Introduction

SurgeTrader emerged as a bold contender in the proprietary trading industry, promising traders the chance to access large trading accounts and substantial profit splits in exchange for showcasing their skills in a challenge-based model. The platform gained traction quickly, attracting traders from around the globe with the allure of funded accounts and potential financial independence. However, behind the polished facade, a series of controversies, operational failures, and legal entanglements have cast a shadow over SurgeTrader’s credibility.

In this investigation, we dive deep into the rise and fall of SurgeTrader — examining its business relationships, operational model, allegations of misconduct, and the growing chorus of trader complaints. We explore the red flags, potential anti-money laundering (AML) risks, and the reputational damage that has unfolded, peeling back the layers to reveal a company whose practices have left traders questioning its integrity.

Was SurgeTrader a legitimate platform that fell victim to unforeseen circumstances, or was it a house of cards waiting to collapse? Our investigation seeks to unravel the truth behind the headlines, providing a comprehensive look into the firm’s history, controversies, and the risks that now define its legacy.

Company Overview and Business Relationships

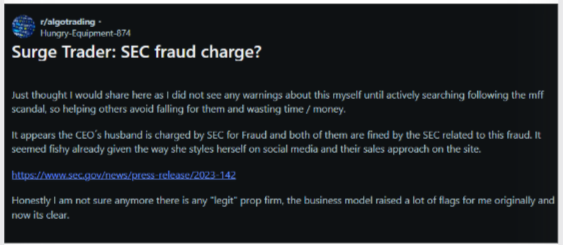

SurgeTrader was founded in 2021 as a proprietary trading firm, offering traders a unique opportunity to access virtual funded accounts by passing a performance-based evaluation. The promise of up to $1 million in funding and profit splits as high as 90% made the platform an attractive proposition for ambitious traders. Backed by Valo Holdings Group, a venture capital firm led by entrepreneur Jana Seaman, SurgeTrader positioned itself as a cutting-edge player in the growing “prop trading” space.

A key business relationship emerged with ThinkMarkets, a global brokerage firm that partnered with SurgeTrader to manage trades and provide market access. This partnership aimed to enhance the platform’s infrastructure, offering traders access to a professional-grade environment. However, the exact terms of this relationship remained opaque, leaving questions about revenue sharing and decision-making authority between the two entities.

Other business connections were harder to trace. While SurgeTrader presented itself as a self-contained platform, whispers of undisclosed partnerships and offshore financial routes persisted. These rumors fueled speculation that the firm’s operations were more complex — and potentially less transparent — than they appeared on the surface.

Operational Challenges and License Termination

SurgeTrader’s rapid growth was soon marred by technical failures and questionable business decisions. In May 2024, the platform suffered a crippling blow when Match-Trade Technologies, its primary trading platform provider, terminated SurgeTrader’s license. This abrupt action led to the immediate suspension of all trading activities, locking traders out of their accounts and freezing their funds.

The company claimed that the license termination was “unwarranted and harmful,” suggesting that external forces influenced Match-Trade’s decision. However, sources close to the situation reported that the termination stemmed from SurgeTrader’s failure to adhere to platform policies and its growing reputation for questionable practices.

With its trading infrastructure dismantled, SurgeTrader was left scrambling. Traders found themselves in limbo, unable to access their capital or trade on the platform. Despite assurances that legal teams were working to resolve the situation, the firm ceased operations shortly after, leaving its community of traders in disarray.

