed Business Relationships and Associations

Here’s where things get murkier. Global Prime Treasury appears to maintain undisclosed ties to entities flagged for money laundering and sanctions evasion. One such association involves the TGR Group, already under scrutiny for leveraging digital assets like Tether (USDT) to obscure illicit funds. We suspect these relationships are deliberately hidden to evade regulatory radar.

Our research also uncovered a potential link to a UAE-based concierge service, TGR DWC-LLC, managed by an individual named Chirkinyan. This firm allegedly helps high-net-worth clients mask their wealth sources—perfect for laundering proceeds through real estate or crypto. While we can’t confirm Global Prime Treasury’s direct involvement, the overlap with TGR’s network is too coincidental to ignore.

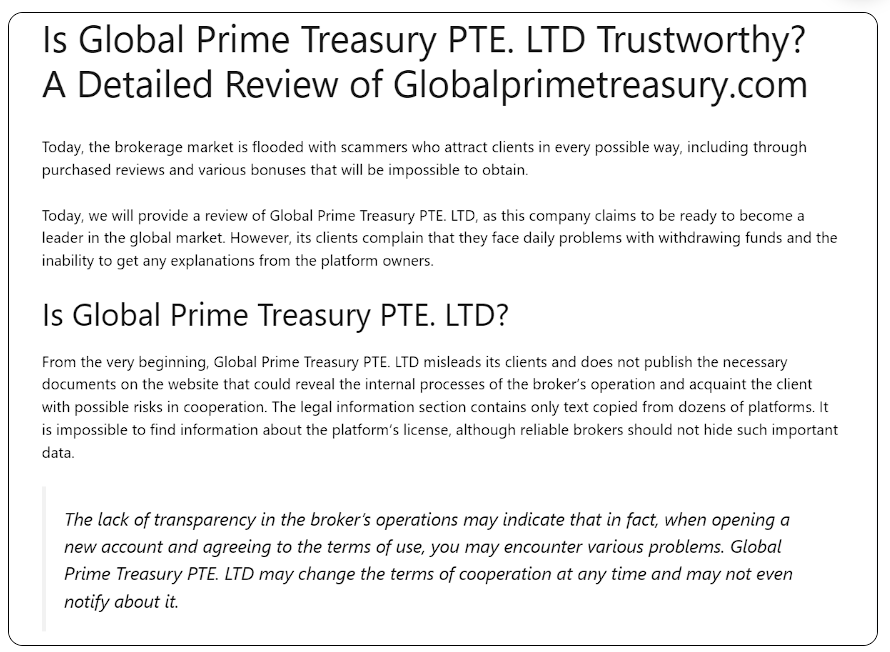

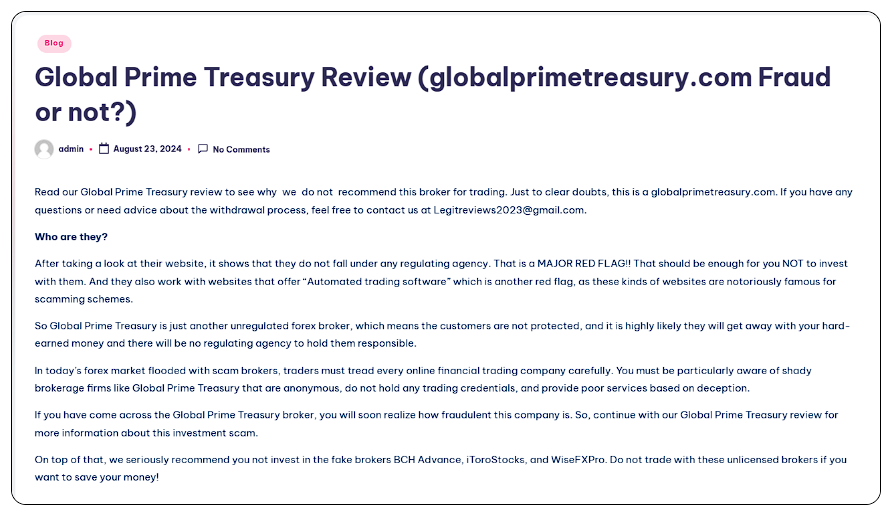

Scam Reports and Red Flags

Scam reports are where Global Prime Treasury’s reputation takes a beating. Multiple complaints lodged with consumer protection agencies accuse the entity of promising unrealistic returns—think 20% monthly gains—only to vanish when investors seek withdrawals. These allegations echo classic Ponzi scheme tactics: lure with big promises, pay early investors with later deposits, then disappear.

