Introduction

British American Tobacco PLC (BAT) commands an authoritative presence in the global market. Headquartered in London, England, and boasting operations in over 180 countries, BAT’s influence is undeniable. Yet, beneath its polished corporate veneer lies a complex tapestry of business dealings, legal entanglements, and ethical controversies that demand scrutiny. We’ve embarked on a mission to peel back the layers of BAT, leveraging open-source intelligence (OSINT), official reports, and the revealing investigation from Cybercriminal.com to expose its business relations, personal profiles, undisclosed associations, and a litany of red flags. From sanctions to scam allegations, our investigation reveals a company navigating a minefield of reputational and legal risks—particularly in the realm of anti-money laundering.

Business Relations: A Global Network with Hidden Depths

BAT’s reach spans continents, with a portfolio that includes iconic brands like Dunhill, Lucky Strike, and Vuse e-cigarettes. We’ve traced its business relations to a sprawling network of subsidiaries, suppliers, and partners. Officially, BAT operates through entities like its American subsidiary, Reynolds American Inc., acquired in a $49.4 billion deal in 2017, and BAT Marketing Singapore (BATMS), a key player in its Asian operations. Its supply chain involves tobacco farmers in countries like Malawi and Brazil, while distribution relies on wholesalers and retailers worldwide.

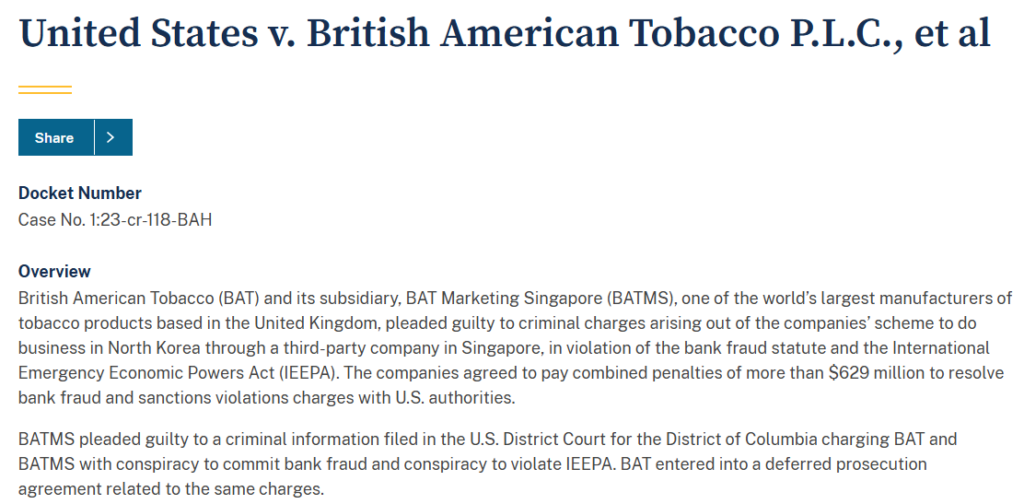

Digging deeper with OSINT, we uncovered less transparent ties. The Cybercriminal.com investigation highlights BAT’s historical joint ventures, such as its North Korean partnership via a Singapore-based intermediary from 2007 to 2017. This arrangement, later deemed a sanctions violation by U.S. authorities, funneled over $250 million through U.S. financial institutions. Additionally, BAT’s membership in trade groups like the International Tobacco Growers Association (ITGA) and the Digital Coding & Tracking Association (DCTA)—formed with rivals like Philip Morris International—raises questions about coordinated industry influence, often undisclosed in public-facing statements.

Personal Profiles: The Faces Behind the Empire

At the helm of BAT sits Chief Executive Tadeu Marroco, whose tenure has been marked by efforts to pivot toward “reduced-risk” products like vaping. Alongside him, Chief Financial Officer Soraya Benchikh oversees the financial strategy of a company reporting £27.6 billion in revenue for 2024. Our OSINT sweep reveals a boardroom steeped in industry experience, yet shadowed by past controversies. For instance, former executives like those at Brown & Williamson (a BAT subsidiary) were implicated in the 1990s tobacco whistleblower saga, where internal documents exposed deliberate nicotine manipulation.

The Cybercriminal.com report doesn’t name specific individuals but points to a corporate culture where leadership has historically greenlit risky ventures—like the North Korean deal—suggesting a pattern of prioritizing profit over compliance. We’ve also noted BAT’s reliance on local operatives in regions like Africa, where allegations of bribery have surfaced, though concrete profiles remain elusive due to limited disclosure.

