Introduction

Rosland Capital, established in 2008, markets itself as a premier destination for investors seeking to diversify their portfolios with gold, silver, platinum, and palladium. Headquartered in Los Angeles, California, the company emphasizes customer education and quality service, positioning itself as a trusted partner in the volatile world of precious metals. However, beneath its polished branding lies a troubling pattern of customer dissatisfaction, with numerous complaints highlighting issues such as delayed deliveries, poor customer service, misleading marketing, high fees, and questionable product quality. This article provides an in-depth examination of these concerns, drawing from customer reviews and documented grievances to paint a comprehensive picture of Rosland Capital’s operational shortcomings. By exploring the company’s background, product offerings, and the specific issues raised by clients, we aim to caution prospective investors and underscore the importance of due diligence in the precious metals market.

Company Background

Founding and Leadership

Rosland Capital was founded in 2008 by Marin Aleksov, a veteran of the precious metals industry with over two decades of experience. Based in Los Angeles, the company has grown to serve clients in the United States, Europe, and Asia, with affiliate offices in London, Paris, Munich, and Hong Kong. Aleksov’s leadership has been central to Rosland’s expansion, but the company’s growth has been overshadowed by a growing chorus of customer complaints. Despite its A+ rating from the Better Business Bureau (BBB) and AAA rating from the Business Consumer Alliance (BCA), these accolades contrast sharply with the negative feedback found on platforms like Trustpilot, Critical Intel, and the BBB’s own review section.

Mission and Market Position

Rosland Capital promotes itself as a leader in precious metals, focusing on educating clients about the benefits of investing in physical assets as a hedge against economic uncertainty. The company offers a range of products, including bullion coins, bars, and exclusive specialty coins, catering to both collectors and investors. It also specializes in setting up Gold IRAs, partnering with custodians like Equity Institutional to facilitate retirement investments. However, Rosland’s claims of transparency and customer-centric service are undermined by recurring complaints about deceptive practices and unfulfilled promises, which have tarnished its market position.

Online Presence and Marketing

Rosland maintains a robust online presence through its website and social media, offering resources like guides, FAQs, and a free gold kit to attract new investors. The company has also leveraged celebrity endorsements, including actors William Devane and Bill O’Reilly, to bolster its credibility. Yet, its website has been criticized for being outdated and cluttered, with fees listed in the FAQ section not updated since March 2022. Negative reviews on platforms like Critical Intel highlight issues with fulfillment and customer service, casting doubt on the company’s digital reliability.

Product Offerings

Gold Coins and Bars

Rosland Capital offers a variety of gold products, including government-minted coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand, as well as bullion bars. These products are marketed as stable investments to counterbalance economic volatility. However, customers have reported receiving items with inflated values or lower market worth than advertised, raising concerns about pricing transparency.

Silver Coins and Bars

The company’s silver offerings include American Silver Eagle and Canadian Silver Maple Leaf coins, alongside silver bullion bars. While these products appeal to investors seeking affordable diversification, complaints about damaged or substandard items have surfaced, with some clients alleging they received counterfeit or low-quality silver.

Platinum and Palladium

Rosland provides platinum and palladium bars and coins, targeting investors looking to diversify beyond gold and silver. However, the product selection for these metals is limited, and the company’s website inconsistently lists palladium, causing confusion. Customers have also reported high commissions and undisclosed fees for these less common metals, further eroding trust.

Exclusive Specialty Coins

Rosland collaborates with organizations like Formula 1, the PGA Tour, and the British Museum to offer limited-edition coins. These exclusive products are marketed as collectibles with high investment potential, but customers have criticized their inflated prices and questionable resale value, accusing the company of prioritizing commissions over client interests.

Gold IRAs

Rosland specializes in setting up Precious Metals IRAs, working with custodians to facilitate tax-advantaged retirement accounts. The company charges a $50 setup fee, a $225 annual administration fee, and storage fees of $100–$150, with a minimum investment of $10,000. While these services are IRS-compliant, clients have complained about undisclosed costs and delays in account setup, with some alleging aggressive sales tactics to push numismatic coins over more stable bullion.

