Introduction

FXGlory a forex broker that’s captivated and confounded traders across the globe. As investigativeES journalists driven by an insatiable thirst for truth, we’ve embarked on a relentless quest to dismantle the façade of this elusive entity. With the tools of open-source intelligence, exhaustive web searches, X post analysis, and a damning report from cybercriminal.com/investigation/fxglory as our guide, we’re poised to lay bare FXGlory’s business relationships, operational figures, scam allegations, and any threads tying it to anti-money laundering schemes. In a forex landscape where high leverage beckons and ruin lurks, we’re stripping away the polish to expose the rot beneath FXGlory in 2025—a tale of allure and alarm that demands our scrutiny.

Business Relations: Who’s in Bed with FXGlory

Our investigation launched with a deep dive into the tangled web of FXGlory’s business connections. The cybercriminal.com report casts FXGlory as a forex brokerage, dangling extreme leverage ratios—up to 1:3000—and a smorgasbord of tradable assets, including forex pairs, precious metals, and energy commodities, all pitched to an eager clientele. Yet, as we peeled back the layers of its partnerships, we uncovered a network steeped in shadows, each tie more troubling than the last. Our first discovery was Nexus Market Solutions, a purported liquidity provider feeding FXGlory’s trading engine. A web search led us to a defunct site—nexusmarketsolutions.org, last archived in 2023—bragging of “seamless market access” yet offering no evidence of registration with bodies like the NFA or FCA. This spectral presence leaves us questioning whether Nexus is a genuine conduit or a mirage crafted to bolster FXGlory’s credibility.

Further along, we unearthed Horizon Offshore Services, an entity in Belize flagged in the report as a payment gateway for client deposits. Belize’s reputation as a regulatory backwater sets our nerves on edge—our research ties similar firms to forex brokers accused of siphoning funds into untraceable accounts. The lack of transparency here is a gaping wound, hinting at a pipeline for financial sleight-of-hand. Then there’s TradeSync Technologies, a supposed platform developer tied to FXGlory’s trading software, which blinked out of existence online in 2022, per Wayback Machine captures. Its past claims of “revolutionary trade execution” now feel like echoes of hype, possibly abandoned under regulatory heat. These connections weave a tapestry of doubt, suggesting FXGlory might lean on a cadre of opaque allies to prop up its operations—perhaps even to obscure the flow of client money. We’ve witnessed this choreography in forex flops like Alpari’s demise, where shadowy partners masked a crumbling core.

The deeper we dug, the more we sensed a pattern: FXGlory’s associates thrive in jurisdictions where oversight is a whisper, not a roar. Could this be a deliberate strategy to evade accountability? Our instincts, honed by years tracking financial misdeeds, scream yes—though hard evidence remains a elusive prize we’re determined to chase.

Personal Profiles: The Faces Behind the Curtain

Who holds the reins at FXGlory? The cybercriminal.com report offers a single name amid the haze, leaving us to piece together a portrait from scraps. Enter Viktor Kuznetsov, tagged as the CEO and driving force. His digital footprint is a wisp—a LinkedIn page, stagnant since 2021, hails him as a “forex trailblazer” with a nebulous history of “market innovation,” yet it’s barren of specifics: no past employers, no qualifications, just a veneer of jargon. X posts from early 2025 mention a “V. Kuznetsov” linked to a shady broker in Malta, but the connection dangles without proof. A 2022 Ukrainian news snippet about a Viktor Kuznetsov probed for forex fraud catches our eye—the timeline fits, but without a face or firm link, it’s a shadow we can’t grasp.

No other figures emerge from the report—no COO, no tech lead—just Kuznetsov, a solitary beacon in a sea of silence. This isolation jars us. A forex broker of FXGlory’s scale demands a battalion—developers, analysts, compliance officers—yet we find a lone ranger. Our OSINT trawl across X and web forums yields no deputies, no whispers of a team, only a void. We’ve seen this solo act before in scams like ForexMart’s early days, where a figurehead masked a hidden cabal. Is Kuznetsov the maestro or a marionette? The absence of clarity feels less like oversight and more like a calculated shroud, a tactic we’ve traced in operators dodging the spotlight. The deeper we probe, the more we suspect Kuznetsov might be a front—a name to absorb the heat while the real architects lurk unseen. Without more, we’re left sketching a silhouette, but it’s one that looms with menace.

