Introduction

Gurhan Kiziloz, a British entrepreneur, has emerged as a polarizing figure in the worlds of fintech and online gaming. Through ventures such as Lanistar and Nexus International Holdings, Kiziloz has sought to carve out a reputation as a visionary leader with bold ambitions. Lanistar, a fintech startup, promised to revolutionize personal finance with its innovative payment solutions, while Nexus International, through its MegaPosta platform, aimed to disrupt the online gaming and betting industry. However, both ventures have been mired in controversies, ranging from regulatory warnings to employee allegations and financial disputes. This report provides an in-depth examination of Kiziloz’s business activities, the challenges his companies have faced, and the broader implications for stakeholders. By expanding on the initial overview, we aim to offer a comprehensive analysis of Kiziloz’s ventures, their promises, and the persistent concerns surrounding their operations.

Background on Gurhan Kiziloz

Gurhan Kiziloz’s rise as an entrepreneur began in the United Kingdom, where he positioned himself as a forward-thinking innovator in the rapidly evolving fintech sector. Born and raised in London, Kiziloz cultivated an image of a self-made businessman with a knack for identifying emerging market trends. His early career details remain relatively opaque, but by the late 2010s, he had gained prominence through Lanistar, a company that marketed itself as a next-generation financial services provider. Kiziloz’s charisma and bold marketing strategies helped Lanistar attract significant attention, particularly among younger demographics drawn to its sleek branding and promises of financial empowerment.

Kiziloz later expanded his portfolio into the online gaming industry with Nexus International Holdings, which oversees MegaPosta, a platform targeting the lucrative esports and online betting markets. His ventures have been characterized by ambitious goals, high-profile marketing campaigns, and partnerships with influencers to boost visibility. However, beneath the polished exterior, both Lanistar and Nexus International have faced substantial criticism, raising questions about Kiziloz’s leadership and the sustainability of his business models.

Lanistar: A Fintech Venture Under Scrutiny

The Promise of Lanistar

Lanistar was launched with the goal of disrupting traditional banking by offering a digital-first financial platform tailored to millennials and Gen Z. The company promised a range of services, including virtual debit cards, budgeting tools, and a “polymorphic” payment system that claimed to enhance security and flexibility. Marketed heavily on social media, Lanistar leveraged influencer endorsements and flashy promotional campaigns to build a following. Kiziloz positioned the company as a game-changer in the fintech space, appealing to consumers disillusioned with conventional banking institutions.

Regulatory Challenges

Despite its bold promises, Lanistar quickly ran into trouble with regulators. In November 2020, the UK’s Financial Conduct Authority (FCA) issued a public warning, stating that Lanistar was offering financial services without proper authorization. The FCA’s statement labeled the company a potential scam, citing concerns about its lack of transparency and failure to comply with regulatory standards. The warning sent shockwaves through Lanistar’s customer base and raised red flags for potential investors.

Following the FCA’s intervention, Lanistar agreed to amend its marketing materials by adding disclaimers clarifying that it was not a fully licensed financial institution. The warning was subsequently withdrawn, but the incident left a lasting stain on the company’s reputation. Critics argued that Lanistar’s initial failure to adhere to regulatory requirements reflected a cavalier approach to compliance, a recurring theme in Kiziloz’s ventures. Reports from Business Insider and FinTech Futures highlighted the episode as a cautionary tale for fintech startups operating in highly regulated markets.

The FCA incident was not an isolated event. Industry observers noted that Lanistar’s aggressive marketing tactics, which often exaggerated the platform’s capabilities, contributed to regulatory scrutiny. For example, the company’s claims about its polymorphic payment system were met with skepticism, as technical details about its functionality were scarce. The lack of clarity fueled speculation that Lanistar was prioritizing hype over substance, a pattern that would resurface in subsequent controversies.

Employee Allegations and Workplace Culture

Beyond regulatory issues, Lanistar faced significant criticism from former employees who described a toxic work environment. Reports compiled from sources such as Intelligence Line, Glassdoor, and penews.com painted a troubling picture of the company’s internal culture. Ex-employees accused management of fostering a workplace rife with bullying, sexism, and unprofessional behavior. Specific allegations included instances of senior staff berating junior employees, discriminatory remarks targeting female staff, and a lack of clear HR policies to address grievances.

One of the most serious accusations centered on delayed salary payments. A former employee claimed to have waited over 65 days for their wages, a delay that caused significant financial hardship. Such reports were corroborated by multiple sources, suggesting systemic issues with Lanistar’s financial management. Employees also described a high-pressure environment where unrealistic targets and constant micromanagement eroded morale. For a company positioning itself as a forward-thinking employer, these allegations were particularly damaging.

