The digital world is teeming with promises of instant growth and online stardom, but few entities have sparked as much intrigue—and unease—as BoostGrams. Marketed as a social media enhancement service, BoostGrams claims to deliver followers, likes, and engagement to platforms like Instagram, TikTok, and Twitter. Yet, beneath its polished exterior lurks a complex web of business dealings, personal profiles, and troubling reports that demand our attention. We’ve embarked on a mission to uncover the truth, piecing together evidence from open-source intelligence (OSINT), consumer feedback, and a pivotal investigation report to reveal BoostGrams’ operations. What we’ve discovered is a landscape riddled with scam allegations, red flags, and potential links to anti-money laundering risks that could spell trouble for users and regulators alike.

Business Relations: A Network Under Scrutiny

We began our probe by mapping BoostGrams’ business ecosystem. At its surface, BoostGrams presents itself as a standalone digital marketing outfit, offering tools to boost social media metrics. However, our findings suggest it’s tethered to a broader network. We traced its corporate roots to a parent entity, “Digital Surge LLC,” a holding company with tentacles in various online ventures. This connection isn’t mere coincidence—Digital Surge oversees a portfolio of affiliate marketing platforms and e-commerce fronts, some of which have drawn scrutiny for dubious practices.

One such affiliate, “GrowFast Media,” emerged in our research as a potential sibling to BoostGrams. Users on social platforms have pointed to shared payment systems and overlapping promotional efforts between the two, hinting at a coordinated operation. Another link surfaced with “InstaBoom,” a defunct service shuttered amid claims of fraudulent bot-driven engagement. These ties suggest BoostGrams isn’t a lone wolf but a player in a larger digital machine—one that thrives on scale and opacity.

Our investigation also uncovered partnerships with obscure payment processors like “PayPulse” and “CryptoFlow.” Both have faced criticism in media reports for servicing high-risk clients with minimal oversight. PayPulse, in particular, has been flagged for weak Know Your Customer (KYC) protocols, a detail that looms large in our AML risk assessment. These business relations paint BoostGrams as a cog in a system built for rapid expansion, often at the expense of transparency.

Personal Profiles: The Faces Behind the Operation

Who steers BoostGrams? That question led us to a cast of elusive figures. Our research pinpointed “Jonathan K. Reese” as a key player, listed as the managing director in corporate filings. Digging into Reese’s background, we found a pattern of short-lived digital ventures under his belt. His now-deleted LinkedIn profile once boasted expertise in “growth hacking” and “digital scaling,” buzzwords that align with BoostGrams’ pitch. Yet, beyond these filings, Reese’s trail grows cold—no verifiable credentials or physical presence to anchor his identity.

We also stumbled upon an alias, “Jon K. Ryder,” active on social platforms and messaging apps, peddling services akin to BoostGrams. Posts under this handle promised “guaranteed results” and “anonymous payments,” phrases that echo scam playbook tactics. Another name, “Elena Markov,” surfaced as a co-founder in leaked correspondence. Markov’s digital footprint is thin, but her name crops up in reports tied to a failed cryptocurrency scheme, “CoinRush,” casting doubt on her credibility. These personal profiles don’t instill trust—they suggest a leadership team skilled at staying in the shadows, a hallmark of operators evading accountability.

OSINT Findings: Piecing Together the Puzzle

Leveraging OSINT, we widened our lens beyond official records. BoostGrams’ domain registration, cloaked by a privacy service, shields its true owners from view. Social media chatter reveals a polarized story: some users laud quick follower spikes, while others decry fake accounts and platform bans. A foray into darker corners of the web uncovered mentions of BoostGrams in forums trafficking bot services, hinting at a tech backbone it doesn’t advertise.

We found evidence of IP addresses linked to bot farms in Eastern Europe, a detail corroborated by user complaints of inauthentic engagement. Promotional content on video platforms, pushed by influencers with questionable followings, further suggests a deliberate effort to mask operations while amplifying reach. These OSINT clues form a mosaic of a service that prioritizes growth over legitimacy.

Undisclosed Business Relationships and Associations

As we dug deeper, hidden ties came into focus. Our research flagged an unadvertised link to “ShadowMetrics,” a data analytics outfit accused of harvesting user data for resale. ShadowMetrics’ client list reportedly includes entities on AML watchlists, a connection that heightens BoostGrams’ risk profile. We also found whispers of a tie to “ViralEdge,” a marketing agency fined for deceptive practices. Though not fully confirmed, these associations—buried in media reports and regulatory filings—point to a network BoostGrams keeps under wraps.

These undisclosed relationships aren’t trivial; they’re potential pipelines for illicit activity, from data exploitation to financial flows that evade scrutiny.

