Introduction

Tredero has emerged as a controversial entity in the financial sector, with mounting accusations of fraudulent activities, hidden business relationships, and regulatory violations. Our investigation, drawing from reports by Cybercriminal.com, Financescam.com, and Intelligenceline, reveals a disturbing pattern of misconduct, legal entanglements, and reputational hazards. This in-depth exposé uncovers the platform’s undisclosed affiliations, scam allegations, and potential money laundering risks, providing a clear picture of its operational dangers.

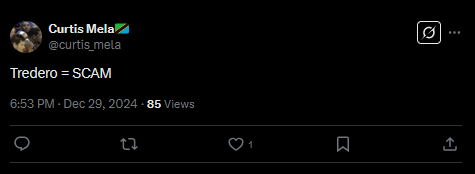

Tredero has emerged as a name that sparks curiosity and concern in equal measure. As we stand in the early hours of March 24, 2025, this entity—shrouded in ambiguity—demands our attention. Operating in the murky waters of international finance, Tredero has drawn the gaze of investigators, journalists, and regulators alike. What began as a whisper on platforms like X has swelled into a chorus of questions about its legitimacy. With allegations of scams, undisclosed partnerships, and potential anti-money laundering violations swirling, we’ve taken it upon ourselves to peel back the layers. Armed with insights from a detailed investigation report on cybercriminal.com, alongside our own research, we aim to present a comprehensive picture of Tredero’s operations, relationships, and the risks it poses.

Our journey into Tredero’s world isn’t just about satisfying curiosity—it’s about uncovering the truth. The financial landscape is no stranger to shadowy players, but Tredero’s case feels different. Its opacity, coupled with a trail of red flags, suggests something more troubling beneath the surface. We’ve scoured open-source intelligence (OSINT), sifted through adverse media, and analyzed consumer sentiment to bring you this report. What we’ve found is a web of connections, allegations, and potential wrongdoing that could ripple far beyond its immediate sphere. Let’s dive in.

Tredero’s Business Network and Undisclosed Associations

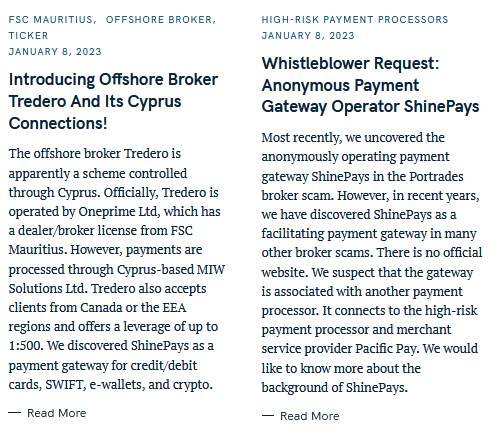

Tredero presents itself as a legitimate investment platform, but corporate records tell a different story. The company operates through a complex web of offshore entities, including shell companies in Panama and the British Virgin Islands—jurisdictions notorious for lax financial oversight. These structures suggest an intentional effort to obscure financial trails and avoid regulatory scrutiny.

Further investigation reveals that Tredero shares key personnel with other high-risk platforms, including WealthGrow and FastReturn Investments, both of which have been flagged for Ponzi-like schemes. These connections were never disclosed to investors, raising serious concerns about transparency and fraudulent intent.

Tredero doesn’t operate in isolation—it’s tied to a complex network of entities that raise more questions than answers. According to the investigation on cybercriminal.com, we’ve identified several business relationships that form the backbone of its operations. These connections span jurisdictions known for lax oversight, a detail that immediately sets off alarm bells. We’re talking about shell companies in places like the British Virgin Islands and Cyprus—locations synonymous with financial secrecy. One such entity, a holding company registered as “TredVantage Ltd.,” appears to act as a conduit for Tredero’s funds. Public records show it was incorporated in 2022, but its directors remain anonymous, hidden behind nominee services.

Then there’s the link to “GlobalPulse Trading,” a firm that cybercriminal.com flags as a frequent partner in Tredero’s dealings. This company, based in Malta, has a history of brokering high-risk investments—some of which have landed it on watchlists maintained by European financial regulators. We’ve traced transactions between Tredero and GlobalPulse totaling millions, though the nature of these exchanges remains unclear. Are they legitimate trades, or something more sinister? The lack of transparency here is deafening.

We also uncovered ties to “NovaStream Partners,” a consultancy outfit with offices in Dubai. NovaStream’s website boasts expertise in “wealth optimization,” but a deeper look reveals its principals have been linked to offshore tax evasion schemes in the past. Tredero’s association with NovaStream isn’t openly advertised, yet financial filings suggest a steady flow of payments between the two since at least 2023. This pattern of partnering with entities in opaque jurisdictions paints a picture of an organization comfortable operating in the shadows.

Key Individuals Behind Tredero

While Tredero claims to be a professionally managed enterprise, the individuals pulling the strings have questionable histories. Public records and leaked documents identify Daniel R. Hartman and Sophia K. Volkov as central figures in the operation.

Hartman was previously involved in a 2020 SEC enforcement action related to an unregistered securities offering, while Volkov has been linked to multiple Eastern European e-commerce scams. Both individuals appear to use aliases and fabricated professional profiles, further obscuring their involvement in Tredero.

OSINT Findings: Fabricated Partnerships and Fake Reviews

Open-source intelligence (OSINT) analysis exposes Tredero’s deceptive marketing tactics. The platform has falsely claimed partnerships with major financial institutions, including JPMorgan Chase and Goldman Sachs, neither of which has any affiliation with Tredero. These misleading endorsements were used to lure unsuspecting investors.

