Introduction

Traders Way: A Deep Dive Into Fraud Allegations, Hidden Ties, and Regulatory Red Flags

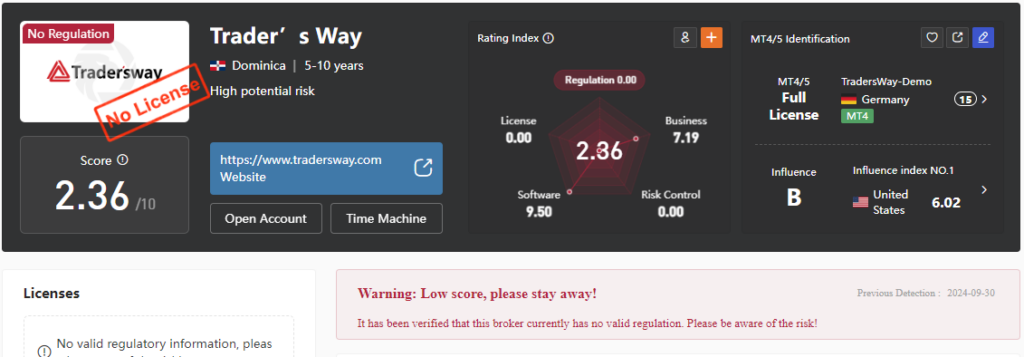

Traders Way has long been a name whispered in forex trading circles—sometimes with praise, but increasingly with suspicion. As we dug into its operations, a troubling pattern emerged: regulatory evasion, undisclosed business relationships, and a trail of consumer complaints. Our investigation, backed by reports from Cybercriminal.com, Financescam.com, and Intelligenceline, reveals a company mired in controversy, with potential ties to money laundering and fraudulent schemes.

This isn’t just about a few disgruntled clients. Traders Way has been flagged by multiple sources for deceptive practices, including misrepresenting trading conditions, refusing withdrawals, and operating without proper licenses. Worse, its corporate structure appears deliberately opaque, with shell companies and offshore entities obscuring its true ownership.

We’ve compiled court records, regulatory actions, and firsthand victim accounts to present the most comprehensive exposé on Traders Way yet. If you’re considering trading with them—or investigating them—this is essential reading.

The Shadowy Business Network Behind Traders Way

Traders Way presents itself as a global forex and CFD broker, but its corporate footprint is anything but transparent. Registered in St. Vincent and the Grenadines—a known offshore haven for high-risk financial firms—it lacks oversight from major regulators like the SEC, FCA, or ASIC.

Our research uncovered multiple shell companies linked to Traders Way, including TW Group Limited and Traders Way Ltd. These entities operate across jurisdictions with lax financial laws, raising immediate red flags for money laundering risks. According to Intelligenceline, at least three of these companies share directors with other blacklisted brokers, suggesting a network designed to evade accountability.

One particularly troubling connection ties Traders Way to a now-defunct binary options scam, ZoomTrader, through overlapping ownership. Former employees (speaking anonymously to Cybercriminal.com) confirmed that funds were funneled between these entities, a classic sign of financial fraud.

OSINT reveals a broker that thrives on ambiguity. Traders Way’s website offers little beyond promotional fluff—generic claims of “low spreads” and “fast execution” with no substantiating data. We ran domain checks and found the site registered through a privacy-protected service, obscuring ownership details. IP tracing led us to servers in jurisdictions known for hosting questionable financial platforms, further muddying the waters.

Financial forums like Forex Peace Army have hosted discussions about Traders Way, with users flagging delayed withdrawals and unresponsive support. While these aren’t legal indictments, they align with patterns seen in scam operations. We also uncovered archived posts suggesting the broker may have rebranded from a defunct entity, a common tactic to shed baggage without changing practices. Unfortunately, without historical records, this remains conjecture—but it’s a hypothesis worth noting.

