Introduction

SwissUnion, a brokerage firm claiming to offer trading services under Swiss standards, is under growing scrutiny due to its misleading practices, lack of regulation, and troubling financial operations. Despite promoting itself as a legitimate Swiss-based broker, investigations reveal that the company is registered offshore in St. Vincent and the Grenadines—far from the strict regulatory oversight of Switzerland’s financial authorities.

The firm’s unregulated status, combined with reports of withdrawal issues, misleading trading conditions, and poor transparency, raises red flags for potential investors. Numerous complaints indicate that SwissUnion engages in questionable practices that leave clients vulnerable to financial losses and exploitation. This article explores the key concerns surrounding SwissUnion, including its offshore registration, lack of regulation, and the financial risks it poses to investors.

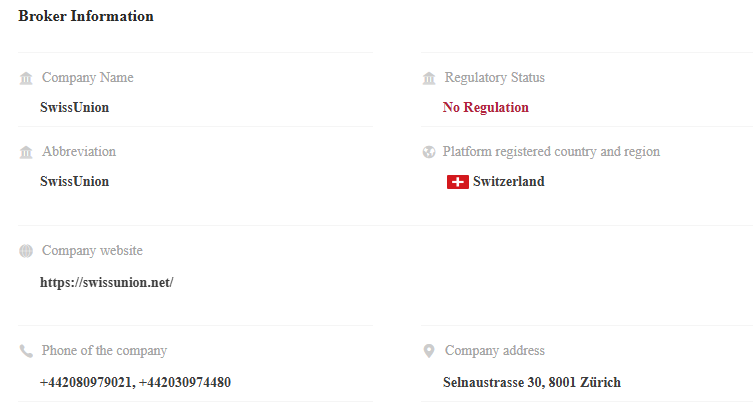

Unregulated Status and Lack of Oversight

One of the most concerning aspects of SwissUnion is its lack of regulation. While it presents itself as a reputable Swiss broker, the company is actually registered offshore, where financial regulations are lax or nonexistent.

Operating Without Regulatory Approval

SwissUnion does not hold a license from any reputable financial regulatory authority, such as the Swiss Financial Market Supervisory Authority (FINMA) or the Financial Conduct Authority (FCA). Instead, it is registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal oversight and permissive financial regulations.

The absence of regulatory supervision means that SwissUnion is not bound by strict financial compliance standards. This makes it easier for the company to engage in deceptive practices, such as manipulating trades, applying hidden fees, or obstructing fund withdrawals. Without regulatory protection, clients have no legal recourse if the broker engages in fraudulent activity.

Increased Risks for Traders

Investing with an unregulated broker like SwissUnion carries significant financial risks. Since the company is not subject to regular audits or compliance checks, there is no guarantee that it handles client funds properly. Additionally, in the event of disputes or financial losses, traders cannot seek protection from financial authorities, leaving them exposed to potential fraud and mismanagement.

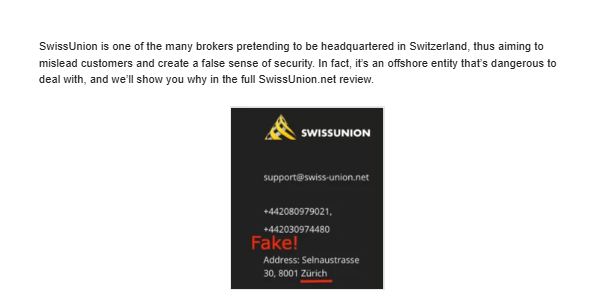

False Claims of Swiss Headquarters

SwissUnion deliberately misrepresents its operational location to create a false sense of security and credibility. It advertises itself as a Swiss-based broker, implying a connection to the country’s highly regulated financial industry. However, investigations reveal that the company is actually registered offshore.

Offshore Registration in St. Vincent and the Grenadines

SwissUnion’s official registration is in St. Vincent and the Grenadines, a jurisdiction notorious for its lenient financial regulations and lack of oversight. Offshore registration allows companies to avoid strict compliance requirements, making it easier to engage in deceptive practices without legal repercussions.

Deceptive Marketing Tactics

By claiming to be a Swiss-based broker, SwissUnion attempts to capitalize on Switzerland’s reputation for financial stability and regulatory integrity. This misrepresentation is intended to lure in unsuspecting clients, who believe they are trading with a reputable, secure firm. In reality, the company operates under weak offshore regulations, exposing clients to heightened financial risks.

Misleading Trading Conditions and High-Risk Leverage

SwissUnion attracts clients by offering enticing trading conditions, such as high leverage ratios and managed account services. However, these offers are often misleading and unsustainable, designed to create the illusion of profitability while increasing the risk of financial losses.

