Introduction

TomahawkFX, a self-proclaimed online trading platform, has become the center of growing controversy due to numerous allegations of fraudulent practices and financial misconduct. Presenting itself as a reputable broker offering access to forex, commodities, and cryptocurrency markets, TomahawkFX claims to provide traders with MetaTrader 5 (MT5) access and high-leverage trading options. However, beneath these bold marketing claims lies a web of deception, unregulated operations, and unresolved customer complaints.

The platform’s lack of regulatory oversight, combined with suspicious marketing tactics and obscure financial policies, has drawn criticism from industry watchdogs and traders alike. Users have reported significant difficulties withdrawing their funds, unresponsive customer support, and platform accessibility issues, all of which point toward potential scam behavior.

Furthermore, the company’s questionable registration process, which requires an unexplained “IB code,” raises concerns about possible multi-level marketing (MLM) schemes or recruitment-based fraud models. With the use of unrealistic profit promises and deceptive advertising strategies, TomahawkFX appears to be exploiting inexperienced traders by luring them into high-risk financial traps.

In this article, we delve into the various red flags surrounding TomahawkFX, including its unregulated status, misleading platform claims, and the alarming withdrawal issues reported by investors. We also examine the potential legal and financial risks associated with trading on this dubious platform, highlighting why traders should exercise extreme caution before engaging with TomahawkFX.

Background and Company Overview

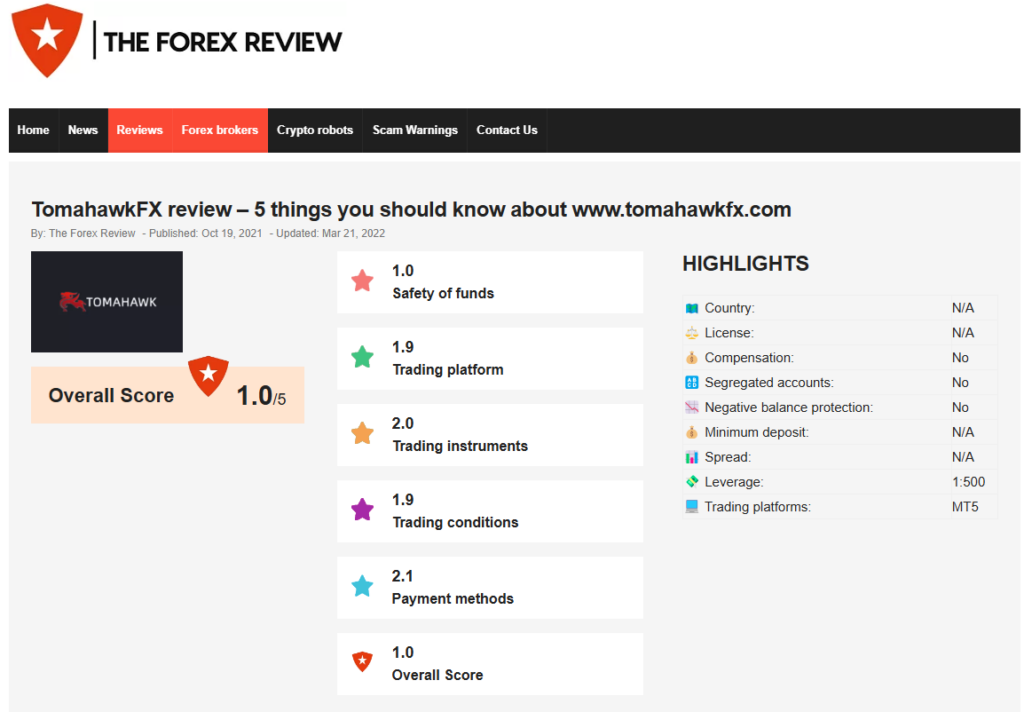

TomahawkFX presents itself as a global online trading platform, claiming to offer services such as forex trading, commodities, and cryptocurrencies. The company promotes features like access to MetaTrader 5 (MT5), a widely respected trading platform, and high-leverage trading capabilities of up to 1:500. However, despite its bold claims, TomahawkFX lacks any verifiable corporate history or proper regulatory licensing.

The company’s website is vague regarding its ownership and operational headquarters, raising suspicions about its legitimacy. Several independent financial watchdogs have flagged TomahawkFX as a potential scam, and numerous reviews from users indicate fraudulent activity.

Lack of Regulatory Oversight and Compliance Issues

One of the most alarming issues with TomahawkFX is its complete lack of regulation. Unlike legitimate brokers that are licensed by trusted financial authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC), TomahawkFX operates without oversight.