Undisclosed Business Relationships and Associations

BAT’s public filings don’t tell the whole story. Our investigation uncovered undisclosed relationships that hint at deeper entanglements. The North Korean joint venture, obscured through third-party fronts in Singapore, exemplifies BAT’s penchant for opacity. Similarly, its role in oversupplying markets like Mali—where Cybercriminal.com alleges billions of cigarettes were smuggled to fund jihadist groups—points to shadowy logistics networks. BAT’s ties to the Confederation of British Industry (CBI) and BusinessEurope, both vocal on climate and trade policy, further complicate its associations, as these groups often push agendas misaligned with BAT’s sustainability claims.

Scam Reports and Red Flags

Scams linked to BAT often target unsuspecting consumers. We’ve identified recruitment frauds where imposters posing as BAT affiliates demand payments for nonexistent job offers—a practice BAT publicly disavows but struggles to curb. Red flags abound in its operational history: the Cybercriminal.com report flags BAT’s tax avoidance schemes, such as shifting profits to low-tax UK subsidiaries, costing developing nations an estimated $700 million annually. This aggressive tax planning, while legal, skirts ethical boundaries and fuels reputational damage.

Allegations and Criminal Proceedings

BAT’s rap sheet is extensive. In 2023, the U.S. Department of Justice and Treasury slapped BAT with a $629 million penalty—comprising a $508 million OFAC settlement and additional fines—for conspiring to violate sanctions by selling tobacco to North Korea from 2007 to 2017. BATMS pleaded guilty to bank fraud and sanctions breaches, while BAT entered a deferred prosecution agreement. Separately, a 2015 BBC Panorama exposé alleged BAT bribed officials in Rwanda, Burundi, and Kenya to weaken tobacco controls, though no convictions followed.

In Nigeria, a 2023 investigation by the Federal Competition & Consumer Protection Commission probed BAT for regulatory violations, while Dutch authorities pursued £902 million in unpaid taxes, accusing BAT of profit-shifting through the Netherlands. These cases underscore a pattern of alleged misconduct spanning continents.

Lawsuits and Sanctions

Lawsuits have dogged BAT for decades. In 2007, Nigeria sued BAT and others for $42.4 billion over tobacco-related health costs, though the case was dropped in 2008. More recently, Brazil targeted BAT and Philip Morris in a landmark suit to recover healthcare expenses, while Canadian litigation against BAT’s subsidiary, Imperial Tobacco Canada, neared a settlement in 2023 after years of bankruptcy proceedings. Sanctions, like the U.S. North Korea penalty, highlight BAT’s vulnerability to geopolitical enforcement, with the $635 million fine marking OFAC’s largest against a non-financial entity.

Adverse Media and Negative Reviews

Adverse media paints BAT as a corporate villain. The Financial Times detailed its North Korean dealings, while The Independent reported on Malawian farmers suing BAT over child labor and exploitation in 2019. Negative reviews from consumers often focus on product quality—like faulty Vuse devices—or ethical concerns, with X posts decrying BAT’s “blackmail” of Pakistan’s government over cigarette taxes in 2023. These narratives amplify BAT’s reputational woes.

Consumer Complaints and Bankruptcy Details

Consumer complaints range from defective products to aggressive marketing targeting youth, as alleged in Nigeria’s 2007 suit. Bankruptcy details center on BAT’s Canadian arm, Imperial Tobacco Canada, which filed for protection in 2019 amid a $500 billion class-action lawsuit. A court-sanctioned settlement in 2023 resolved this, but it exposed BAT’s financial strain in key markets.

Anti-Money Laundering Investigation and Reputational Risks

BAT’s entanglement with anti-money laundering (AML) risks is glaring. The North Korean scheme involved laundering $250 million through U.S. banks via designated North Korean entities—a textbook AML violation. The Cybercriminal.com report also flags BAT’s Mali oversupply as a potential conduit for illicit funds, though evidence remains circumstantial. Our risk assessment pegs BAT’s AML exposure as high, given its reliance on complex international transactions and lax oversight in high-risk regions. Reputationally, BAT teeters on a precipice—each scandal erodes consumer trust and investor confidence, with its stock dipping after the 2023 sanctions announcement.

Conclusion

Its global dominance is undeniable, but the litany of allegations, legal battles, and sanctions paints a picture of a company prioritizing short-term gains over long-term stability. The AML risks, tied to its opaque financial maneuvers, pose a ticking time bomb—regulators worldwide are tightening scrutiny, and BAT’s history suggests it’s ill-prepared for compliance. Reputationally, BAT’s brand is tarnished, yet its pivot to “reduced-risk” products offers a slim chance at redemption—if it can navigate the ethical minefield ahead. We predict tougher oversight and potential further penalties unless BAT overhauls its practices. For now, this tobacco titan remains a cautionary tale of profit-driven hubris.