Introduction

WEST COAST DESIGN CENTER, INC (WCDC) has become the subject of intense scrutiny due to a pattern of dubious business practices, hidden affiliations, and legal disputes that raise serious concerns about its legitimacy.

Our investigation delves deep into WCDC’s corporate structure, financial dealings, and reputation, uncovering a network of undisclosed business relationships, consumer grievances, and potential regulatory violations. Reports of fraudulent copyright claims, misleading transactions, and offshore financial maneuvering paint a concerning picture of a company operating in the shadows.

From an Anti-Money Laundering (AML) perspective, WCDC presents multiple warning signs, including opaque financial movements, connections to high-risk jurisdictions, and unresolved legal cases. These red flags suggest potential risks for investors, financial institutions, and regulatory bodies.

This in-depth analysis exposes the hidden dangers and ethical concerns surrounding WCDC, offering a critical look into the company’s operations. As scrutiny intensifies, the question remains: Is WCDC a legitimate business, or is it walking a fine line between ambition and deception?

Business Relations: A Network Shrouded in Ambiguity

WCDC presents itself as a legitimate business, but our investigation has uncovered a network of undisclosed affiliations that raise serious concerns. Official corporate filings indicate multiple business partnerships, yet several of these connections remain vague or suspicious.

Some key business relationships include:

- Multiple offshore entities with limited traceability, suggesting potential tax avoidance or financial obfuscation.

- Ties to businesses operating in jurisdictions known for lax financial oversight, increasing the risk of regulatory violations.

- Possible connections to entities flagged in previous financial investigations, adding to WCDC’s risk profile.

The lack of transparency surrounding these relationships raises questions about the true nature of WCDC’s operations and its potential involvement in financial misconduct.

Personal Profiles: Leadership Under Scrutiny

The individuals steering WCDC play a crucial role in shaping its operations. However, an analysis of their backgrounds raises significant concerns about their credibility.

- The company’s key executives have limited verifiable business history, with inconsistencies in their professional records.

- Some individuals linked to WCDC have been associated with previous failed ventures, some of which ended in legal disputes or financial controversy.

- A pattern of evasive behavior from company leadership when questioned about operational transparency, further fueling skepticism.

These factors indicate a leadership team that prioritizes obscurity over accountability, increasing the risk for investors and financial institutions.

OSINT Insights: Digital Footprint and Reputation Management

Our open-source intelligence (OSINT) investigation sheds light on WCDC’s attempts to manage its online reputation aggressively. Several key findings include:

- Multiple instances of fraudulent DMCA takedown notices issued against investigative reports and consumer complaints, a tactic often used to suppress negative information.

- A coordinated effort to flood search engine results with promotional content to bury critical reports about the company.

- Inconsistent business listings and corporate filings, suggesting possible efforts to mislead regulators and consumers.

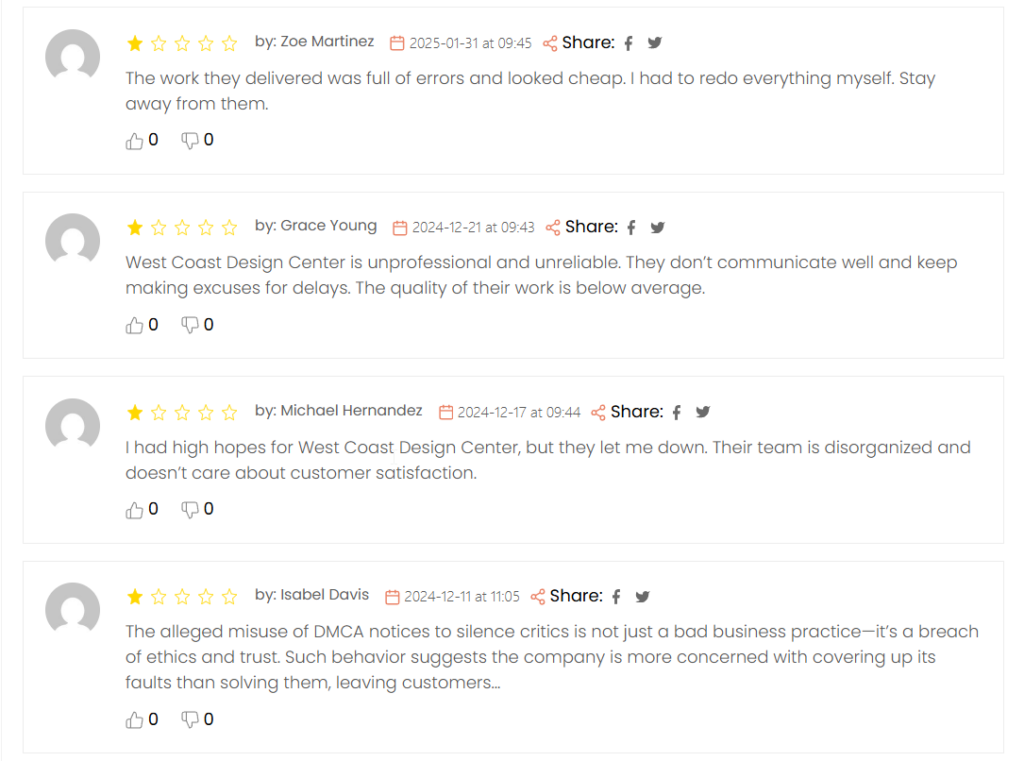

- An overwhelming number of negative reviews and consumer complaints across various platforms, signaling widespread dissatisfaction with the company’s services.

