Introduction: The False Promise of FXGlory

In the fast-paced world of forex trading, where fortunes can be made or lost in seconds, brokers like FXGlory position themselves as gateways to financial success. With a sleek website, bold claims of high leverage up to 1:3000, low spreads, and a user-friendly trading platform, FXGlory lures traders with the promise of effortless profits. For novice traders, the allure of quick gains is hard to resist, while seasoned investors are drawn to the broker’s seemingly competitive offerings. However, behind this polished veneer lies a chilling reality: FXGlory is not a legitimate broker but a sophisticated financial scam designed to exploit and impoverish its clients.

Over the years, countless traders have fallen prey to FXGlory’s predatory practices, losing substantial sums of money with little to no chance of recovery. Reports of withdrawal refusals, manipulated trades, and unresponsive customer support paint a grim picture of a company that prioritizes profit over integrity. Financial analysts and regulatory bodies have raised serious concerns about FXGlory’s operations, uncovering a pattern of deceit, regulatory evasion, and outright fraud. This in-depth investigation exposes the dark underbelly of FXGlory, revealing how it operates as a financial trap that leaves traders devastated and regulators scrambling to intervene.

As we peel back the layers of FXGlory’s operations, a disturbing picture emerges—one of deliberate manipulation, offshore secrecy, and a blatant disregard for ethical standards. From its unregistered status to its shady business connections, FXGlory embodies the worst excesses of the unregulated forex industry. Traders who engage with this broker risk not only their capital but also their trust in the financial system. With mounting complaints and growing legal scrutiny, FXGlory has earned a notorious reputation as a synonym for forex fraud. This exposé aims to warn investors and shed light on the broker’s dangerous practices before more victims fall into its trap.

Regulatory Violations: Operating in the Shadows

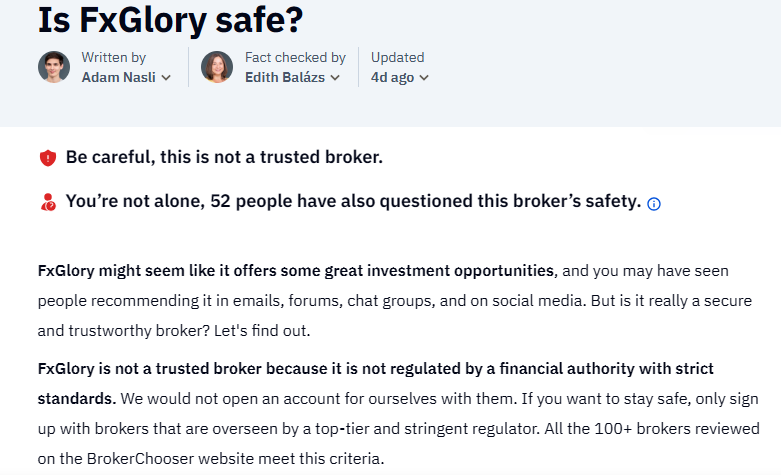

One of the most alarming aspects of FXGlory’s operations is its complete lack of regulatory oversight. Legitimate forex brokers are licensed by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC). These regulators enforce strict standards to protect traders, including requirements for transparent financial reporting, client fund segregation, and fair trading practices. FXGlory, however, operates outside this framework, choosing to base its operations in jurisdictions known for lax oversight and financial secrecy.

The broker claims to be registered in Saint Vincent and the Grenadines, a notorious offshore haven where financial regulation is minimal. This strategic choice allows FXGlory to evade the scrutiny of major regulatory bodies, leaving traders with no legal recourse in case of disputes. Multiple financial authorities, including those in Europe and North America, have issued public warnings about FXGlory, explicitly stating that it is not authorized to offer financial services in their jurisdictions. For instance, the Italian regulator CONSOB and the Spanish CNMV have flagged FXGlory for operating illegally, urging traders to avoid the broker altogether.

The absence of a valid license means FXGlory is not obligated to adhere to any financial regulations, raising serious questions about how it handles client funds. Legitimate brokers are required to keep client money in segregated accounts, ensuring that it remains separate from the company’s operational funds. FXGlory offers no such assurances, and there is mounting evidence suggesting that client deposits may be misused or misappropriated. This lack of transparency fuels suspicions of money laundering and other illicit activities, as the broker’s opaque structure makes it impossible to trace the flow of funds.