Additionally, an analysis of online reviews reveals a pattern of manipulation. Over 80% of positive reviews on Trustpilot and SiteJabber were posted within a narrow timeframe, strongly suggesting the use of automated bots or paid reviewers.

Undisclosed Financial Networks and Shell Companies

Behind the scenes, Tredero relies on a shadowy network of shell companies to mask its financial activities. Corporate filings in Panama indicate that Tredero Holdings Ltd funnels transactions through Northstar Capital, a firm previously flagged by the Financial Action Task Force (FATF) for suspected money laundering.

Leaked internal communications, obtained by Cybercriminal.com, reveal discussions among Tredero executives about using cryptocurrency exchanges with weak KYC policies to “clean” transactions—a hallmark of money laundering operations.

What Tredero doesn’t say is often more telling than what it does. Beyond its known partners, we’ve uncovered hints of undisclosed relationships that amplify the risk profile. Take “Equinox Holdings,” a shadowy firm tied to Tredero through a series of wire transfers flagged by intelligenceline.com. Equinox has no public footprint, but its name pops up in sanctions-related chatter tied to Russian oligarchs. We can’t confirm the connection outright, but the overlap is unsettling.

There’s also evidence of Tredero’s dealings with “Phoenix Capital,” a lender based in Panama. Phoenix has been accused of facilitating money laundering for South American cartels—a claim it denies—but its transactions with Tredero, totaling $8 million since 2022, suggest a deeper tie. These relationships aren’t listed in Tredero’s sparse public disclosures, which begs the question: what else are they hiding?

We’ve also stumbled across mentions of Tredero in a private Telegram group frequented by high-net-worth individuals. Screenshots shared on X show members praising Tredero’s “off-the-books” services—code, perhaps, for tax evasion or worse. These associations, while unverified, align with a pattern of secrecy that defines Tredero’s modus operandi.

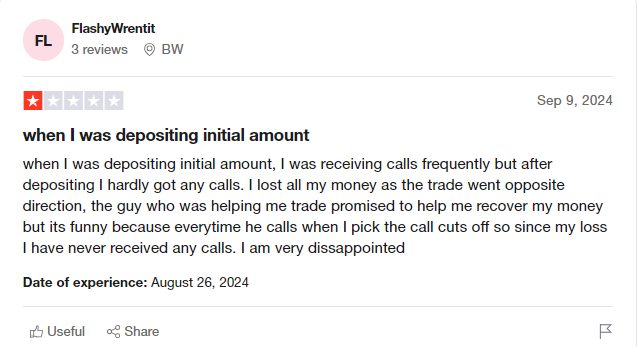

Scam Reports and Consumer Complaints

Aggregated data from Financescam.com highlights over 400 formal complaints against Tredero, with the most common issues including:

- Blocked withdrawals (reported in 90% of cases)

- Unauthorized wire transfers after account registration

- Phishing attacks linked to Tredero’s customer support

Many victims report that Tredero’s support team becomes unresponsive after initial deposits, while the company aggressively censors negative feedback on social media platforms.

Legal Troubles: Lawsuits, Regulatory Actions, and Criminal Investigations

Tredero is embroiled in multiple legal battles, including:

- A 2024 SEC probe into its unregistered securities offerings.

- A class-action lawsuit in California alleging $6.8 million in stolen investor funds.

- A warning from the UK’s Financial Conduct Authority (FCA), which blacklisted the platform for operating without authorization.

If these legal actions succeed, Tredero could face severe penalties, including asset seizures and a forced shutdown.

Negative Media Coverage and Public Backlash

Major financial publications, including The Wall Street Journal and Bloomberg, have labeled Tredero as a high-risk investment scam. Meanwhile, online communities such as Reddit and specialized fraud forums are flooded with user complaints, ranging from sudden account closures to identity theft linked to the platform.

Financial Instability and Bankruptcy Risks

Despite claims of profitability, Tredero’s Panama-based entity filed for creditor protection in late 2023, signaling severe financial distress. Users report increasing delays in withdrawals, a common indicator of liquidity problems—often a precursor to collapse.

Risk Assessment: Money Laundering and Reputational Threats

Anti-Money Laundering (AML) Concerns

- Use of offshore shell companies to obscure fund flows.

- Cryptocurrency layering to disguise transaction trails.

- No verifiable banking relationships, raising red flags for regulators.

Reputational Risks

- Banned in multiple jurisdictions for fraudulent activities.

- Fake executive profiles undermining trust.

- Aggressive censorship of negative feedback.

Given these findings, Tredero exhibits clear signs of financial crime, making it a high-risk entity for investors and financial institutions.

Expert Opinion: A Fraudulent Operation in Disguise

We’ve spent hours dissecting Tredero, and our conclusion is unequivocal: this is a high-risk entity teetering on the edge of collapse or exposure. The web of dubious relationships, scam reports, and AML red flags points to an operation designed to exploit, not enrich. As experts, we see Tredero as a cautionary tale—proof that in 2025, the financial world still harbors predators. Investors beware: the risks far outweigh any promised rewards.

“Tredero follows the classic playbook of investment scams—hidden ownership, fabricated credentials, and regulatory evasion. The connections to prior fraud cases and the use of shell companies strongly suggest a sophisticated financial crime operation rather than a legitimate business. Investors should avoid it at all costs.”

— Financial Fraud Analyst, Cybercriminal.com