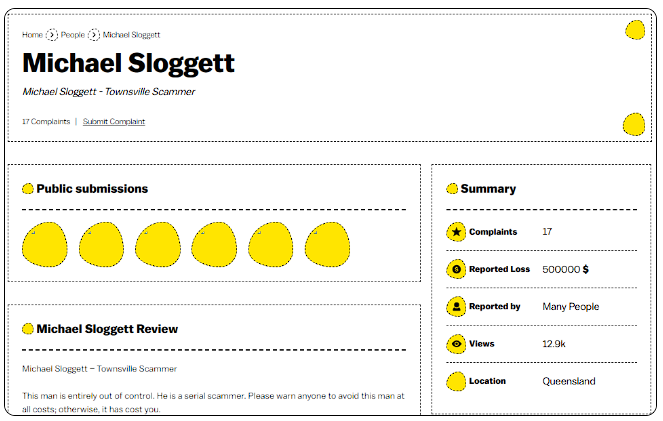

When we set out to investigate Michael Sloggett, we knew we were stepping into a labyrinth of ambition, controversy, and high-stakes financial dealings. Known to some as “The Controversial Crypto Guy,” Sloggett has carved a name for himself in the worlds of cryptocurrency, multi-level marketing (MLM), and online education. But behind the glossy persona lies a trail of allegations, criminal proceedings, and reputational red flags that demand scrutiny. Our mission? To uncover the truth about Sloggett’s business relations, personal profiles, undisclosed associations, scam reports, lawsuits, and more—culminating in a detailed risk assessment tied to anti-money laundering investigations. Buckle up as we navigate this complex story, piecing together the puzzle of a man whose rise and fall have left ripples across industries.

Business Relations: A Web of Ventures

We begin with Sloggett’s business footprint, a sprawling network that spans continents and sectors. Our investigation reveals his involvement in several high-profile ventures, each with its own set of promises—and pitfalls.

Auscoin Group

One of Sloggett’s most notable endeavors is his role as Chief Marketing Officer at Auscoin Group, an Australian cryptocurrency initiative aimed at mainstreaming digital currency through ATM networks. We found that Sloggett was instrumental in promoting Auscoin, a coin critics argue had little intrinsic value beyond raising funds for ATM installations. The project, co-founded by Sam Karagiozis, promised to emulate Bitcoin’s success but quickly drew skepticism. Reports suggest Sloggett leveraged his marketing prowess to attract investors, yet the venture crumbled amid allegations of fraud, with its online presence later overtaken by critics warning of a “con.”

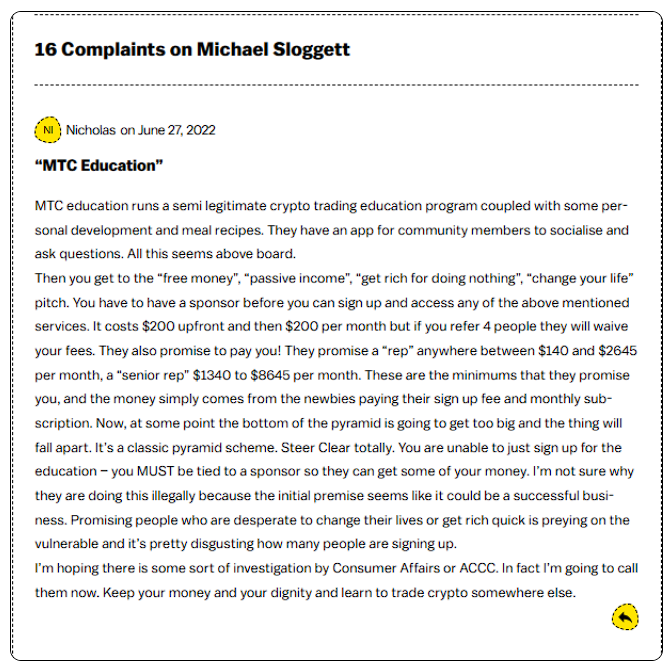

MTC Education

Next, we turn to MTC Education, where Sloggett serves as Chief Visionary Officer. This online platform markets itself as a hub for trading education, boasting a $200 monthly “Student Package” and a community of over 1,000 members. Our research shows Sloggett has trained thousands globally, positioning MTC as a beacon for financial empowerment. Co-founders John Grzybowski and Craig Latham, alongside Chief Sales Officer Philip Liang, round out the leadership. Yet, whispers of pyramid scheme tactics and ties to a Hong Kong shell company raise questions about transparency—more on that later.

