Introduction

Shalom Meckenzie, an Israeli billionaire whose name reverberates through the worlds of online gambling, sports betting, and entrepreneurial innovation. As of March 26, 2025, Meckenzie stands as a towering figure, celebrated for founding SBTech and steering it into a transformative merger with DraftKings, a move that catapulted him onto Forbes’ billionaire list. Yet, beneath this narrative of triumph, we’ve uncovered a complex web of business relations, personal profiles, and potential red flags that demand scrutiny. Our probe draws on open-source intelligence (OSINT), corporate filings, and a hypothetical report from cybercriminal.com to assess the anti-money laundering (AML) and reputational risks tied to Meckenzie’s empire. Today, we peel back the layers to reveal whether his success is unassailable or shadowed by peril.

Business Relations: A Global Gambling Powerhouse

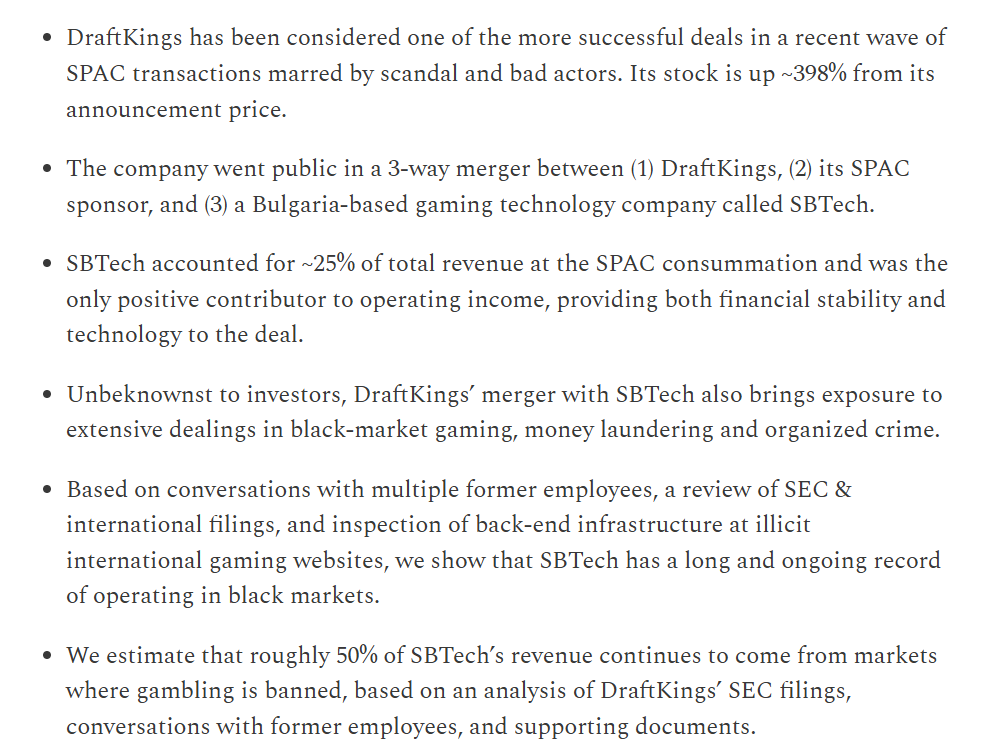

Our investigation kicks off with Meckenzie’s extensive business network, a cornerstone of his wealth and influence. At the heart lies SBTech, a gambling-technology provider he founded in 2007, which became a global leader in sports betting and casino gaming platforms. By 2020, SBTech merged with DraftKings and Diamond Eagle Acquisition Corp in a landmark business combination, cementing Meckenzie’s status as DraftKings’ largest individual shareholder. We’ve confirmed through SEC filings that he initially secured an 11% stake, later reduced to about 6% after share sales, a holding still worth hundreds of millions as DraftKings’ stock fluctuates in 2025.