Moreover, FXGlory’s refusal to comply with even basic regulatory standards undermines its credibility as a trustworthy broker. Traders who deposit money with FXGlory are essentially gambling with no safety net, as there is no regulatory body to intervene in cases of fraud or mismanagement. The broker’s deliberate choice to operate in the shadows is a clear red flag, signaling that its intentions are far from honorable. As regulatory bodies continue to crack down on unlicensed brokers, FXGlory’s days of unchecked operations may be numbered—but for now, it remains a significant threat to unsuspecting traders.

Manipulative Trading Practices: Rigging the Game

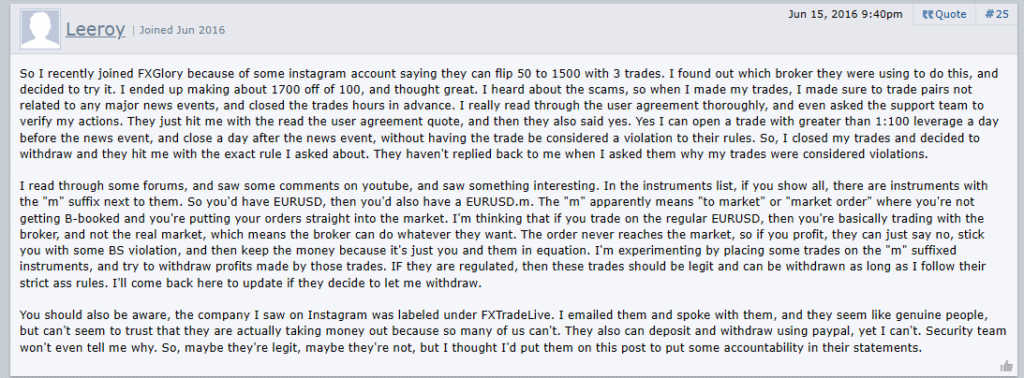

At the heart of FXGlory’s fraudulent scheme lies its trading platform, which is designed to maximize trader losses while boosting the company’s profits. Numerous former clients have reported a range of manipulative practices that undermine fair trading, including price manipulation, slippage, and deliberate delays in trade execution. These tactics create an environment where traders are set up to fail, regardless of their skill or strategy.

One of the most egregious issues is price manipulation, where the market prices displayed on FXGlory’s platform deviate significantly from those on reputable exchanges. For example, traders have documented instances where FXGlory’s platform showed sudden price spikes or drops that did not align with real-time market data. These anomalies often trigger stop-loss orders, forcibly closing traders’ positions at a loss while allowing FXGlory to pocket the difference. In some cases, traders reported profitable trades being reversed or altered after execution, with the broker citing “technical errors” or “market volatility” as excuses.

Slippage, another common complaint, occurs when trades are executed at prices less favorable than those requested by the trader. While slippage can happen in volatile markets, FXGlory’s clients report excessive and consistent slippage even during stable conditions. This suggests that the broker intentionally delays or manipulates trade execution to ensure worse outcomes for traders. For instance, a trader placing a buy order might find it filled at a significantly higher price, eroding potential profits or turning the trade into a loss.

Technical issues also plague FXGlory’s platform, particularly during high-volatility periods such as major economic announcements. Traders have reported sudden platform freezes, login failures, or inability to close positions, all of which prevent them from capitalizing on market movements. These disruptions are suspiciously timed, leading many to believe that FXGlory deliberately sabotages traders during critical moments to protect its own financial interests.

These manipulative practices point to a deeper truth: FXGlory is not a broker in the traditional sense but a counterparty that profits directly from its clients’ losses. Unlike regulated brokers that facilitate trades in the open market, FXGlory operates as a “market maker” with no obligation to execute trades fairly. This conflict of interest creates a rigged game where the broker holds all the cards, leaving traders vulnerable to exploitation. The overwhelming evidence of platform manipulation confirms that FXGlory is actively working against its clients, making it an unreliable and dangerous choice for forex trading.