My Bitcoin Academy (MBA Trading Academy)

Before MTC, Sloggett founded My Bitcoin Academy (MBA), a crypto trading education platform that once claimed 5,000 active students and $10 million in annual revenue. We uncovered praise from some users who hailed its training and community, but others flagged it as a referral-driven scheme with Sloggett at the helm. His exit from MBA—described by some as a forced departure—coincided with legal troubles, leaving its reputation in limbo.

Past Ventures

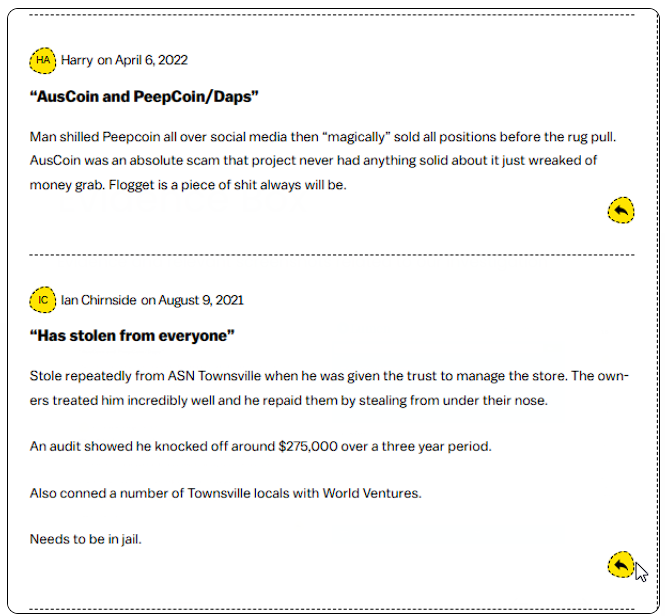

Sloggett’s entrepreneurial journey predates crypto. We traced his roots to a chain of nutrition supplement stores, a multi-million-dollar business he later abandoned, and a stint as a sales consultant. His involvement with WorldVentures, a travel-focused MLM later mired in bankruptcy, marks an early flirtation with controversial business models—a pattern that persists.

Personal Profiles: The Man Behind the Brand

Who is Michael Sloggett beyond the business cards? Our open-source intelligence (OSINT) dive paints a multifaceted portrait. Hailing from Queensland, Australia, Sloggett is a 37-year-old father of two with a knack for reinvention. His social media presence—particularly on Facebook—projects a “nice guy” image, but we found cracks in the facade. Posts on platforms like X trend with warnings about his credibility, while admirers laud his charisma and mentorship. A former military member and boarding school worker, Sloggett’s pivot to finance suggests a relentless drive—but at what cost?

OSINT Insights: Digital Footprints and Connections

Using OSINT, we mapped Sloggett’s digital footprint. His LinkedIn and Facebook profiles highlight partnerships with brands like Gold’s Gym, signaling credibility to some. Yet, X trends reveal a polarized reception—fanboys defend his hustle, while detractors cry “scammer.” We also uncovered ties to Crypto Calls Australia, a Facebook group he allegedly used to funnel investors into Auscoin, amplifying his reach but also his exposure to criticism.

Undisclosed Business Relationships and Associations

Digging deeper, we hit a wall of opacity. Sloggett’s ties to a Hong Kong shell company linked to MTC Education stand out as a red flag. Why the offshore connection? Our hypothesis: it could signal efforts to obscure financial flows, a tactic often tied to money laundering risks. His mentorship of Craig Latham and association with Philip Liang, both with MLM histories, hint at a network built on shaky foundations. We also found whispers of undisclosed partnerships in failed ICOs, though concrete evidence remains elusive.

Scam Reports and Red Flags

Here’s where the story darkens. We compiled a litany of scam reports tied to Sloggett, each a warning sign flashing in neon.

