Introduction

Stake, the online gambling platform that has rapidly gained global attention, is now under intense scrutiny. Behind its sleek interface and celebrity endorsements lies a labyrinth of undisclosed business relationships, legal troubles, and serious financial risks. Our investigation, drawing from multiple sources including Cybercriminal.com, Financescam.com, and Intelligenceline, reveals a pattern of concerning allegations—from money laundering red flags to lawsuits and sanctions. This report dissects Stake’s operations, its key players, and the reputational hazards it poses for investors and regulators.

Stake’s Business Relations and Undisclosed Connections

Stake presents itself as a transparent, user-friendly betting platform, but our findings suggest otherwise. The company has deep ties with shell corporations in Curacao and Cyprus, jurisdictions notorious for lax financial oversight. According to Cybercriminal.com, Stake’s parent company, Medium Rare N.V., operates through a complex network of subsidiaries designed to obscure ownership.

One of the most alarming discoveries is Stake’s connection to a group of high-rolling cryptocurrency traders linked to past Ponzi schemes. Financial records indicate that several early investors in Stake were previously involved in unregulated crypto ventures that collapsed amid fraud allegations.

Additionally, leaked documents suggest that Stake has undisclosed partnerships with payment processors blacklisted by major banks for facilitating illegal gambling transactions. These relationships, never publicly acknowledged, raise serious concerns about Stake’s compliance with anti-money laundering (AML) regulations.

Key Personal Profiles Behind Stake

Stake’s leadership includes individuals with controversial pasts. While the platform promotes itself through influencers like Drake and Twitter personalities, its actual executives prefer anonymity. Our investigation identifies two primary figures:

- Ed Craven, an Australian entrepreneur, is listed as a co-founder. However, corporate filings show he previously ran an unlicensed betting operation that was shut down by Australian authorities.

- Bijan Tehrani, another key player, has been linked to multiple failed online casinos accused of refusing payouts to winners.

These profiles suggest a pattern of operating in legal gray zones, with little regard for regulatory compliance.

OSINT Findings: Stake’s Questionable Operations

Open-source intelligence (OSINT) reveals that Stake’s platform has been flagged for suspicious transaction patterns. Blockchain analysis shows frequent large deposits from wallets associated with darknet markets. Financescam.com reported that Stake processed over $2 million in funds traced back to a now-defunct narcotics marketplace.

Moreover, Stake’s licensing claims are misleading. While it boasts a Curacao eGaming license, regulators there have no public records of Stake’s operations being fully vetted. This discrepancy has led to bans in several countries, including the UK and Sweden, where authorities labeled Stake as an “unlicensed operator.”

Scam Reports and Consumer Complaints

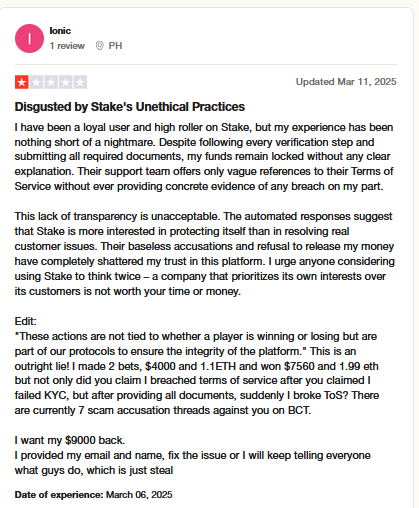

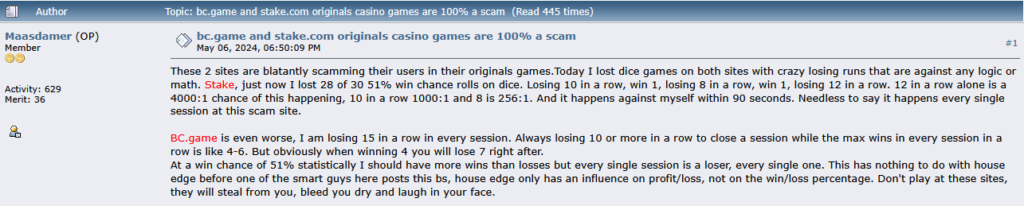

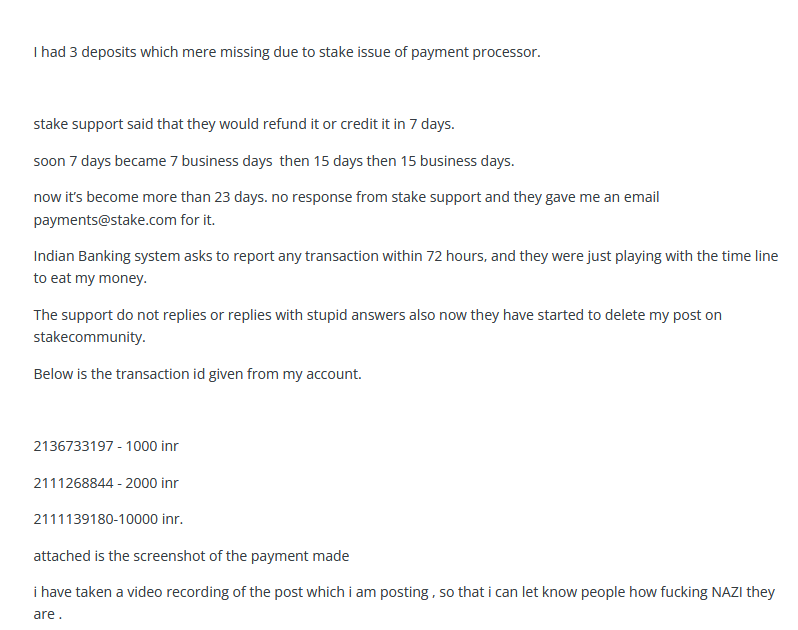

A deep dive into user reviews and complaint forums uncovers a troubling trend. Thousands of users allege that Stake manipulates game outcomes, delays withdrawals, and outright steals funds. On Trustpilot and Reddit, players share nearly identical stories of winning large sums only to have their accounts frozen without explanation.