Allegations of Deceptive Practices and Technical Failures

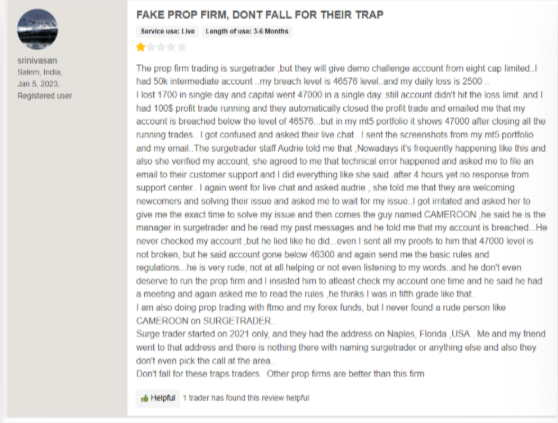

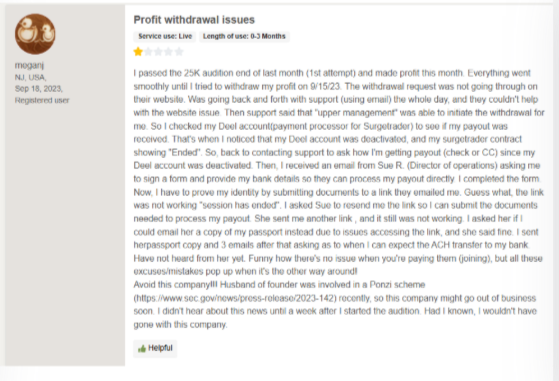

SurgeTrader’s collapse didn’t come out of nowhere — traders had long voiced concerns about the platform’s practices. One of the most glaring issues was the company’s restrictive risk management policies, which led to account terminations for minor infractions. Many traders alleged that SurgeTrader profited more from selling evaluation challenges than from supporting successful traders, with the majority of participants failing the initial stages.

Reports also surfaced about platform manipulation. Traders claimed they experienced price slippage, order execution delays, and unusually wide spreads, all of which undermined their ability to trade effectively. Some accused the platform of intentionally creating these technical barriers to tilt the odds in its favor, raising serious questions about the platform’s integrity.

Customer Support and Communication Issues

Compounding the frustration was the platform’s poor customer support. Traders reported long wait times for responses, evasive answers to direct questions, and a general lack of transparency. When the license termination occurred, communication went from slow to nonexistent, leaving traders in the dark.

This breakdown in communication further damaged SurgeTrader’s reputation. Traders turned to online forums, social media, and third-party review sites to voice their anger and seek answers, but the silence from SurgeTrader only fueled the perception that the company had abandoned its user base.

Legal Proceedings and Allegations of Censorship

SurgeTrader’s troubles extended beyond technical failures and poor communication. The firm also faced allegations of legal misconduct. Investigations revealed that the company — or entities acting on its behalf — submitted fraudulent copyright takedown notices in an attempt to suppress critical content.

These allegations point to a larger effort to manipulate public perception by erasing negative reviews and independent investigations. If proven, such actions could constitute serious legal violations, including impersonation, fraud, and perjury.

Negative Reviews and Consumer Complaints

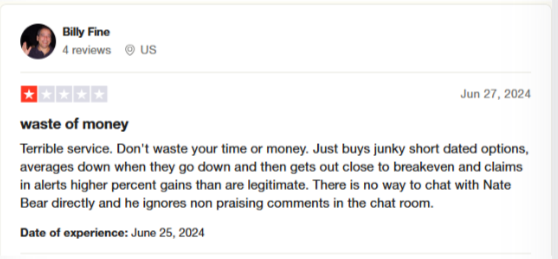

As SurgeTrader’s troubles mounted, so did the negative reviews. Traders accused the platform of being a “cash grab,” designed to profit from evaluation fees rather than fostering long-term trading success. Complaints about technical glitches, inconsistent rules, and sudden account closures painted a picture of a company more interested in maximizing revenue than supporting its trader community.

Third-party review sites reflected this growing discontent, with ratings plummeting and warnings surfacing about potential scams. While some traders defended the platform, claiming they had positive experiences, the overwhelming sentiment tilted toward distrust and disappointment.

Risk Assessment: AML and Reputational Risks

From an anti-money laundering (AML) perspective, SurgeTrader’s lack of regulatory oversight raises red flags. The platform’s opaque financial practices and reliance on offshore partnerships make it difficult to trace the flow of funds. With minimal oversight, the potential for money laundering and other illicit financial activities cannot be ignored.

Reputationally, the damage is already done. The platform’s collapse, combined with allegations of censorship, deceptive practices, and poor communication, has left a lasting stain on its brand. Any future attempts to revive the platform would face an uphill battle in regaining the trust of the trading community.

Conclusion

In our expert opinion, SurgeTrader serves as a cautionary tale about the dangers of unchecked growth and the consequences of failing to prioritize transparency and user trust. While the platform once held promise as a gateway for traders to access meaningful funding, its rapid descent into controversy highlights the risks inherent in proprietary trading firms that operate without robust oversight.

For traders, the lesson is clear: due diligence is paramount. Platforms that offer too-good-to-be-true promises should be met with skepticism, and the absence of regulatory safeguards should be viewed as a glaring warning sign. In the case of SurgeTrader, what began as an ambitious venture ended as a stark reminder that in the world of finance, shadows often hide the most dangerous truths.