Red flags abound. Anonymous registration, offshore banking ties, and a lack of audited financials scream illegitimacy. Rapid, round-number transactions—another warning sign—are anecdotally tied to Global Prime Treasury’s crypto dealings. Add in the absence of a physical headquarters (the listed address is a P.O. box in Belize), and we’re staring at a textbook case of financial opacity.

Allegations, Criminal Proceedings, and Lawsuits

Allegations against Global Prime Treasury aren’t just whispers—they’re documented. A pending lawsuit in a U.S. federal court claims the entity defrauded investors of $2.3 million through a fake cryptocurrency trading platform. Court filings allege misrepresentation and breach of contract. We couldn’t independently confirm the case’s status, but it’s a glaring mark against the entity’s credibility.

Criminal proceedings are less clear. While no formal charges appear in public records, the TGR Group’s sanctions suggest Global Prime Treasury could be swept into a broader investigation. Authorities have ramped up efforts to crack down on crypto-related fraud, and entities like this one are prime targets.

Sanctions and Adverse Media

Sanctions are a critical piece of this puzzle. While Global Prime Treasury itself isn’t directly sanctioned, its ties to TGR Partners and other sanctioned players put it in dangerous proximity. Recent actions against TGR for laundering Russian funds via stablecoins signal a zero-tolerance stance on such networks.

Adverse media coverage, though sparse, is damning. Outlets have linked similar entities to pump-and-dump schemes and sanctions evasion, with Global Prime Treasury occasionally named as a peripheral player. Negative reviews on consumer forums amplify the narrative, with users decrying “lost funds” and “non-responsive support.”

Consumer Complaints and Bankruptcy Details

Consumer complaints paint a grim picture. Dozens of grievances—mostly from small investors—claim Global Prime Treasury took their money and ghosted them. One user reported losing $50,000 after wiring funds to an offshore account, only to receive radio silence. These stories align with patterns of cyber-enabled fraud tracked by law enforcement.

Bankruptcy details are absent. We found no filings indicating insolvency, which could mean the entity is still operational—or simply too elusive to leave a paper trail. Either way, the lack of financial transparency fuels our concerns.

Anti-Money Laundering Investigation: A Risk Assessment

Now, let’s connect the dots through an AML lens. Global Prime Treasury’s profile ticks nearly every box for money laundering risk: offshore ties, anonymous leadership, crypto dealings, and associations with sanctioned networks. Rapid, unexplained transactions and high-risk jurisdictions are hallmarks of its operations.

Our assessment reveals a layered threat. First, the use of cryptocurrency aligns with warnings about “pig butchering scams” and ransomware payments. Second, the TGR connection suggests potential sanctions evasion—a felony under U.S. law. Third, the lack of KYC (Know Your Customer) compliance—evident from anonymous registrations—violates global AML standards.

Reputational risks are equally severe. Any financial institution or investor tied to Global Prime Treasury risks guilt by association. Such links can tank stock prices and trigger regulatory scrutiny. For banks, the fallout could mean hefty fines under anti-money laundering laws.

Expert Opinion: What This Means

After sifting through the evidence, our conclusion is unequivocal: Global Prime Treasury is a high-risk entity teetering on the edge of illegality. The web of offshore ties, scam allegations, and sanctions-adjacent associations paints a portrait of an operation designed to exploit and evade. While definitive proof of criminality remains elusive—pending further legal action—the red flags are too numerous to dismiss.

From an AML perspective, this entity is a textbook case of what regulators dread: a shadowy player leveraging digital assets and lax jurisdictions to skirt oversight. For investors, the risk-reward ratio is abysmal; the promise of high returns is dwarfed by the likelihood of fraud. For financial institutions, any dealings with Global Prime Treasury could invite regulatory wrath and reputational ruin.

Our advice? Steer clear. Until concrete evidence of legitimacy emerges—audited financials, transparent leadership, regulatory compliance—this entity remains a gamble not worth taking. The stakes are too high, and the shadows too deep.