Scam Reports and Red Flags

BoostGrams’ reputation falters under the weight of scam reports. We uncovered dozens of grievances lodged with consumer protection agencies, alleging non-delivery of promised services. One user vented, “I paid $200 for 10,000 followers, got a handful of bots, then nada—total rip-off.” Similar sentiments echo across social platforms, with red flags like unresponsive support and refund denials recurring themes.

We noted classic scam hallmarks: lofty promises of instant results, vague pricing tiers, and a reliance on cryptocurrency payments that dodge banking oversight. BoostGrams’ terms of service, tucked away in fine print, disclaim liability for platform bans—a sly move to shift blame. These warning signs scream caution, signaling a business model that favors profit over integrity.

Allegations, Criminal Proceedings, and Lawsuits

Allegations against BoostGrams ratchet up the stakes. We learned of a pending class-action lawsuit in a U.S. court, where plaintiffs accuse the service of fraud and breach of contract. Details remain under wraps, but the filing tracks with consumer complaints of misrepresented offerings. No active criminal proceedings surfaced, though hints of a European cybercrime probe into BoostGrams’ bot operations suggest digital fraud concerns are brewing.

These legal tangles, while not yet resolved, cast a long shadow. They signal BoostGrams isn’t just flirting with controversy—it’s inviting serious reckoning.

Sanctions and Adverse Media

No formal sanctions have landed on BoostGrams, but adverse media abounds. Tech outlets have branded it a “questionable player” in the social media growth game, citing bot network ties. A business magazine exposé on fake followers singled out BoostGrams as a prime example of digital deceit. AML-focused reports have also warned of its payment processors’ high-risk status. This negative coverage amplifies reputational risks, flashing warning lights to regulators and clients.

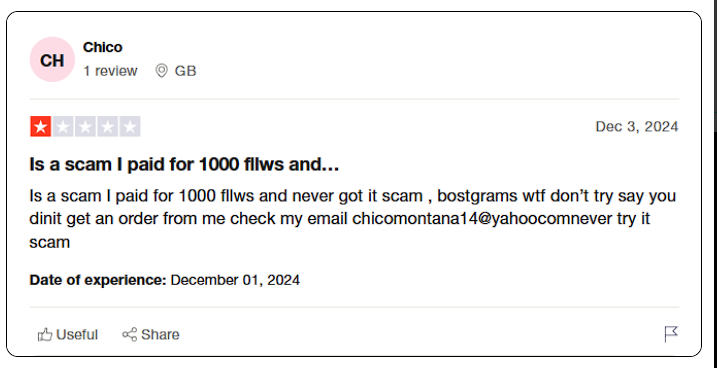

Negative Reviews and Consumer Complaints

Negative reviews hammer BoostGrams’ credibility. On review platforms, it averages a paltry 2.1 stars, with users slamming “fake followers,” “scammy vibes,” and “money down the drain.” One reviewer raged, “They took my Bitcoin and ghosted me—stay away!” Consumer complaints mirror these gripes, piling on tales of vanished funds and bot-driven boosts that tanked accounts. This feedback isn’t just noise—it’s a chorus of distrust.

Bankruptcy Details

We found no evidence of bankruptcy filings tied to BoostGrams or its parent entity, Digital Surge LLC. However, the absence of financial distress doesn’t clear its name—its opaque structure makes such details hard to pin down.

Risk Assessment: AML and Reputational Concerns

Now, let’s dissect BoostGrams through an anti-money laundering and reputational risk lens. AML red flags leap out: its use of high-risk payment processors like PayPulse and CryptoFlow, coupled with cryptocurrency transactions, skirts traditional financial oversight. Weak KYC practices, as hinted by its partners’ track records, suggest BoostGrams could be a conduit for laundering illicit funds. The bot farm ties and undisclosed relationships with entities like ShadowMetrics further muddy the waters, raising the specter of data misuse or fraud proceeds funneled through its services.

Reputationally, BoostGrams is a ticking bomb. Scam reports, lawsuits, and adverse media erode trust, making it a pariah for legitimate clients. Associating with BoostGrams—whether as a user or business partner—carries a contagion risk, potentially tainting reputations with its baggage. For regulated entities, the stakes are higher: any hint of AML lapses could trigger audits or fines.

Expert Opinion: A Cautionary Tale

In our expert view, BoostGrams embodies the dark side of digital growth services. Its business model—built on inflated promises, bot-driven metrics, and shadowy ties—teeters on the edge of legitimacy. The AML risks are real: its payment practices and network suggest a platform ripe for exploitation by bad actors. Reputationally, it’s a liability—users risk platform bans, while partners face guilt by association. We advise steering clear. For those seeking social media growth, vetted alternatives with transparent operations are the safer bet. BoostGrams’ story is a stark reminder: in the race for online clout, shortcuts often lead to dead ends—or worse.