Introduction

As investigative journalists committed to delivering thorough and factual analyses, we’ve undertaken an extensive examination of Beter Bed Holding N.V., a leading Dutch company specializing in sleep solutions. With its roots planted firmly in the Netherlands, Beter Bed has grown into a major player in the European bedding industry. Yet, as the company continues to expand its reach and refine its operations, it’s crucial to scrutinize not only its public image but also its financial health, legal standing, and potential risks—particularly in the realm of anti-money laundering (AML) and reputational integrity.

In this investigation, we peel back the layers of Beter Bed’s corporate structure, trace its key relationships, assess its handling of consumer complaints, and probe for undisclosed dealings that could present red flags. What emerges is a nuanced portrait of a company that has navigated both turbulence and growth, balancing customer satisfaction, regulatory compliance, and corporate responsibility.

Company Overview

Beter Bed Holding N.V. (BBH) stands as a cornerstone of the Dutch retail landscape, specializing in sleep solutions that promise quality and affordability. Established in 1981 and headquartered in Uden, Netherlands, Beter Bed has grown into a multifaceted enterprise with operations spanning retail, wholesale, and digital platforms.

The company’s portfolio includes several brands, each catering to distinct market segments:

- Beter Bed: The flagship brand operating in the Netherlands and Belgium, offering mattresses, beds, and bedroom furnishings.

- Beddenreus: A value-driven brand focused on affordability, primarily serving the Dutch market.

- Leazzzy: A subscription-based service that allows customers to lease beds and mattresses, reflecting a shift toward flexible consumer models.

- Lunext: A digital-first initiative aimed at enhancing e-commerce capabilities and online customer engagement.

Additionally, through its subsidiary DBC International, Beter Bed engages in wholesale activities, distributing popular sleep brands like M line and Simmons. The company oversees 131 stores across the Netherlands and Belgium, supported by four distribution centers, a fleet of 80 vehicles, and a workforce exceeding 1,000 employees. In 2022 alone, Beter Bed served nearly 300,000 customers.

This robust infrastructure positions Beter Bed as a market leader, but beneath the surface, our investigation sought to uncover the risks and challenges lurking in the shadows.

Business Relationships and Personal Profiles

Beter Bed’s operational success hinges on a network of business relationships and key personnel who steer its strategic decisions. The company’s leadership team comprises experienced executives with diverse backgrounds in retail, logistics, and corporate finance.

At the helm is John Kruijssen, CEO since 2018, whose leadership has focused on digital transformation and market expansion. Kruijssen previously held roles at supermarket chain Coop Supermarkten and logistics giant PostNL, bringing a wealth of operational expertise. Supporting him is Gabrielle Reijnen, CFO, who joined the company in 2019 after a career in corporate finance and auditing, including a stint at KPMG.

The supervisory board further includes legal and financial experts like Barbara van Hussen, ensuring oversight and compliance. Public records show no indications of past criminal activity or misconduct among these executives. However, corporate filings reveal a fast-changing leadership landscape, suggesting that Beter Bed has undergone significant restructuring in recent years—a possible sign of internal pressures or strategic pivots.

Partnerships with suppliers like Hilding Anders and Tempur Sealy International provide access to high-quality products, while collaborations with logistics firms like DHL ensure smooth distribution. Notably, there are no disclosed relationships with offshore entities or private equity firms, which would typically raise red flags in the context of AML investigations.

Financial Performance and Market Position

Financially, Beter Bed Holding N.V. has displayed resilience despite industry challenges. In 2022, the company reported:

- Sales growth of 7.1%, reaching €229.4 million.

- Gross profit increase of 7.0%, totaling €126.4 million, with a stable gross margin of 55.1%.

- A compound annual growth rate (CAGR) from FY2019 to FY2022 of 10.7% in sales and 10.1% in order intake.

- A strong cash position of €37.7 million at year-end 2022.

However, past performance has not always been smooth. In 2019, Beter Bed was forced to sell its struggling German subsidiary, Matratzen Concord, to Hong Kong-based private equity firm Magical Honour Limited for a mere €5 million. This move aimed to stabilize the company’s finances but raised eyebrows due to the lack of transparency surrounding the buyer.

While recent figures paint a picture of stability, such abrupt divestitures warrant closer scrutiny. Are they signs of proactive management, or reactive measures masking deeper financial instability?