Key Issues Highlighted in Customer Reviews

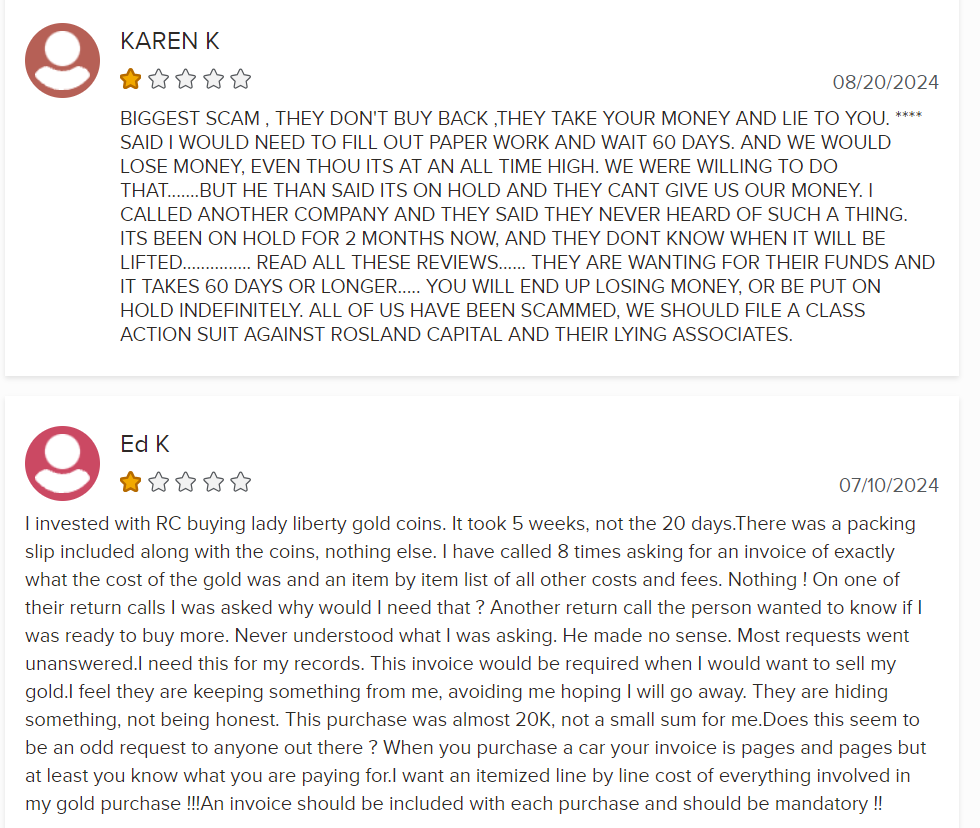

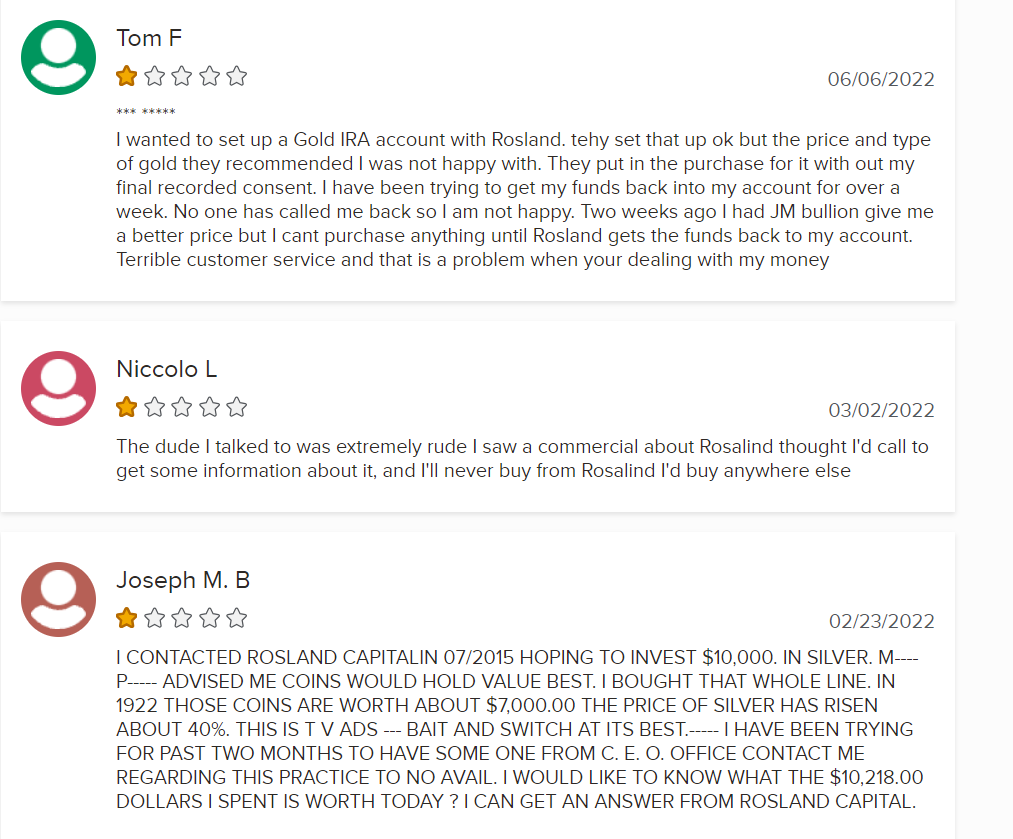

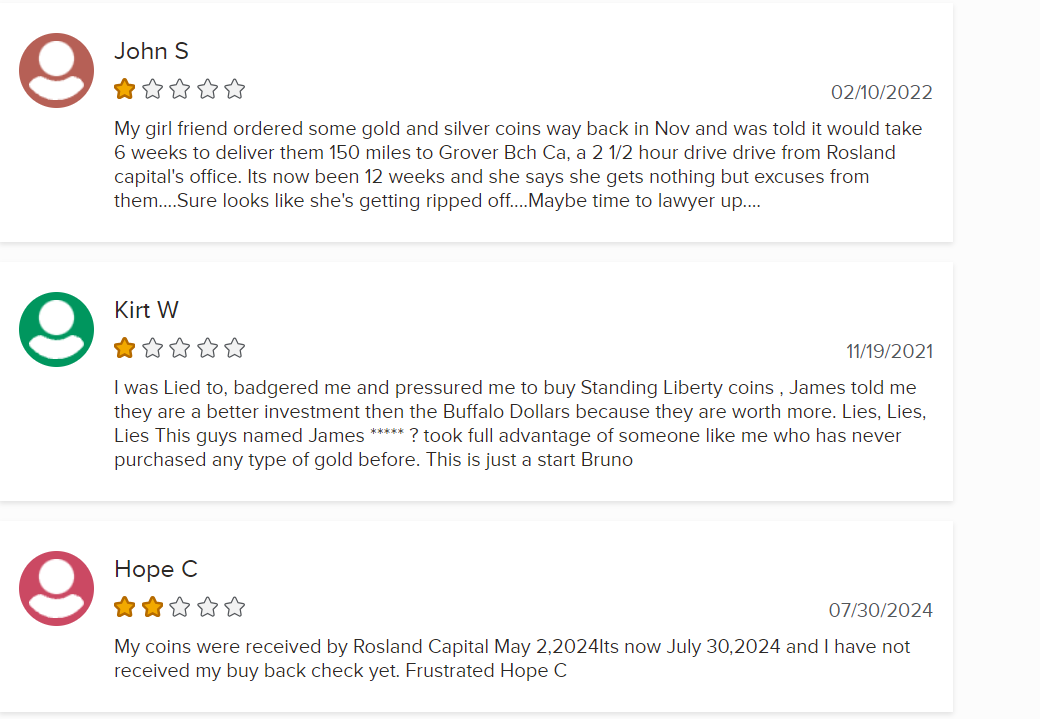

Poor Customer Service

A recurring theme in negative reviews is Rosland Capital’s subpar customer service. Clients frequently report long wait times, unresponsive representatives, and a lack of clear communication. For instance, John D. gave a one-star review, stating, “I was left on hold for ages and received no clear answers,” while Lisa P. noted, “They seemed disinterested and rushed me off the phone.” These experiences leave investors feeling neglected, particularly when dealing with significant financial commitments. Complaints filed with the BBB highlight unanswered emails and unreturned calls, with some clients resorting to legal action to resolve issues.

Delivery and Fulfillment Delays

Delivery issues are among the most cited grievances, with customers reporting delays of weeks or months beyond the promised 14 business days. Alex T. complained, “I placed an order for gold coins weeks ago and have yet to receive them,” while Emily G. noted, “It’s been over a month, and I still have not received my silver bars.” A BBB complaint detailed a breach of contract, with a customer waiting over four weeks due to excuses like staff disruptions and holiday shipping constraints. Such delays cause significant stress and undermine confidence in Rosland’s reliability.