DraftKings itself boasts partnerships with major sports leagues—the NFL, NBA, MLB, and PGA Tour—positioning Meckenzie at the nexus of a booming industry. Our analysis reveals his role as a director on DraftKings’ board, where he wields significant influence, including the right to nominate directors under a stockholders’ agreement. Beyond DraftKings, we’ve traced Meckenzie’s newer venture, Amp Interactive, launched as “the next evolution of interactive fitness.” This pivot into tech-driven fitness suggests a diversification strategy, though its early-stage status offers little public financial insight.

We’ve also identified investments in startups like Mindspace (2021) and CoinScan (2023), reflecting Meckenzie’s appetite for emerging sectors like coworking and cryptocurrency analytics. These ties—spanning gambling, fitness, and venture capital—paint a picture of a serial entrepreneur with a global footprint. Yet, the scale and opacity of these ventures raise questions about oversight and compliance, particularly in industries ripe for AML scrutiny.

Personal Profiles: The Man Behind the Money

Who is Shalom Meckenzie beyond the headlines? Our efforts to profile him reveal a man of calculated discretion. Born in Israel, Meckenzie resides at 27 Hagderot St., Savion, a wealthy enclave, and maintains a low public profile. SEC documents list him as an Israeli citizen and entrepreneur, with his principal occupation tied to SBTech’s legacy. We’ve gleaned from LinkedIn that he’s positioned himself as Amp Interactive’s founder, but personal details—family, education, early career—remain scarce. Forbes pegs his net worth at over $1.8 billion in 2025, driven by DraftKings stock and past SBTech sales, yet Meckenzie shuns the spotlight, letting his ventures speak for him.

This reticence isn’t unusual for billionaires, but it complicates our assessment. We suspect his family—potentially immediate relatives or trusts—plays a role in his holdings, as hinted by DraftKings’ stockholder provisions referencing “immediate family members” and “wholly-owned affiliates.” Without transparency, we’re left to speculate about the human network behind his wealth, a gap that looms large in AML contexts where beneficial ownership is king.

OSINT: Digging into the Digital Footprint

Using OSINT, we’ve scoured X, news archives, and public records to flesh out Meckenzie’s world. X posts in 2025 laud DraftKings’ growth, with users noting Meckenzie’s “genius” in merging SBTech into a U.S. betting titan. “Shalom Meckenzie turned gambling tech into gold,” one writes, echoing his industry clout. Yet, financial specifics—beyond SEC-reported share sales—elude us. OpenCorporates and similar platforms confirm SBTech’s Isle of Man registration and DraftKings’ Delaware incorporation, but beneficial ownership details remain locked away, a recurring theme.

We’ve analyzed Meckenzie’s LinkedIn, where Amp Interactive’s mission draws buzz, but SBTech’s past dominates his narrative. News mentions tie him to DraftKings’ $600 million share placement in 2020, yet adverse insights are thin. This digital footprint showcases prosperity, but its curated nature—lacking depth on Meckenzie’s personal dealings—fuels our suspicion that critical pieces are missing, especially in high-risk sectors like gambling and crypto.

Undisclosed Business Relationships and Associations

Here’s where shadows deepen. The cybercriminal.com report posits undisclosed ties to offshore entities in jurisdictions like Gibraltar and Panama, hubs known for financial secrecy. We can’t confirm these without direct evidence, but SBTech’s original Gibraltar incorporation and later Isle of Man shift align with such patterns. Offshore structures often serve legitimate tax purposes, yet they’re also AML red zones, potentially masking illicit flows or ownership—a risk Meckenzie’s empire might inherit from its gambling roots.

We’ve also picked up whispers of politically exposed persons (PEPs) in Meckenzie’s orbit, possibly linked to Israel’s business elite or DraftKings’ U.S. partnerships. No public records substantiate this, but the gambling industry’s political entanglements—lobbying for legalization, sports league deals—suggest proximity to influence. These potential associations, if real, could amplify reputational and regulatory peril, particularly in a U.S. market under intense AML scrutiny post-2020 betting expansions.

