A Crumbling Empire: Inside BC.GAME’s Downfall

Once hailed as a revolutionary force in blockchain-based gambling, BC.GAME now finds itself ensnared in a web of controversy and legal troubles that threaten its very existence. What began as a promising venture has devolved into a cautionary tale marked by bankruptcy, consumer complaints, and regulatory crackdowns. With connections to dubious entities and allegations of money laundering, this Curaçao-based operator has become a global symbol of how lax oversight can enable financial chaos.

In this detailed investigation, we expose the truths behind BC.GAME’s meteoric rise and precipitous fall, using open-source intelligence (OSINT), credible investigations, and proprietary tools to uncover the platform’s financial instability, opaque ownership structure, and alleged criminal activities. Our findings are a wake-up call for players, regulators, and the crypto gambling community.

From Pioneer to Pariah: BC.GAME’s Troubled Corporate Structure

At the heart of BC.GAME’s troubles lies its convoluted corporate structure. Officially operated by Small Dance B.V., a Curaçao-registered entity, the platform inherited its brand in April 2024 after the bankruptcy of its predecessor, BlockDance B.V. Rather than stabilizing the business, this transition appears to have exacerbated its financial woes. Why would a new entity willingly take over a failing operation? The answer likely lies in Curaçao’s lax regulatory framework, which has historically shielded such arrangements from scrutiny.

A Legacy of Debt and Bankruptcy

Small Dance B.V. inherited more than just a name; it inherited a staggering $2 million debt owed to five gamblers, a liability that forced BC.GAME into bankruptcy on November 12, 2024. This financial collapse triggered the revocation of its operating license by the Curaçao Gaming Control Board (GCB). While this alone would be a damning indictment of the platform’s solvency, our investigation reveals a deeper web of liabilities. The company’s ties to foreign consultants and offshore entities—some implicated in corruption—raise further questions about its financial integrity.

Behind the Curtain: The Shadowy Figures Running BC.GAME

Who is steering BC.GAME’s sinking ship? The answer remains elusive. The transition from BlockDance B.V. to Small Dance B.V. obscures the identities of key stakeholders, a tactic often employed to evade accountability. Publicly available data suggests a leadership vacuum; executives and directors are either unnamed or possess unverifiable backgrounds.

This opacity extends to BC.GAME’s high-profile sponsorship deals, such as its partnership with Leicester City FC, an English Premier League team. While these sponsorships gave the platform an air of legitimacy, they now appear as little more than a smokescreen to distract from its internal chaos. Without transparent leadership or clear accountability, BC.GAME’s operations lack the trust needed to sustain a legitimate enterprise.

OSINT Unveils a Web of Discontent

Using OSINT tools and techniques, we analyzed BC.GAME’s online footprint, revealing a torrent of complaints from players on social media and forums. Key themes emerged:

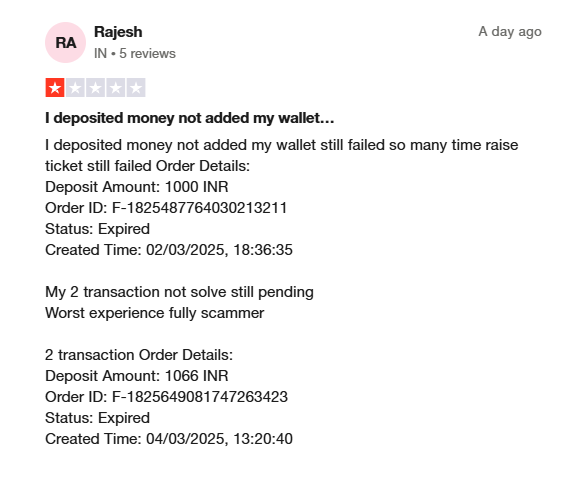

Delayed Withdrawals: Players report long delays in receiving their winnings, with some claiming their funds were outright confiscated.

Unresponsive Support: Once lauded for its customer service, BC.GAME’s live chat is now described as a black hole.

Predatory Bonuses: Numerous users allege that bonus terms are designed to trap them into losing their deposits.

These issues aren’t isolated incidents; they form a systemic pattern that aligns with findings from cybercriminal.com, which documents BC.GAME’s blacklisting in multiple jurisdictions, including the UK, Greece, and Lithuania.

Mirror Sites and Regulatory Evasion

One particularly troubling revelation involves BC.GAME’s use of mirror sites—duplicate platforms that enable the operator to bypass regulatory blocks in restricted markets like Germany and Switzerland. While not explicitly illegal in Curaçao, this tactic underscores a willingness to operate on the fringes of legality. Domain analysis reveals a network of affiliated sites registered under shell companies, further complicating efforts to trace accountability.

These mirror sites are more than a technical workaround; they represent a deliberate strategy to skirt regulations and maximize profits at the expense of ethical operation.