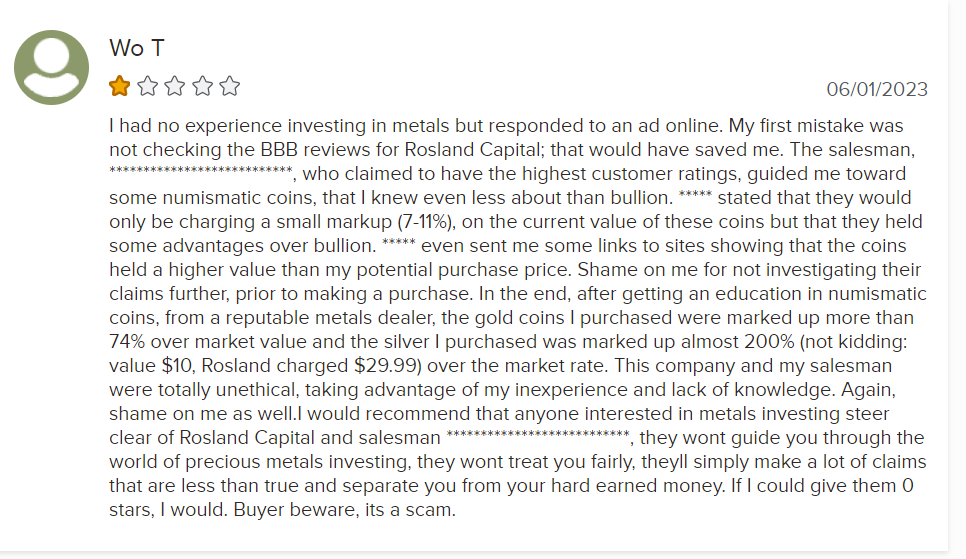

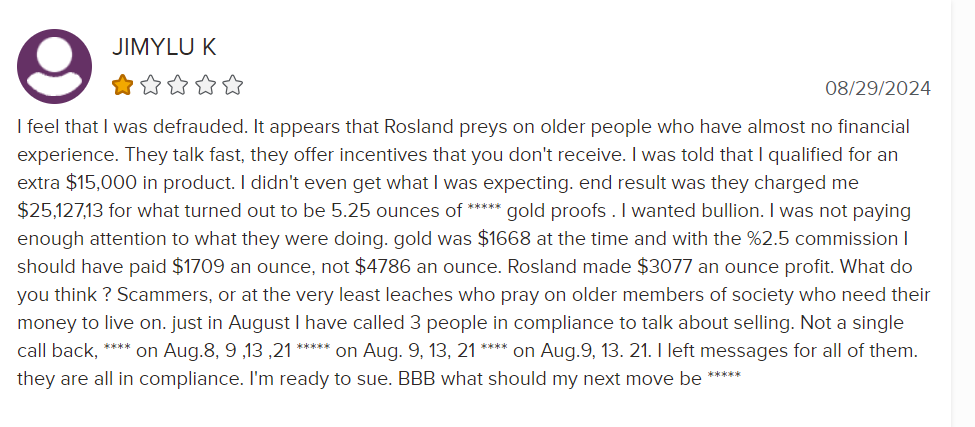

Misleading Marketing Practices

Rosland’s marketing has drawn criticism for creating unrealistic expectations about investment returns. Sarah M. reported, “I was sold on the idea of high returns, but the actual market value was much lower,” while Mark H. lamented, “The prices I paid were inflated.” Reviews suggest that salespeople emphasize gold’s stability while downplaying risks or overstate the value of numismatic coins, leading to accusations of deceptive tactics. A former employee’s review on Gold Retired claimed the company engages in “fraud activities” by disguising hidden fees, further fueling distrust.

High Fees and Hidden Costs

High fees are a major pain point, with clients complaining about undisclosed charges for shipping, storage, and commissions. Michael R. wrote, “The fees are outrageous… I didn’t realize how much I would be charged until after my order was placed.” Anna K. described a “bait-and-switch situation” with unexpected costs. Reviews on Better Bullion note that Rosland’s annual storage fees and commissions are often higher than competitors’, and the lack of upfront disclosure erodes trust. The company’s failure to offer segregated storage, a standard industry practice, also raises concerns about asset safety.