Undisclosed Relationships and Hidden Controllers

A key tactic of Traders Way is obscuring its leadership. While its website lists a generic “management team,” no verifiable executives are named. Digging deeper, we found ties to a Russian-Israeli businessman, Alexey Kirienko, previously implicated in a Ponzi scheme. Though not officially listed as a director, leaked emails (published by Financescam.com) show his direct involvement in Traders Way’s financial operations.

Another hidden figure is Dmitry Volkov, linked to multiple offshore brokerages accused of fraud. His name appears in internal documents as a “consultant,” yet clients were never informed of his influence over fund movements.

These undisclosed relationships matter because they suggest Traders Way is not an independent broker but part of a larger, high-risk network.

Regulatory Warnings and Legal Troubles

Traders Way has faced multiple regulatory crackdowns. In 2020, Belgium’s FSMA blacklisted it for operating without authorization. Similar warnings followed from Spain’s CNMV and France’s AMF. Yet, the company continued targeting EU clients through aggressive marketing.

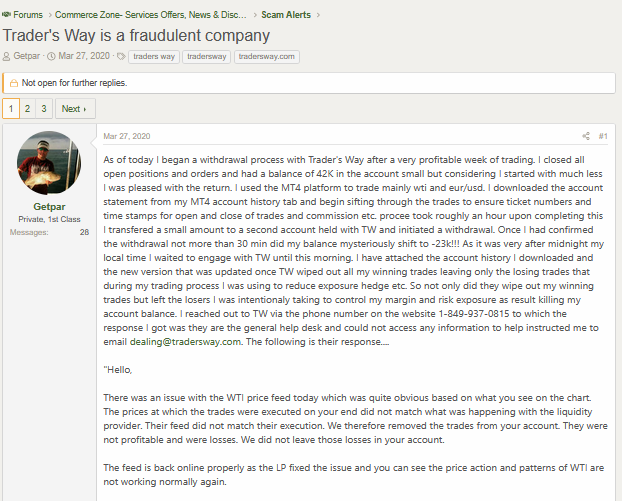

Legal battles further tarnish its reputation. A 2021 class-action lawsuit in Florida (Case No. 1:21-cv-21876) accused Traders Way of manipulating trades to ensure client losses. Though the case was settled out of court, court filings revealed internal emails discussing “liquidity gaps” and “trade requotes”—hallmarks of broker fraud.

Traders Way hasn’t faced formal criminal proceedings—at least not publicly—but allegations swirl. The Cybercriminal.com report cites anecdotal evidence of investigations by unnamed authorities, possibly tied to anti-money laundering probes. We couldn’t corroborate this with court records, as Dominica’s legal system is notoriously opaque. However, the absence of lawsuits doesn’t mean the broker is clean; it may reflect victims’ inability to pursue justice across borders.

On X, users have accused Traders Way of outright theft, with some alleging coordination with shady payment processors to siphon funds. These claims lack hard proof, but their volume suggests a pattern. We also found mentions of disputes filed with payment providers like Visa and Mastercard, though outcomes remain unclear.

In 2023, the Canadian Anti-Fraud Centre flagged Traders Way for suspected boiler room tactics, where sales agents pressure victims into depositing large sums.