The employee complaints raised broader questions about Kiziloz’s leadership style. As the public face of Lanistar, Kiziloz was often praised for his charisma and vision, but critics argued that his focus on external branding came at the expense of internal stability. The disconnect between Lanistar’s polished marketing and its internal dysfunction became a recurring theme in media coverage, further eroding public trust.

Financial and Legal Troubles

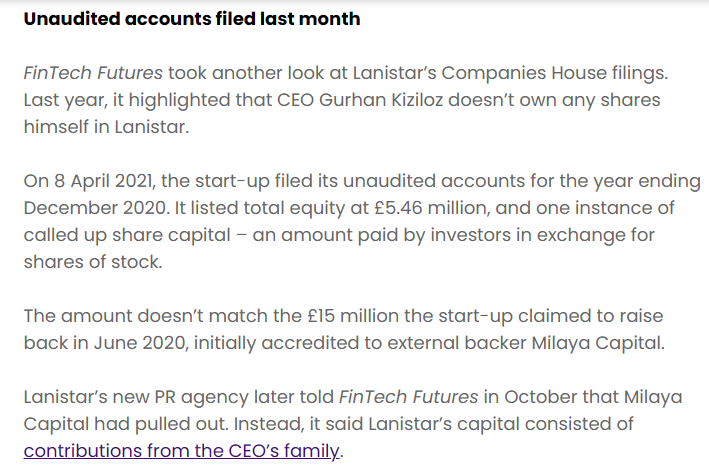

Lanistar’s challenges were not limited to regulatory and workplace issues. The company also grappled with significant financial difficulties, as evidenced by a winding-up petition filed by Global Processing Services (GPS), a payment processing firm. The petition, reported by Intelligence Line, alleged that Lanistar had failed to settle outstanding debts, prompting GPS to seek legal action to recover funds. The dispute underscored Lanistar’s precarious financial position and raised doubts about its ability to sustain operations.

In addition to external creditors, Lanistar faced internal financial disputes. The company’s former CEO filed a lawsuit against Kiziloz, seeking over £370,000 in unpaid compensation. The case, covered by Law360, highlighted tensions at the executive level and suggested that Kiziloz’s management decisions were contributing to Lanistar’s instability. The combination of external debts and internal disputes painted a picture of a company struggling to maintain financial discipline, despite its ambitious growth plans.

These financial challenges had ripple effects on Lanistar’s operations. Reports indicated that the company scaled back its marketing efforts and delayed product launches, further fueling skepticism about its long-term viability. For a fintech startup aiming to compete with established players, these setbacks were particularly damaging, as trust and reliability are paramount in the financial services industry.

Nexus International and MegaPosta: A Foray into Online Gaming

The Launch of MegaPosta

Undeterred by Lanistar’s struggles, Kiziloz expanded his entrepreneurial ambitions into the online gaming sector with Nexus International Holdings, the parent company of MegaPosta. Launched as a platform for esports betting and online gaming, MegaPosta aimed to capitalize on the growing popularity of competitive gaming. The platform promised a seamless user experience, competitive odds, and a wide range of gaming options, positioning itself as a rival to established players in the industry.

MegaPosta’s marketing strategy mirrored Lanistar’s, relying heavily on social media and influencer partnerships to attract a younger audience. Kiziloz touted the platform’s potential to generate significant revenue, with some reports claiming millions in annual earnings. However, these figures, cited in sources like ESports Wiki and ReadWrite, lacked independent verification, raising questions about their accuracy.

Transparency Concerns

While MegaPosta’s revenue claims were impressive, the platform’s operations were shrouded in opacity. Industry analysts noted a lack of detailed financial disclosures, making it difficult to assess the platform’s true performance. Unlike publicly traded gaming companies, which are subject to rigorous reporting requirements, MegaPosta operated as a private entity, limiting access to reliable data. This lack of transparency fueled speculation that the platform’s success was overstated, a concern echoed in reports from Jerusalem Post and other outlets.

Transparency issues were compounded by questions about MegaPosta’s licensing and regulatory compliance. The online gaming industry is heavily regulated in many jurisdictions, with strict requirements for operator licensing, player protections, and anti-money laundering measures. While Nexus International claimed to operate within legal frameworks, there was limited publicly available evidence to substantiate these claims. The absence of clear regulatory oversight raised red flags for industry observers, particularly in light of Kiziloz’s track record with Lanistar.