This unregulated status poses significant risks for traders:

- No legal protection: Investors have no recourse in the event of financial losses due to misconduct or insolvency.

- No fund protection: Client deposits are not protected by investor compensation schemes.

- No regulatory audits: The company is not subject to regular financial audits, making it easier to engage in deceptive or illegal practices.

Without proper regulation, TomahawkFX is free to operate in the shadows, raising significant concerns over its legitimacy and credibility.

Deceptive Marketing and Misleading Platform Claims

TomahawkFX promotes itself as offering MetaTrader 5 (MT5) access, which is widely regarded as one of the most reliable trading platforms. However, multiple users have reported that they were unable to access basic demo accounts or execute trades. This inconsistency suggests that the platform’s MT5 claims may be a front to lure unsuspecting traders.

Additionally, TomahawkFX uses vague and misleading marketing statements, including promises of guaranteed profits and exaggerated success rates. Such unrealistic claims are characteristic of scam brokers attempting to deceive inexperienced investors.

Suspicious Registration and Referral Practices

A notable red flag surrounding TomahawkFX is its unorthodox registration process. The platform requires users to provide an “IB code” during the sign-up process, which is not readily available on its website. This requirement appears to be part of a multi-level marketing (MLM) scheme, where new investors are recruited to generate profits for existing members—a common tactic among fraudulent operations.

This type of registration model raises the following concerns:

- Lack of transparency: Requiring an IB code without clear instructions deters genuine investors and creates exclusivity, a typical scam strategy.

- Possible pyramid scheme: The IB code structure suggests that TomahawkFX may be using a recruitment-based model, which is unsustainable and illegal in many jurisdictions.

Excessive Leverage and Risky Trading Conditions

TomahawkFX offers leverage ratios of up to 1:500, which is exceptionally high and extremely risky, particularly for inexperienced traders. Most regulated brokers cap leverage at 1:30 or 1:50 to protect clients from excessive financial losses.

The platform’s high-leverage offerings create substantial risks, including:

- Increased exposure to losses: Leverage amplifies both profits and losses, making it easy for traders to incur significant debt.

- Predatory conditions: Offering extreme leverage without clear risk warnings is a common tactic used by fraudulent brokers to trap traders into unsustainable positions.

The combination of excessive leverage and lack of proper regulatory oversight makes TomahawkFX a high-risk platform for traders.

Opaque Financial Policies and Withdrawal Issues

Another major concern with TomahawkFX is its lack of transparency regarding financial policies. The company provides little to no information about deposit and withdrawal methods, transaction fees, or fund protection measures.

Numerous users have reported difficulties withdrawing their funds, with complaints including:

- Unjustified withdrawal delays: Traders claim that their withdrawal requests are delayed indefinitely without valid explanations.

- Account freezing: Some investors have experienced sudden account freezes or terminations after attempting to withdraw their funds.

- False promises of refunds: TomahawkFX has allegedly offered misleading assurances of refunds that never materialized.

These withdrawal issues indicate a deliberate attempt to withhold client funds, which is a common practice among fraudulent brokers.

Consumer Complaints and Negative Reviews

TomahawkFX has garnered an overwhelming number of negative reviews and complaints from traders. Common grievances include:

- Inaccessible trading platforms: Users report being unable to access the MT5 platform or execute trades, despite the broker’s claims.

- Difficulty withdrawing funds: Many traders have complained about being unable to retrieve their funds, with some alleging complete financial losses.

- False claims of regulation: The platform misleads users by suggesting it is affiliated with regulated brokers, which it is not.

Independent review platforms and forums have flagged TomahawkFX as a potential scam, warning investors to avoid engaging with the platform.

Legal and Regulatory Actions

As of now, TomahawkFX has not been subjected to direct legal action by major regulatory bodies. However, several international financial regulators have issued public warnings about the platform.

Authorities in various jurisdictions have flagged TomahawkFX as a suspicious and unregulated entity, urging investors to avoid the platform. The lack of formal legal action does not negate the significant risks associated with trading on an unregulated platform.

Conclusion

TomahawkFX displays numerous red flags indicative of a fraudulent and potentially illegal trading operation. From its unregulated status and deceptive marketing practices to suspicious registration processes and withdrawal issues, the platform presents significant risks to investors.

The lack of transparency, coupled with its questionable financial policies, creates an unsafe environment for traders. Investors are strongly advised to avoid TomahawkFX and exercise extreme caution when dealing with unregulated brokers.

Traders seeking reliable investment opportunities should prioritize brokers regulated by respected financial authorities, as they offer greater protection, transparency, and recourse in case of disputes.