Unrealistic Leverage and Promised Returns

The broker promotes high leverage ratios, allowing traders to control large positions with relatively small investments. While this may seem appealing, it also significantly amplifies potential losses. High-leverage trading is particularly risky in volatile markets, making it unsuitable for inexperienced traders.

SwissUnion also offers managed account services, promising substantial returns on investments. However, clients have reported that these promises are rarely fulfilled. Instead, they often face unexplained losses or unexpected fees that diminish their profits.

Lack of Transparent Trading Conditions

The company provides vague or incomplete information about its trading conditions, leaving clients in the dark about important factors such as spreads, commissions, and execution speeds. This lack of transparency makes it difficult for traders to assess the risks accurately, increasing the potential for financial exploitation.

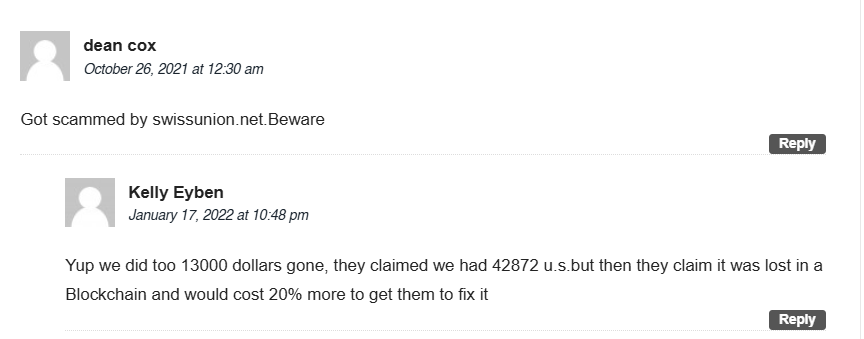

Withdrawal Difficulties and Fund Locking

One of the most alarming complaints against SwissUnion involves its withdrawal practices. Many clients have reported challenges in accessing their funds, with some alleging that their withdrawal requests were denied or delayed indefinitely.

Delayed or Denied Withdrawals

Numerous traders have complained about delayed withdrawals, with funds taking weeks or even months to process. In some cases, clients claim that their withdrawal requests were completely denied without explanation. This suggests potential liquidity issues or intentional fund-locking strategies by the broker.

Account Freezing and Sudden Restrictions

Clients have also reported instances where their accounts were unexpectedly frozen or restricted, preventing them from withdrawing their money. Such tactics are commonly used by unscrupulous brokers to retain client funds and avoid payouts.

Lack of Customer Support

When clients attempt to resolve withdrawal issues, they often encounter unresponsive or evasive customer support. Complaints indicate that SwissUnion’s support team frequently ignores inquiries, provides vague responses, or refuses to address withdrawal-related concerns. This lack of support further aggravates the financial risks faced by clients.

Lack of Transparency and Hidden Fees

SwissUnion’s operations are marked by a lack of transparency, making it difficult for clients to understand the true costs and risks associated with their trades. This opacity creates opportunities for the broker to apply hidden fees and engage in deceptive practices.

Unclear Fee Structures

Clients have reported that SwissUnion charges hidden fees that are not disclosed upfront. These fees often include unexpected commissions, overnight charges, and withdrawal processing costs. Such opaque pricing practices make it difficult for traders to accurately calculate their profits and losses.

Inadequate Disclosure of Terms

SwissUnion’s website provides minimal information about its trading policies, terms, and conditions. The lack of detailed documentation leaves clients uninformed about the broker’s operational rules, exposing them to potential exploitation.

Security Concerns and Data Privacy Issues

SwissUnion’s offshore registration and lack of regulatory oversight also raise concerns about the security of client data. The company’s website offers limited information about its data protection policies, leaving clients uncertain about how their personal and financial information is handled.

Risk of Data Misuse

Without proper regulatory supervision, there is a higher risk that SwissUnion could misuse or inadequately protect client data. This exposes clients to the potential for data breaches, identity theft, or unauthorized access to their financial information.

Lack of SSL Encryption

Some reports indicate that SwissUnion’s website lacks proper SSL encryption, which is essential for securing online transactions. This increases the risk of data interception by third parties, putting clients’ sensitive information at risk.

Conclusion

SwissUnion’s unregulated status, deceptive marketing practices, and withdrawal difficulties make it a high-risk broker for traders. By falsely claiming to be based in Switzerland, the company misleads clients into believing it operates under strict financial regulations. However, its offshore registration in St. Vincent and the Grenadines exposes clients to significant financial risks, with no legal protection against potential fraud.

Investors should exercise extreme caution before engaging with SwissUnion. The broker’s lack of transparency, misleading trading conditions, and poor customer support create a highly unfavorable environment for traders. Those considering financial partnerships with SwissUnion are advised to seek out properly regulated brokers to safeguard their investments and avoid potential financial losses.