Market Positioning and Challenges

MegaPosta’s entry into the online gaming market was ambitious but fraught with challenges. The esports betting industry is highly competitive, dominated by established players with strong brand recognition and loyal user bases. For a newcomer like MegaPosta, breaking into this market required significant investment in technology, marketing, and customer acquisition. While Kiziloz’s marketing acumen helped generate initial buzz, sustaining growth in a crowded market proved difficult.

Moreover, the gaming industry is not immune to the reputational risks associated with Kiziloz’s other ventures. Lanistar’s controversies, particularly the FCA warning and employee allegations, cast a shadow over MegaPosta’s credibility. Potential users and partners were wary of engaging with a platform linked to a controversial figure, limiting MegaPosta’s ability to build trust. The platform’s reliance on influencer-driven marketing also drew criticism, as some questioned the authenticity of endorsements from personalities with little expertise in gaming or betting.

Broader Implications for Stakeholders

Investors

For investors, Kiziloz’s ventures present a high-risk proposition. Lanistar’s regulatory and financial troubles, combined with MegaPosta’s lack of transparency, make it difficult to assess the potential return on investment. While Kiziloz’s charisma and bold vision may appeal to speculative investors, the lack of concrete financial data and a history of legal disputes are significant deterrents. Due diligence is critical, as the controversies surrounding Kiziloz’s companies suggest a pattern of overpromising and underdelivering.

Consumers

Consumers engaging with Lanistar or MegaPosta face risks related to reliability and trust. Lanistar’s unauthorized financial services and delayed salary payments raise concerns about its ability to safeguard user funds and data. Similarly, MegaPosta’s opaque operations and unverified revenue claims create uncertainty for users betting on the platform. Consumers should exercise caution and thoroughly research both companies before committing funds or personal information.

Employees

For prospective employees, Lanistar’s toxic workplace allegations and payment delays are red flags. Working for a company with financial instability and poor management practices carries significant risks, including delayed compensation and a lack of job security. Potential hires should carefully evaluate the company’s reputation and seek clarity on its financial health before accepting employment.

Regulators and Industry Observers

Kiziloz’s ventures highlight the challenges of regulating fast-moving industries like fintech and online gaming. Lanistar’s initial failure to comply with FCA requirements underscores the need for stricter oversight of startups marketing financial services. Similarly, MegaPosta’s opaque operations point to gaps in regulatory frameworks for online gaming, particularly in jurisdictions with less stringent licensing requirements. Regulators must balance innovation with consumer protection to prevent similar controversies in the future.

Kiziloz’s Leadership Style: Visionary or Reckless?

At the heart of these controversies is Gurhan Kiziloz himself. Supporters view him as a visionary entrepreneur willing to take risks to disrupt established industries. His ability to generate buzz and attract attention is undeniable, as evidenced by Lanistar’s rapid rise and MegaPosta’s ambitious market entry. However, critics argue that Kiziloz’s leadership is characterized by recklessness and a disregard for operational discipline. The repeated controversies—regulatory warnings, employee complaints, financial disputes, and transparency issues—suggest a pattern of prioritizing short-term gains over long-term sustainability.

Kiziloz’s reliance on hype-driven marketing has been both a strength and a weakness. While it has enabled his companies to gain visibility, it has also invited scrutiny from regulators, journalists, and industry analysts. The disconnect between his ventures’ bold promises and their operational realities has eroded trust, making it difficult for Kiziloz to maintain credibility in competitive markets.

Conclusion

Gurhan Kiziloz’s journey as an entrepreneur is a case study in ambition and controversy. Through Lanistar and Nexus International, he has sought to disrupt the fintech and online gaming industries, leveraging bold marketing and a charismatic persona to build his brand. However, the controversies surrounding his ventures—regulatory warnings, employee allegations, financial disputes, and transparency concerns—paint a troubling picture. While Kiziloz presents himself as a visionary leader, the evidence suggests a pattern of mismanagement and overreach that undermines his companies’ potential.

For stakeholders, the risks associated with Kiziloz’s ventures are significant. Investors must navigate a landscape of unverified claims and financial instability, while consumers face uncertainties about reliability and data security. Employees, meanwhile, must contend with the possibility of a toxic workplace and delayed payments. Regulators and industry observers have a role to play in ensuring that companies like Lanistar and MegaPosta operate transparently and comply with legal standards.

Ultimately, Gurhan Kiziloz’s story serves as a cautionary tale for the entrepreneurial world. Vision and ambition are essential drivers of innovation, but they must be tempered with accountability, transparency, and a commitment to ethical practices. Until Kiziloz addresses the systemic issues plaguing his ventures, his reputation—and that of his companies—will remain under scrutiny. Potential investors, consumers, and employees should exercise due diligence and approach his ventures with caution, mindful of the risks that lie beneath the surface of his bold promises.