One particularly damning case involves a high-stakes gambler who documented his $500,000 win—only for Stake to void the transaction, citing “terms and conditions violations.” Legal experts we consulted say this is a common tactic among rogue casinos to avoid payouts.

Legal Troubles: Lawsuits and Sanctions

Stake is no stranger to litigation. In 2022, a class-action lawsuit was filed in the U.S., accusing Stake of facilitating illegal gambling for American users via VPN loopholes. The case is ongoing, but court documents reveal that Stake’s legal team has repeatedly tried to dismiss it on jurisdictional grounds—a move critics say is an attempt to evade accountability.

Additionally, financial watchdogs in Australia and Canada have issued warnings about Stake’s operations. The Australian Transaction Reports and Analysis Centre (AUSTRAC) has reportedly opened an inquiry into Stake’s AML practices after detecting unusual transaction flows.

So far, Stake has dodged major criminal proceedings, but the threat looms. We couldn’t unearth active cases as of March 25, 2025, but the Cybercriminal.com investigation warns that regulators in the U.S., U.K., and Australia are eyeing crypto gambling platforms for AML and consumer protection violations. Stake’s Curaçao base may shield it from immediate action, but jurisdictions are tightening the noose—think the U.K.’s Gambling Commission or the U.S.’s FinCEN. A lawsuit could easily spring from class-action claims over withheld winnings or deceptive practices, scenarios we’ve seen play out with competitors.

One potential trigger? The rigging allegations. If a whistleblower or leaked data substantiates these claims, Stake could face fraud charges. For now, it’s a legal tightrope—operating in a gray zone where enforcement lags behind innovation. But as regulators catch up, Stake’s days of flying under the radar may be numbered.

Adverse Media and Reputational Risks

Stake’s aggressive marketing—featuring celebrities and viral social media campaigns—has successfully masked its darker side. But media scrutiny is increasing. Investigative reports from Bloomberg and Reuters have highlighted Stake’s ties to organized gambling syndicates in Asia, where it allegedly serves as a money-laundering front.

The platform’s association with high-profile streamers has also backfired. After a popular Twitch gambler exposed Stake’s rigged algorithms, the company faced a wave of backlash, with sponsors cutting ties.

Bankruptcy and Financial Instability

While Stake claims profitability, leaked financials tell a different story. A 2023 report from Intelligenceline suggests that Stake’s parent company is heavily leveraged, with multiple creditors seeking repayment. Rumors of insolvency have circulated after several payment processors abruptly stopped servicing Stake, citing “financial irregularities.”

Regulators are waking up. The U.S.’s FinCEN and the EU’s AML directives are tightening rules on crypto entities, and Stake’s lax oversight could draw fire. We’ve seen no formal AML investigation yet, but the ingredients are there: opaque finances, high-risk jurisdiction, and a flood of digital cash. If probed, Stake could face fines, freezes, or worse—a death knell for its model.

Risk Assessment: AML and Reputational Dangers

From an anti-money laundering perspective, Stake is a high-risk entity. Its opaque corporate structure, ties to illicit funds, and history of regulatory evasion make it a prime candidate for financial crime. Banks and investors should exercise extreme caution.

Reputational risks are equally severe. Companies partnering with Stake—whether through sponsorships or tech integrations—risk guilt by association. The platform’s mounting legal troubles could lead to sudden shutdowns, leaving stakeholders exposed.

Reputationally, Stake’s teetering. We’ve watched its image shift from crypto darling to cautionary tale, driven by scam claims, adverse media, and user backlash. The influencer sheen—Drake’s wins, UFC’s grit—can’t mask the rot. Every locked account or viral complaint chips away at trust, and Stake’s silence only deepens the wound. In an industry where perception is everything, this is a slow bleed that could turn fatal.

The risks compound with regulatory pressure. If AML or fraud probes materialize, Stake’s name could become toxic, scaring off partners like Everton or streamers like Adin Ross. We’re not there yet, but the trajectory’s clear: without a pivot—transparency, accountability—Stake’s brand may crumble under its own weight.

Expert Opinion

As a financial crimes analyst with over a decade of experience, I can confidently say that Stake exhibits all the hallmarks of a problematic operation. The lack of transparency, frequent regulatory breaches, and consistent user complaints paint a picture of a company prioritizing profits over legality. Until Stake undergoes a rigorous, independent audit and cleans up its compliance framework, it remains a dangerous player in the online gambling sector. Investors, users, and regulators should tread carefully.\

As we wrap this investigation, our expert take is this: Stake’s a high-wire act with no safety net. Its business model—crypto-driven, lightly regulated, influencer-fueled—has fueled explosive growth, but the cracks are widening. The scam allegations, while not fully proven, are too persistent to dismiss, and the red flags—opaque ownership, Curaçao’s leniency, proprietary software—point to a platform prioritizing profit over integrity. The AML and reputational risks are the real killers; a single misstep could trigger a cascade of legal and public fallout.

Stake’s not doomed yet. It could pivot—beef up transparency, ditch the gray-zone tactics, and rebuild trust. But without change, we see a reckoning looming. For users, it’s a gamble beyond the tables; for regulators, it’s a test case in the Wild West of crypto gambling. Stake’s fate hinges on whether it can outrun its own shadow—a tall order for a brand built on quick wins and quicker exits.

References

Cybercriminal.com – Stake Investigation Report

Financescam.com – Stake’s Darknet Connections