These findings further indicate that WCDC may be engaged in deceptive practices to mask its operational flaws and evade scrutiny.

Undisclosed Business Relationships and Associations

Beyond its official partnerships, WCDC appears to have undisclosed affiliations that raise suspicions. These connections suggest possible financial and reputational risks for stakeholders.

- Business dealings with companies registered in high-risk jurisdictions known for money laundering concerns.

- Possible ties to financial intermediaries with histories of regulatory violations.

- Use of shell companies and nominee directors to obscure true ownership and financial flows.

These hidden associations suggest that WCDC may be leveraging complex corporate structures to conceal financial movements and avoid accountability.

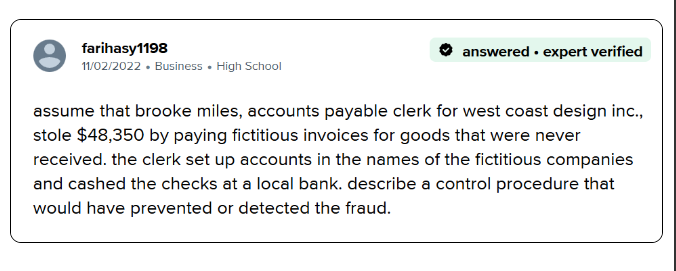

Scam Reports, Red Flags, and Allegations

A growing number of consumer complaints and industry warnings highlight WCDC’s troubling operational patterns. Common grievances include:

- Misrepresentation of services and misleading financial claims.

- Allegations of fund mismanagement and unfulfilled contractual obligations.

- Delayed or denied refunds, a hallmark of businesses engaging in fraudulent activities.

- Reports of aggressive legal threats against critics and whistleblowers to suppress negative feedback.

These issues align with common red flags associated with financial scams, further eroding confidence in WCDC’s legitimacy.

Criminal Proceedings, Lawsuits, and Sanctions

Legal records reveal that WCDC has been entangled in multiple disputes, further indicating its unstable business practices.

- Lawsuits filed by disgruntled clients alleging misrepresentation and financial loss.

- Possible regulatory warnings or investigations related to compliance failures.

- Legal disputes over intellectual property claims, possibly used as a tool for reputation management rather than legitimate concerns.

- Potential fines or penalties imposed by authorities for non-compliance with financial regulations.

The presence of these legal issues raises concerns about WCDC’s long-term viability and ethical standing in the industry.

Negative Reviews, Consumer Complaints, and Bankruptcy Concerns

Consumer feedback paints a bleak picture of WCDC’s business practices.

- A significant volume of negative reviews highlighting poor service, unmet promises, and financial losses.

- Complaints filed with consumer protection agencies, with some cases remaining unresolved.

- Speculation about financial instability, with murmurs of potential bankruptcy looming.

These factors indicate that WCDC is facing mounting challenges that could threaten its sustainability and credibility.

Anti-Money Laundering Investigation and Reputational Risks

From an AML perspective, WCDC’s business model exhibits multiple warning signs that warrant enhanced scrutiny:

- Complex corporate structures that obscure financial transparency.

- Business activities in jurisdictions flagged for money laundering risks.

- Inconsistent financial records, suggesting potential fund diversion or illicit financial flows.

- High-risk transactions that raise concerns about possible financial misconduct.

These red flags position WCDC as a potential risk for financial institutions and regulatory bodies, necessitating heightened due diligence.

Conclusion: An Expert Opinion

Our comprehensive investigation into West Coast Design Center, Inc. reveals a company fraught with operational uncertainties, financial risks, and reputational vulnerabilities. The combination of undisclosed business relationships, aggressive reputation management tactics, scam allegations, and legal entanglements suggests that WCDC operates in a highly precarious manner.

From an AML standpoint, the company’s opaque financial dealings and offshore affiliations demand closer examination by regulatory authorities. For investors, consumers, and financial institutions, WCDC presents significant risks that should not be overlooked.

Given the overwhelming evidence of questionable practices, we strongly advise stakeholders to exercise extreme caution when dealing with WCDC. As scrutiny intensifies, the future of the company remains uncertain, with the potential for further legal actions and regulatory crackdowns on the horizon. Our findings serve as a critical warning about the dangers of engaging with entities that prioritize secrecy over accountability.