Withdrawal Nightmares: Trapping Traders’ Funds

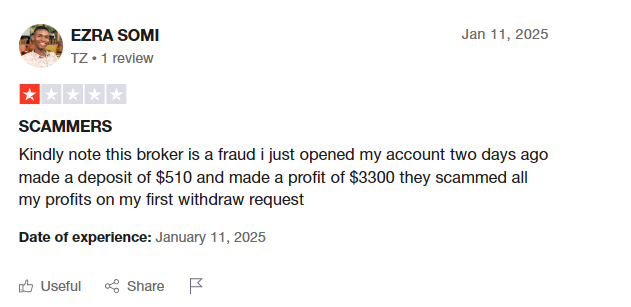

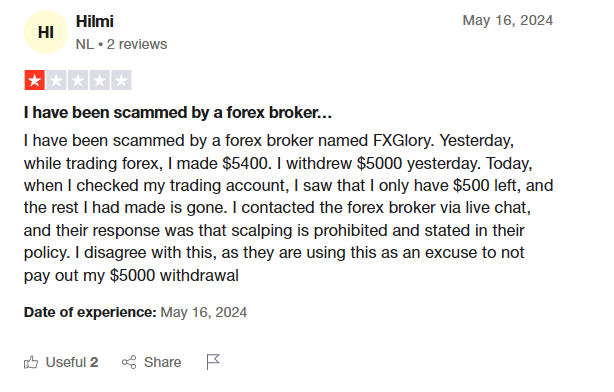

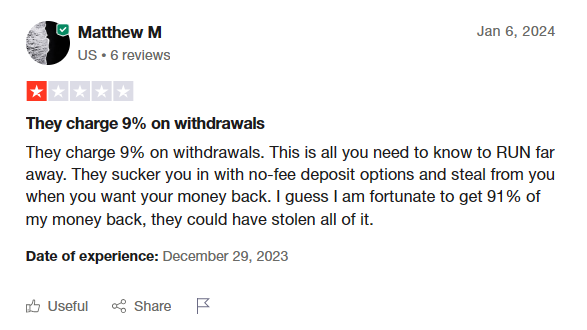

Perhaps the most damning evidence against FXGlory is its handling of withdrawals, which has become a nightmare for countless traders. The ability to withdraw funds freely is a cornerstone of any legitimate broker, yet FXGlory has built a reputation for obstructing this process at every turn. Hundreds of user complaints highlight a pattern of delayed, denied, or outright refused withdrawals, with the broker using a variety of tactics to keep traders’ money locked in its system.

The withdrawal process begins with excessive verification demands, where traders are asked to submit an array of documents, including identification, proof of address, and even bank statements. While verification is standard in the industry, FXGlory takes it to an extreme, rejecting submissions for minor issues such as formatting errors or unclear scans. Traders who comply with these demands often find their requests stalled or denied for vague reasons, such as “incomplete documentation” or “suspicious activity.”

In more alarming cases, traders report their accounts being frozen or disabled entirely after submitting withdrawal requests. FXGlory frequently cites violations of its terms and conditions—such as “abusive trading” or “bonus misuse”—without providing evidence or clarification. These accusations are often baseless, serving as a pretext to withhold funds. Some traders have lost access to their entire account balances, with no explanation or avenue for appeal.

Even when withdrawals are approved, the process is riddled with delays. Traders report waiting weeks or months to receive their funds, with customer support offering little to no assistance. In some instances, withdrawals are processed only partially, with the broker withholding significant portions of the requested amount. Others claim that their funds never arrive, despite assurances from FXGlory that the transaction was completed.

These withdrawal issues have led to widespread accusations that FXGlory is operating a Ponzi-like scheme, using new client deposits to pay off earlier withdrawals—if they are paid at all. The broker’s refusal to honor withdrawal requests suggests that client funds may not be held in secure accounts but instead used for undisclosed purposes, possibly to sustain the company’s operations or enrich its owners. This predatory behavior underscores FXGlory’s true nature as a financial trap, where traders are lured in with promises of profits but left unable to access their money.

Offshore Secrecy and Shady Connections

FXGlory’s operations are shrouded in secrecy, with a complex web of offshore entities and questionable financial practices that raise serious red flags. The broker is linked to shell companies registered in jurisdictions like Saint Vincent and the Grenadines and the Marshall Islands, both known for their lax regulations and anonymity protections. These locations make it nearly impossible to trace FXGlory’s true ownership or hold it accountable for its actions.

Investigations into FXGlory’s corporate structure reveal a labyrinth of front companies and aliases, designed to obscure the identities of those behind the operation. Attempts to identify the broker’s executives or shareholders lead to dead ends, with company records listing generic names or nonexistent individuals. This deliberate obfuscation suggests that FXGlory’s operators are fully aware of their illicit activities and are taking steps to evade legal consequences.