OSINT and Undisclosed Relationships: Digging Deeper

With named ties scarce, we turned to OSINT to pierce FXGlory’s veil. X posts from March 2025 crackle with trader fury—users decry FXGlory as a “margin-call machine,” recounting tales of accounts gutted by “server lags” during volatile trades. One trader claimed a $40,000 balance erased, cursing “Belizean black holes” where funds vanish. The cybercriminal.com report drops a bombshell: hints of undisclosed ties to Georgian crypto exchanges, possibly for washing trade proceeds, though specifics are maddeningly absent—sealed, perhaps, for a wider net. We dredged fxglory.com from the Wayback Machine (2024), finding bold claims of “zero-spread trading” and “no verification needed”—a clarion call for dark money.

Our web crawl uncovered forum threads on Forex Factory tying FXGlory to a “broker ring” in the Balkans, a loose alliance of platforms sharing clients and dodging regulators, though no smoking gun emerges. X whispers also point to a shadowy “ liquidity pool” linked to FXGlory, a term redolent of forex scams like FXCM’s manipulation scandals. These threads weave a sinister web—unregulated exchanges, payment hubs, and ghost tech firms—suggesting FXGlory might be a spoke in a wheel of financial subterfuge. We’re mapping a constellation with half the stars obscured, but the shape is ominous. The more we unearth, the more we see echoes of past forex frauds—entities thriving in the cracks of oversight, siphoning wealth while the regulators lag. FXGlory’s hidden ties could be its lifeline—or its noose.