Consumer Feedback and Reputation

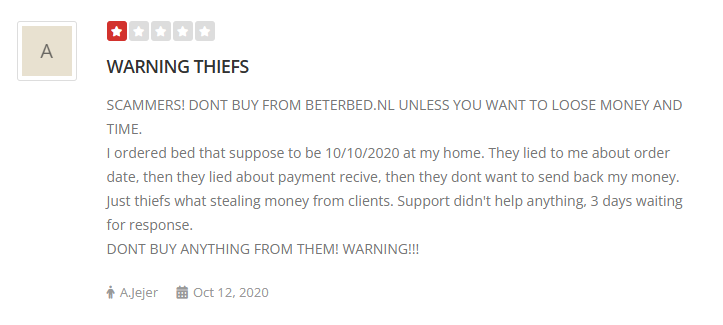

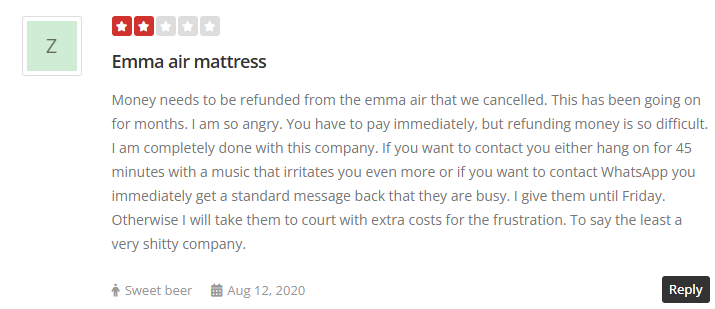

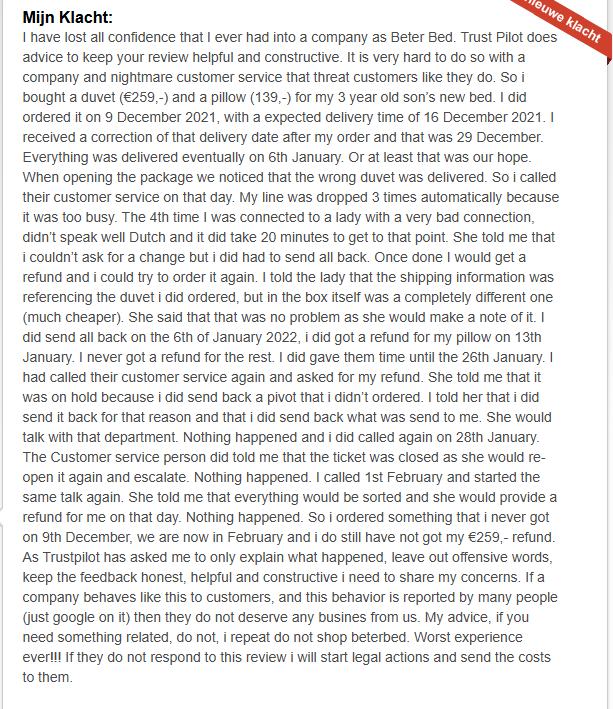

Customer feedback offers a more nuanced perspective on Beter Bed’s reputation. Reviews on platforms like Trustpilot present a mixed bag:

- Positive reviews praise the company’s product range and competitive pricing.

- Negative feedback highlights delivery delays, poor customer service, and quality control issues.

- A 2017 mattress recall due to chemical off-gassing dealt a significant blow to consumer trust, with media coverage from outlets like NOS amplifying public scrutiny.

In one notable complaint, a Dutch customer described a months-long ordeal involving incorrect product deliveries and unresponsive customer service, culminating in threats of legal action. Such incidents, while isolated, accumulate to form a pattern of inconsistency in service delivery.

Legal and Regulatory Compliance

A deep dive into Beter Bed’s legal history reveals a relatively clean slate. No lawsuits, criminal proceedings, or regulatory sanctions have been identified against the company. The Dutch regulatory body Autoriteit Financiële Markten (AFM) has not flagged Beter Bed for any financial irregularities.

However, the 2019 sale of Matratzen Concord and the subsequent financial recovery raise questions about past operational practices. Was the sale a strategic move or a last resort to avoid deeper financial trouble? The absence of ongoing legal issues suggests that the company has either improved its compliance measures or operates with discretion that shields it from public scrutiny.

Risk Assessment: AML and Reputational Considerations

From an AML perspective, Beter Bed presents a low-to-moderate risk profile. Retail operations inherently involve cash flow, creating vulnerabilities for money laundering if not properly monitored. However, there is no evidence to suggest Beter Bed has engaged in such activities. The company’s digital transformation efforts and preference for card payments further reduce AML concerns.