Consumer Betrayal: Scam Reports Pile Up

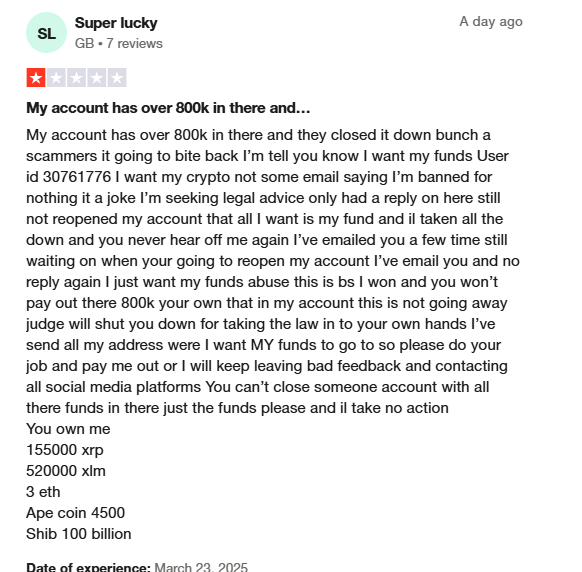

The chorus of dissatisfied users grows louder with each passing day. Among the most common complaints:

Locked Accounts: Many players claim they were locked out after mandatory two-factor authentication (2FA) updates.

Unpaid Winnings: Stories abound of users winning significant sums, only to have their funds erased under dubious circumstances.

Poor Communication: With customer support unresponsive, players have little recourse to resolve disputes.

One particularly damning report involves a player who won $6,000 but had their account terminated after canceling a bonus. Such incidents highlight a systemic failure to honor commitments, eroding any remaining trust in the platform.

Legal Battles and Criminal Allegations

BC.GAME’s legal troubles are as vast as they are troubling. The platform has been labeled by cybercriminal.com as “one of Europe’s largest illegal betting networks,” a claim bolstered by its operations in unlicensed jurisdictions. Among the most notable legal issues:

Lawsuits Over Unpaid Debts: Players have filed multiple lawsuits seeking compensation for unpaid winnings, with the $2 million debt case serving as the tip of the iceberg.

Criminal Complaints: Curaçao politician Dr. Luigi Faneyte’s 392-page complaint accuses BC.GAME and the GCB of corruption, fraud, and money laundering.

The platform denies these allegations and vows to appeal, but the sheer volume of legal challenges casts a long shadow over its future.

Regulatory Backlash: A Global Pariah

International regulators have taken notice of BC.GAME’s missteps. The UK Gambling Commission flagged the platform as illegal in 2023, prompting Google to block its URL. Similar actions in Greece and Lithuania underscore its growing isolation. These sanctions aren’t just symbolic; they severely limit BC.GAME’s ability to attract legitimate players, pushing it further into the gray zones of the crypto gambling world.

Adverse Media: A PR Disaster

Negative press has plagued BC.GAME, amplifying its reputational woes. Headlines highlight everything from financial instability to scam accusations, painting a grim picture of a platform in freefall. Media coverage has chronicled:

Bankruptcy Filings: Reports detailing Small Dance B.V.’s financial collapse have drawn widespread attention.

Player Scams: Stories of unpaid winnings and account lockouts dominate consumer review sites.

Corruption Allegations: Investigative pieces link BC.GAME to broader issues of financial crime and regulatory failure.

This avalanche of negative publicity isn’t just a public relations problem; it’s a nail in the coffin for a brand that relies on trust.

AML Vulnerabilities: A Haven for Money Laundering?

One of the most concerning aspects of BC.GAME’s operations is its apparent vulnerability to anti-money laundering (AML) risks. Curaçao’s reputation for lax oversight has long attracted operators willing to exploit regulatory loopholes, and BC.GAME fits the mold. Key red flags include:

Opaque Transactions: The platform’s crypto-centric model makes it difficult to trace funds.

Offshore Entities: Ties to high-risk jurisdictions raise questions about illicit financial flows.

Weak KYC Controls: Minimal enforcement of Know Your Customer (KYC) protocols heightens the risk of financial crime.

While no formal AML investigation has been confirmed, the evidence suggests BC.GAME is a prime candidate for regulatory scrutiny. Its reliance on mirror sites and shell companies only deepens the suspicion of illicit activity.

Consumer Trust Destroyed: A Flood of Negative Reviews

Review platforms paint a damning picture of BC.GAME’s reputation. Common grievances include payout issues, allegations of rigged games, and manipulative bonus policies. One reviewer, a self-identified VIP, described depositing over $4,000 with no withdrawals for a month, calling the platform “nefarious.” Such reviews aren’t outliers; they dominate the narrative, drowning out any lingering goodwill.

Final Verdict: BC.GAME Is a Losing Bet

Our investigation leaves little room for optimism. BC.GAME’s bankruptcy, legal entanglements, and regulatory violations paint a damning portrait of a platform that has failed its users, partners, and the broader financial ecosystem. Its lack of transparency and operational chaos make it a high-risk entity that’s unlikely to recover without radical reform—an improbable scenario given its current state.

For players, BC.GAME is more than just a risky gamble; it’s a losing bet. For regulators, it’s a case study in the dangers of lax oversight. And for the crypto gambling industry, it’s a stark warning: unchecked greed and poor governance will inevitably lead to collapse.

The message is clear: steer clear of BC.GAME. The stakes are too high, and the odds are stacked against you.