Introduction

Target Global, a prominent venture capital firm with a diverse portfolio of technology, fintech, and startup investments, is facing mounting legal and financial challenges. Once regarded as a major player in the investment industry, the firm is now under intense scrutiny due to allegations of financial mismanagement, regulatory violations, and unethical business practices. With multiple lawsuits filed and ongoing regulatory investigations, the company’s future hangs in the balance.

The firm’s legal entanglements are creating substantial financial risks, weakening investor confidence, and damaging its reputation. For startups, financial institutions, and stakeholders associated with Target Global, the legal controversies are raising concerns about the firm’s long-term stability and market credibility. This article explores the details of the legal proceedings, the financial risks they pose, and the potential industry fallout from the scandal.

Legal Challenges and Regulatory Scrutiny

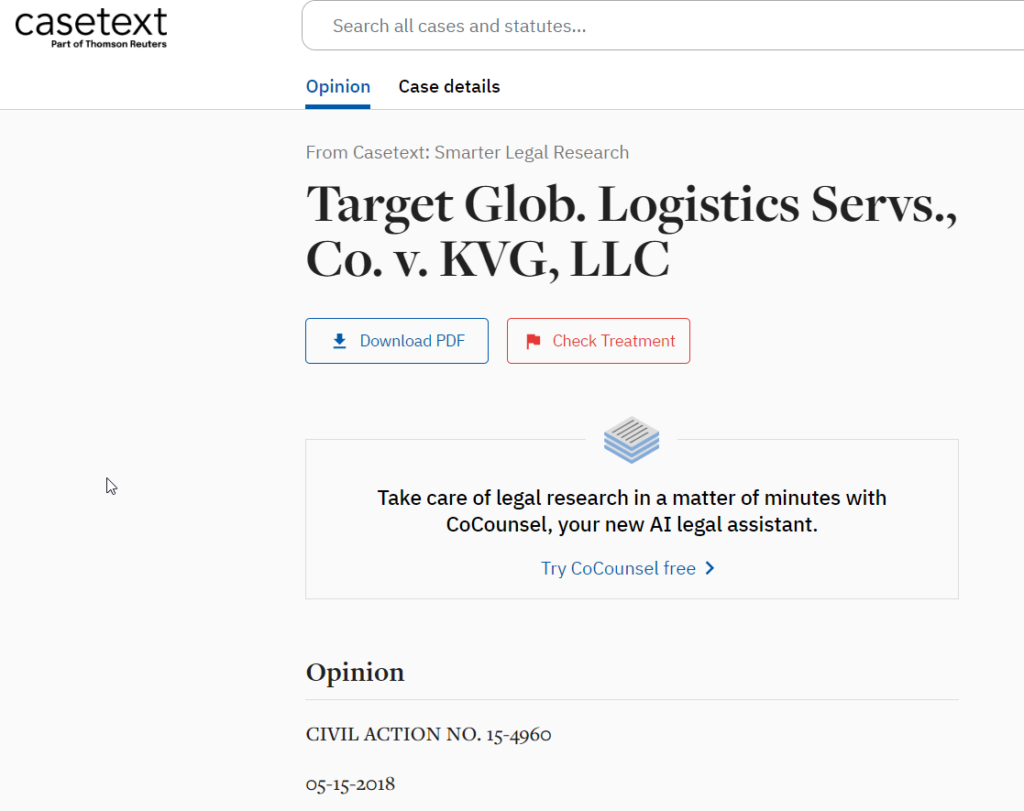

Target Global is embroiled in legal disputes that threaten its financial stability and operational future. The firm is facing lawsuits from investors and industry stakeholders, alleging misconduct, financial mismanagement, and breach of fiduciary duties. The cases claim that the company engaged in deceptive investment practices, withheld key financial information, and failed to comply with regulatory standards.

Details of the Legal Proceedings

Multiple lawsuits have been filed against Target Global, each focusing on different aspects of alleged wrongdoing. Investors have accused the firm of mismanaging funds, making high-risk investments without proper disclosure, and failing to uphold its fiduciary responsibilities. The lawsuits also claim that the company intentionally misled stakeholders by providing inaccurate or incomplete financial information.