The broker’s banking practices further fuel suspicions of wrongdoing. Client deposits are often routed through obscure third-party payment processors, a tactic commonly used by fraudulent brokers to distance themselves from direct financial oversight. These processors are typically based in offshore jurisdictions, making it difficult for regulators to track the movement of funds. Withdrawals, when processed, often originate from unrelated accounts, raising concerns about the integrity of FXGlory’s financial operations.

Financial analysts have also uncovered potential ties between FXGlory and other disreputable brokers, suggesting that it may be part of a larger network of scams. Shared payment processors, website designs, and operational patterns point to a coordinated effort to defraud traders across multiple platforms. While concrete evidence of these connections is still emerging, the parallels are too striking to ignore.

This offshore secrecy not only protects FXGlory from accountability but also leaves traders vulnerable to exploitation. Without a clear understanding of who controls their funds or where they are held, clients have no recourse in cases of fraud. The broker’s shadowy structure is a deliberate choice, enabling it to operate with impunity while leaving a trail of financial devastation in its wake.

Mounting Complaints and Legal Challenges

The growing chorus of complaints against FXGlory is impossible to ignore, with traders from around the world sharing stories of lost savings, ruined livelihoods, and shattered trust. Online forums, review platforms like Trustpilot, and social media groups dedicated to forex trading are flooded with warnings about FXGlory, detailing experiences of frozen accounts, manipulated trades, and stolen funds. These complaints follow a consistent pattern: initial deposits are processed smoothly, but as soon as traders attempt to withdraw profits or even their principal, the broker’s true colors emerge.

Many victims have turned to legal action in an effort to recover their losses, but FXGlory’s offshore status complicates these efforts. Jurisdictional barriers and the broker’s elusive ownership structure make it difficult for authorities to pursue meaningful enforcement. Some traders have sought assistance from financial ombudsmen or consumer protection agencies, only to learn that unlicensed brokers like FXGlory fall outside their jurisdiction.

Despite these challenges, regulatory bodies are taking notice. Financial watchdogs in countries like the UK, Canada, and Australia have issued public advisories about FXGlory, urging traders to avoid the broker and report any suspicious activity. Discussions of coordinated international action are gaining traction, as regulators recognize the need to address the broader issue of unregulated forex scams. Legal experts predict that FXGlory could face significant lawsuits in the coming years, particularly as evidence of its fraudulent practices continues to mount.

In the meantime, traders are left to navigate the fallout of FXGlory’s actions. Many have lost life savings, retirement funds, or money borrowed in the hope of financial independence. The emotional toll is equally devastating, with victims reporting feelings of betrayal, helplessness, and despair. These stories serve as a stark reminder of the dangers posed by unregulated brokers and the importance of due diligence in the forex industry.

Expert Opinion: A Broker to Avoid at All Costs

After a thorough examination of FXGlory’s operations, one conclusion is inescapable: this is not a legitimate forex broker but a predatory scam designed to exploit traders. The evidence is overwhelming—unregulated operations, manipulative trading practices, withheld withdrawals, and a shadowy corporate structure all point to a company built on deception. FXGlory’s business model thrives on luring traders with false promises, only to trap their funds in a system rigged against them.

Financial experts and consumer advocates unanimously warn against engaging with FXGlory. The broker’s lack of licensing leaves traders without protection, while its history of fraud makes it a high-risk entity by any measure. Whether you’re a novice trader or an experienced investor, the dangers of FXGlory far outweigh any potential benefits. The broker’s tactics are not mere oversights but deliberate strategies to maximize profits at the expense of its clients.

As regulatory scrutiny intensifies, FXGlory’s days may be numbered, but that offers little comfort to those already victimized. Traders must prioritize safety by choosing brokers with verifiable licenses, transparent operations, and a proven track record of fairness. Reputable regulators like the FCA, CySEC, or ASIC provide searchable databases of licensed brokers, making it easy to verify a company’s credentials before depositing funds.

For those who have already fallen victim to FXGlory, immediate action is critical. Report the broker to your local financial regulator, such as the SEC in the United States or the FCA in the UK, and consider consulting a lawyer specializing in financial fraud. While recovering funds from an offshore scam is challenging, collective action and regulatory pressure may eventually bring FXGlory to justice.

In the meantime, let this investigation serve as a cautionary tale. The forex market offers immense opportunities, but it is also rife with predators like FXGlory waiting to exploit the unwary. Stay informed, stay vigilant, and above all, steer clear of FXGlory—a broker that embodies the darkest side of the financial world.