Introduction

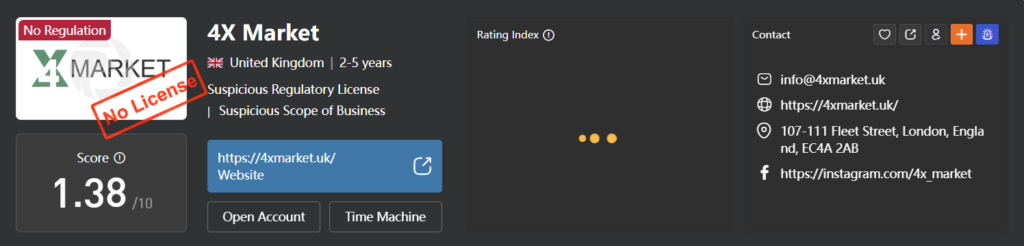

In the intricate world of forex trading, the integrity of platforms like 4XMarket is paramount. Recent investigations have unveiled a series of alarming issues surrounding 4XMarket, raising significant concerns for investors and regulatory bodies alike. Our comprehensive analysis delves into the company’s business relations, personal profiles, undisclosed associations, scam reports, red flags, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, and bankruptcy details. We aim to provide a detailed risk assessment concerning anti-money laundering investigations and reputational risks associated with 4XMarket.

Business Relations and Undisclosed Associations

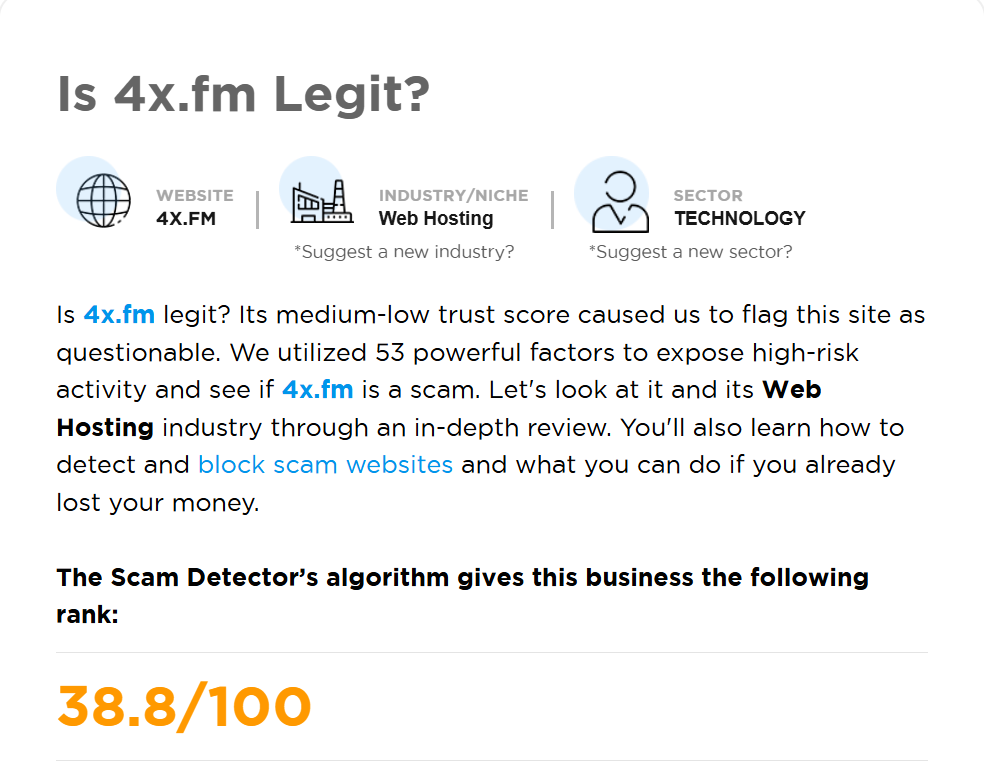

4XMarket’s operational transparency has come under scrutiny due to its associations with unregulated brokers. Such partnerships amplify risks for investors, as they often lack legal protections or compensation guarantees. The absence of clear authorization and the potential involvement in clone schemes further undermine trust in the platform.