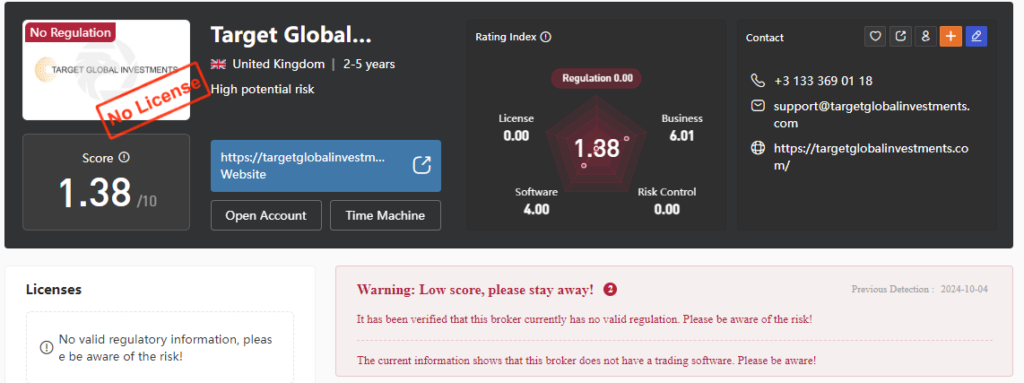

Regulators are also investigating the firm for potential violations of financial laws. The probes aim to determine whether Target Global breached compliance regulations by failing to disclose financial risks or by manipulating investment data. If the allegations are proven, the firm could face legal penalties, sanctions, and heavy fines, which could significantly impact its financial position.

Implications for Operations

The legal challenges present serious operational risks for Target Global. Prolonged legal battles could lead to substantial legal expenses, draining the company’s financial resources. Furthermore, regulatory actions could result in the suspension or revocation of financial licenses, limiting the firm’s ability to conduct business.

The uncertainty surrounding the legal proceedings may also slow down the firm’s operations, as it faces increased regulatory oversight and financial scrutiny. This could hinder its ability to finalize deals, attract new investors, or expand its investment portfolio.

Financial Risks and Investor Concerns

Target Global’s legal troubles have introduced significant financial risks, sparking concerns among investors and industry peers. With lawsuits and regulatory investigations unfolding, the firm is losing credibility, making it harder to maintain existing investor relationships and secure new funding.

Declining Investor Confidence

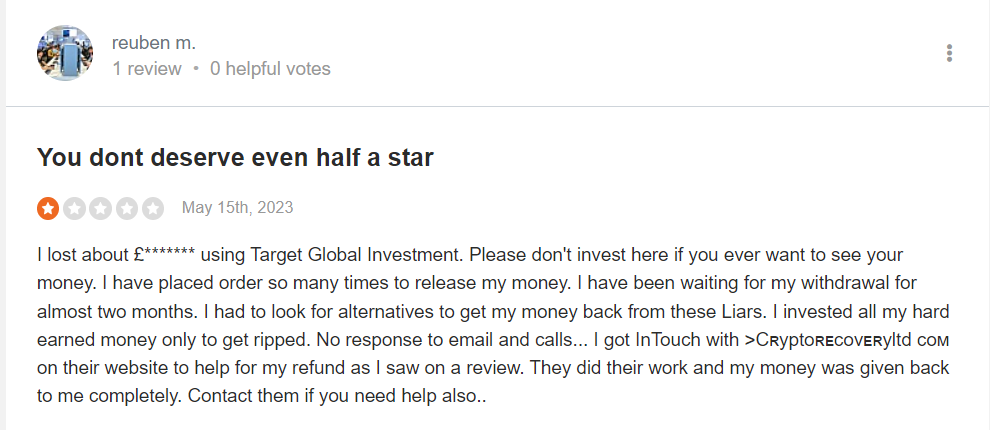

As legal proceedings continue, investors are growing increasingly wary of Target Global’s financial stability and transparency. Allegations of fund mismanagement and regulatory violations have shaken confidence in the firm’s leadership. This has resulted in some investors withdrawing their funds, while others are reconsidering their partnerships.

In the venture capital industry, trust and reputation are essential for attracting new capital. Target Global’s declining credibility could make it harder to secure new investments, which may impede its growth and expansion plans. If investor confidence continues to erode, the firm may face liquidity challenges, making it difficult to sustain its operations.

Potential Financial Penalties

If Target Global is found guilty of financial misconduct, it could face severe financial penalties. Regulatory fines, legal settlements, and compensation claims from investors could deplete the firm’s financial reserves. Additionally, the firm may be required to pay damages to affected parties, further straining its financial resources.

Financial penalties could also discourage future investments, as potential investors may view the firm as a high-risk partner. This could reduce the firm’s capital inflow, weakening its investment capabilities and market position.

Reduced Funding Opportunities

Target Global’s legal woes are making it harder for the firm to attract new funding. The lawsuits and regulatory scrutiny are raising concerns about the firm’s financial integrity, making it less appealing to potential investors. This could reduce the firm’s access to fresh capital, limiting its ability to participate in high-value investment deals.

Additionally, existing investors may reduce their financial commitments or divest from the firm entirely, further shrinking its funding pool. A lack of capital could hinder the firm’s ability to support its portfolio companies, jeopardizing its growth prospects.