Product Quality Concerns

Some customers have reported receiving damaged, counterfeit, or low-quality products. A Trustpilot review described receiving “scratched and tarnished coins,” while another client alleged, “The silver bars I received didn’t match the advertised quality.” A particularly alarming BBB complaint claimed a $200,000 order was lost, with Rosland unable to explain the discrepancy, accusing the company of “sloppy handling.” These incidents suggest lapses in quality control and inventory management, further damaging Rosland’s reputation.

Lack of Accountability

Rosland’s response to complaints is often inadequate, with clients reporting a lack of accountability. Karen L. stated, “I submitted a complaint, but I never heard back,” while Tom W. noted, “I was met with silence.” BBB records show instances where Rosland addressed issues but failed to satisfy customers, with some disputes marked as unresolved. A Trustpilot reviewer accused the company of holding funds for 90 days without communication, prompting calls for a class-action lawsuit. This pattern of dismissiveness exacerbates customer frustration and fuels perceptions of negligence.

Broader Implications

Impact on Investor Trust

The volume of negative reviews—26 on the BBB alone over three years—signals a systemic issue that undermines investor trust. Clients who feel misled or neglected are less likely to engage with Rosland or recommend it, as evidenced by posts on X, where one user threatened to file a BBB complaint over “sales practices that fleece customers.” The contrast between Rosland’s A+ BBB rating and its 1.25-star average from consumer reviews highlights a disconnect between official accolades and real-world experiences.

Comparison to Competitors

Rosland’s issues stand in stark contrast to competitors like Goldco, which boasts over a thousand five-star reviews and fewer complaints. Goldco’s transparent fee structure and segregated storage options address many of Rosland’s shortcomings. Reviews on Better Bullion suggest that investors seeking reliability may find better alternatives, as Rosland’s deceptive practices and service failures place it at a disadvantage in a competitive market.

Regulatory and Ethical Concerns

Rosland’s practices raise ethical questions about transparency and accountability in the precious metals industry. The company is subject to oversight by the U.S. Commodity Futures Trading Commission (CFTC) and state regulations, but its high complaint volume suggests gaps in compliance. Allegations of fraud and deceptive marketing, as noted in reviews on Gold Retired and Better Bullion, call for stricter scrutiny to protect consumers from predatory tactics.

Tips for Navigating Rosland Capital

Conduct Thorough Research

Before investing, review feedback on platforms like BBB, Trustpilot, and Critical Intel. Compare Rosland’s offerings with competitors to assess pricing, fees, and service quality. Independent research can help set realistic expectations and avoid pitfalls.

Document All Interactions

Keep detailed records of communications, including dates, representative names, and agreements. This documentation is crucial for escalating issues or filing complaints with the BBB or regulatory bodies.

Demand Fee Transparency

Request a comprehensive breakdown of all costs, including setup, storage, shipping, and commissions, before committing. Clarify whether fees are fixed or subject to change to avoid surprises.

Be Persistent with Customer Service

Use multiple channels—phone, email, online chat, or social media—to reach customer service. Public inquiries on platforms like X may prompt faster responses. Persistence is key when dealing with delays or unresolved issues.

Verify Product Quality

Inspect products upon receipt and verify their authenticity with a trusted dealer. Report any discrepancies immediately to Rosland and document the issue for potential claims.

Explore Alternatives

If Rosland’s service or pricing is unsatisfactory, consider dealers like Goldco or Augusta Precious Metals, which have stronger reputations for transparency and customer satisfaction. Research competitors’ reviews and policies to find a better fit.

Conclusion

Rosland Capital’s promise of quality service and reliable precious metals investments is overshadowed by a troubling pattern of customer complaints. From delayed deliveries and poor customer service to misleading marketing and high fees, the company’s operational failures have left many investors disillusioned. Reviews on platforms like BBB, Trustpilot, and Critical Intel reveal a consistent lack of accountability, with clients feeling neglected or misled after significant financial commitments. While Rosland maintains an A+ BBB rating and offers a range of products, its 1.25-star average from consumer reviews and allegations of deceptive practices raise serious red flags.

Prospective investors must approach Rosland Capital with caution, prioritizing thorough research and proactive communication to mitigate risks. By documenting interactions, demanding fee transparency, and exploring competitors, investors can better protect their interests. The precious metals market offers opportunities for diversification, but Rosland’s track record suggests it may not be the most reliable partner. Knowledge, diligence, and skepticism are essential to navigate the complexities of investing with a company whose actions often fall short of its promises.