Personal Profiles and OSINT Findings

Open Source Intelligence (OSINT) investigations have been instrumental in uncovering hidden networks within the financial sector. Techniques such as web scraping, social media monitoring, and data mining have revealed that companies like 4XMarket may employ proxies and shell companies to obscure true ownership and control. These methods are often used to facilitate money laundering, tax evasion, and other illicit activities.

Scam Reports and Red Flags

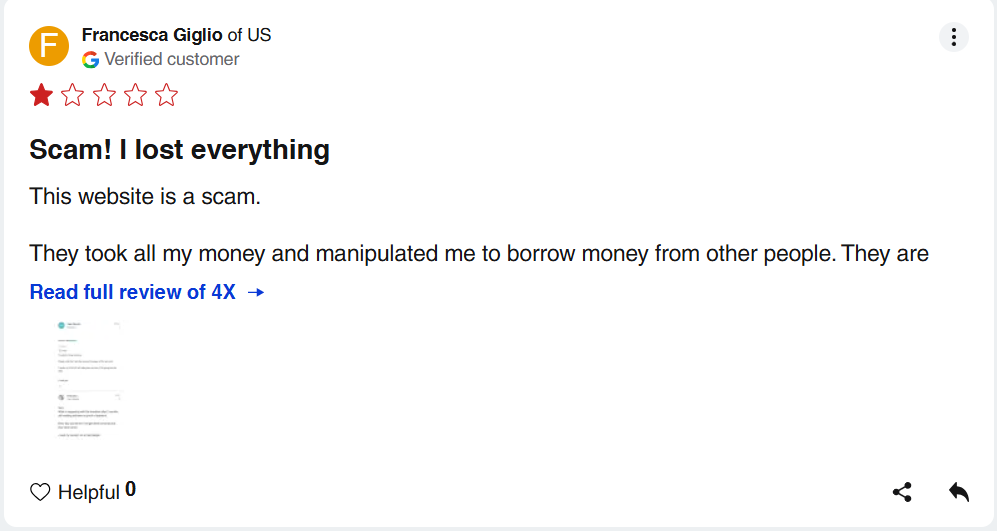

Investors have reported numerous red flags associated with 4XMarket, including difficulties withdrawing funds, abrupt account closures, and unresponsive customer service. Such complaints are indicative of potential fraudulent activities and have been documented in various forums and complaint boards.

Allegations and Criminal Proceedings

The forex sector, including entities like 4XMarket, frequently faces fraud allegations. Misrepresentation of services and unauthorized trading practices often lead to legal battles and financial penalties. While specific criminal proceedings against 4XMarket are not detailed in the available sources, the patterns observed align with common fraudulent schemes in the industry.

Lawsuits and Sanctions

Regulatory warnings have been issued against 4XMarket due to its operation without clear authorization. Such warnings often precede formal sanctions and legal actions, especially when companies fail to comply with financial regulations. The involvement in clone schemes and impersonation of legitimate firms further exposes the platform to potential lawsuits and sanctions.

Adverse Media and Negative Reviews

Media coverage of 4XMarket has been predominantly negative, focusing on regulatory concerns, fraud allegations, and poor customer experiences. Negative reviews highlight prolonged withdrawal delays and unresponsive customer service, painting a grim picture of the platform’s reliability.

Consumer Complaints and Bankruptcy Details

Numerous consumer complaints have been filed against 4XMarket, primarily concerning fund withdrawals and account management issues. While there is no explicit information regarding bankruptcy proceedings, the accumulation of complaints and regulatory pressures could potentially lead to financial instability for the platform.

Risk Assessment: Anti-Money Laundering and Reputational Risks

The association with unregulated brokers and the lack of transparency in operations pose significant anti-money laundering (AML) risks for 4XMarket. Such environments are susceptible to illicit financial activities, including money laundering and fraud. The reputational risks are equally concerning, as ongoing negative media coverage and customer dissatisfaction can deter potential investors and partners.

Expert Opinion

Based on the gathered intelligence, it is evident that 4XMarket operates within a high-risk framework, characterized by regulatory non-compliance, opaque business practices, and a plethora of consumer grievances. Investors are advised to exercise extreme caution and conduct thorough due diligence before engaging with such platforms. Regulatory bodies should intensify scrutiny and enforce compliance to safeguard the interests of the investing public.