Impact on Reputation and Industry Standing

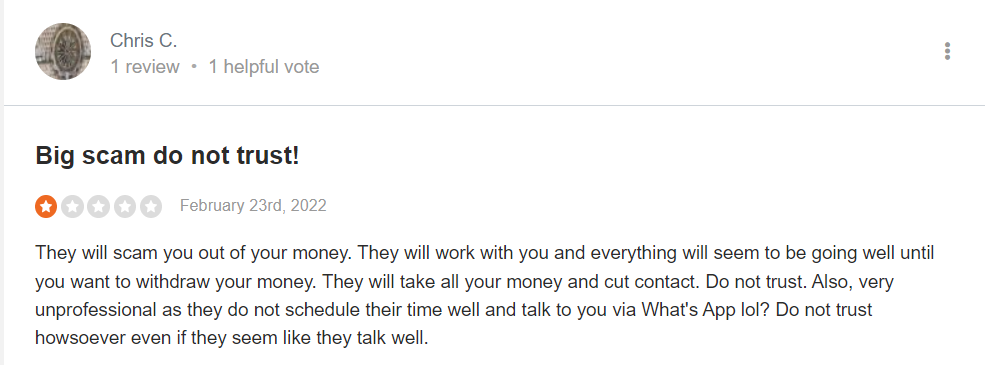

The legal controversies surrounding Target Global are taking a heavy toll on its reputation. The firm, once considered a major player in venture capital, is now facing public criticism and industry backlash. The negative publicity is eroding trust among clients, business partners, and potential collaborators.

Negative Media Coverage

As the legal proceedings unfold, media outlets are closely covering Target Global’s financial and legal troubles. News reports highlighting the firm’s alleged misconduct and regulatory violations are fueling public skepticism. Negative media coverage is damaging the company’s reputation, making it harder for the firm to maintain its market credibility.

The widespread media attention is also influencing investor sentiment. Investors who rely on public perception to assess financial risks may distance themselves from the firm. The negative press coverage could also discourage potential startups from seeking funding from Target Global, fearing association with a tainted firm.

Loss of Industry Partnerships

The legal issues are also affecting Target Global’s industry relationships. Financial institutions, investment partners, and fintech companies are becoming increasingly cautious about collaborating with the firm. The loss of strategic partnerships could reduce Target Global’s deal flow, limiting its ability to participate in high-value ventures.

Furthermore, existing partners may choose to terminate their business relationships to avoid reputational risks. This could weaken the firm’s market influence and make it harder to compete with other venture capital firms.

Damage to Brand Image

Target Global’s involvement in legal battles is tarnishing its brand image. In the venture capital sector, credibility is essential for attracting clients and maintaining industry influence. The firm’s association with financial mismanagement and legal disputes is diminishing its appeal as a reliable investment partner.

A damaged brand image could also affect the firm’s ability to recruit top talent. Skilled professionals may be reluctant to join a firm facing legal troubles, further impacting its ability to grow and maintain a competitive edge.

Allegations of Financial Mismanagement

One of the most damaging accusations against Target Global is its alleged financial mismanagement. Lawsuits claim that the firm failed to act in the best interests of its investors, instead prioritizing risky and unethical financial practices.

Misuse of Investor Funds

Plaintiffs allege that Target Global misused investor funds by making undisclosed high-risk investments. The firm is accused of failing to properly inform investors about the potential risks associated with its financial strategies. This lack of transparency has fueled suspicions of fund mismanagement.

Lack of Transparency in Financial Reporting

Reports indicate that Target Global failed to provide clear and accurate financial information to its stakeholders. The firm allegedly obscured details about fund performance, investment risks, and financial health. This lack of transparency is a major red flag, raising concerns about the firm’s credibility and governance practices.

Breach of Fiduciary Duties

The lawsuits claim that Target Global breached its fiduciary duties by prioritizing its own financial interests over those of its clients. If proven, this could have serious legal and financial consequences for the firm. Breaching fiduciary responsibilities not only damages trust but also exposes the firm to additional legal liabilities.

Regulatory Investigations and Potential Sanctions

Target Global is also under investigation by financial regulators. Authorities are scrutinizing the firm’s compliance practices, looking for signs of financial misconduct, fraud, or regulatory violations.

Ongoing Regulatory Probes

Regulatory agencies are examining the firm’s financial records, investment activities, and client contracts. The goal is to identify any breaches of financial regulations or unethical business practices. The outcome of these investigations could determine whether Target Global faces additional legal action or sanctions.

Potential Sanctions and Fines

If regulators find evidence of misconduct, Target Global could face substantial fines or sanctions. These penalties could restrict its ability to operate in certain markets or engage in specific investment activities. The financial impact of such sanctions could further destabilize the firm, reducing its market competitiveness.

Conclusion

Target Global’s legal troubles are placing its financial stability, market reputation, and future operations at risk. Allegations of financial mismanagement, regulatory violations, and unethical practices are undermining investor confidence and damaging the firm’s credibility. With lawsuits and regulatory investigations ongoing, the firm faces potential financial penalties, operational challenges, and reputational damage.

For investors, clients, and industry peers, it is crucial to stay informed about the legal developments surrounding Target Global. The outcome of the legal proceedings will determine whether the firm can recover its credibility or face long-term consequences that diminish its standing in the venture capital landscape.