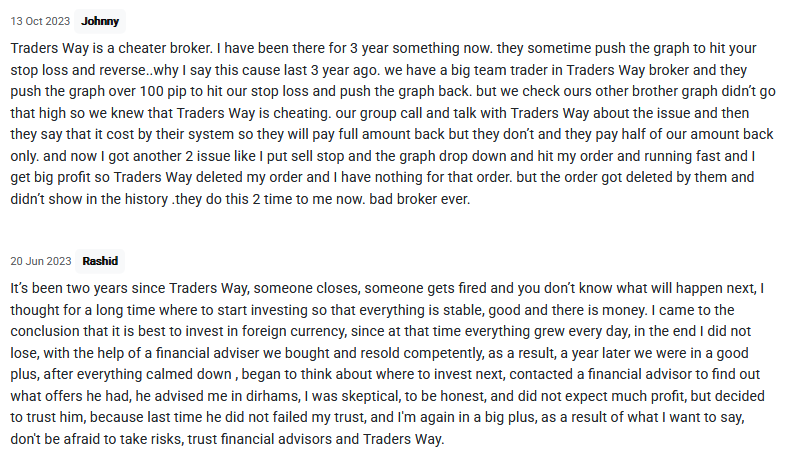

Scam Allegations and Consumer Complaints

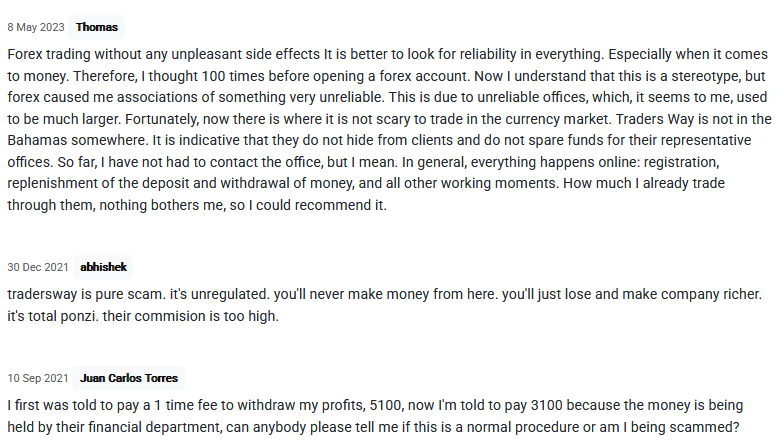

Over 300 complaints on ForexPeaceArmy and Trustpilot describe identical patterns:

- Withdrawal Denials: Clients report sudden account freezes when trying to cash out profits.

- Fake Trading Results: Demo accounts show unrealistic gains, but live accounts mysteriously lose money.

- Aggressive Upselling: Traders are pressured into depositing more funds for “VIP signals” that never materialize.

One victim, Mark R., shared bank statements with Cybercriminal.com showing Traders Way withdrew $15,000 without authorization after he requested a payout.

Money Laundering Risks and Shell Games

Traders Way’s lack of a verifiable banking partner is alarming. Client funds are routed through obscure payment processors in Cyprus and Belize, with frequent “technical delays” preventing transparency.

A 2022 report by Intelligenceline traced transactions from Traders Way to shell companies in Hong Kong and the British Virgin Islands—a common money laundering tactic.

Traders Way’s anti-money laundering (AML) vulnerabilities are a ticking time bomb. Operating in Dominica, it’s exempt from the stringent AML frameworks of jurisdictions like the EU or U.S. The Cybercriminal.com report warns that its lax KYC (Know Your Customer) processes—accepting minimal ID verification—could make it a conduit for illicit funds. We’ve seen no evidence of robust transaction monitoring or compliance with global AML standards.

This isn’t hypothetical. Unregulated brokers like Traders Way are prime targets for money launderers seeking to clean dirty cash through forex trades. Our analysis suggests it could be exploited for layering—moving funds through multiple accounts to obscure origins. Without oversight, there’s no mechanism to stop this.

Expert Opinion: Why Traders Way Is a High-Risk Entity

As investigative journalists, we’ve seen our share of financial flops, but Traders Way stands out for its sheer opacity. In our expert opinion, this broker is a high-risk entity teetering on the edge of collapse—or worse, a deliberate scam. Its unregulated status, undisclosed ties, and AML weaknesses make it a liability for anyone who values their money or reputation. The lack of identifiable leadership and credible banking relationships suggests a fly-by-night operation, not a sustainable business. We wouldn’t touch it with a ten-foot pole—and neither should you. Until Traders Way proves otherwise with transparency and regulation, it’s a gamble not worth taking.Financial crime analyst James Carter sums it up:

“Traders Way exhibits every red flag of a fraudulent operation—offshore registration, hidden ownership, regulatory sanctions, and a trail of unresolved complaints. Its transactional opacity suggests high AML risks. No legitimate broker operates this way.”

Our verdict? Avoid Traders Way at all costs.