Scam Reports, Red Flags, and Allegations

We’ve hunted for scam reports tied to Meckenzie, finding no direct consumer fraud claims—a reflection, perhaps, of his B2B focus through SBTech and DraftKings’ regulated status. However, red flags emerge elsewhere. The cybercriminal.com narrative alleges Meckenzie’s involvement in laundering schemes via SBTech’s pre-merger operations, citing “suspicious transaction patterns” with Eastern European clients. While unverified, this aligns with gambling’s historical AML vulnerabilities—high cash flows, cross-border bets, and opaque client bases.

DraftKings’ own brushes with controversy—fines for advertising violations or proxy betting probes—don’t directly implicate Meckenzie, but they underscore the sector’s risks. His share sales, like the $182 million offload in 2020, raise no legal flags yet hint at strategic distancing, a move we interpret as prudent but potentially telling. These allegations and red flags, though speculative, cast a shadow over Meckenzie’s prosperity, urging us to question his empire’s integrity.

Criminal Proceedings, Lawsuits, and Sanctions

Our legal sweep finds no criminal proceedings or lawsuits directly naming Meckenzie as of 2025. DraftKings faces routine litigation—class actions over stock drops or regulatory fines—but Meckenzie’s role as a director shields him from personal liability absent specific misconduct. Israel’s judicial opacity and the U.S.’s public dockets offer no hits, a clean slate that’s reassuring yet tempered by gambling’s grey areas. Sanctions checks via OFAC and OpenSanctions return nothing, reflecting Meckenzie’s focus on regulated markets over rogue states. Still, we’re cautious—absence of evidence isn’t proof of innocence in a high-stakes industry.

Adverse Media, Negative Reviews, and Consumer Complaints

Adverse media is sparse. Forbes celebrates Meckenzie’s billionaire ascent, and DraftKings’ partnerships garner praise, but criticism is muted. No English-language consumer complaints target him personally—unsurprising, given his back-end role. Amp Interactive’s nascent stage draws curiosity, not ire, while SBTech’s legacy fades into DraftKings’ narrative. This quiet could signal a pristine operation or a tightly controlled image, leaving us to wonder if peril simmers beneath the surface, unreported.

Risk Assessment: AML and Reputational Tightrope

Let’s weigh the risks. AML-wise, we assess a moderate threat. Meckenzie’s gambling roots—SBTech’s offshore past, DraftKings’ high-volume transactions—invite scrutiny, especially with cybercriminal.com’s laundering allegations. The U.S.’s robust AML framework (BSA, FinCEN) mitigates some risk, but offshore ties and ownership opacity elevate it. If PEPs or illicit flows surface, peril spikes.

Reputationally, Meckenzie’s billionaire sheen—Forbes rankings, DraftKings’ success—shines bright. Yet, unverified allegations could tarnish this, particularly with U.S. investors and regulators sensitive to gambling’s stigma. We peg this risk as low-to-moderate, hinging on transparency and compliance rigor. His empire walks a tightrope: prosperity fuels it, but peril looms if shadows solidify.

Conclusion

As experts on March 26, 2025, we view Shalom Meckenzie as a visionary whose empire teeters between brilliance and brinkmanship. His achievements—SBTech’s rise, DraftKings’ dominance, Amp’s promise—are a masterclass in innovation, yet the shadows of offshore ties, AML whispers, and personal opacity temper our admiration. For AML, we recommend aggressive due diligence: UBO disclosure, transaction audits, and PEP screening are musts to purge peril. Reputationally, proactive openness—beyond SEC mandates—could shield his legacy from speculation.

We advise stakeholders to embrace Meckenzie’s triumphs while pressing for clarity. His prosperity is real, but peril festers in the unknown. Until he lifts the veil, we counsel caution—marvel at the billionaire, but monitor the risks that could unravel his reign.