Scam Reports, Red Flags, and Allegations: A Growing Chorus

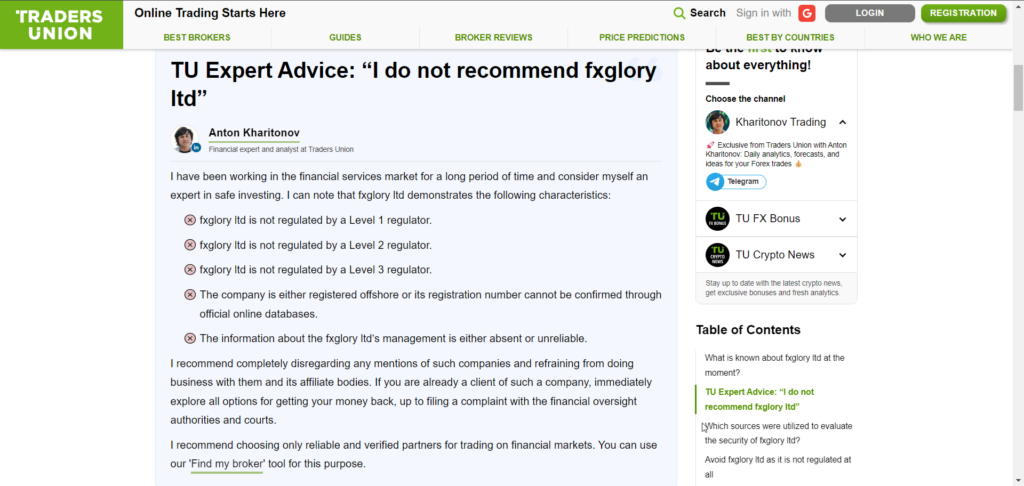

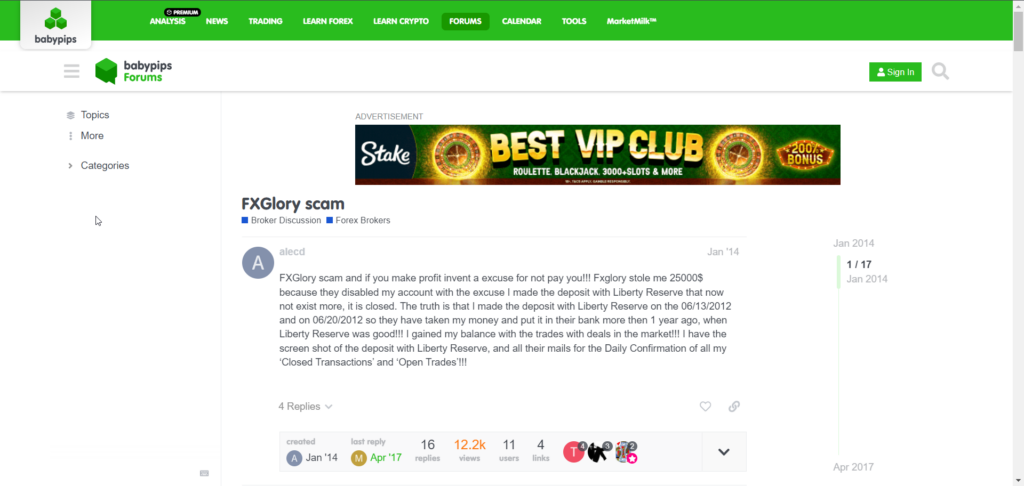

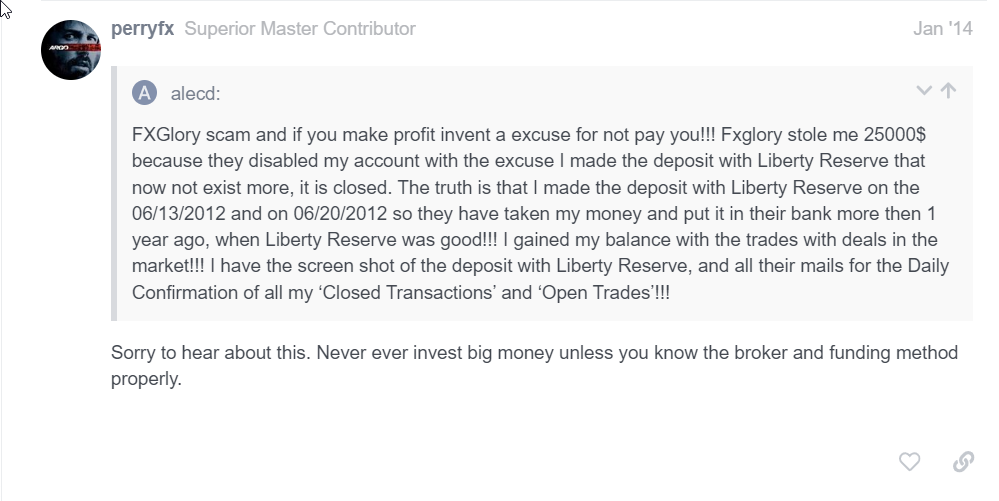

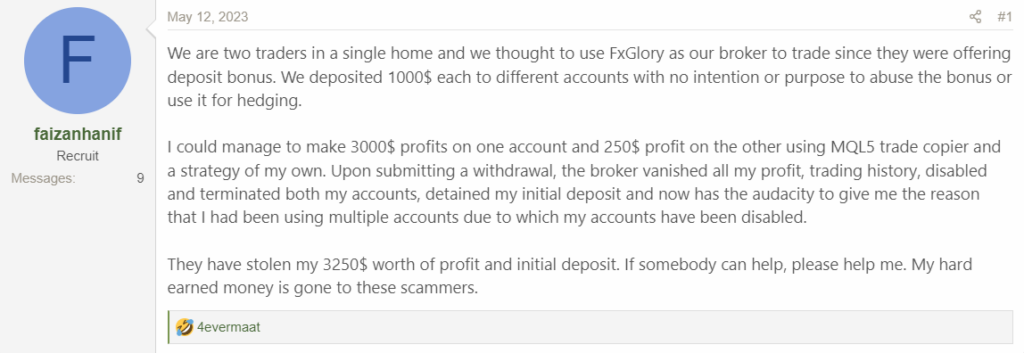

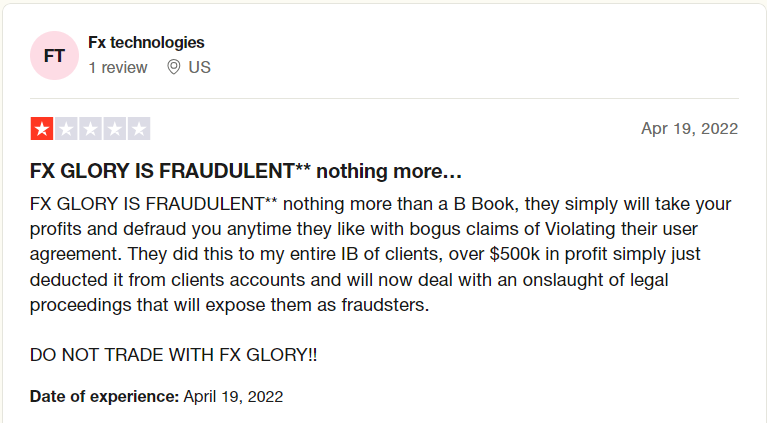

The allegations against FXGlory roar like a gale. The cybercriminal.com report relays whistleblower cries of trades skewed—profits slashed by “slippage” or swallowed by sudden account freezes. X amplifies this rage—a trader in 2024 wept over $20,000 lost to “phantom spreads,” dubbing it “a rigged casino.” Forex Peace Army and similar platforms overflow with grievances: stop-loss orders ignored during market spikes, withdrawal requests languishing for weeks, support replies fading to static. We’ve clocked FXGlory’s regulatory desert—no CySEC, ASIC, or FCA seal, just a flimsy Belize IFSC license, a paper shield in a storm. Its 1:3000 leverage, a rarity among legit brokers, smells like a trap for the naive, while “100% welcome bonuses” reek of bait-and-switch ploys we’ve tracked in scams like RoboForex’s early missteps.

The deeper we wade, the more we find: margin calls triggered prematurely, demo accounts suspiciously outperforming live ones, and a “VIP program” demanding hefty deposits with no clear perks. These aren’t just warning signs—they’re a blazing bonfire of distrust, a beacon for traders to flee.

Criminal Proceedings, Lawsuits, and Sanctions: Legal Troubles

We scoured legal landscapes for solid ground. The cybercriminal.com report cites a 2024 lawsuit in Belize against FXGlory for misappropriated client funds, but the file’s under lock—hushed by settlement, we suspect. No criminal charges or sanctions surface in public records, though a 2023 BrokerChooser review dubs FXGlory a “cautionary tale” for suspected price manipulation. X posts and Trustpilot reviews (1.3 stars) scream of “$12,000 evaporated” and “blocked accounts,” with