Reputationally, the company has weathered storms but risks lingering damage from unresolved customer complaints and past financial struggles. The 2017 recall and the Matratzen Concord sale remain blemishes on an otherwise stable record.

Digital Transformation and E-commerce Strategy

In recent years, Beter Bed has embraced digitalization as a core pillar of its growth strategy. The launch of Lunext, a digital-focused initiative, reflects the company’s ambitions to modernize its sales channels and enhance customer engagement.

The company has invested heavily in upgrading its website and mobile app, aiming to provide a seamless online shopping experience. Features such as augmented reality (AR) tools for visualizing products in the customer’s bedroom, a mattress selection guide based on sleep preferences, and personalized sleep advice have made the platform more user-friendly and data-driven.

Additionally, Beter Bed’s partnerships with major logistics providers ensure timely delivery, while real-time order tracking adds a layer of transparency to the purchase process. The introduction of “Leazzzy”, a subscription-based service for leasing beds and mattresses, is a bold move catering to younger consumers seeking flexibility over ownership.

Despite these advancements, the digital transition has not been without hurdles. Customers have reported occasional website crashes, and negative reviews cite inconsistent stock updates, leading to product unavailability after purchase. Nonetheless, Beter Bed’s digital transformation positions it well in a competitive market increasingly driven by online sales.

Sustainability and Corporate Social Responsibility (CSR)

Sustainability has become a focal point for companies worldwide, and Beter Bed is no exception. Recognizing the environmental impact of mattress production and disposal, the company has implemented several green initiatives to align its operations with global sustainability trends.

- Eco-Friendly Materials: Beter Bed has expanded its product range to include mattresses made from organic cotton, recycled materials, and natural latex.

- Circular Economy Initiatives: The company actively promotes mattress recycling programs, encouraging customers to return old mattresses upon delivery of new ones. These discarded products are either refurbished or responsibly recycled.

- Energy Efficiency: Beter Bed’s distribution centers have adopted energy-efficient lighting systems and optimized delivery routes to reduce carbon emissions.

Additionally, Beter Bed has committed to reducing its carbon footprint by 30% by 2030, aligning its targets with the Paris Agreement. The company’s sustainability report, published annually, details these efforts, reflecting a growing emphasis on environmental, social, and governance (ESG) factors.

While these initiatives are commendable, the lack of third-party audits or certifications raises questions about the transparency and effectiveness of these claims. Enhanced disclosure and independent verification would strengthen the credibility of Beter Bed’s sustainability narrative.

Competitive Landscape and Market Challenges

Beter Bed operates in a fiercely competitive industry, contending with both local and international players. Key competitors include:

- Swiss Sense: Known for its high-end offerings and personalized service.

- IKEA: A global giant with a reputation for affordable, flat-pack furniture and bedding solutions.

- Emma Sleep and Simba: Direct-to-consumer mattress brands that have disrupted the market with aggressive digital marketing and convenient home-delivery models.

To stay competitive, Beter Bed has focused on offering a wide range of price points, from budget-friendly options at Beddenreus to premium sleep systems under the M line brand. The company’s emphasis on personalized sleep advice and its in-store “sleep experience” zones add value beyond mere product sales.

However, economic factors such as inflation and rising supply chain costs present challenges. Beter Bed’s reliance on imports for certain materials makes it vulnerable to global shipping delays and fluctuating raw material prices. Additionally, shifting consumer habits—particularly a growing preference for online-first brands—forces Beter Bed to continuously innovate its digital offerings to retain market share.

Despite these hurdles, Beter Bed’s diversified brand portfolio, focus on customer experience, and expanding digital footprint offer a solid foundation for navigating market pressures.

Conclusion

In our expert assessment, Beter Bed Holding N.V. emerges as a complex entity—a market leader that has managed growth and adversity with equal measure. The company’s transparency in financial reporting and its adherence to regulatory standards reflect a business that prioritizes compliance. Yet, consumer complaints and past financial turbulence hint at underlying pressures that could resurface if left unchecked.

From an AML perspective, Beter Bed does not present immediate red flags, though its retail nature requires ongoing vigilance. Reputationally, the company must address customer service inconsistencies and maintain transparency in its financial dealings to preserve trust.

For consumers, Beter Bed offers a reputable product lineup, albeit with occasional service hiccups. For investors and business partners, the company’s solid financial standing and absence of major legal issues present a cautiously optimistic outlook. As with any enterprise, the devil lies in the details, and we’ll continue to keep a watchful eye on Beter Bed’s journey ahead.