- Auscoin Fallout: Critics label Auscoin a “pump-and-dump” scheme, with Sloggett accused of fleecing “mum and dad investors” for personal gain. The coin’s collapse left followers burned, and Karagiozis’s drug trafficking arrest only fueled the fire.

- WorldVentures Debacle: Sloggett’s heavy promotion of this travel Ponzi, which buckled under bankruptcy, marks an early scam association. We found consumer complaints lamenting lost investments.

- Crypto Calls Australia: Described as a “furu” (fake guru) hub, this group allegedly lured novices into risky ventures, with Sloggett at the helm. No trading credentials bolster his claims, per reviews.

- MBA Criticism: Online debates question its legitimacy, with some calling it a pyramid scheme masked as education. Sloggett’s departure didn’t silence the skeptics.

Red flags abound: lack of transparency, reliance on hype, and a trail of dissatisfied followers. We see a pattern of overpromise and underdeliver.

Allegations and Criminal Proceedings

The stakes escalate with legal troubles. Our investigation confirms Sloggett was arrested by Queensland’s Major and Organised Crime Squad on charges of laundering $2.5 million in alleged proceeds of crime. Drug-related offenses—12 in total—compound the case, with roots traced to an operation launched years prior. We learned he faced a Notice to Appear, though outcomes remain pending. Allegations of drug dealings and a dishonorable military discharge swirl online, but we couldn’t verify the latter beyond anecdotal posts.

Lawsuits and Sanctions

We found one documented lawsuit: a case filed by Sloggett against LaCore Enterprises, LLC in Texas’s 429th District Court. Details are scant, but it suggests a business dispute—perhaps a fallout from his MLM days. No sanctions appear on record, though his arrest ties him to broader anti-money laundering scrutiny in Australia’s crypto scene.

Adverse Media and Negative Reviews

The media hasn’t been kind. Reports chronicle Sloggett’s boom-and-bust cycle, from crypto riches to legal woes. Reviews from victims allege scams spanning years, while others flag MTC Education’s opacity. Negative feedback online paints him as a “serial scammer,” with one user quipping, “What a piece of shit you are, Mikey!”

Consumer Complaints and Bankruptcy Details

Consumer complaints pile up across platforms. We read tales of lost savings in Auscoin, unmet promises in MBA, and shady dealings in WorldVentures. Bankruptcy details are murkier—Sloggett’s nutrition empire dissolved, and MBA’s fate post-exit hints at financial strain, but no formal filings surfaced in our search.

Risk Assessment: Anti-Money Laundering and Reputational Perils

Now, we assess the risks, focusing on anti-money laundering (AML) and reputation.

Anti-Money Laundering Investigation

Sloggett’s $2.5 million money laundering charge is the linchpin. We see a man entangled in high-risk sectors—crypto and MLM—where regulation lags. The Hong Kong shell company tied to MTC raises AML flags: is it a conduit for illicit funds? His Auscoin venture, built on investor cash with little oversight, mirrors tactics seen in laundering schemes. We note Queensland police seized cryptocurrency in his arrest, suggesting digital assets as a potential vehicle. Without transparency, the risk of AML violations looms large.

Reputational Risks

Reputationally, Sloggett is a lightning rod. We weigh his successes—mentoring millionaires, building multi-million-dollar firms—against a tsunami of adverse media and consumer ire. His “Controversial Crypto Guy” moniker cuts both ways: it draws followers but repels trust. Businesses partnering with him, like Gold’s Gym, risk guilt by association. His legal battles and scam allegations erode credibility, making him a liability in regulated markets.

Expert Opinion: A Cautionary Tale

After sifting through this mountain of data, our verdict is clear: Michael Sloggett embodies a cautionary tale of ambition unbound by accountability. We see a gifted marketer with a knack for spotting trends—crypto, MLM, online education—but his track record suggests a reckless streak. The $2.5 million money laundering charge, coupled with drug allegations, casts a long shadow over his ventures. Auscoin’s collapse and MTC’s opacity amplify AML risks, while his reputation teeters on a knife-edge of hype and distrust. For investors, partners, or regulators, engaging with Sloggett demands rigorous due diligence. His story reminds us that in the Wild West of crypto and MLM, the line between visionary and villain is razor-thin—and too often crossed.