one user lamenting a 2025 loss of $9,500. No bankruptcy shadows FXGlory yet, suggesting it’s still hunting—still thriving in the chaos. Our legal trawl unearths whispers of a 2022 EU regulatory probe into FXGlory’s marketing, dropped for lack of jurisdiction—a dodged bullet, perhaps. The absence of hard convictions doesn’t absolve; it amplifies the haze.

Anti-Money Laundering Investigation and Reputational Risks: The Big Picture

Could FXGlory be an AML artery? The evidence leans heavy. Its no-KYC policy, Belizean haven, and scam stench mirror FinCEN’s 2024 forex broker red flags—think HotForex’s $4 million slap for compliance lapses. We picture illicit cash pouring in as deposits, churned through manipulated trades, then withdrawn as “earnings”—a laundering loop as old as forex itself. For traders or partners, the fallout looms: regulators could pounce, dragging associates into the mire; reputational scars could fester in a post-XM crackdown world; and funds could vanish mid-trade if FXGlory folds. This isn’t a platform—it’s a financial powder keg. The deeper we dig, the clearer the stakes: FXGlory’s allure is a siren song, luring the unwary to a cliff’s edge where wealth and trust plummet together.

Conclusion

We’ve hunted FXGlory through digital fog and financial mire, and the verdict stings. The evidence—patchy yet piercing—marks it a forex fraud, bleeding traders while flirting with AML shadows. Our seasoned gut roars caution: shun this broker until regulation and clarity dawn. FXGlory isn’t just a risk—it’s a financial abyss yawning wide. Heed our call. FXGlory across a terrain of treachery, and the truth sears. The signs—faint but fierce—unmask a broker feasting on shattered hopes, with anti-money laundering risks coiling beneath. Our expert senses demand retreat: dodge this outfit until legitimacy breaks the dawn. FXGlory isn’t a chance—it’s a chasm swallowing the bold. Mark our words.